UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

INFORMATION

STATEMENT PURSUANT TO

SECTION

14(f) OF THE

SECURITIES

EXCHANGE ACT OF 1934

AND

RULE 14f-1 THEREUNDER

LEGACY

VENTURES INTERNATIONAL, INC.

(Name

of Registrant)

|

Nevada

|

|

000-55849

|

|

30-0826318

|

|

State

of Incorporation)

|

|

(Commission

File No.)

|

|

(IRS

Employer Identification No.)

|

27

Baycliffe Rd. Markham, ON, L3R 7T9

(Address

of Principal Executive Offices)

(647)

969-7383

(Registrant’s

Telephone Number)

McMurdo

Law Group, LLC

1185

Avenue of the Americas, 3rd Floor

New

York, NY 10036

(917)

318-2865

(Name,

Address and Telephone Number of Person Authorized to Receive

Notice

and Communications on Behalf of the Person(s) Filing Statement)

We

Are Not Asking You for a Proxy and

You

Are Required Not to Send Us a Proxy

LEGACY

VENTURES INTERNATIONAL, INC.

27

Baycliffe Rd. Markham, ON, L3R 7T9

Information

Statement Pursuant to Section 14(f) of the

Securities

Exchange Act of 1934 and

Rule

14f-1 Thereunder

Notice

of Proposed Change in the

Majority

of the Board of Directors

INTRODUCTION

The

information contained in this Information Statement pursuant to Rule 14f-1 (the “Notice”) is being furnished to all holders

of record of common stock of Legacy Ventures International, Inc. (the “Company”) at the close of business on October 14,

2021 in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934 (the “Exchange Act”), and

Rule 14f-1 under the Exchange Act.

No

action is required by the stockholders of the Company in connection with this Information Statement. However, Section 14(f) of the Exchange

Act and Rule 14f-1 promulgated thereunder require the mailing to our stockholders of record of the information set forth in this Information

Statement at least 10 days prior to the date a change in a majority of our directors occurs, otherwise than at a meeting of our stockholders.

Accordingly, the change in a majority of our directors pursuant to the terms of the Stock Purchase Agreement will not occur until at

least 10 days following the mailing of this Information Statement. This Information Statement will be mailed to our stockholders of record

on or about October 14, 2021.

Please

read this Information Statement carefully. It describes the terms of the Stock Purchase Agreement and contains certain biographical and

other information concerning our executive officers and directors after completion of the Stock Purchase Agreement. All of our filings

and exhibits thereto, may be inspected without charge at the public reference section of the Securities and Exchange Commission (“SEC”)

at 100 F Street N.E., Washington, DC 20549 or obtained on the SEC’s website at www.sec.gov.

NO

VOTE OR OTHER ACTION BY THE COMPANY’S STOCKHOLDERS IS REQUIRED IN RESPONSE TO THIS INFORMATION STATEMENT. PROXIES ARE NOT BEING

SOLICITED.

As

of September 29, 2021, Peter Sohn (the “Seller”), entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”)

pursuant to which the Seller agreed to sell to Ying Feng LAI, Wei TJONG, Pak Hong WAN, Johnathan Chung Hon CHOI, Chi Hung YEUNG, and

Hau Ming CHOW (together, the “Purchasers”), 286,720 common shares of the Company (the “Shares”) owned by the

Seller for a total purchase price of $480,000. As a result of the sale there will be a change of control of the Company, and the transaction

was closed on October 14, 2021. It is intended that the change of management will be completed approximately 11 days after this Information

Statement is filed with the SEC and mailed to the Company’s stockholders. There is no family relationship or other relationship

between the Seller and the Purchasers.

In

connection with the sale under the Stock Purchase Agreement, the Seller, who is also the Company’s sole officer and director, has

agreed to (a) appoint Ying Feng LAI (the “Designee”) as the sole director of the Company, subject to the filing and dissemination

of this Information Statement, and (b) submit his resignation as the sole director and officer of the Company, subject to the filing

and dissemination of this Information Statement. As a result thereof, the Designee will then constitute the entire Board of Directors

of the Company.

