Filed by: Everi Holdings Inc.

(Commission File No.: 001-32622)

pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Everi Holdings Inc.

(Commission File No.: 001-32622)

Excerpt from Transcript of Everi Holdings Inc. First Quarter Town Hall

May 21, 2024

Randy Taylor

President and Chief Executive Officer

Good Morning everyone and welcome to our 2024 first Quarter Town hall.

As I noted in our Q1 earnings call a few weeks ago, we continue to make progress on our proposed merger with IGT’s Global Gaming and Play Digital Businesses. While we have no further update regarding the antitrust or regulatory matters, we still anticipate closing the merger in late 2024, or early 2025. I would like to update you on several meetings that took place in late April between IGT and Everi; and the progress achieved since our initial meetings.

On April 17th and 18th, we held a kickoff planning meeting with personnel from IGT, Everi, and two consulting firms, KPMG and Bain.

This was our initial planning meeting and was focused on identifying those areas where we might need to develop plans to help the businesses come together more efficiently after close. While we covered a multitude of areas within both companies, the discussion was primarily focused on back-office administrative and support operations, such as legal, accounting, people ops, and financial reporting. Another objective of the meeting was to simply better acquaint the teams -- enable people to put a name to a face, better understand how each company is structured, and appreciate the many duties and responsibilities that the departmental teams oversee.

Mike, Vince, Fabio, and I attended the kick-off session of the meeting; and the following day, we completed the video that was sent out in early May. Our marketing team did a great job with the editing and the final product.

Following that meeting, the advisors from KPMG and Bain worked with both Everi and IGT personnel to begin to schedule meetings on permissible integration planning topics. These include items such as IT networks and how we will bring those together to ensure that we have a safe and secure environment and accounting systems we utilize and what the requirements might be to consolidate these systems. At this time, as we work through the various regulatory approval processes, we must continue to operate independently and there are many restrictions on what may be discussed. So, we are NOT talking about product strategy or operations directly with IGT. As a result, most of the information being shared will be collected and aggregated by the consultants only and not be provided to the other company. This process is early and ongoing, and I plan to keep you updated on further progress.

In today’s town hall, our plan is to address all your questions related to Everi’s business operations. Out of an abundance of caution related to the sensitivities of the regulatory approval process, any merger-related questions will be addressed, if permitted, in future email communications to all employees. This will allow for our external counsel to review the questions and responses and allow us to be as open and forthcoming as possible. This is also a good time to remind you that we have

established the Merger Q&A link in Sharepoint so you may submit merger-specific questions or concerns.

Finally, I want to touch briefly on our results for Q1. If you listened to our earnings call, you are aware that it was a tough quarter for Everi’s business. The Company’s revenue, net income, and Adjusted EBITDA were all lower as compared to the first quarter of 2023. While we expected our financial results to be down, the decline was greater than anticipated. The message we shared with our investors is that we expect improvements to begin in the second half of the year. This progress is expected to be driven by both improved game sales and higher revenues from our leased gaming machines; and is primarily related to the deployment of our new cabinets, together with new game content for both new cabinets and existing cabinets in our installed base. We also expect improved momentum in hardware sales from the FinTech segment.

The task ahead of us in 2024 remains challenging, but I firmly believe we have the people, the products, and the resources to decisively meet this challenge. As always, I want to thank each one of you for your hard work, and your efforts and contributions.

While I understand that the announced merger with IGT comes with an element of uncertainty for many of our employees, I want to close by reminding you that change can also bring about great opportunities.

Now let me turn the mic over to Jeff LeSeur to provide a video tour of our new office facility in India and update us on developments in our mobile platform; Marshall Adair to cover the advances in our Digital Gaming business, and Jesse DeBruin and Courtney Brack to update us on the developments and opportunities in our leased gaming operations.

Thank you.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) among Everi Holdings Inc. (“Everi”), International Game Technology PLC (“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, c/o IGT Global Solutions Corporation, IGT Center, 10 Memorial Boulevard, Providence, RI 02903-1160, Attention: Investor Relations.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in

any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, related to Everi, IGT and the proposed spin-off of IGT’s Global Gaming and PlayDigital businesses (the “Spinco Business”), and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,” “expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,” “would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking statements in this communication include, among other things, statements about the anticipated timing of closing of the Proposed Transaction; the integration of IT networks to ensure a safe and secure environment and the requirements to consolidate accounting systems; the collection and aggregation of information relating to integration planning; our expectation for improvements in our financial condition in the second half of 2024, driven by improved games sales and higher revenues from leased gaming machines; and our expectation of improved momentum in hardware sales from the FinTech segment. In addition, all statements that address operating performance, events or developments that Everi or IGT expects or anticipates will occur in the future — including statements relating to creating value for stockholders and shareholders, benefits of the Proposed Transaction to customers, employees, stockholders and other constituents of the combined company and IGT, separating and integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking statements. These forward-looking statements involve substantial risks and uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied (including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital stock of Everi and IGT and on Everi’s and IGT’s operating results; risks relating to the value of Everi’s shares to be issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction (the “Merger Agreement”); changes in the extent and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect pursuant to the Merger Agreement for the Proposed Transaction on the number of shares of Everi common stock issuable pursuant to the Proposed Transaction, magnitude of the dividend (if any) payable to Everi’s stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition,

losses and future prospects); expected or targeted future financial and operating performance and results; the ability to execute on key initiatives and deliver ongoing improvements; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks relating to any resurgence of the COVID-19 pandemic or similar public health crises; risks related to competition in the gaming and lottery industry; dependence on significant licensing arrangements, customers, or other third parties; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed Transaction; economic changes in global markets, such as currency exchange, inflation and interest rates, and recession; government policies (including policy changes affecting the gaming industry, taxation, trade, tariffs, immigration, customs, and border actions) and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in other filed reports including IGT’s Current Reports on Form 6-K.

A further description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

Everi does not intend to update forward-looking statements as the result of new information or future events or developments, except as required by law.

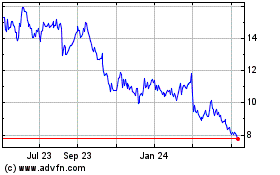

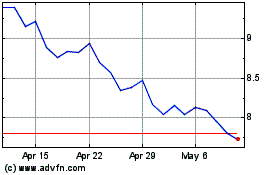

Everi (NYSE:EVRI)

Historical Stock Chart

From May 2024 to Jun 2024

Everi (NYSE:EVRI)

Historical Stock Chart

From Jun 2023 to Jun 2024