Cigna Profit Falls 8.8%

February 04 2016 - 7:52AM

Dow Jones News

By Anne Steele

Cigna Corp.'s profit fell 8.8% in the final quarter of the year

as unfavorable medical costs in the company's individual and

government businesses offset strength in the commercial employer

and specialty businesses.

The health-care provider also took a hit from charges related to

its proposed merger with Anthem Inc. and gave guidance for the year

below expectations.

For full-year 2016, Cigna forecast earnings of $8.85 to $9.25 a

share, compared with analyst estimates for $9.30 a share, according

to Thomson Reuters.

In the most recent quarter, the Bloomfield, Conn., insurer said

it had 15 million total medical customers at the end of the

quarter, compared with 14.46 million a year earlier and 14.85

million in the previous quarter.

In Cigna's global health-care business, premiums and fees

revenue grew 7.5% to $6.72 billion, reflecting growth in

self-funded programs, specialty products and government

businesses.

Over all, Cigna reported earnings of $426 million, or $1.64 a

share, down from $467 million, or $1.77 a share, a year earlier.

Income in the 2015 quarter included a charge of $28 million, or 11

cents a share, for transaction costs related to Cigna's proposed

merger with Anthem.

Excluding certain items, earnings from operations rose to an

adjusted $1.87 a share from $1.80 a share.

Revenue rose 6.7% to $9.53 billion.

In November, the company issued guidance for earnings of $1.61

to $1.81 a share. Analysts polled by Thomson Reuters forecast

revenue of $9.52 billion.

Cigna said its medical-loss ratio, or the share of premiums paid

out for members' health expenses, was 83.1% for its

government-based business, which the company said included some

"unfavorable medical cost variability in a specific market." The

medical-loss ratio for commercial members was 80.4%, reflecting

expected higher seasonal medical costs.

In July, Anthem agreed to buy Cigna for $48 billion, capping

months of merger frenzy among top U.S. health insurers. The deal

combines the second- and fifth-largest health insurers by revenue

and would create a company with a huge footprint in commercial

insurance, the type of coverage provided to employers and

consumers.

The biggest companies are seeking more cost efficiency and scale

as the health-care landscape changes because of the Affordable Care

Act and other factors.

Shares of the company, which have risen 2% over the past three

months, were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 04, 2016 07:37 ET (12:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

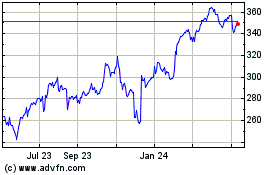

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

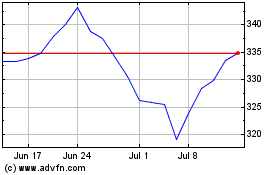

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024