Amen Properties Reports Results for First Quarter of 2009

May 29 2009 - 12:32PM

Business Wire

Amen Properties (Pink Sheets: AMEN) today announced financial

results for its fiscal quarter ended March 31, 2009. The Company

posted quarterly revenue of $1.9 million and a net loss of $488

thousand, or $(0.09) per diluted share. These results compare to

revenue of $1.4 million and net income of $977 thousand, or $0.26

per diluted share, for the year ago quarter. The decrease in

earnings during Q109 was a result of decreased oil and gas

commodity prices, increased sales expenses at Priority Power and

other one-time items as described below.

Priority Power received a one-time payment of $300 thousand in

the first quarter of 2008 related to a power plant development

project. Recurring revenue for Priority was down 12% versus last

year due to reduced energy demand caused by economic factors,

particularly among Priority�s oil and gas customers. Priority�s

general and administrative expenses were 43% higher than the same

quarter in 2008 due to increases in sales staff. Management has

recently let go a number of sales staff and believes that these

expenses will be reduced in future quarters.

The Company recognized a gain of $535 thousand in the first

quarter of 2008 on the liquidation of its ownership in the Santa Fe

Energy Trust. The first quarter of 2009 is the first period that

the financial results of SFF Production, LLC are consolidated with

the Company�s financial statements. The Company�s Oil & Gas

Interests generated a loss of $101 thousand for the quarter due to

reduced commodity prices during the quarter. Despite these

disappointing accounting earnings, the Company received over $700

thousand in cash distributions related to its oil and gas holdings

during the quarter.

The Company�s 2009 first quarter report is available for viewing

or download from the company�s web site �

www.amenproperties.com.

About Amen Properties:

Amen is a Christian corporation with a strategic asset � a net

operating loss accumulated during the Company�s �dot com� past

totaling $28 million which can be used to offset tax liabilities

arising from future earnings. Amen seeks to own strong

energy-related assets and businesses with earnings which can be

shielded from taxes via the Company�s NOL. Currently, Amen owns

business and assets which fall into two categories: Energy Services

and Energy Resources.

Energy Services: Priority Power (www.prioritypower.net)

Priority Power is an independent energy management and

consulting services firm whose sole purpose is to act as an

extension of our clients� staff to mitigate the risk and overcome

the challenges associated with energy supply, information, and

demand management. Priority Power has 1,200 clients representing

over 7.1 billion kilowatt hours and $650 million in annual energy

consumption.

Energy Resources: Oil and Gas Interests

Amen owns royalty and working interests in over 1,200 properties

in twelve states through its ownership of SFF Royalty, LLC (33.3%

ownership) and SFF Production, LLC (79.1% owner), the entities

which own the interests formerly held by Santa Fe Energy Trust.

Additionally, the Company owns a 5% working interest and 4% net

revenue interest in producing wells located on the 30,000 acres of

the Permian Basin known as the Yarborough and Allen Field.

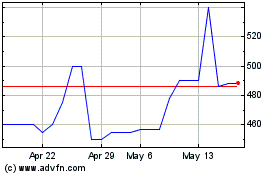

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From Apr 2024 to May 2024

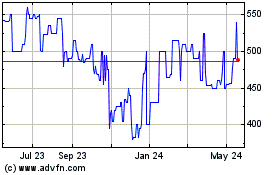

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From May 2023 to May 2024