TIDMTOWN

RNS Number : 1379F

Town Centre Securities PLC

03 November 2022

3 November 2022

Town Centre Securities PLC

('The Company' or 'TCS')

Commencement of Share Buy-back Programme

Town Centre Securities Plc, the Leeds , Manchester, Glasgow and

London property investment, development, car park and hotel

operator, today announces the launch of a new share buy-back

programme (the "Programme").

The Board remains acutely aware of the significant discount that

the Company's shares trade at relative to TCS's recently reported

net asset value (NAV) per share of 341p (EPRA NTA per share -

333p); both numbers stated as at 30 June 2022.

The Board regularly reviews capital allocation to optimise

long-term returns for shareholders; reflecting this TCS has

continued to make disposals to reduce debt including the

significantly accretive sale of its investment in YourParkingSpace.

Given the wide discount referred to above, and further to the 4

million share Tender Offer undertaken in August 2022, the Board

believes that share buybacks continue to be an appropriate means of

returning value, whilst maximising sustainable long-term growth for

shareholders, given the enhancement to NAV and earnings per share

that will result from reducing the number of shares in issue.

Accordingly, the Company today announces the commencement of the

Programme, to repurchase ordinary shares in accordance with the

remaining buyback authority granted by shareholders at its AGM on

29 December 2021 (the "2021 AGM"). Subject to the passing of the

relevant resolution at the Company's 2022 annual general meeting

(expected to be held on 22 November 2022, the "2022 AGM"), the

Programme is expected to continue in accordance with this refreshed

authority until the Company enters the closed period prior to

announcing its full year results for the year ended 30 June

2023.

Any purchase of ordinary shares will be executed

opportunistically and in accordance with the terms of the Company's

general authority to repurchase ordinary shares granted at the 2021

AGM, up to a maximum of 7,671,868 ordinary shares. Subject to the

passing of the relevant resolution at the 2022 AGM, any subsequent

purchase of ordinary shares will be executed in accordance with the

terms of this refreshed authority, up to a maximum of 7,279,590

ordinary shares.

The purpose of the Programme is to reduce the ordinary share

capital of the Company. No purchases will be made by the Company

under the Programme unless they are accretive on a per-share net

asset value basis.

The Board will keep the Programme under review and ensure that

the Group's loan-to-value ratio and liquidity remain within a

prudent level, to ensure it continues as an efficient and effective

means of generating value for shareholders. While the Company has

launched the Programme, there is no certainty on the volume of

shares that may be acquired under the Programme and the pace of

acquisitions.

Given the level of liquidity in the Company's shares, the

Company will retain the ability to exceed the average daily volume

restrictions established by the Commission Delegated Regulation

2016/1052/EU (as in force in the UK and as amended by the FCA's

Technical Standards (Market Abuse Regulation) (EU Exit) Instrument

2019) (the "Delegated Regulation") and therefore the Programme may

not fall within the safe harbour provisions of the Regulation.

In advance of moving into a closed period ahead of its half year

results for the period ending 31 December 2022 (the "Closed

Period"), the Company may choose to enter into an irrevocable

commitment with Liberum in order to continue the Programme through

a non-discretionary mandate, under which Liberum will make

purchases of shares within certain pre-set parameters independently

of, and uninfluenced by, the Company for the duration of the Closed

Period. Under the terms of any non-discretionary mandate, Liberum

will retain the ability to exceed the average daily volume

restrictions set out in the Delegated Regulation. Thereafter, the

Programme will continue on the basis set out above.

Liberum will purchase the Company's ordinary shares as

principal. Shares purchased through the Programme will be

cancelled.

Potential REIT Regime implications related to the Programme

The UK Real Estate Investment Trust ("REIT") Regime was

introduced by the UK Finance Act 2006. The Company elected for

Group REIT status with effect from 2 October 2007 and has been a

qualifying REIT since then.

As detailed in both the Company's circular to Shareholders dated

15 July 2022 (the "Circular") and the Annual Report of the Company

for the year ended 30 June 2022, one of the conditions for

continued REIT status is that over 35% of the Company's share

capital is held beneficially by the public. As at [19] October 2022

this percentage, assuming New Fortress Finance Holdings Limited

remains a close company (as defined by the REIT regulation) and not

held beneficially by the public, is 35.27%.

Accordingly the Company is able to buy-back for cancellation

203,789 ordinary shares held beneficially by the public before the

35% threshold is crossed. If this threshold were to be crossed the

Company would automatically lose its REIT status with effect from

the beginning of the current accounting period, commencing on 1

July 2022.

Shareholder attention is drawn to the consequences of a loss of

REIT status by the Company, as set out in Section B.II of the

Circular, and the associated risk factors set out in Section IV of

the Circular.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information, please contact:

Town Centre Securities PLC www.tcs-plc.co.uk / @TCS PLC

Edward Ziff, Chairman and Chief Executive

0113 222 1234

Stewart MacNeill, Group Finance Director

MHP Communications tcs@mhpc.com

Reg Hoare / Matthew Taylor 020 3128 8567

Liberum www.liberum.com

Jamie Richards / Lauren Kettle / Nikhil Varghese

020 3100 2123

Peel Hunt www.peelhunt.com

Carl Gough / Henry Nicholls / Capel Irwin 020 3597 8673 /

8640

Notes to Editors:

Town Centre Securities PLC (TCS) is a Leeds based property

investor and car park operator with assets of over GBP370m. With

more than 50 years' experience, a commitment to sustainable

development and a reputation for quality and innovation, TCS

creates mixed use developments close to transport hubs in major

cities across the UK.

For more information visit www.tcs-plc.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSZZMGMRZKGZZM

(END) Dow Jones Newswires

November 03, 2022 03:00 ET (07:00 GMT)

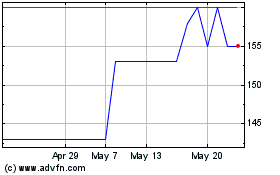

Town Centre (AQSE:TOWN.GB)

Historical Stock Chart

From Oct 2024 to Oct 2024

Town Centre (AQSE:TOWN.GB)

Historical Stock Chart

From Oct 2023 to Oct 2024