Japanese Stocks on Track for a Winning Week

May 13 2016 - 1:10AM

Dow Jones News

Mining and materials stocks sent Japan's benchmark index lower

on Friday, capping a volatile week for shares across the

region.

Still, the Nikkei Stock Average is headed to gain 2.2% for the

week, making it one of the better performing Asian stock

benchmarks. The Shanghai Composite Index and Hang Seng Index are on

track to lose 2.8% and 1.9%, respectively.

But concerns about volatile oil prices—and more recently gloomy

updates from some of the largest U.S. retailers—were on display on

Friday, weighing on most major stock benchmarks.

"Two or three weeks ago, there was a semi-optimistic

wait-and-see mode amongst investors," said Andy Maynard, head of

Asian equities at HSBC. Now, "we are seeing outflows."

The Nikkei, initially buoyed by a strengthening dollar against

the Japanese yen overnight, was recently down 1.1%. A weaker yen

helps the competitiveness of Japanese exporters, thereby supporting

their shares. But the local currency reversed its overnight move

and was last up 0.2% against the dollar.

Leading the declines in Japan on Friday was oil explorer Inpex

Corp., which fell 2.4% to 827 yen, as crude oil prices fluctuated

in recent sessions. Brent crude was last off 0.7% at $47.74, also

reversing overnight gains

Meanwhile, commodities firm Mitsubishi Materials Corp. tumbled

11% to ¥ 313 after the company provided lower sales and profit

forecasts for the fiscal year that started in April, citing a

cloudy outlook for metal prices.

Elsewhere in the region, the Hang Seng Index was recently off

0.9%, Australia's S&P ASX 200 was down 0.7% and the Shanghai

Composite Index was flat.

Pressures on regional stock this week have been mostly global:

Both fluctuations in oil prices and the coming June vote on

'Brexit' are causing uncertainty for traders. Meanwhile, U.S.

corporate announcements have been disappointing and the U.S.

Federal Reserve has toned down its outlook for the American

economy.

Nonetheless, Japanese shares have fared better this week as the

yen has weakened by about 1.6% in the same period.

Foreign investors have been snapping up Japanese shares

recently, buying a net 1.1 trillion yen ($10.1 billion) worth of

equities in April, after three months of net selling, according to

latest data from Japan's Ministry of Finance. Traders also say the

Japanese government has been buying stocks to support the

market.

"Japan's bucked the selling, amid [the] at-home economic

initiative," Mr. Maynard said.

Still, he added that for most of the region, especially China

and Hong Kong, "people are looking to shift positions [in stocks]

to raise cash, either to sit on cash or to buy bonds."

Kosaku Narioka contributed to this article.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

May 13, 2016 00:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

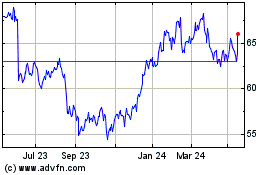

ASX (ASX:ASX)

Historical Stock Chart

From May 2024 to Jun 2024

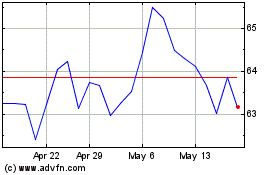

ASX (ASX:ASX)

Historical Stock Chart

From Jun 2023 to Jun 2024