Amen Properties Announces Completion of Reverse Stock Split

January 13 2010 - 6:32PM

Business Wire

Amen Properties (Pink Sheets: AMEN) today announced that a

previously approved 1-for-100 reverse split of its common stock

will take effect at the start of trading on Thursday, January 14,

2010. Trading of AMEN’s common stock on the OTC Pink Sheets will

begin on a split-adjusted basis at the open of trading on January

14th. Amen’s shares will continue to trade under the symbol “AMEN”

with the letter “D” added to the end of the trading symbol for a

period of 20 trading days to indicate that the reverse stock split

has been effected.

As a result of the reverse stock split, every 100 shares of

AMEN’s common stock issued and outstanding immediately prior to the

effective time will be combined into one share of common stock.

Fractional shares will not be issued and stockholders who otherwise

would have been entitled to receive a fractional share as a result

of the reverse stock split will receive an amount in cash equal to

$4.00 per pre-split share for such fractional interests. The number

of shares of Amen’s common stock issued and outstanding will be

reduced from approximately 4,233,714 pre-split to approximately

42,300 post-split.

Letters of transmittal are expected to be sent to stockholders

by the company’s transfer agent, American Stock Transfer and Trust

Company, shortly after the effectiveness of the reverse stock

split. No action by Amen’s stockholders is required prior to

receipt of these letters.

The reverse stock split was approved by the non-unanimous

written consent of Amen’s stockholders on December 18, 2009. The

number of shares of common stock subject to outstanding stock

warrants and options or convertible securities, and the exercise

prices and conversion ratios of those securities, will

automatically be proportionately adjusted for the 1-for-100 ratio

provided for by the reverse stock split.

About Amen Properties:

Amen is a Christian corporation with a strategic asset – a net

operating loss accumulated during the Company’s “dot com” past

totaling $28 million which can be used to offset tax liabilities

arising from future earnings. Amen seeks to own strong

energy-related assets and businesses with earnings which can be

shielded from taxes via the Company’s NOL. Currently, Amen owns

business and assets which fall into two categories: Energy Services

and Energy Resources.

Energy Services: Priority Power (www.prioritypower.net)

Priority Power is an independent energy management and

consulting services firm whose sole purpose is to act as an

extension of our clients’ staff to mitigate the risk and overcome

the challenges associated with energy supply, information, and

demand management. Priority Power has 1,200 clients representing

over 7.1 billion kilowatt hours and $650 million in annual energy

consumption.

Energy Resources: Oil and Gas Interests

Amen owns royalty and working interests in over 1,200 properties

in twelve states through its ownership of SFF Royalty, LLC (33.3%

ownership) and SFF Production, LLC (79.1% owner), the entities

which own the interests formerly held by Santa Fe Energy Trust.

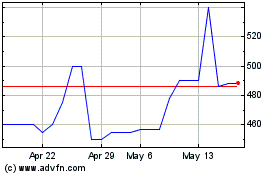

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From May 2024 to Jun 2024

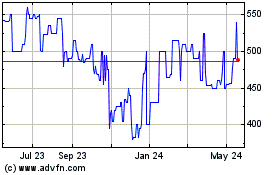

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From Jun 2023 to Jun 2024