As

of the date of this Information Statement, the authorized capital stock of the Company consists of 100,000,000 shares of common stock,

par value $.0001 per share, of which 315,064 shares are issued and outstanding, and 10,000,000 shares of Preferred Stock, $.0001 par

value per share, none of which shares are issued and outstanding. Each share of common stock is entitled to one vote with respect to

all matters to be acted on by the stockholders.

CURRENT

DIRECTORS AND EXECUTIVE OFFICERS

Set

forth below are the current directors and executive officers of the Company:

|

Name

|

|

Position/Title

|

|

|

|

|

|

Peter Sohn

|

|

President, CEO, CFO, and Director

|

|

|

(1)

|

Mr.

Sohn will resign all of his positions when the change of control is completed, on or about

October 25, 2021.

|

The

following sets forth biographical information regarding the Company’s current directors and officers:

|

Name and Address

|

|

Position/Title

|

|

|

|

|

|

Peter Sohn

|

|

President, CEO, CFO, and Director

|

27 Baycliffe Rd.

Markham, ON, L3R 7T9

|

|

|

Mr.

Sohn was recently the Customer Service Manager at Gay Lea Foods from 2017 to 2018. Mr. Sohn was a Consultant on a supply chain project

at Smucker Foods of Canada from 2016 to 2017. Mr. Sohn was the Senior Manager of Customer Supply Chain at Kraft from 2012 to 2015. Mr.

Sohn earned his Masters of Business Administration from the Richard Ivey School of Business in 2001 and his Bachelor of Mechanical Engineering

at Western University in 1995.

Set

forth below is information describing the Company’s proposed new directors (the “Designees”), to be designated pursuant

to the terms of the Stock Purchase Agreement:

|

Name and Address

|

|

Position/Title

|

|

|

|

|

|

Ying Feng Lai

|

|

President, CEO, CFO, and Director

|

Mr.

Ying Feng LAI (“Mr. LAI”), age 30, obtained his Diploma of Business Administration in the Columbia College in Canada in 2012.

From

January 2012 to March 2016, Mr. LAI was an assistant operation commissioner of Aquaporin Industries Limited, a water tech company delivering

innovative technology built on nature’s own water filtration. (“Aquaporin”) Aquaporin had three target markets, namely

industrial water, drinking water and hemodialysis. Mr. LAI was responsible for resource planning and management including hiring and

interviewing, training, coaching, developing, objective setting and performance management.

From

April 2016 to the present, Mr. LAI has been a Vice President of Operation of Zeus Medicine Pharmaceutical Group Limited, a manufacturing

company on branded and generic medicines and medical supplies. (“Zeus”) Mr. LAI is responsible for the leading, developing

and mentoring manufacturing operation.

There

is no relationship between the Seller and the Designee. The Designee has no material plan, contract or arrangement (written or not written)

to which a proposed new director or officer is a party, or in which either participates, that is entered into, or a material amendment,

in connection with the triggering event or any grant or award to any such covered person or modification thereto, under any such plan,

contract or arrangement in connection with any such event.

INVOLVEMENT

IN CERTAIN LEGAL PROCEEDINGS

To

the Company’s knowledge, during the past ten (10) years, neither our sole director and officer nor the Designee has been:

|

|

●

|

the

subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer

either at the time of the bankruptcy or within two years prior to that time;

|

|

|

●

|

convicted

in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities

or banking activities; or found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures

Trading Commission to have violated a federal or state securities or commodities law.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding the beneficial ownership of the Company’s common stock by (i) each stockholder

known by the Company to be the beneficial owner of more than 5% of the Company’s common stock and (ii) by the directors and executive

officers of the Company. The person or the company named in the table has sole voting and investment power with respect to the shares

beneficially owned.

