UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income

for the quarter ended March 31, 2024 of $57.7 million as compared

to $52.6 million for the quarter ended March 31, 2023, representing

an increase of 10%. Net Loss Attributable to Common Shareholders

amounted to $6.3 million or $0.09 per diluted share for the quarter

ended March 31, 2024 as compared to a Net Loss of $5.3 million or

$0.09 per diluted share for the quarter ended March 31, 2023.

Funds from Operations Attributable to Common

Shareholders (“FFO”), was $14.0 million or $0.20 per diluted share

for the quarter ended March 31, 2024 as compared to $10.6 million

or $0.18 per diluted share for the quarter ended March 31, 2023,

representing an 11% per diluted share increase. Normalized Funds

from Operations Attributable to Common Shareholders (“Normalized

FFO”), was $15.0 million or $0.22 per diluted share for the quarter

ended March 31, 2024, as compared to $11.7 million or $0.20 per

diluted share for the quarter ended March 31, 2023, representing a

10% per diluted share increase.

A summary of significant financial information

for the three months ended March 31, 2024 and 2023 is as follows

(in thousands except per share amounts):

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Total Income |

|

$ |

57,680 |

|

|

$ |

52,607 |

|

| Total Expenses |

|

$ |

48,408 |

|

|

$ |

45,240 |

|

| Net Loss Attributable to

Common Shareholders |

|

$ |

(6,264 |

) |

|

$ |

(5,297 |

) |

| Net Loss Attributable to

Common Shareholders per Diluted Common Share |

|

$ |

(0.09 |

) |

|

$ |

(0.09 |

) |

| FFO (1) |

|

$ |

14,046 |

|

|

$ |

10,640 |

|

| FFO (1) per Diluted Common

Share |

|

$ |

0.20 |

|

|

$ |

0.18 |

|

| Normalized FFO (1) |

|

$ |

15,017 |

|

|

$ |

11,720 |

|

| Normalized FFO (1) per Diluted

Common Share |

|

$ |

0.22 |

|

|

$ |

0.20 |

|

| Weighted Average Shares

Outstanding |

|

|

69,130 |

|

|

|

59,085 |

|

A summary of significant balance sheet

information as of March 31, 2024 and December 31, 2023 is as

follows (in thousands):

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

| Gross Real Estate

Investments |

|

$ |

1,554,401 |

|

|

$ |

1,539,041 |

|

| Marketable Securities at Fair

Value |

|

$ |

29,143 |

|

|

$ |

34,506 |

|

| Total Assets |

|

$ |

1,416,439 |

|

|

$ |

1,427,577 |

|

| Mortgages Payable, net |

|

$ |

493,767 |

|

|

$ |

496,483 |

|

| Loans Payable, net |

|

$ |

77,547 |

|

|

$ |

93,479 |

|

| Bonds Payable, net |

|

$ |

100,267 |

|

|

$ |

100,055 |

|

| Total Shareholders’

Equity |

|

$ |

717,157 |

|

|

$ |

706,794 |

|

Samuel A. Landy, President and CEO, commented on

the results of the first quarter of 2024.

“We are pleased to announce another solid

quarter of operating results and an excellent start to 2024. During

the quarter, we:

| |

● |

Increased Rental and Related Income by 11%; |

|

|

● |

Increased Community Net Operating Income (“NOI”) by 16%; |

|

|

● |

Increased Normalized Funds from Operations (“Normalized FFO) by 28%

and Normalized FFO per diluted share by 10%; |

|

|

● |

Increased Same Property Community NOI by 16%; |

|

|

● |

Increased Same Property Occupancy by 200 basis points from 85.5% to

87.5%; |

|

|

● |

Improved our Same Property expense ratio from 42.3% in the first

quarter of 2023 to 39.6% at quarter end; |

|

|

● |

Issued and sold approximately 1.3 million shares of Common Stock

through our At-the-Market Sale Programs at a weighted average price

of $15.40 per share, generating gross proceeds of $20.7 million and

net proceeds of $20.4 million, after offering expenses; |

|

|

● |

Issued and sold approximately 194,000 shares of Series D Preferred

Stock through our At-the-Market Sale Program at a weighted average

price of $23.01 per share, generating gross proceeds of $4.5

million and net proceeds of $4.4 million, after offering

expenses; |

|

|

● |

Subsequent to quarter end, amended our unsecured credit facility to

expand available borrowings by $80 million from $180 million to

$260 million syndicated with BMO Capital Markets Corp., JPMorgan

Chase Bank, NA and Wells Fargo, N.A; |

|

|

● |

Subsequent to quarter end, raised our quarterly common stock

dividend by $0.01 representing a 4.9% increase to $0.215 per share

or $0.86 annually; |

|

|

● |

Subsequent to quarter end, issued and sold approximately 190,000

shares of Common Stock through our At-the-Market Sale Program at a

weighted average price of $15.92 per share, generating gross and

net proceeds, net of offering expenses, of $3.0 million; and |

|

|

● |

Subsequent to quarter end, issued and sold approximately 19,000

shares of Series D Preferred Stock through our At-the-Market Sale

Program at a weighted average price of $23.27 per share, generating

gross proceeds of $451,000 and net proceeds of $444,000, after

offering expenses.” |

Mr. Landy stated, “We are pleased with the

progress that we have made on all fronts. Year over year,

normalized FFO per diluted share increased by 10%, from $0.20 in

the first quarter of last year to $0.22 this year. These results

are in line with our expectations and position the company to

continue to grow earnings per diluted share in the coming quarters.

