South East Asian Currencies Advance Against US Dollar

October 20 2009 - 12:47AM

RTTF2

Tuesday in Asia, South east Asian currencies advanced against

the US dollar as a surge in regional stocks increased demand for

the emerging market assets. The currencies of Taiwan, India,

Philippines, Thailand, Malaysia, Singapore and Pakistan climbed to

new multi-day highs against the dollar.

Buoyed by a positive close on Wall Street overnight on the back

of some better-than-expected earnings reports and economic

optimism, Asian stock markets are mostly trading notably higher on

Tuesday.

Markets in Australia, Japan, and South Korea are trading higher.

Among other markets in the Asia-Pacific region, Shanghai, Hong Kong

and New Zealand are trading notably higher, while Singapore and

Taiwan are up with modest gains. The Indonesian market is trading

weak. Stock markets across the region had ended on a mixed note on

Monday.

In early Asian deals on Tuesday, the Taiwan dollar rose to

32.2510 against the U.S. currency. The near term resistance for the

Taiwan dollar is seen at 32.19. The pair closed yesterday's trading

at 32.3650

The Chinese yuan that closed yesterday's trading at 6.8278

against the U.S. dollar climbed to a 4-day high of 6.8259 in early

Asian deals on Tuesday. If the Chinese currency advances further,

it may target the 6.823 level.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair at 6.8273. The pair is allowed to

strengthen or weaken 0.5% from the parity rate.

In early Asian trading on Tuesday, the Philippine peso jumped to

a 4-day high of 46.46 against the U.S. dollar. The next upside

target level for the Philippine currency is seen at 46.2050. The

dollar-peso pair was worth 46.6850 at yesterday's close.

After a brief slide, the Thai baht soared against the US dollar

during early Asian deals on Tuesday. The pair moved from 33.4250 to

33.32 at 9:50 pm ET. This set a 4-day high for the Thai baht. On

the upside, 33.19 is seen as the next target level for the Thailand

currency. At yesterday's close, the dollar-baht pair was quoted at

33.35.

During early Asian deals on Tuesday, the Malaysian ringgit

strengthened to a 4-day high of 3.3575 against the US dollar. This

may be compared to Monday's closing value of 3.3735. If the

Malaysian currency gains further, it may likely target the 3.343

level.

The Singapore dollar that closed yesterday's trading at 1.3895

against the U.S. currency rose to a 5-day high of 1.3871 in early

Asian deals on Tuesday. The next upside target level for the

Singapore dollar is seen at 1.3855.

The Indian rupee opened higher against the dollar during

Tuesday's early trading and soared to a 4 -day high of 45.85 by

8:55 pm ET. This may be compared with yesterday's close of 46.1050.

On the upside, the immediate likely resistance for the Indian

currency is seen around the 45.76 level.

Tuesday during early Asian deals, the Pakistan rupee advanced to

a 5-day high of 82.96 against the greenback. This may be compared

with yesterday's close of 83.35. On the upside, the immediate

likely resistance for the local currency is seen around 82.76

level.

From U.S., a report on housing starts, is slated to be released

at 8:30 am ET. Economists estimate housing starts of 610,000 for

September. At the same time, the U.S. Labor Department is scheduled

to release its report on the producer price index for September.

Economists expect the headline index to have remained unchanged and

the core index to show 0.1%growth.

Philadelphia Federal Reserve Bank President Charles Plosser is

scheduled to speak on monetary policy in a tough environment to the

Standford Institute for Economic Policy Research in Palo Alto,

California at 8 pm ET.

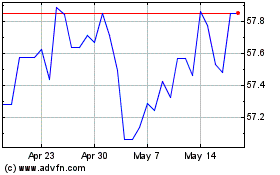

US Dollar vs PHP (FX:USDPHP)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs PHP (FX:USDPHP)

Forex Chart

From Jul 2023 to Jul 2024