UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2023

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

Buenos Aires, April 11, 2023

Messrs.

Comisión Nacional de Valores

Bolsas y Mercados Argentinos S.A.

Mercado Abierto Electrónico

S.A.

Ref.: Material Fact –

Consent Solicitation in respect of its 9.75% Senior Notes due 2025

Dear Sirs:

I hereby address you on behalf of Empresa

Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.) (the “Issuer”), in order to inform that today the Issuer

is soliciting consents (the “Consent Solicitation”) from all registered holders (the “Holders”) of its

9.75% Senior Notes due 2025 (the “Notes Class 1”) issued under the indenture executed as of May 12, 2022, among the

Issuer, The Bank of New York Mellon, as trustee, and Banco de Valores S.A., as representative of the trustee in Argentina (as amended

by the First Supplemental Indenture dated October 24, 2022, the “Indenture”), upon the terms and conditions described

in the Issuer’s Consent Solicitation Statement dated April 10, 2023 (the “Statement”), to obtain a certain waiver

to Section 9.1 of the Indenture so that the Issuer may grant guarantees to Compañía Administradora del Mercado Mayorista

Eléctrico S.A. (“CAMMESA”) in compliance with its agreement with the Secretary of Energy and the Ente

Nacional Regulador de la Electricidad (ENRE) dated December 29, 2022 and notified to CAMMESA on that same date.

Attached hereto as an exhibit is the press

release corresponding to the Consent Solicitation.

Please bear in mind that the Issuer has

convened to meetings of the holders of Notes Class 1 and holders of Notes 9.75% Senior Notes due 2024 (“Notes Class 2”)

to be held on April 25, 2023 at 10 am and 3 pm (Buenos Aires time), respectively. Each Holder who is eligible to attend, shall provide

notice to “asambleatenedores@edenor.com.

Yours faithfully,

Silvana E. Coria

Market Relations Officer

Empresa Distribuidora y

Comercializadora Norte S.A.

(EDENOR S.A.)

Announces Consent Solicitation

in respect of its

9.75% Senior Notes due 2025

(N° CUSIP 29244AAL6/P3710FAM6;

N° ISIN US29244AAL61/USP3710FAM60)

Buenos Aires, April 10, 2023

– Empresa Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.) (the “Issuer”) announced today that it

is soliciting consents (the “Consent Solicitation”) from all registered holders (individually, a “Holder,”

and collectively, the “Holders”) of its 9.75% Senior Notes due 2025 (the “Notes”), upon the terms

and conditions described in the Issuer’s Consent Solicitation Statement dated April 10, 2023 (the “Statement”),

to certain proposed waiver (the “Proposed Waiver”) under the Indenture dated as of May 12, 2022, among the Issuer and

The Bank of New York Mellon, as trustee, and Banco de Valores S.A., as representative of the Trustee in Argentina (as amended by the First

Supplemental Indenture dated October 24, 2022, the “Indenture”), pursuant to which the Notes were issued. Unless otherwise

defined herein, capitalized terms used herein have the meanings given to them in the Statement.

On December 29, 2022, the Issuer

reached an agreement with the Argentine Government to restructure its commercial debt with CAMMESA as of August 2022 (the “2022

Agreement”). The 2022 Agreement effectively reduces debt owed to CAMMESA by around Ps. 20 billion (around US$100 million), from

US$288 million to US$188 million, with the balance to be repaid over 8 years at a discounted interest rate (50% of the WEM rate). The

Issuer believes that the 2022 Agreement lowers a risk in terms of a large outstanding supplier payable and provides additional predictability

moving forward, and is seeking Consents to obtain the Proposed Waiver because the 2022 Agreement requires a pledge of accounts receivable

of the Issuer in order to secure at any time the payment of up to three (3) installments of the payment plan agreed under the 2022 Agreement.

As of the date of the Statement, the amount equivalent to three (3) of the ninety-six (96) progressively increasing installments amounts

to approximately US$3.2 million (representing around 2% of the debt owed to CAMMESA and less than 0.2% of the Issuer’s total assets)

(the “CAMMESA Pledge”).