Our earnings growth over the past year, combined with strong

community operating results, has resulted in a fourth consecutive

annual dividend increase. Since 2020, we have raised our dividend

by 19%, or $0.14 per share.”

“Our communities continue to experience strong

demand for both sales and rentals. This demand is being translated

into increased occupancy, revenue, and improved community operating

results. Overall occupancy increased by 598 units or 220 basis

points as compared to the first quarter of last year. Same property

occupancy increased by 545 units or 200 basis points as compared to

last year. Sequentially, overall occupancy increased by 132 units.

These gains in occupancy, paired with our reasonable rent

increases, drove same property income growth of 10% and same

property community NOI growth of 16%. These improved operating

results substantially increase the value of our communities.”

“Backlogs from our manufacturers remain in the

normal 6 to 8 week range so we are able to effectively balance our

inventory deliveries with our absorption. This allows us to

generate similar occupancy gains without the negative financial

impact from elevated inventory levels and the associated carrying

costs. During the first quarter, we converted 120 homes from

inventory to occupied rental units. We believe that we are on track

to install and rent 800 new homes this year.”

“UMH is well positioned in an asset class with

strong fundamentals. We have a strong balance sheet and can execute

on external acquisition opportunities as accretive deals become

available. We have substantial internal growth opportunities that

provide a runway for earnings per diluted share growth for the next

few years. We will continue to fill our 3,300 vacant sites, develop

300 or more expansion sites per year and grow the profitability of

our sales and finance division.”

“We have a proven business plan that has and

should continue to generate long-term value for our

shareholders.”

UMH Properties, Inc. will host its First Quarter

2024 Financial Results Webcast and Conference Call. Senior

management will discuss the results, current market conditions and

future outlook on Friday, May 3, 2024, at 10:00 a.m. Eastern

Time.

The Company’s 2024 first quarter financial

results being released herein will be available on the Company’s

website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the

webcast icon on the homepage of the Company’s website at

www.umh.reit, in the Upcoming Events section. Interested parties

can also participate via conference call by calling toll free

877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be

available at 12:00 p.m. Eastern Time on Friday, May 3, 2024, and

can be accessed by dialing toll free 877-344-7529 (domestically)

and 412-317-0088 (internationally) and entering the passcode

4830899. A transcript of the call and the webcast replay will be

available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in

1968, is a public equity REIT that owns and operates 136

manufactured home communities containing approximately 25,800

developed homesites. These communities are located in New Jersey,

New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan,

Maryland, Alabama, South Carolina and Georgia. UMH also has an

ownership interest in and operates two communities in Florida,

containing 363 sites, through its joint venture with Nuveen Real

Estate.

Certain statements included in this press

release which are not historical facts may be deemed

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any such forward-looking

statements are based on the Company’s current expectations and

involve various risks and uncertainties. Although the Company

believes the expectations reflected in any forward-looking

statements are based on reasonable assumptions, the Company can

provide no assurance those expectations will be achieved. The risks

and uncertainties that could cause actual results or events to

differ materially from expectations are contained in the Company’s

annual report on Form 10-K and described from time to time in the

Company’s other filings with the SEC. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements whether as a result of new information, future events,

or otherwise.

Note:

