ADM Battles Weak Prices, Strong Dollar

November 04 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/4/15)

By Jacob Bunge

Archer Daniels Midland Co. posted steeper-than-expected declines

in quarterly sales and profit as the grain giant contended with

weak commodity prices and slowdowns in some emerging markets.

ADM's stock tumbled 6.8% on Tuesday, wiping out about $2 billion

in market value.

ADM, which besides being one of the world's top grain traders is

a major ethanol producer, has seen profit margins for the

corn-based fuel additive shrink in the face of lower oil

prices.

The U.S. dollar's rise against overseas currencies also has

restrained demand for ADM's exports of U.S. corn and other crops,

Chief Executive Juan Luciano told investors on a post-earnings

conference call.

ADM, which warned investors earlier this year about tougher

conditions in the ethanol business, reported that third-quarter

operating profit in its ethanol-producing division dropped 78% to

$40 million, the biggest decline among ADM's units. The drop in oil

prices has made gasoline cheap and limited the premiums that ADM

and other ethanol producers can charge for the fuel additive, which

typically accounts for about 10% of gas content at U.S. fuel

pumps.

Slowing overseas economies buffeted ADM's grain-trading and

oilseed divisions. The sliding Brazilian real encouraged farmers

there to sell their grain, Mr. Luciano said, which provided a boost

to ADM's Brazilian crop traders but crimped the competitiveness of

its U.S. grain exports. The Chicago-based company maintains its

biggest grain-terminal and shipment network in the U.S.

Operating profit in ADM's oilseeds business fell partly due to

diminished European demand for vegetable oils, and the

strengthening U.S. dollar damped profits in ADM's newly established

division focused on flavorings and specialty ingredients.

"The macroeconomic [impact] was greater than we expected," said

Mr. Luciano, who took over as ADM's CEO in January.

ADM and other big commodity-trading firms are trying to navigate

economic turbulence in developing parts of the world, which has

driven rapid shifts in currency values and commodity demand. Bunge

Ltd. last week reported a steeper-than-expected decline in

quarterly profit due to weaker results in vegetable oil and grain

milling. Cargill Inc. posted a 20% increase in profit, boosted by

well-timed trading in agricultural commodities, the company

said.

Mr. Luciano said ADM, which maintains the largest U.S.

production capacity for ethanol, is working to make its plants more

efficient. He also expressed hope that foreign buyers such as China

will buy more U.S. ethanol.

ADM is taking a close look at its two dry mills, which process

corn into ethanol and byproducts used as animal feeds, and Mr.

Luciano said that if ADM discovers the plants can't "compete in a

more challenging U.S. ethanol environment," the company would "look

at various alternatives to maximize shareholder value."

Overall, ADM posted third-quarter earnings of $252 million, or

41 cents a share, down from $747 million, or $1.14 a share, a year

earlier. The quarter included $65 million in impairment, exit and

restructuring costs.

Excluding those charges and other special items, per-share

earnings fell to 60 cents from 86 cents a year earlier. Revenue

slid 8.6% to $16.57 billion. Analysts had projected per-share

earnings of 70 cents on revenue of $17.77 billion.

---

Chelsey Dulaney contributed to this article.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

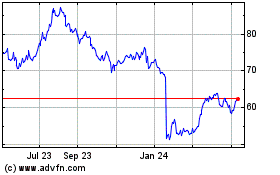

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

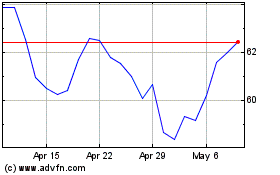

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024