TIDMTHS

RNS Number : 8279Q

Tharisa PLC

23 February 2023

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

A2X share code: THA

ISIN: CY0103562118

LEI: 213800WW4YWMVVZIJM90

('Tharisa' or the 'Company')

Results of the Annual General Meeting and dividend conversion

rates and timetable

Shareholders are advised that all the resolutions tabled at the

Annual General Meeting of shareholders held on Wednesday, 22

February 2023 (in terms of the notice dispatched on Thursday, 22

December 2022), were passed by the requisite majority. A poll was

conducted on each resolution.

Details of the results of voting at the Annual General Meeting

are as follows:

Total number of shares in issue on 22 February 2023: 302 596

743

Total number of shares entitled to vote at the Annual General

Meeting: 299 901 330

Resolution For Against Total shares Abstained

voted in

person or

by proxy

Shares Shares Shares Shares

------------ ------------ ------------- ------------

% of shares % of shares % of shares % of shares

voted voted entitled entitled

to vote to vote

------------ ------------ ------------- ------------

Ordinary resolution 210 335

1: 454 0 210 333 454 41 315

Adoption of Annual

Financial Statements 100% 0.00% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 210 335

2: 454 0 210 333 454 41 315

Appointment of Ernst

& Young as external

auditors 100% 0.00% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 209 803

3.1: 928 528 897 210 332 825 43 944

Re-election of Carol

Bell as a non-executive

director 99.75% 0.25% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 210 330

3.2: 765 2 060 210 332 825 43 944

Re-election of Omar

Kamal as a non-executive

director 100% 0.00% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 210 333

3.3: 325 500 210 333 825 42 944

Re-election of Roger

Davey as a non-executive

director 100% 0.00% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 135 891

4: 801 74 454 653 210 346 454 30 315

Placement of authorised

but unissued shares

under the directors'

control 64.60% 35.40% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 137 199

5: 476 73 135 638 210 335 114 41 655

Dis-application

of pre-emptive rights 65.23% 34.77% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 174 411

6: 970 35 922 644 210 334 614 42 155

General authority

to issue shares

for cash 82.92% 17.08% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 203 426

7.1: 951 6 908 503 210 335 454 41 315

Approval of the

Group remuneration

policy 96.72% 3.28% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 200 975

7.2: 020 9 360 934 210 335 954 40 815

Approval of the

Remuneration Implementation

Report 95.55% 4.45% 70.13% 0.01%

------------ ------------ ------------- ------------

Special resolution 205 078

1: 694 5 258 560 210 337 254 39 515

General authority

to repurchase shares 97.50% 2.50% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 208 943

8: 986 1 404 268 210 348 254 28 515

Dividend 99.33% 0.67% 70.13% 0.01%

------------ ------------ ------------- ------------

Ordinary resolution 210 334

9: 329 2 925 210 337 254 39 515

Directors' authority

to implement resolutions 100% 0.00% 70.13% 0.01%

------------ ------------ ------------- ------------

Dividend currency conversion rates and timetable

The final dividend of US 4.0 cents per share having been

approved by shareholders, Tharisa advises as follows:

Shareholders on the principal Cyprus register will be paid in

US$, shareholders whose shares are held through Central Securities

Depositary Participants (CSDPs) and brokers and are traded on the

JSE will be paid in South African Rand (ZAR) and holders of

Depositary Interests traded on the LSE will be paid in Sterling

(GBP). The dividend will be paid from income reserves and may

therefore be subject to dividend withholding tax depending on the

tax residency of the shareholder.

The currency equivalents of the dividend, based on the weighted

average of the South African Reserve Bank's daily rate at

approximately 10:30 (UTC +2) on 5 December 2022, being the currency

conversion date, are as follows:

Exchange rate Dividend per share in payment

currency

South Africa ZAR 17.2587/US$ 69.03480 South African cents per

- JSE share

---------------- ---------------------------------

United Kingdom GBP 0.81486/US$ 3.25944 pence per share

- LSE

---------------- ---------------------------------

The timetable for payment of the dividend is as follows:

Declaration and currency conversion Monday, 5 December 2022

date

Currency conversion rates announced Thursday, 23 February

2023

Last day to trade cum-dividend rights Tuesday, 28 February

on the JSE 2023

Last day to trade cum-dividend rights Wednesday, 1 March 2023

on the LSE

Shares will trade ex-dividend rights Wednesday, 1 March 2023

on the JSE from

Shares will trade ex-dividend rights Thursday, 2 March 2023

on the LSE from

Record date for payment on both JSE Friday, 3 March 2023

and LSE

Dividend payment date Wednesday, 15 March 2023

No dematerialisation or rematerialisation of shares within

Strate will be permitted between Wednesday, 1 March 2023 and

Friday, 3 March 2023, both days inclusive. No transfers between

registers will be permitted between Thursday, 23 February 2023 and

Friday, 3 March 2023, both days inclusive.

