Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

May 08 2024 - 5:04PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-279143

Issuer Free Writing Prospectus dated May 8,

2024

Relating to Preliminary Prospectus Supplement

dated May 8, 2024

Strictly Confidential

CNO Financial Group, Inc.

Pricing Term Sheet

$700,000,000 6.450% Senior Notes due 2034

(the “Senior Notes Offering”)

The

information in this pricing term sheet relates to the Senior Notes Offering and should be read together with (i) the preliminary

prospectus supplement dated May 8, 2024, including the documents incorporated by reference therein, and (ii) the

related base prospectus dated May 6, 2024 each filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended.

| Issuer: |

CNO Financial Group, Inc. |

| |

|

| Securities Offered: |

6.450% Senior Notes due 2034 (the “Notes”) |

| |

|

| Trade Date: |

May 8, 2024 |

| |

|

| Settlement Date:* |

May 13, 2024 (T+3) |

| |

|

| Aggregate Principal Amount Offered: |

$700,000,000 |

| |

|

| Maturity Date: |

Unless earlier redeemed, the Notes will mature on June 15, 2034. See “Optional Redemption.” |

| |

|

| Price to Public: |

99.668% of aggregate principal amount |

| |

|

| Yield to Maturity: |

6.494% |

| |

|

| Benchmark Treasury: |

4% due February 15, 2034 |

| |

|

| Benchmark Treasury Yield: |

4.494% |

| |

|

| Spread to Benchmark Treasury: |

T + 200 basis points |

| |

|

| Net Proceeds to Issuer: |

$693,126,000 (after deducting underwriting discounts and before estimated expenses) |

| |

|

| Use of Proceeds: |

The Issuer intends to use the net proceeds from the Senior Notes Offering, together with cash on hand, (i) for general corporate purposes, which may include the redemption, repurchase or repayment at or prior to maturity of its $500.0 million of 5.250% Senior Notes due 2025 and (ii) to pay fees, costs and expenses in connection with the foregoing and the Senior Notes Offering. |

| Optional Redemption: |

Prior to March 15, 2034 (the date that is three months prior to the maturity date of the Notes), the Issuer may redeem the Notes, in whole or in part, at any time and from time to time, at a redemption price equal to the greater of (i) 100% of the principal amount of the Notes to be redeemed and (ii) a make-whole amount calculated as set forth in the preliminary prospectus supplement (Treasury Rate plus 30 basis points), plus, in either case, accrued and unpaid interest thereon to, but excluding, the redemption date. On and after March 15, 2034, the Issuer may redeem the Notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest thereon to, but excluding, the redemption date. |

| |

|

| CUSIP / ISIN: |

12621E AM5 / US12621EAM57 |

| |

|

| Interest Payment Dates: |

June 15 and December 15 of each year |

| |

|

| Regular Record Dates: |

June 1 and December 1 of each year |

| |

|

| First Interest Payment Date: |

December 15, 2024 |

| |

|

| Anticipated Ratings:** |

Baa3 / BBB- / BBB (Moody’s / S&P / Fitch) |

| |

|

| Joint Book-Running Managers: |

Goldman Sachs & Co. LLC

RBC Capital Markets, LLC

Barclays Capital Inc.

KeyBanc Capital Markets Inc.

|

| |

|

| Co-Managers: |

Drexel Hamilton, LLC

Loop Capital Markets LLC |

*It

is expected that delivery of the Notes will be made against payment therefore on or about May 13, 2024, which is the third business

day following the date hereof (such settlement cycle being referred to as “T+3”). Under Rule 15c6-1 under the Securities

Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties

to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second business day before

the delivery of the Notes hereunder will be required, by virtue of the fact that the Notes initially will settle in T+3, to specify an

alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

**Note: A securities rating is not a recommendation

to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time. Each credit rating should be evaluated

independently of any other credit rating.

The Issuer has filed a registration statement,

including a prospectus and preliminary prospectus supplement, with the U.S. Securities and Exchange Commission (“SEC”) for

the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and accompanying

prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the

Issuer and the Senior Notes Offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively,

the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and preliminary prospectus

supplement if you request it by contacting Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York,

NY 10282-2198, by phone at (866) 471-2526 or by email at prospectus-ny@ny.email.gs.com; RBC Capital Markets, LLC, Attention: DCM Transaction

Management/Scott Primrose, 200 Vesey Street, 8th Floor, New York, NY 10281, by phone at (866) 375-6829 or by email at rbcnyfixedincomeprospectus@rbccm.com;

Barclays Capital Inc., by phone at (888) 603-5847; or KeyBanc Capital Markets Inc., Attention: Fixed Income Syndicate, 127 Public Square,

7th Floor, Cleveland, Ohio 44114 or by phone at (866) 227-6479.

Any disclaimer or other notice that may appear

below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result

of this communication being sent by Bloomberg or another email system.

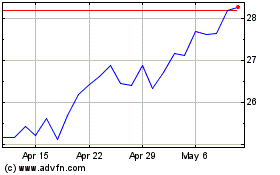

CNO Financial (NYSE:CNO)

Historical Stock Chart

From May 2024 to Jun 2024

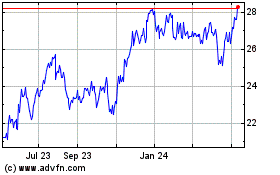

CNO Financial (NYSE:CNO)

Historical Stock Chart

From Jun 2023 to Jun 2024