Geox Fiscal Year 10 Ebitda Down 13%; Sees Hurdles In '11

March 03 2011 - 12:30PM

Dow Jones News

Italian shoemaker Geox SpA (GEO.MI) Thursday said its 2010

full-year net profit fell 13% to EUR58 million and predicted rising

raw material costs and currency fluctuations will pose challenges

in 2011.

The company also posted a worse-than-expected 20% fall in Ebitda

-- earnings before interest, taxes, depreciation and

amortization.

The company also reduced its dividend to EUR0.18 a share from a

EUR0.20 a share dividend on 2009 earnings.

MAIN FACTS:

--Revenues fell 1.7% to EUR850.1 million from EUR865 million

posted in 2009.

--Ebitda fell 20% to EUR132.3 million compared to EUR166.4

million in 2009.

--Geox previously forecast a 6% to 8% drop in revenues and a 4%

To 5% fall in Ebitda in 2010.

--Company said Spring/Summer 2011 orders backlog has increased

2%.

--Says forex, raw material prices, labor costs in supplier

countries could put pressures on margins in the first half of

2011.

-By Sofia Celeste, Dow Jones Newswires, +39 06;

sofia.celeste@dowjones.com

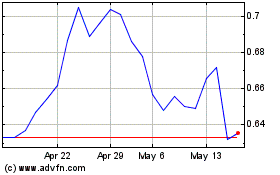

Geox (BIT:GEO)

Historical Stock Chart

From Apr 2024 to May 2024

Geox (BIT:GEO)

Historical Stock Chart

From May 2023 to May 2024