Barclays Global Investors Canada Limited

(TSX:XBB)(TSX:XCB)(TSX:XCG)(TSX:XCV)(TSX:XDV)(TSX:XEG)(TSX:XFN)(TSX:XGB)(TSX:XGD)(TSX:XIC)(TSX:XIN)(TSX:XIT)(TSX:XIU)(TSX:XLB)(TSX:XMA)(TSX:XMD)(TSX:XRB)(TSX:XRE)(TSX:XSB)(TSX:XSP)(TSX:XTR)(TSX:XSU)(TSX:XEN)(TSX:XCS)(TSX:XCR)(TSX:XGR)(TSX:XGC)(TSX:XAL)

-

The Board of Directors of Barclays PLC today announces agreement for the sale of

its iShares business ("iShares") to Blue Sparkle LP ("Bidco"), a new limited

partnership established by CVC Capital Partners Group SICAV-FIS S.A. ("CVC"),

for a total consideration of approximately US$4.4 billion (Pounds Sterling 3.0

billion).

The transaction will:

- Allow Barclays to crystallise significant value through the realisation of an

expected net gain on sale of US$2.2 billion (Pounds Sterling 1.5 billion),

taking into consideration goodwill of US$1.4 billion (Pounds Sterling 1.0

billion), from a business grown largely organically over the last five years;

- Give Barclays the opportunity to maximise value through the sale of a business

which represents a distinct channel for Barclays Global Investors ("BGI") and

which now has the scale, depth of client relationships and brand equity to

continue to be successful on a standalone basis;

- Provide Barclays the opportunity to participate in future value creation

through a continuing commercial relationship with the iShares business and the

potential crystallisation of consideration through a cash-settled participation

interest entitling Barclays to receive a portion of the value uplift on iShares

if certain performance-related hurdles are met; and

- Enhance the capital position of Barclays, adding an estimated 54 bps to Equity

Tier 1 pro forma as at 31 December 2008. Taking into account the expected net

gain on the sale of iShares, conversion of the Mandatorily Convertible Notes

issued in November 2008 and all innovative Tier 1 capital, on a pro forma basis,

Barclays would have reported an estimated Tier 1 ratio of 10.3 % and an

estimated Equity Tier 1 ratio of 7.2 % as at 31 December 2008.

Under the transaction agreement, for a period of at least 45 business days from

15 April 2009, Barclays may solicit proposals for iShares and potentially other

related businesses from third parties. There can be no assurance that the

solicitation of proposals will result in any superior alternative transaction

being agreed.

iShares is a leading global provider of exchange traded funds ("ETFs") and forms

part of BGI. Following the transaction, BGI will remain one of the world's

largest asset managers. This scale, combined with deep client relationships and

strong investment capabilities, offers significant opportunities for the growth

of BGI's presence and share of supply in institutional asset management. BGI

will retain all of its securities lending business.

The consideration of US$4.4 billion (Pounds Sterling 3.0 billion), which

includes the Barclays cash-settled participation interest, represents a multiple

of 10.1x 2008 EBITDA of iShares and is made up as follows:

US$ billion Nominal Value

Equity 1.05 1.05

Senior debt 1.70 1.70

Vendor loan 1.40 1.10

Participation interest n/a 0.52

-------------

Total 4.37

-------------

The net proceeds of the transaction, after costs and assuming the distribution

of a dividend to the minority shareholders in BGI comprising current and former

employees, will be retained by Barclays and contributed to capital resources.

The transaction is subject to receipt of regulatory and other approvals.

The debt financing for the transaction will be provided by Barclays in the

amount of approximately US$3.1 billion (Pounds Sterling 2.1 billion). Barclays

has agreed to hold no less than 51% of the total financing for the first five

years and may syndicate the remaining 49% after the first year. The remainder of

the consideration will be funded by equity provided by Bidco.

Commenting on the transaction, John Varley, Group Chief Executive of Barclays, said:

"This transaction realises significant value for Barclays. iShares has

experienced rapid growth over the past several years and has reached a point

where it can develop further on a standalone basis. Barclays shareholders will

benefit from a reinforcement of our capital base and an ongoing commercial

relationship with iShares."

Details of the transaction

1. Transaction terms

The consideration of approximately US$4.4 billion (Pounds Sterling 3.0 billion)

will be subject to a price adjustment mechanism based on the level of revenues

and costs at the initial closing relative to the 2009 business plan for iShares.

The breakdown of total consideration of US$4.4bn is shown above.

