YieldMax™ Announces 1-for-2 Reverse Split of TSLY

February 13 2024 - 5:00PM

YieldMax™ ETFs today announced that the Board of Trustees of Tidal

Trust II has approved a one-for-two (1-for-2) reverse split of the

YieldMax™ TSLA Option Income Strategy ETF (NYSE Arca: TSLY).

|

YieldMax™ ETF Name |

Ticker |

Reverse Split Ratio |

Old CUSIP |

New CUSIP |

|

YieldMax™ TSLA Option Income Strategy ETF |

TSLY |

1:2 |

88634T709 |

88636J444 |

FAQs about the TSLY Reverse

Split

1. What is a reverse split of

an ETF?

A reverse split of an ETF is a type

of corporate action that reduces the number of outstanding shares

of the ETF while proportionately increasing the ETF’s net asset

value (“NAV”).

2. What is the timing and

effective date of the TSLY reverse split?

The TSLY reverse split will become

effective prior to market open on February 26,

2024. TSLY will begin trading at its post-split price on

such date. The total market value of the TSLY shares outstanding

will not be affected as a result of this reverse split, except with

respect to the redemption of fractional shares, as

discussed below.

3. Will a TSLY reverse split

affect the value of a TSLY shareholder’s investment

portfolio?

No, a TSLY reverse split will not

alter the rights or value of a shareholder’s investment

portfolio.

The table below illustrates, among

other things, how a hypothetical dividend before and after a

1-for-2 reverse split of a hypothetical ETF does not affect such

ETF’s hypothetical dividend yield. This example is provided for

informational purposes only.

|

|

# of Shares Owned |

ETF NAV |

Value of Investment |

Monthly Dividend per Share |

Total Monthly Dividend |

Hypothetical Dividend Yield* |

|

Before Rev. Split |

200 |

$10 |

$2,000 |

$0.10 |

$20 |

12% |

|

After Rev. Split |

100 |

$20 |

$2,000 |

$0.20 |

$20 |

12% |

* The Hypothetical Dividend Yield above does not represent

actual dividend payment history, and is the yield a shareholder

would receive if the hypothetical Monthly Dividend per Share shown

above is annualized. It is calculated by multiplying such dividend

per share by twelve (12), and dividing the resulting amount by the

ETF NAV.

4. Will a TSLY reverse split

impact TSLY’s performance?

The performance of TSLY is based on

its portfolio holdings. A reverse split of TSLY has no impact on

its portfolio or its performance.

5. What are fractional

shares?

Fractional shares arise when the

number of shares held by a shareholder cannot be evenly divided by

the reverse split factor (see following example).

In that case, the excess, post-split fractional shares are redeemed

for cash that will be sent to the shareholder’s broker of

record.

Example: Say a

shareholder owns 101 shares of an ETF worth $10 each that are

subject to a 1-for-2 reverse split (in such case, the

reverse split factor is 2). Prior to the reverse

split, the value of the shareholder’s investment portfolio is

$1,010 (101 x $10). After the 1-for-2 reverse split, the

shareholder owns 50 shares worth $20 each and one fractional share

(0.5 of a post-split share), which is redeemed for $10 in cash (0.5

x $20). The value of the shareholder’s investment portfolio remains

$1,010 ($1,000 + $10). The reverse split does not

affect the value of the shareholder’s investment

portfolio.

This cash payout on the redeemed

fractional shares, if any, may cause some shareholders to realize a

gain or loss, which could be a taxable event for those

shareholders. Otherwise, the reverse split will not result

in a taxable transaction for shareholders.

6. How many fractional TSLY

shares should a TSLY shareholder expect to receive from this

reverse split?

Given that the TSLY reverse split has

a reverse split ratio of 1:2 (and a reverse split factor of 2), a

TSLY shareholder will only receive fractional shares if the number

of TSLY shares held prior to the reverse split cannot be evenly

divided by 2. In such case, the shareholder will never

receive more than 0.9999 fractional TSLY shares as a result of this

reverse split.* The table below serves as an

illustration.

|

Before Reverse Split |

AfterReverse Split |

|

# of TSLY Shares |

# of TSLY Shares |

# of Fractional TSLY Shares |

|

1 |

0 |

0.5 |

|

41.26 |

20 |

0.63 |

|

50 |

25 |

0 |

|

71 |

35 |

0.5 |

|

88.33 |

44 |

0.165 |

|

150 |

75 |

0 |

|

211.9998 |

105 |

0.9999 |

|

1,000 |

500 |

0 |

|

8,245 |

4,122 |

0.5 |

* This is true for each brokerage account that holds TSLY

shares.

7. Is shareholder

approval required for a TSLY reverse split?

No.

8. Will a reverse split

result in a ticker change for TSLY?

No.

An investor should carefully consider the investment

objectives, risks, fees and other expenses carefully before

investing. A prospectus or summary prospectus and

other information about the Fund can be obtained by going

to https://www.yieldmaxetfs.com/.

Read the prospectus or summary prospectus carefully before

investing.

An investment in TSLY does not represent an investment in

TSLA.

All investments are subject to risks, including the loss of

money and the possible loss of the entire principal amount

invested.

Past performance is not a guarantee or indicative of future

investment results.

For standardized performance please click here.

Distributed by Foreside Fund Services, LLC.

Contact Gavin Filmore at gfilmore@tidalfg.com for more information.

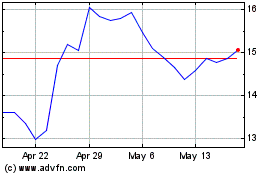

Yieldmax Tsla Option Inc... (AMEX:TSLY)

Historical Stock Chart

From Jun 2024 to Jul 2024

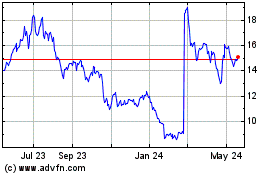

Yieldmax Tsla Option Inc... (AMEX:TSLY)

Historical Stock Chart

From Jul 2023 to Jul 2024