U.S. Treasury Unveils New Steps to Limit Tax Inversions

April 04 2016 - 5:40PM

Dow Jones News

WASHINGTON—The Treasury Department took new steps Monday to

limit corporate tax-avoidance transactions, targeting what it calls

"serial inverters" and internal corporate borrowing that shifts

profits out of the U.S.

The rules represent the government's third wave of

administrative action against the transactions known as corporate

inversions, in which U.S. companies take foreign addresses, often

through mergers with smaller firms outside the country. The largest

such deal, Pfizer Inc.'s merger with Allergan PLC, was announced

last year and is scheduled to close in 2016.

The Pfizer deal could be endangered by the proposed rules since

Allergan itself is a product of several inversions over the past

few years.

"After an inversion, many of these companies continue to take

advantage of the benefits of being based in the United

States—including our rule of law, skilled workforce,

infrastructure, and research, and development capabilities—all

while shifting a greater tax burden to other businesses and

American families," said Treasury Secretary Jack Lew.

As he did upon releasing anti-inversion rules in September 2014

and November 2015, Mr. Lew again called for Congress to pass

short-term anti-inversion legislation and a broader revamp of the

U.S. business tax system.

The rules announced Monday would make it harder for individual

foreign companies to pick off multiple U.S. targets in a short

period of time. The new rules would prevent purchases of American

companies within the previous three years from counting as the

foreign company's assets when determining whether U.S.

anti-inversion rules apply to a new transaction.

They also go after earnings stripping, the maneuvers that

inverted companies can use to push profits outside the U.S.

Inverted companies can lend money to their U.S. subsidiaries. Those

moves, unavailable to companies based in the U.S., create

deductible interest in the U.S., reduce the income subject to the

35% U.S. corporate tax rate and move income to a lower-taxed

jurisdiction.

In those instances, the Treasury Department is basically giving

itself more authority to disregard the formal structure of those

transactions as borrowing and revoke the tax advantages of

debt.

A senior Treasury official said the rules would be effective on

deals closing after today.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

April 04, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

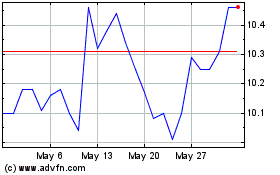

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2024 to May 2024

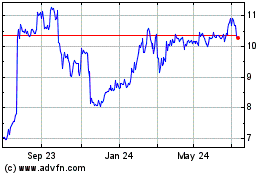

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2023 to May 2024