Amgen's Profit Rises on Improved Margins, Steady Top-line Growth

February 02 2017 - 4:36PM

Dow Jones News

By Anne Steele

Amgen Inc.'s profit rose 7.8% in the final quarter of the year

as the biotechnology company continued to improve margins and see

steady top-line growth.

Results beat Wall Street expectations. Amgen's forecast for the

year, however, is more tepid than analysts had expected.

For 2017, Amgen expects revenue of $22.3 billion to $23.1

billion, just below the average analyst estimate for $23.31

billion. And the company forecast adjusted earnings between $11.80

and $12.60 a share, bracketing analysts' view of $12.46 a

share.

Biosimilar competition continued to pressure Amgen's cancer drug

Neupogen. Sales of the drug -- which began to see competition late

in 2015 from Novartis AG's Zarxio -- dropped 34% to $173 million,

mostly owing to competition in the U.S., the company said.

In August, Novartis AG's biosimilar for Amgen's Enbrel, which

competes with Humira, also won FDA approval. But the drug remained

the top contributor to Amgen's top line, with sales increasing 14%

to $1.64 billion, thanks largely to a price increase.

As older drugs face intensified competition from lower-priced

treatments, many drugmakers have been counting on new medicines

brought to market, as well as cost cuts, to prop up sales.

On Thursday, Chief Executive Robert Bradway said the company

anticipates several new product-development opportunities and

launches in 2017.

Sales of one of Amgen's newer drugs, anti-cholesterol treatment

Repatha, which initially got off to a slow start, accelerated in

the latest quarter, reaching $58 million. That compared with $7

million in sales a year iearlier.

And sales of Amgen's multiple-myeloma drug Kyprolis, which

failed to meet its primary endpoint of superior progression-free

survival against a rival drug in a recent study -- results that

could limit use in previously untreated patients -- shot up 24% to

$183 million.

Sales of bone drugs Prolia and Xgeva also continued to be a

revenue boon, rising 22% and 6% respectively.

In all for the December period, Amgen earned $1.94 billion, or

$2.59 a share, up from $1.8 billion, or $2.37 a share, a year

earlier. Excluding restructuring-related charges and other items,

adjusted per-share earnings grew to $2.89 from $2.61. Revenue rose

7.7% to $5.97 billion.

Analysts expected adjusted per-share profit of $2.79 on $5.74

billion in revenue, according to Thomson Reuters.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 02, 2017 16:21 ET (21:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

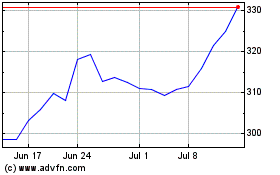

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

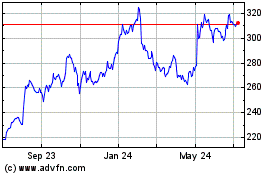

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024