The services which are currently provided by BGI to iShares as part of the

Barclays Group will either be separated through the direct transfer of readily

separable services on completion or provided, at least for an initial period,

pursuant to transitional service agreements which will be entered into prior to

completion. CVC and iShares will also establish commercial agreements in

relation to a range of services which Barclays will continue to provide on an

ongoing basis following completion, including in respect of securities lending.

The transaction is not expected to have any impact on the ETFs provided by

iShares nor on the holders of ETFs.

2. Financial information

31 December 2008 BGI iShares Net BGI

Pounds Pounds Pounds

Sterling m Sterling m Sterling m

Total Income 1,844 658 1,186

Operating Expenses

(excl. Liquidity Support) (986) (370) (616)

Liquidity Support (263) - (263)

Operating Expenses (1,249) (370) (879)

Profit before tax 595 288 307

EBITDA 673 294 379

Total Assets 71,340 465 70,875

AUM (Pounds Sterling bn) 1,040 226 814

Note: The financial information relating to iShares has been extracted from

the financial records of BGI, a business segment of Barclays PLC. The

financial information for BGI is as reported for BGI in the segmental

reporting set out in the 2008 financial statements of Barclays PLC

3. Go-shop provision

Barclays has the benefit of a go-shop period, which expires no earlier than 18

June 2009, 45 business days from 15 April 2009. During this period Barclays can

solicit or consider proposals for a superior transaction involving iShares and

potentially other related businesses.

A go-shop break fee of US$175 million (Pounds Sterling 120 million) would be

payable by BGI to Bidco if BGI terminates the transaction agreement and agrees

to any superior transaction with a party other than CVC involving iShares, and

potentially other related businesses, and which is not matched by CVC within

five business days.

Details of a superior transaction, if any, agreed during the go-shop period

would be communicated in a separate announcement.

4. Employees and management

At the end of 2008, the iShares business had approximately 620 employees

(excluding contractors and support staff) across 14 countries and five

continents.

A number of employees are shareholders in BGI UK Holdings Limited ("BGI

Holdings"), which is the main holding company for BGI (including the iShares

business) within Barclays. These shareholders purchased their shares through the

BGI Equity Ownership Plan ("EOP"). The EOP shares now represent 4.5% of the

share capital of BGI Holdings. The EOP was approved by Barclays shareholders in

2000. It is currently envisaged that employees who are shareholders in BGI

Holdings will receive a cash dividend on their shares as a consequence of the

transaction in respect of a proportion of the transaction proceeds. The payment

of the dividend will in effect release part of the value of their shareholding.

Some employees hold options under the EOP and it is currently expected that

those with vested options will have the opportunity to exercise those options to

obtain BGI Holdings shares ahead of completion of the transaction. Should all

the vested options be exercised, the EOP shares would increase from 4.5% to

represent 10.3% of the share capital of BGI Holdings. Such shares arising on

exercise of options may also carry the right to receive a dividend in respect of

a proportion of the transaction proceeds.

Robert E. Diamond Jr, President of Barclays PLC and Chief Executive of

Investment Banking and Investment Management, holds shares in BGI Holdings which

he purchased through his participation in the EOP. His participation in the EOP

predates his appointment to the Board of Barclays PLC in June 2005. As a BGI

Holdings shareholder and option holder, he may receive a cash dividend (net of a

US$2.9 million (Pounds Sterling 2.0 million) payment required in consideration

of his options) on his BGI Holdings shares of up to approximately US$6.9 million

(Pounds Sterling 4.7 million) before any applicable deductions.

Mr Diamond has taken no part in the consideration of the iShares transaction

either as a member of the Board or as a director of BGI Holdings.

The members of the iShares core management team who are expected to constitute

the iShares core management team following the completion of this transaction

are:

- Lee Kranefuss

- Mike Latham

- Rory Tobin

The majority of the remaining employees working within the iShares business are

also expected to transfer with iShares as part of this transaction.

5. Financing

Barclays will provide Bidco with debt financing in connection with the

transaction through: (i) a six-year senior secured term loan facility of

approximately US$850 million (Pounds Sterling 580 million) at a spread of 4.0%

over the London Interbank Offered Rate ("LIBOR"); (ii) a seven-year senior

unsecured loan facility with a bullet repayment of approximately US$850 million

(Pounds Sterling 580 million) at a spread of 5.5% over LIBOR; and (iii) a

ten-year vendor loan with a principal amount of approximately US$1,400 million

(Pounds Sterling 956 million), with a mandatory payment in kind interest

mechanism at 7.0%. The remaining US$1,050 million (Pounds Sterling 717 million)

of financing will consist of equity provided by Bidco.