Tax implications of the dividend

Shareholders and Depositary Interest holders should note that

information provided should not be regarded as tax advice.

Shareholders are advised that the dividend declared will be paid

out of income reserves and may therefore be subject to dividend

withholding tax depending on the tax residency of the

shareholder.

South African tax residents

South African shareholders are advised that the dividend

constitutes a foreign dividend. For individual South African tax

resident shareholders, dividend withholding tax of 20% will be

applied to the gross dividend of 69.03480 South African cents per

share. Therefore, the net dividend of 55.22784 South African cents

per share will be paid after 13.80696 South African cents in terms

of dividend withholding tax has been applied. Shareholders who are

South African tax resident companies are exempt from dividend tax

and will receive the dividend of 69.03480 South African cents per

share. This does not constitute legal or tax advice and is based on

taxation law and practice in South Africa. Shareholders should

consult their brokers, financial and/or tax advisors with regard to

how they will be impacted by the payment of the dividend.

UK tax residents

UK tax residents are advised that the dividend constitutes a

foreign dividend and that they should consult their brokers,

financial and/or tax advisors with regard to how they will be

impacted by the payment of the dividend.

Cyprus tax residents

Individual Cyprus tax residents are advised that the dividend

constitutes a local dividend and that they should consult their

brokers, financial and/or tax advisors with regard to how they will

be impacted by the payment of the dividend.

Additional information required by the JSE Listing

Requirements

Tharisa has a total of 302 596 743 ordinary shares in issue on

22 February 2023, of which 299 901 330 carry voting rights and are

eligible to receive dividends.

Paphos, Cyprus

23 February 2023

JSE Sponsor

Investec Bank Limited

Connect with us on LinkedIn and Twitter to get further news and

updates about our business.

Investor Relations Contacts:

Ilja Graulich (Head of Investor Relations and

Communications)

+27 11 996 3500

+27 83 604 0820

igraulich@tharisa.com

Financial PR Contacts:

Bobby Morse / Oonagh Reidy

+44 207 466 5000

tharisa@buchanan.uk.com

Broker Contacts:

Peel Hunt LLP (UK Joint Broker)

Ross Allister / Georgia Langoulant

+44 207 7418 8900

BMO Capital Markets Limited (UK Joint Broker)

Thomas Rider / Nick Macann

+44 207 236 1010

Berenberg (UK Joint Broker)

Matthew Armitt / Jennifer Lee / Detlir Elezi

+44 203 207 7800

Nedbank Limited (acting through its Corporate and Investment

Banking division) (RSA Broker)

Carlyle Whittaker

+27 11 294 0061

About Tharisa

Tharisa is an integrated resource group critical to the energy

transition and decarbonisation of economies. It incorporates

exploration, mining, processing and the beneficiation, marketing,

sales, and logistics of PGMs and chrome concentrates, using

innovation and technology as enablers. Its principal operating

asset is the Tharisa Mine, located in the south-western limb of the

Bushveld Complex, South Africa. The mechanised mine has an 18 year

pit life and can extend operations underground by at least 40

years. Tharisa also owns Karo Mining Holdings a development stage,

low-cost, open-pit PGM asset located on the Great Dyke in Zimbabwe.

The Company is committed to reducing its carbon emissions by 30% by

2030 and the development of a roadmap is continuing to be net

carbon neutral by 2050. Tharisa plc is listed on the Johannesburg

Stock Exchange (JSE: THA) and the Main Board of the London Stock

Exchange (LSE: THS).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMTJMRTMTTTMMJ

(END) Dow Jones Newswires

February 23, 2023 03:00 ET (08:00 GMT)

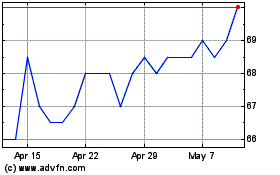

Tharisa (LSE:THS)

Historical Stock Chart

From May 2024 to Jun 2024

Tharisa (LSE:THS)

Historical Stock Chart

From Jun 2023 to Jun 2024