The

following sets forth the beneficial ownership information prior to the closing of the Stock Purchase Agreement :

|

|

|

Name and Address

|

|

Amount and Nature of

|

|

|

|

|

Title of Class

|

|

of Beneficial Owner

|

|

Beneficial Ownership

|

|

Percent of Class

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001

|

|

Peter Sohn

27 Baycliffe Rd. Markham, ON, L3R 7T9

|

|

|

286,720

|

|

|

91.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001

|

|

All Executive Officers

and Directors as a Group

(1 person)

|

|

|

286,720

|

|

|

91.0

|

%

|

The

following sets forth the beneficial ownership information after the closing of the Stock Purchase Agreement :

|

|

|

Name and Address

|

|

Amount and Nature of

|

|

|

|

|

Title of Class

|

|

of Beneficial Owner

|

|

Beneficial Ownership

|

|

Percent of Class

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par value $0.0001

|

|

Ying Feng LAI

|

|

|

60,480

|

|

|

19.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, Par value $0.0001

|

|

Wei TJONG

|

|

|

189,040

|

|

|

60.0

|

%

|

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires our officers, directors and persons who own more than 10% of a registered class of our equity securities

to file reports of ownership and changes in ownership with the SEC. Officers, directors and 10% stockholders are required by regulation

to furnish us with copies of all Section 16(a) forms they file. To the best of our knowledge (based upon a review of the Forms 3, 4 and

5 filed), the officer, director and 10% beneficial stockholder of the Company failed to file, on a timely basis, any reports required

by Section 16(a) of the Exchange Act during the Company’s fiscal year ending June 30, 2021.

COMPENSATION

OF DIRECTORS AND OFFICERS

For

the years ended June 30, 2021 and 2020, the Company’s sole Director and Officer, earned fees of $12,000, respectively.

Corporate

Governance

Board

of Directors and Committees; Director Independence

We

do not have standing audit, nominating or compensation committees of the Board of Directors or committees performing similar functions.

These functions are currently performed by the Board of Directors, which currently consists of two persons. We do not have an audit committee

charter or nominating committee charter.

Our

Board of Directors does not currently have an expressed policy with regard to the consideration of any director candidates recommended

by stockholders because the Board of Directors believes that it can adequately evaluate any such nominees on a case-by-case basis. Our

Board of Directors does not currently have any formal minimum criteria for nominees. We have not received any recommendations for director

nominees from any stockholders.

None

of our current directors, nor any of the proposed directors following the change of control, are “independent” directors

under the Nasdaq Marketplace Rules.

Board

Meetings

During

the Company’s fiscal year ended June 30, 2021, and the fiscal year ended June 30, 2020, our Board of Directors did not hold any

meetings and took no actions by written consent. We have not yet established a policy with respect to board member’s attendance

at annual meetings.

Stockholder

Communications

Our

Board of Directors does not currently have a process for our stockholders to send communications to the Board of Directors. Following

the change of control of the Board of Directors, our stockholders can send communications to the new Board of Directors by writing to:

Legacy Ventures International Inc.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

Except

for the ownership of the Company’s securities, neither the current sole director and officer, nor the Designee, nor holders of

more than ten percent of the Company’s outstanding Common Shares, or any member of the immediate family of such person, have, to

the knowledge of the Company, had a material interest, direct or indirect, during the fiscal year ended June 30, 2020, and the fiscal

year ended June 30, 2021, in any transaction or proposed transaction which may materially affect the Company.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

The

Company is subject to the information and reporting requirements of the Securities Exchange Act of 1934 and, in accordance with that

act, files periodic reports, documents and other information with the SEC relating to its business, financial statements and other matters.

These reports and other information may be inspected and are available for copying at the offices of the SEC, 100 F Street N.E., Washington,

D.C. 20549 and are available on the SEC’s website at www.sec.gov.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Information Statement to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

LEGACY

VENTURES INTERNATIONAL, INC.

|

|

|

|

|

|

October

14, 2021

|

|

|

|

|

|

/s/

Ying Feng LAI

|

|

|

By:

|

Ying

Feng LAI

|

|

|

Title:

|

CEO

|

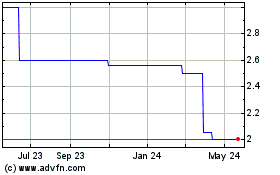

Legacy Ventures (CE) (USOTC:LGYV)

Historical Stock Chart

From May 2024 to Jun 2024

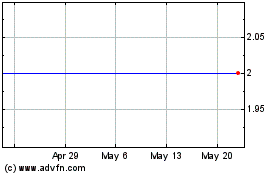

Legacy Ventures (CE) (USOTC:LGYV)

Historical Stock Chart

From Jun 2023 to Jun 2024