UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | | Definitive Proxy Statement |

| ☒ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

NEXTDOOR HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 1, 2024

Nextdoor Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-40246 | 86-1776836 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

420 Taylor Street

San Francisco, California

(Address of principal executive offices)

(415) 344-0333

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | KIND | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 ((§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, Nextdoor Holdings, Inc. (the “Company”) issued a letter to shareholders and press release (together, the “Letter and Press Release”) announcing its financial results for the first quarter ended March 31, 2024. The Company also announced that it would be holding a conference call on May 7, 2024 to discuss its financial results. Copies of the Letter and Press Release are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

This information included in this Item 2.02 of this Current Report on Form 8-K and the exhibits hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it been deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d) On May 1, 2024, the Company’s Board of Directors (the “Board”), following a recommendation from the Nominating, Corporate Governance and Corporate Responsibility Committee of the Board, appointed each of Robert Hohman, Marissa Mayer, and Niraj Shah to serve as a director of the Company, effective May 1, 2024. Mr. Hohman will serve as a Class II director until the earliest to occur of the Company’s 2026 annual meeting of stockholders and until his successor is duly elected and qualified, or until his death, resignation, disqualification or removal. Ms. Mayer and Mr. Shah will each serve as a Class III director until the earliest to occur of the Company’s 2024 annual meeting of stockholders and until her or his successor is duly elected and qualified, or until her or his death, resignation, disqualification or removal. Ms. Mayer and Mr. Shah have been nominated for election at the 2024 annual meeting of stockholders. Mr. Hohman was appointed to the Nominating, Corporate Governance and Corporate Responsibility Committee of the Board and Ms. Mayer was appointed to the Compensation and People Development Committee of the Board.

Each of Mr. Hohman’s, Ms. Mayer’s, and Mr. Shah’s compensation will be as provided under the Company’s non-employee director compensation program, as amended (the “Non-Employee Director Compensation Program”), as described in the Company’s supplement to its definitive proxy statement filed with the Securities and Exchange Commission on or about May 7, 2024. The Non-Employee Director Compensation Program provides for the following:

Cash Compensation

•General Board Service Fee: $40,000

•Lead Independent Director Fee (in addition to General Board Service Fee): $15,000

•Committee Chair Service Fee (in addition to General Board Service Fee; in lieu of Non-Chair Committee Member Service Fee set forth below):

◦Audit and Risk Committee: $27,500

◦Compensation and People Development Committee: $27,500

◦Nominating, Corporate Governance and Corporate Responsibility Committee: $10,000

•Non-Chair Committee Member Service Fee (in addition to General Board Service Fee; in lieu of Committee Chair Service Fee):

◦Audit and Risk Committee: $10,000

◦Compensation and People Development Committee: $10,000

◦Nominating, Corporate Governance and Corporate Responsibility Committee: $4,000

Equity Compensation

•Initial Equity Award: Restricted stock units with a grant date fair value of $350,000, which award vests annually over a two-year period

•Annual Equity Award: Restricted stock units with a grant date fair value of $175,000, which award vests on the date of the next annual meeting of stockholders (or the date immediately prior to the next annual meeting of stockholders if the applicable non-employee director’s service as a director ends at such meeting due to the director’s failure to be re-elected or the director not standing for re-election) and (b) the date that is one year following the grant date

In connection with their appointment as a non-employee director of the Board and consistent with the Non-Employee Director Compensation Program, as amended, each of Mr. Hohman, Ms. Mayer and Mr. Shah will receive, effective July 1, 2024, (i) a pro-rated annual retainer fee of $40,000, which is payable quarterly and (ii) an initial award of restricted stock units having an aggregate grant date fair value of $350,000, which award shall vest annually over a two-year period, subject to their continued service as a director on the Board (the “Initial Award”). Mr. Hohman and Ms. Mayer will also receive the Nominating, Corporate Governance and Corporate Responsibility member fee and Compensation and People Development Committee member fee, respectively. The Initial Award will accelerate in full upon the consummation of a Corporate Transaction (as defined in the Company’s 2021 Equity Incentive Plan).

There is no arrangement or understanding between any of Mr. Hohman, Ms. Mayer and Mr. Shah and any other persons pursuant to which Mr. Hohman, Ms. Mayer or Mr. Shah, respectively, was selected as a director. None of Mr. Hohman, Ms. Mayer or Mr. Shah is a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The Company plans to enter into its standard form of indemnification agreement with each of Mr. Hohman, Ms. Mayer and Mr. Shah. The form of the indemnification agreement was previously filed by the Company as Exhibit 10.6 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2021 and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On May 7, 2024, the Company issued a press release announcing the appointments of Mr. Hohman, Ms. Mayer and Mr. Shah to the Board. A copy of the press release is attached as Exhibit 99.3 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.3, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | Letter to Shareholders, dated May 7, 2024. |

| 99.2 | Press Release issued by Nextdoor Holdings, Inc., dated May 7, 2024. |

99.3 | Press Release issued by Nextdoor Holdings, Inc., dated May 7, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The information is being provided to stockholders in addition to the definitive proxy statement filed by the Company with the Securities and Exchange Commission (the “SEC”) on April 26, 2024 in connection with the solicitation of proxies for its 2024 annual meeting of stockholders. The Company plans to supplement the proxy statement to reflect the changes described in this Current Report on Form 8-K. Stockholders are urged to read the proxy statement, including the supplement, and accompanying materials carefully before making a voting decision. The proxy statement, including the supplement, and other documents filed by the Company with the SEC may be obtained free of charge at www.sec.gov and from the Company’s website at investors.nextdoor.com.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NEXTDOOR HOLDINGS, INC. |

| | |

| | |

Date: May 7, 2024 | By: | /s/ Matt Anderson |

| | Matt Anderson |

| | Chief Financial Officer |

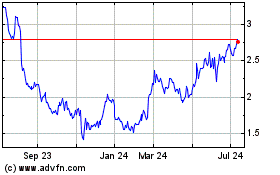

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Apr 2024 to May 2024

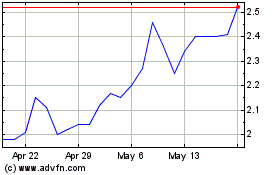

Nextdoor (NYSE:KIND)

Historical Stock Chart

From May 2023 to May 2024