Amen Properties Reports Results for Fourth Quarter of 2009

April 08 2010 - 12:00PM

Business Wire

Amen Properties (Pink Sheets: AMEN) today announced financial

results for its fiscal quarter and year ended December 31, 2009.

The Company posted quarterly revenue of $2.3 million and net income

of $401 thousand versus revenue of $1.0 million and net income of

$6 thousand in the fourth quarter of 2008. This improvement in

earnings was driven by a 42% increase in Priority Power revenue

which resulted from a large reengineering project. Priority

delivered full year earnings of $1.4 million in 2009, an increase

of 6% over 2008.

For the full year 2009, Amen reported revenue of $8.6 million

and net income of $451 thousand, versus revenue of $4.5 million and

net income of $550 thousand in 2008. The significant increase in

2009 revenue was caused by the consolidation of SFF Production, in

which the Company purchased a controlling interest at the end of

2008. The decrease in profitability versus 2008 was driven by

decreases in oil and gas prices, depletion expense for SFF

Production and the recognition of a gain of $703 thousand in 2008

related to the liquidation of the Company’s holdings in Santa Fe

Energy Trust. After payment of preferred dividends, the Company

generated a loss per common share of $(0.11) for 2009, compared to

earnings per share of $0.05 in 2008 (diluted).

Amen recognized income of $184 thousand in 2009 from its

minority investment in HPG Acquisition, LLC, an entity which owns

commercial real estate in Midland, Texas. Additionally, the

Company’s corporate overhead decreased over $500 thousand in 2009

as a result of the Company’s decision to delist from NASDAQ and

other cost-cutting measures.

“Despite our negative accounting results caused by significant

depletion expense, our oil and gas investments delivered over $2.3

million in cash flow in 2009, leaving Amen in a very strong

financial position with nearly $6 million in cash and less than $2

million in debt at the end of the year,” said Kris Oliver, Amen’s

Chief Executive Officer. “We expect our oil and gas properties to

continue to drive significant cash flow but little or no accounting

income in the near term until the properties are fully depleted,

after which our NOL will allow us to maximize cash flow by

shielding the earnings from taxes.”

Mr. Oliver also mentioned that Amen accrued a tithing liability

of $48 thousand for 2009 in accordance with its bylaws. Amen

donates 10% of its net income to Christian charities with an

emphasis on benevolence and youth ministry.

The Company’s 2009 fourth quarter report is available for

viewing or download from the company’s web site –

www.amenproperties.com.

About Amen Properties:

Amen is a Christian corporation with a strategic asset – a net

operating loss accumulated during the Company’s “dot com” past

totaling $28 million which can be used to offset tax liabilities

arising from future earnings. Amen seeks to own strong

energy-related assets and businesses with earnings which can be

shielded from taxes via the Company’s NOL. Currently, Amen owns

business and assets which fall into two categories: Energy Services

and Energy Resources.

Energy Services: Priority Power (www.prioritypower.net)

Priority Power is an independent energy management and

consulting services firm whose sole purpose is to act as an

extension of our clients’ staff to mitigate the risk and overcome

the challenges associated with energy supply, information, and

demand management. Priority Power has 1,200 clients representing

over 7.1 billion kilowatt hours and $650 million in annual energy

consumption.

Energy Resources: Oil and Gas Interests

Amen owns royalty and working interests in over 1,200 properties

in twelve states through its ownership of SFF Royalty, LLC (33.3%

ownership) and SFF Production, LLC (79.1% owner), the entities

which own the interests formerly held by Santa Fe Energy Trust.

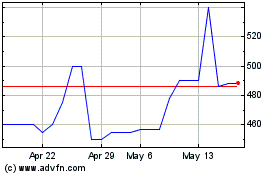

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From Apr 2024 to May 2024

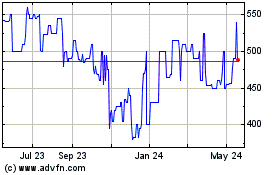

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From May 2023 to May 2024