By Justin Baer

The recent rally in financial stocks came too late for a cadre

of money managers and analysts at investment firms swept out of

their jobs earlier this year as the shares tumbled.

More than a dozen financial-stock specialists lost their jobs or

stepped down in recent months, people familiar with the matter

said. The turnover hit companies ranging from hedge-fund firm

Millennium Management LP to mutual funds including Pioneer

Investments and Sun Life Financial Inc.'s MFS Investment

Management, the people said. Hedge-fund giant Citadel LLC also shut

down four financial-stock teams at its Surveyor Capital arm as part

of a broader round of jobs cuts earlier this year.

Many of the investors exited after early losses, casualties of a

deep slump in the shares of banks and other financial firms, the

people said.

The KBW Nasdaq Bank Index, which touched a nearly three-year low

this February, has rebounded in recent days as the biggest U.S.

banks reported quarterly results that weren't as bad as feared. The

benchmark, which is down 8.2% for the year, rose 7% last week and

is up again Monday in late morning trading.

According to Morningstar, 31 U.S. mutual funds focused on

financial stocks were down an average of more than 3% this year

through Thursday.

Some of the investors left their posts amid general cost cuts or

other moves despite their stocks holding up fairly well during the

latest swoon, people familiar with the matter said.

The turnover has rattled a group on Wall Street whose members

see each other frequently at conferences and dinners with company

management teams. It also shows that many so-called experts are as

flummoxed as the firms they cover about how to adjust to the

industry's new regulations and lower returns.

"A lot of people are very worried about their jobs," said

Brennan Hawken, a bank analyst at UBS AG. "People are not feeling

good."

Worries about global economic growth, loan losses tied to the

energy industry and negative interest rates conspired to hammer

financial stocks through most of this year.

As a group, financials are the worst performer in the S&P

500 this year. The S&P 500 financial sector is down 3.9%

through last week.

Gerard Cassidy, an analyst at RBC Capital Markets, reckons the

exodus among financial-stock analysts is the worst since 1990, when

bank stocks tanked. In more recent periods of turmoil, including

the 2008 financial crisis, money managers at least had a sense that

stocks would be heading in one direction -- south -- for a period

and could plan accordingly, he said.

Mr. Cassidy said a number of investors bought bank stocks in

late 2015, reasoning that the Federal Reserve's move to raise

interest rates that December -- and forecast to raise them four

more times this year -- would help fuel profits of financial

firms.

In a Dec. 18 note to clients, Goldman analysts noted that

large-stock mutual funds had increased their holdings in financial

stocks, relative to the rest of the S&P 500, throughout 2015.

The analysts found that J.P. Morgan Chase & Co., Citigroup Inc.

and Visa Inc. were among the most popular holdings for both mutual

and hedge funds.

Mr. Cassidy said the turnover has been especially high among

hedge-fund investors. But Mr. Hawken noted he had seen a lot of

changes at "long-only" funds, too.

"This quarter caught us all by surprise," said Mr. Cassidy, who

is also president of the BancAnalysts Association of Boston, which

puts on an annual conference for members.

At a February conference hosted by Credit Suisse Group AG and

attended by many long-term bank shareholders, Lloyd Blankfein,

Goldman Sachs Group Inc.'s chairman and chief executive,

acknowledged the uneasy period investors faced in 2016.

"It's sober for everybody, the people who run our businesses,

but also for the investors who are also not enjoying this moment,"

Mr. Blankfein said. "Believe me, that's on my mind because some of

you I've been talking to for years and years.

"This is not the environment we always anticipated, but you know

something? You don't get to pick your time."

Jimmy Moynihan, an analyst at Pioneer Investments who covered

financials, left the mutual-fund firm, as did MFS's Kevin Conn.

Millennium Management earlier this year cut several employees

who specialize in financial stocks, people familiar with the matter

said.

The Wall Street Journal reported earlier this year that Citadel

had cut staff at Surveyor Capital, one of the firm's

stock-investing arms. The four financials teams let go collectively

employed more than 10 managers and analysts, and were led by Scott

Carmel, Ed Kosnik, Peter Seuss and Ryan Stevens, people familiar

with the matter said.

Surveyor is looking to add new financials managers and analysts,

the people said. "We've increased head count year over year" at

Citadel, Surveyor's parent, a spokesman for the firm said.

A financials analyst at Moore Capital Management, Stephen Rigo,

departed after the portfolio manager to whom he reported left the

firm, people familiar with the matter said. Mr. Rigo was hired by

ClearBridge Investments, a unit of Legg Mason, earlier this month,

a ClearBridge spokeswoman confirmed.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

April 19, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

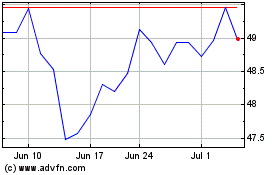

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

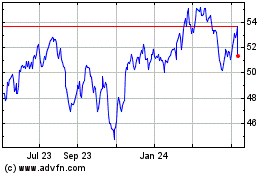

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Apr 2023 to Apr 2024