The Consent Solicitation will expire

at 5:00 p.m., New York City Time, on April 19, 2023, unless extended or earlier terminated by the Issuer in its sole discretion (such

date and time, as the same may be extended, the “Expiration Date”). The record date of the Consent Solicitation is

5:00 p.m., New York City time, on April 19, 2023.

The Issuer has convened a meeting

of the holders of the Notes (the “Holders’ Meeting”), expected to be held on or about April 25, 2023 on first

notice at our offices in Avenida del Libertador 6363, Ground Floor, City of Buenos Aires, C1428ARG, Argentina. The Holders’ Meeting

may be adjourned on one occasion to a date within the following 30 days.

The Information, Tabulation and

Proxy Agent (as defined below) will attend the Holders’ Meeting (on first and/or second call, and as it may be adjourned) and consent

and approve in favor of the Proposed Waiver on behalf of the Holders of the Notes who participate in the Consent Solicitation. If the

Issuer obtains the Required Consent, the Issuer and the Trustee will execute the Waiver Agreement, subject to the Trustee’s receipt

of any documentation required under the Indenture.

The Proposed Waiver will become

effective and operative immediately upon execution thereof as to all Holders at the Consent Effective Time,

whether or not a Holder delivered a Consent.

A separate electronic instruction

must be submitted on behalf of each beneficial owner. The name of the beneficial owner must be included in the instruction.

Morrow Sodali International LLC

(“Morrow Sodali”) has been retained to serve as the information, tabulation agent and proxy agent (the “Information,

Tabulation and Proxy Agent”).

Requests for the Statement can be

accessed through the Consent Website operated by the Information, Tabulation and Proxy Agent (https://projects.morrowsodali.com/Edenor)

or should be directed to Information, Tabulation and Proxy Agent, at +1 203 609 4910, New York and +44 20 4513 6933 London, or by email

to edenor@investor.morrowsodali.com.

None of the Issuer, the Information,

Tabulation and Proxy Agent, the trustee or the representative of the trustee in Argentina, or any of their respective affiliates is making

any recommendation as to whether Holders of the Notes should deliver Consents in response to the Consent Solicitation. Holders must make

their own decisions as to whether to deliver Consents.

This press release is for informational

purposes only and is neither an offer to sell nor a solicitation of an offer to buy any security. This announcement is also not a solicitation

of consents with respect to the Proposed Waiver or otherwise. The Consent Solicitation is being made solely through the Statement referred

to above and related materials. The Consent Solicitation is not being made to Holders of Notes in any jurisdiction in which the Issuer

is aware that the making of the Consent Solicitation would not be in compliance with the laws of such jurisdiction. In any jurisdiction

in which the securities laws or blue-sky laws require the Consent Solicitation to be made by a licensed broker or dealer, the Consent

Solicitation will be deemed to be made on the Issuer’s behalf by one or more registered brokers or dealers that are licensed under

the laws of such jurisdiction.

Neither the Statement nor any

documents related to the Consent Solicitation have been filed with, and have not been approved or reviewed by any federal or state securities

commission or regulatory authority of any country. No authority has passed upon the accuracy or adequacy of the Statement or any documents

related to the Consent Solicitation, and it is unlawful and may be a criminal offense to make any representation to the contrary.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements are information of a non-historical nature or which relate to future events and are subject to

risks and uncertainties. No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms

of any such transactions. The Issuer undertakes no obligation to publicly update or revise any forward-looking statements, whether as

a result of new information or future events or for any other reason.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

April 11, 2023

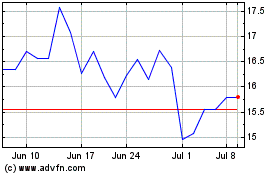

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Apr 2024 to May 2024

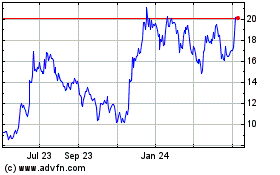

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From May 2023 to May 2024