With the U.S. deadlock temporarily abated, the equity markets once

again reached their multi-year highs on improving economic

conditions and recovering housing fundamentals. A string of Q3

earnings beat also supported the market uptrend (read: 3 Biggest

ETF Winners from the 3rd Quarter).

Further, growing assurance over the continuation of the Fed’s bond

buying program, at least till the end of this year, encouraged

investors’ to put in huge amounts in the global equity markets. The

broad

U.S. market fund (SPY) has pulled in nearly

$5.8 billion for October, closely followed $2.8 billion inflows

into

iShares Core S&P Mid-Cap ETF (IJH).

Though there have been winners in every corner of the space, a few

sectors have easily outpaced the broad market, in the year-to-date

period. Below, we have highlighted these sector ETFs that have been

the star performers this year and could be better plays as we move

towards the end of the year (see: all the Categories ETF here).

Solar

The biggest winner in the global space so far this year is

definitely the alternative energy world, in particular solar. Most

of the gains in this corner of the market came from impressive

performances and a strong growth outlook by the major

companies.

In addition, demand for photovoltaic cells is rising rapidly with

China leading the way higher. Notably, China is expected to account

for nearly 30% of the total solar demand next year.

Though both the solar ETFs have provided triple digit returns this

year,

Guggenheim Solar ETF (TAN) has been the top

performer. The fund has attracted $226.10 million in assets so far

this year reaching a total base of $385.4 million. It charges

investors 70 bps in fees per year while sees good volume of more

than 300,000 shares a day.

The product tracks the MAC Global Solar Energy Index, holding 29

stocks in the basket. The ETF puts nearly 51% of assets in top 10

holdings and focuses on small caps as these account for

three-fourths share (read: 3 Small Cap Value ETFs Poised to

Outperform). Further, American firms dominate the fund’s portfolio

with nearly 42%, closely followed by China (27.25%) and Hong Kong

(12.58%).

The fund surged nearly 122% year-to-date and still has room for

further upside given the bullish trend in the sector. Also, TAN has

a Zacks ETF Rank of 2 or ‘Buy’ rating, suggesting that the product

would outperform over the next one-year period (read: Inside the

Incredible Surge in Solar ETFs).

Biotech

The biotechnology sector is also performing remarkably well this

year on increased mergers and acquisitions, promising new drugs and

their approval, ever-increasing health care spending and an

insatiable demand for new drugs. Expansion into emerging markets

like India, China and Brazil would provide a further boost to the

sector going forward.

The top ETF in this space is

PowerShares Dynamic

Biotechnology & Genome Portfolio (PBE), which is

enjoying a rally of over 51% year-to-date (read: Inside Biotech

ETFs: Can the Run Continue?). The trend is expected to continue

given the Zacks ETF Rank of 1 or ‘Strong Buy’ rating with ‘Medium’

risk outlook for the fund.

This ETF follows the Dynamic Biotechnology & Genome Intellidex

Index. The product has a somewhat sparse volume of 44,000 shares a

day, but a decent level of about $236 million in assets under

management. The fund charges 63 bps in fees and expenses from

investors.

Holding 29 stocks, the fund is moderately concentrated on its top

10 holdings at 50% but well spread across market spectrums. Large

caps account for 42%, small caps make up for 33% while rest goes to

mid caps. The ETF has a certain tilt toward the growth stocks

(read: Bet on This Top Ranked Large Cap Growth ETF).

Social Media

The social media space is back on track and were on fire this year

thanks to robust earnings, a bullish outlook, and growing Internet

usage (read: Social Media ETF on Fire After String of Earnings

Beats).

One great way to play the sector surge is with the

Global X

Social Media Index ETF (SOCL), which gained immense

popularity in recent days. The product has gathered $80 million of

capital this year, propelling its total asset base to $95.6

million.

Volume is moderate as it exchanges 82,000 shares in hand on average

daily basis. The ETF charges 65 bps in fees and expenses.

The fund tracks the Solactive Social Media Index and holds 27

securities in the basket. The product puts more than 76% of assets

in the top 10 firms, suggesting heavy concentration. However, the

fund is well spread across large and mid cap stocks with a slight

tilt toward growth stocks. In terms of country exposure, U.S. firms

take half of the portfolio, closely followed by China (30%) and

Japan (7%).

The social media ETF returned over 47% in the year-to-date time

frame and currently has a Zacks ETF Rank of 2 or ‘Buy’ rating with

‘High’ risk outlook.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DYN BIO (PBE): ETF Research Reports

GLBL-X SOCL MDA (SOCL): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

GUGG-SOLAR (TAN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

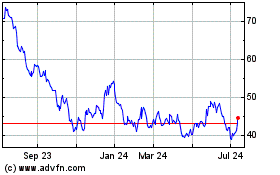

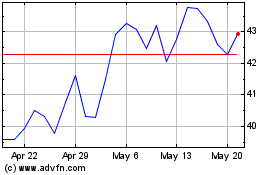

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Apr 2024 to May 2024

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From May 2023 to May 2024