| |

(1 |

) |

Non-GAAP Information: We assess and measure our overall operating

results based upon an industry performance measure referred to as

Funds from Operations Attributable to Common Shareholders (“FFO”),

which management believes is a useful indicator of our operating

performance. FFO is used by industry analysts and investors as a

supplemental operating performance measure of a REIT. FFO, as

defined by The National Association of Real Estate Investment

Trusts (“NAREIT”), represents net income (loss) attributable to

common shareholders, as defined by accounting principles generally

accepted in the United States of America (“U.S. GAAP”), excluding

gains or losses from sales of previously depreciated real estate

assets, impairment charges related to depreciable real estate

assets, the change in the fair value of marketable securities, and

the gain or loss on the sale of marketable securities plus certain

non-cash items such as real estate asset depreciation and

amortization. Included in the NAREIT FFO White Paper - 2018

Restatement, is an option pertaining to assets incidental to our

main business in the calculation of NAREIT FFO to make an election

to include or exclude gains and losses on the sale of these assets,

such as marketable equity securities, and include or exclude

mark-to-market changes in the value recognized on these marketable

equity securities. In conjunction with the adoption of the FFO

White Paper - 2018 Restatement, for all periods presented, we have

elected to exclude the gains and losses realized on marketable

securities investments and the change in the fair value of

marketable securities from our FFO calculation. NAREIT created FFO

as a non-U.S. GAAP supplemental measure of REIT operating

performance. We define Normalized Funds from Operations

Attributable to Common Shareholders (“Normalized FFO”), as FFO

excluding certain one-time charges. FFO and Normalized FFO should

be considered as supplemental measures of operating performance

used by REITs. FFO and Normalized FFO exclude historical cost

depreciation as an expense and may facilitate the comparison of

REITs which have a different cost basis. However, other REITs may

use different methodologies to calculate FFO and Normalized FFO

and, accordingly, our FFO and Normalized FFO may not be comparable

to all other REITs. The items excluded from FFO and Normalized FFO

are significant components in understanding the Company’s financial

performance. |

FFO and Normalized FFO (i) do not

represent Cash Flow from Operations as defined by U.S. GAAP; (ii)

should not be considered as alternatives to net income (loss) as a

measure of operating performance or to cash flows from operating,

investing and financing activities; and (iii) are not alternatives

to cash flow as a measure of liquidity. FFO and Normalized FFO, as

calculated by the Company, may not be comparable to similarly

titled measures reported by other REITs.

The diluted weighted shares outstanding used in

the calculation of FFO per Diluted Common Share and Normalized FFO

per Diluted Common Share were 69.5 million shares for the three

months ended March 31, 2024 and 59.8 million shares for the three

months ended March 31, 2023. Common stock equivalents resulting

from stock options in the amount of 406,000 shares for the three

months ended March 31, 2024 and 682,000 shares for the three months

ended March 31, 2023 were excluded from the computation of Diluted

Net Loss per Share as their effect would have been

anti-dilutive.

The reconciliation of the Company’s U.S. GAAP

net loss to the Company’s FFO and Normalized FFO for the three

months ended March 31, 2024 and 2023 are calculated as follows (in

thousands):

| |

|

Three Months Ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| Net Loss Attributable to

Common Shareholders |

|

$ |

(6,264 |

) |

|

$ |

(5,297 |

) |

| Depreciation Expense |

|

|

14,741 |

|

|

|

13,373 |

|

| Depreciation Expense from

Unconsolidated Joint Venture |

|

|

197 |

|

|

|

159 |

|

| (Gain) Loss on Sales of

Investment Property and Equipment |

|

|

3 |

|

|

|

(32 |

) |

| Decrease in Fair Value of

Marketable Securities |

|

|

5,369 |

|

|

|

2,395 |

|

| Loss on Sales of Marketable

Securities, net |

|

|

-0- |

|

|

|

42 |

|

| FFO Attributable to

Common Shareholders |

|

|

14,046 |

|

|

|

10,640 |

|

| Amortization of Financing

Costs(2) |

|

|

556 |

|

|

|

518 |

|

| Non-Recurring Other Expense

(3) |

|

|

415 |

|

|

|

562 |

|

| Normalized FFO

Attributable to Common Shareholders

(2) |

|

$ |

15,017 |

|

|

$ |

11,720 |

|

| |

(2 |

) |

Due to the change in sources of capital, amortization expense is

expected to become more significant and is therefore included as an

adjustment to Normalized FFO for the three months ended March 31,

2024 and 2023. |

| |

|

|

| |

(3 |

) |

Consists of non-recurring expenses for one-time legal fees and fees

relating to the OZ Fund ($33), and costs associated with the

liquidation/sale of inventory in a particular sales center ($382)

for the three months ended March 31, 2024. Consisted of special

bonus and restricted stock grants for the August 2020

groundbreaking Fannie Mae financing, which were being expensed over

the vesting period ($431) and non-recurring expenses for the joint

venture with Nuveen ($47), one-time legal fees and fees relating to

the OZ Fund ($53), and costs associated with an acquisition that

was not completed ($31) for the three months ended March 31,

2023. |

The following are the cash flows provided by

(used in) operating, investing and financing activities for the

three months ended March 31, 2024 and 2023 (in thousands):

| |

|

2024 |

|

|

2023 |

|

| Operating Activities |

|

$ |

19,048 |

|

|

$ |

13,289 |

|

| Investing Activities |

|

|

(25,424 |

) |

|

|

(40,544 |

) |

| Financing Activities |

|

|

(8,849 |

) |

|

|

29,440 |

|

| Contact: Nelli

Madden |

|

732-577-9997 |

# # # #

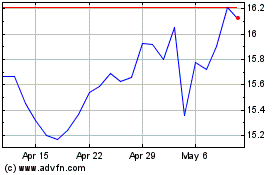

UMH Properties (NYSE:UMH)

Historical Stock Chart

From May 2024 to Jun 2024

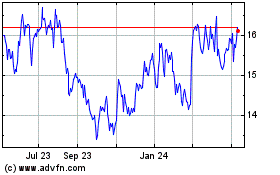

UMH Properties (NYSE:UMH)

Historical Stock Chart

From Jun 2023 to Jun 2024