U.S. Existing-Home Sales Highest Since February 2007

November 22 2016 - 10:50AM

Dow Jones News

WASHINGTON—Homebuying activity rose in October for the second

straight month to a new cyclical high, a sign the housing market is

stabilizing as the year comes to a close.

Sales of previously owned homes rose 2.0% from September to a

seasonally adjusted annual rate of 5.60 million, the National

Association of Realtors said Tuesday. That is the strongest pace

since February 2007.

Economists surveyed by The Wall Street Journal had expected a

sales rate of 5.45 million in October.

Existing-home sales account for the vast majority of U.S.

homebuying activity. After hitting an annual rate of 5.57 million

in June, sales softened over most of the third quarter before

picking up over the past two months. September's sales pace was

revised up to 5.49 million from an earlier estimate of 5.47

million.

Sales were up on an annual basis in all four regions of the

country, pointing to a "broad-based" housing recovery, said

Lawrence Yun, the NAR's chief economist.

Sales of previously owned homes in October were up 5.9% from a

year earlier.

Homebuying continued despite low inventory and rising prices. At

the latest sales pace, it would take 4.3 months to exhaust the

supply of previously owned homes on the market, down from 4.8

months in October 2015. Housing inventory has fallen on a

year-over-year basis for 17 straight months, NAR said. The median

price of an existing home sold in October was $232,200 up 6.0% on

the year.

First-time home buyers accounted for 33% of October sales,

according to NAR, down from 34% in September, a figure that matched

the highest level since July 2012. Distressed sales ticked up 1

percentage point to account for 5% of all sales.

News Corp, owner of The Wall Street Journal, also operates

Realtor.com under license from the National Association of

Realtors.

The U.S. housing market's prolonged recovery following the

2007-09 recession was a solid contributor to overall economic

growth in recent years. But a pullback in residential investment

during the second and third quarters, following eight consecutive

quarters of growth, has acted as a drag on the broader economy.

Still, home-building activity rebounded in October, with starts

in single-family and multifamily housing posting increases, and

permits edging higher as well, the Commerce Department said last

week. Home-builder sentiment also held at an elevated level in

November, the National Association of Home Builders said last week,

although construction is still at historically low levels.

The Commerce Department's report on new home sales will be

released Wednesday.

Borrowing costs remain low for prospective home buyers who

qualify for loans. The average interest rate on a 30-year

fixed-rate mortgage in October was 3.47%, below the October 2015

average of 3.80%, according to Freddie Mac. But mortgage rates have

already risen since then and may continue to, if, as many

economists surveyed by The Wall Street Journal predict, Federal

Reserve officials raise interest rates at their December policy

meeting. That could further damp enthusiasm for home buying.

Write to Anna Louie Sussman at anna.sussman@wsj.com and Jeffrey

Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

November 22, 2016 10:35 ET (15:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

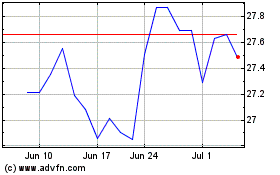

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

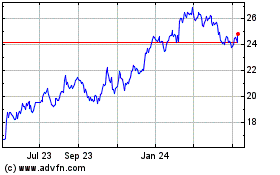

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024