Foster Wheeler Outperforms - Analyst Blog

May 02 2012 - 12:54PM

Zacks

Foster Wheeler AG (FWLT) reported first-quarter

2012 earnings per share from continuing operations of 40 cents

compared with 19 cents in the prior-year quarter. The company

surpassed the Zacks Consensus Estimate by a penny.

Including an asbestos-related provision, earnings per share in

the quarter came in at 38 cents, up 11.6% compared with 18 cents in

the prior-year quarter.

Total Revenue

Consolidated operating revenue in the quarter was $933.1

million, up 10% compared with $1.04 billion in the prior-year

period. FW scope revenue, excluding revenues relating to

third-party cost incurred by the company as agent or principal on a

reimbursable basis, was $625.0 million compared with $568.8

million.

Segment Results

Global Engineering and Construction (E&C) Group’s operating

revenue (FW scope) was $365.0 million, up 1.7% compared with $358.8

million in the prior-year period. In the reported quarter, orders,

which are generally of small and medium sizes, declined to $375.8

million from $561.5 million.

Global Power Group (GPG) operating revenue (FW Scope) increased

to $260.0 million from $210.0 million in the prior-year period, up

23.8%, led by backlog executed steadily. New order in the segment

increased to $159.4 million compared with $141.3 million in the

prior-year period.

Income & Expenses

Contract profit in the quarter was $139.3 million, up 40%

compared with $99.3 million in the prior-year quarter. SG&A

expense was $83.3 million, up 12.9% compared with $73.8 million in

the year-ago quarter.

E&C EBTDA was $46.9 million in the quarter, up 12.5%

compared with $41.7 million in the prior-year quarter and GPG

EBITDA was $52.3 million, up 97.4% compared with $26.5 million in

the year-ago comparable period.

Balance Sheet

Cash and cash equivalents at the end of March 2012 were $648.9

million compared with $718.0 billion at the end of 2011. Long-term

debt was $138.3 million compared with $136.4 million and

shareholders’ equity was $736.5 million compared with $687.7

million at the end of 2011.

During the reported quarter, the company repurchased 564,100

shares for approximately $10.1 million.

Outlook

The company expects Global E&C Group and Global Power Group

scope revenue to increase in 2012 versus 2011. Global E&C

Group EBITDA margin on scope revenue in 2012 is expected to be in

the range of 12%–14% and for Global Power Group in the range of

16%-18%.

Further, Foster Wheeler expects its earnings per share to

increase significantly in 2012 versus 2011 with an expected rise in

volume and a decline in share count.

Foster Wheeler AG is based in Zug Switzerland, but its

operational headquarters are in Clinton NJ USA. Majority of

Foster’s revenues and new businesses originate from outside the

United States. The company serves the following industries:

Oil and Gas; Oil Refining; Chemical & Petrochemical;

Pharmaceutical; Environmental; Power Generation; and Power Plant

Operation and Maintenance. Major competitors of Foster Wheeler are

Fluor Corporation (FLR) and Jacobs

Engineering Group Inc. (JEC).

We maintain a Zacks #2 Rank (Buy recommendation) over the next

one-to-three months on Foster Wheeler.

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

FOSTER WHELR AG (FWLT): Free Stock Analysis Report

JACOBS ENGIN GR (JEC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

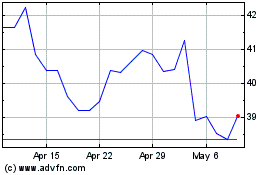

Fluor (NYSE:FLR)

Historical Stock Chart

From Aug 2024 to Sep 2024

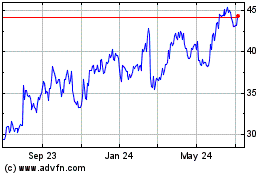

Fluor (NYSE:FLR)

Historical Stock Chart

From Sep 2023 to Sep 2024