By Saabira Chaudhuri

To flavor or not to flavor: That is the question for booze

makers.

Alcohol executives argue that flavored extensions of existing

spirits brands can attract new customers -- particularly women --

while reviving interest among existing drinkers.

But flavors often tend to be fads, meaning sales plummet when

customers tire of the new taste. That piles pressure on alcohol

makers to continually discover the next big thing or brace for wild

revenue swings.

"If you overdo it, you get into dangerous territory. You're a

little bit like a hamster on a wheel who has to run faster and

faster just to stay still," said Bob Kunze-Concewitz, chief

executive of Davide Campari-Milano SpA, which owns brands such as

Campari liqueur and Skyy vodka.

An apple variant of Crown Royal Canadian whisky that Diageo PLC

launched at the end of 2014 helped the brand rebound from stagnant

revenue to a 12% jump in North America sales for fiscal 2015.

Diageo in 2014 also unveiled a range of Canadian whiskies in pie

flavors such as apple, cherry and pecan.

Diageo's Piehole Whiskey, however, hasn't gained traction, and

Crown Royal's North American growth halved in fiscal 2016. Now,

Diageo hopes that its new vanilla Crown Royal flavor, which it

announced last month, will again juice sales.

"It tastes good and a lot of my friends like it because they can

drink it straight," said Justin Capetillo, a 35-year-old

Houston-based cameraman.

Although advertising costs can be hefty, creating the new

flavors isn't particularly expensive. New variants usually are

developed internally and packaging costs generally are minimal,

mainly requiring a modified label. Consumer research typically runs

between $50,000 and $150,000, said Angelo Vassallo, a former

marketing executive for Seagram Co.

Results, however, are choppy. Brown-Forman Corp. in August

reported its cinnamon-flavored extension of Jack Daniel's Tennessee

whiskey declined in the U.S. by a double-digit percentage in the

first quarter of fiscal 2017. The company doesn't plan to create

any new flavors for Jack Daniel's, instead focusing on expanding

the brand outside the U.S.

John McDonnell, a former Seagram executive, recalls how the

company's Leroux cordials brand churned out flavor after

flavor.

"We were releasing a new flavor every month and just doing it to

pipeline product into distributors' warehouses," said Mr.

McDonnell, now the managing director of international operations

for Fifth Generation Inc.'s Tito's Handmade Vodka, which hasn't

released flavored extensions. "It finally just backs up." Leroux is

now owned by Beam Suntory Inc., which sells 27 flavors of the

cordial.

San Diego-based Jeremy LeBlanc, who has been a bartender for 18

years, says the recent trend toward craft cocktails hasn't helped

demand for flavor extensions. "A lot of mixologists doing craft

cocktails stick their noses up at flavored spirits because

everything is about fresh ingredients," the 41-year-old said.

Companies sometimes decide to flavor brands that are

struggling.

Pernod Ricard SA in 2013 rolled out honey- and apple-flavored

variants of its Paddy Irish whiskey, but the new lines weren't able

to stop the declines in market share. In May, it sold Paddy to

Sazerac Co.

By contrast, Pernod hasn't created flavors for its flagship

Irish whiskey Jameson, instead pouring money into more

sophisticated innovations such as Caskmates, a Jameson variant

seasoned in beer casks.

"The Jameson Caskmates initiative has a lot more substance to it

and is much more appealing than just coming up with yet another

flavor," said Pernod CEO Alex Ricard earlier this year.

Sazerac CEO Mark Brown said he is reviewing the flavored

versions of Paddy and won't roll out additional ones. "When you

take a brand down the flavor path, you really are taking an

enormous risk with brand equity," he said. "You don't see serious

brands of whiskey launching flavors."

Mr. Brown remains in favor of stand-alone flavored brands, such

as Sazerac's Fireball, a cinnamon-flavored whiskey that soared to

five million cases in 2015 from 50,000 in 2009, according to

investment research firm Bernstein. But even Fireball's growth has

all but flattened recently.

Nowhere has the volatility been more apparent than in vodka,

which for years has relied heavily on flavored extensions.

Diageo in July said full-year sales of Cîroc plunged 43% from a

year earlier, when customers had embraced a new pineapple variant

of the brand. About 80% of the high-end vodka brand's sales come

from flavor extensions.

"In the U.S., we have got to get more resilient and less

dependent on big flavors every year," said Diageo CEO Ivan

Menezes.

Pernod last year took a EUR652 million (about $693 million)

write-down on its Absolut vodka brand, which kick-started the

modern American wave of vodka flavorings.

Flavored vodka's growth slowed to 2.2% in the 52 weeks ended

Sept. 10 from 12% in the same period in 2013, according to Nielsen

data. The slowdown of flavored vodkas portends the potential risk

for flavored whiskey, whose growth deteriorated to 13% in the 52

weeks ended Sept. 10 from a 132% rise in 2013 and a 71% increase in

2014.

Diageo, however, remains upbeat about its recent launch of Crown

Royal vanilla-flavored whisky. "The life cycle of flavors on whisky

may be longer than the life cycle of flavors on vodka," said James

Thompson, Diageo's chief marketing officer for North America. "Our

research on vanilla gives us confidence."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

November 18, 2016 11:20 ET (16:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

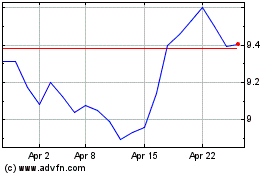

Davide Campari (BIT:CPR)

Historical Stock Chart

From Apr 2024 to May 2024

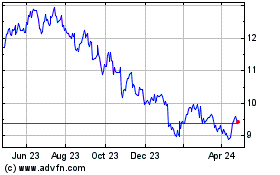

Davide Campari (BIT:CPR)

Historical Stock Chart

From May 2023 to May 2024