Barclays has agreed to hold no less than 51% of each facility for the first five

years and may syndicate the remaining 49% after the first year. Barclays has

certain rights to modify some of the financing terms (including pricing of the

senior unsecured term loan) at the time of syndication.

The debt financing provided by Barclays is expected to add US$4.0 billion

(Pounds Sterling 2.7 billion) of risk weighted assets to Barclays PLC's balance

sheet.

6. Barclays participation interest

Under the transaction agreement, CVC will grant Barclays a participation

interest which will entitle Barclays to receive, in cash, 20% of the value of

the equity return from the iShares business received by CVC on realisation after

CVC has achieved a minimum return of no less than: (i) in the first two years,

2.0 times, and thereafter 2.5 times its equity investment; and (ii) a 25%

internal rate of return from the iShares business.

7. Closing requirements

Closing is conditional upon obtaining regulatory approvals and is expected to

occur in several stages. Before the initial closing can take place regulatory

approvals must have been received in the US, Germany, the UK and Ireland, and

shareholder approvals must have been obtained in respect of US-registered

iShares funds whose assets represent at least 85% of the assets under management

as of 31 December 2008 of all such funds. The initial closing is expected to

take place in the third quarter of 2009. Subsequent closings will occur in

respect of iShares operations in other jurisdictions on a country by country

basis once appropriate regulatory approvals and other necessary conditions have

been obtained.

Currently, pre-closing regulatory approvals are expected to be required in the

US, UK, Germany, Ireland, Australia, Brazil, Canada, Mexico, Chile, Hong Kong,

Japan and Singapore.

Termination rights exist for both parties in the event that there is a material

change in the business before closing or if a separation plan for the businesses

being sold is not agreed. Termination would entitle CVC to a payment of US$25

million.

A fee of US$50 million (Pounds Sterling 34 million) or US$175 million (Pounds

Sterling 120 million) will be payable by CVC or Barclays respectively if closing

does not occur due to a material default of CVC or Barclays, as the case may be,

in certain circumstances.

8. Expected timetable of principal events

The expected timetable of the principal events is set out below:

Commencement of go-shop period 15 April 2009

Conclusion of go-shop period 18 June 2009

Anticipated initial closing Third quarter 2009

Anticipated final closing November 2009

The timetable is included for illustrative purposes only and may be subject

to change.

9. Advisers

Barclays Capital is acting as lead financial adviser to Barclays and Lazard &

Co., Limited ("Lazard") is acting as financial adviser to Barclays. Clifford

Chance LLP and Sullivan & Cromwell LLP are acting as legal advisers to Barclays.

As previously disclosed in Barclays Annual Report 2008, Sir John Sunderland,

Non-executive Director of Barclays, is currently an Adviser to CVC. Sir John

Sunderland notified the Board of Barclays PLC of his interest in the disposal of

iShares pursuant to section 177 of the Companies Act 2006. He has not been

involved in advising CVC on the disposal.

About Barclays

Barclays is a major global financial services provider engaged in retail and

commercial banking, credit cards, investment banking, wealth management and

investment management services with an extensive international presence in

Europe, the USA, Africa and Asia. With over 300 years of history and expertise

in banking, Barclays operates in over 50 countries and employs approximately

156,000 people. Barclays moves, lends, invests and protects money for 48 million

customers and clients worldwide. For further information about Barclays, please

visit our website www.barclays.com.

About BGI

BGI is one of the world's largest asset managers and a leading global provider

of investment management products and services with more than 3,000

institutional clients and US$1.5 trillion of assets under management as at 31st

December 2008. BGI transformed the investment industry by creating the first

index strategy in 1971 and the first quantitative active strategy in 1979. BGI

is one of the global product leaders in exchange traded funds (iShares(R)

exchange traded funds) with over 360 funds globally across equities, fixed

income and commodities which trade on 18 exchanges worldwide. iShares' customer

base consists of the institutional segment of pension plans and fund managers,

as well as the retail segment of financial advisors and high net worth

individuals.

About CVC

Founded in 1981, CVC is a leading global private equity and investment advisory

firm, headquartered in Luxembourg with a network of 19 offices across Europe,

Asia and the USA. CVC focuses on building businesses over the long-term,

typically holding investments for five years or more. CVC funds currently own 52

companies worldwide employing approximately 447,000 people in numerous

countries. Together these companies have combined annual sales of EUR 88.0

billion.

Exchange rates used

The exchange rate used in this announcement is Pounds Sterling 1 equals

US$1.4644 as published by Thomson Reuters at the close of trading on 8 April

2009.

Nothing in this announcement is intended or is to be construed as a profit

forecast or to be interpreted to mean that earnings per Barclays share for the

current or future financial years, or those of the enlarged group, will

necessarily match or exceed the historical published earnings per Barclays

share.

This announcement is for information only and shall not constitute an offer to

sell, or a solicitation of offers to purchase or subscribe for, any securities.

The securities referred to herein have not been, and will not be, registered

under the Securities Act of 1933, as amended, and may not be offered or sold in

the United States absent registration or an applicable exemption from

registration requirements.

Forward-looking Statements

This announcement contains (or may contain) certain forward-looking statements

within the meaning of Section 21E of the US Securities Exchange Act of 1934 and

Section 27A of the US Securities Act of 1933 with respect to certain of Barclays

plans and its current goals and expectations relating to its future financial

condition and performance and which involve a number of risks and uncertainties.

Barclays cautions readers that no forward-looking statement is a guarantee of

future performance and that actual results could differ materially from those

contained in the forward-looking statements. These forward-looking statements

can be identified by the fact that they do not relate only to historical or

current facts. Forward-looking statements sometimes use words such as 'will',

'would', 'could', 'aim', 'anticipate', 'target', 'expect', 'envisage',

'estimate', 'intend', 'intention', 'plan', 'goal', 'believe', or other words of

similar meaning. Examples of forward-looking statements include, among others,

statements regarding Barclays future financial position, income growth, profit

before tax, impairment charges, business strategy, projected levels of growth in

the banking and financial markets, projected costs, estimates of capital

expenditure, expected capital ratios, plans with respect to dividend payments,

and plans and objectives for future operations of Barclays and other statements

that are not historical fact.

By their nature, forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances, including, but not limited to,

UK domestic and global economic and business conditions, the effects of

continued volatility in credit markets, liquidity conditions in the market,

market-related risks such as changes in interest rates and exchange rates,

effects of changes in valuation of credit market exposures, changes in valuation

of issued notes, the policies and actions of governmental and regulatory

authorities, changes in legislation, the further development of standards and

interpretations under International Financial Reporting Standards ('IFRS')

applicable to past, current and future periods, evolving practices with regard

to the interpretation and application of standards under IFRS, progress in the

integration of the Lehman Brothers North American businesses into the enlarged

group's business and the quantification of the benefits resulting from such

acquisition, the outcome of pending and future litigation, the success of future

acquisitions and other strategic transactions and the impact of competition, a

number of which factors are beyond Barclays control. As a result, Barclays

actual future results may differ materially from the plans, goals, and

expectations set forth in Barclays forward-looking statements. Any

forward-looking statements made herein by or on behalf of Barclays speak only as

of the date they are made. Except as required by the Financial Services

Authority, the London Stock Exchange or applicable law, Barclays expressly

disclaims any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained in this announcement to

reflect any changes in Barclays expectations with regard thereto or any changes

in events, conditions or circumstances on which any such statement is based. The

reader should, however, consult any additional disclosures that Barclays has

made or may make in documents it has filed or may file with the Securities and

Exchange Commission.

Notwithstanding anything in this announcement to the contrary, there is and can

be no assurance that the transaction announced (or any part thereof) will be

consummated in the manner described herein.

Lazard is acting exclusively for Barclays and for no-one else in relation to the

sale of iShares, and will not be responsible to any other person for providing

the protections afforded to clients of Lazard nor for providing advice in

connection with the sale of iShares.

JPMorgan Cazenove, which is authorised and regulated in the United Kingdom by

the Financial Services Authority, is acting for Barclays and for no-one else in

connection with the sale of iShares, and will not be responsible to anyone other

than Barclays for proving the protections afforded to customers of JPMorgan

Cazenove nor for providing advice to any other person in relation to the sale of

iShares.

Neither the content of Barclays website nor any website accessible by hyperlinks

on Barclays website is incorporated in, or forms any part of, this announcement.

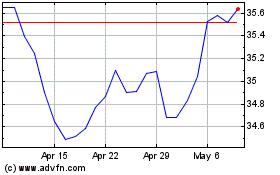

S&P TSX Capped Composite... (TSX:XIC)

Historical Stock Chart

From May 2024 to Jun 2024

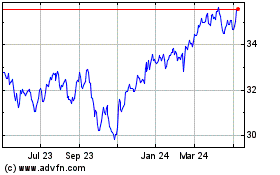

S&P TSX Capped Composite... (TSX:XIC)

Historical Stock Chart

From Jun 2023 to Jun 2024