UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23rd floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

CCU REPORTS CONSOLIDATED SECOND QUARTER 2022 RESULTS1,2

Santiago, Chile, August 3, 2022 – CCU announced today

its consolidated financial and operating results for the second quarter 2022, which ended June 30, 2022.

| · | Consolidated Volumes decreased 2.9%. Volume variation

per Operating segment was as follows: |

| o | International Business (1.7)% |

| · | Gross profit increased 2.2% |

| · | EBITDA reached CLP 32,471 million, a 47.3% decline.

EBITDA variation per Operating segment was as follows: |

| o | International Business 148.2% |

| · | Net income reached a loss of CLP 10,455 million versus

a gain of CLP 18,968 million last year |

| · | Earnings per share reached a loss of CLP 28.3 per share |

| |

|

|

|

|

|

|

|

| Key figures |

|

2Q22 |

2Q21 |

Total Change % |

YTD22 |

YTD21 |

Total Change % |

| (In ThHL or CLP million unless stated otherwise) |

|

| Volumes |

|

6,559 |

6,759 |

(2.9) |

16,244 |

15,801 |

2.8 |

| Net sales |

|

558,503 |

469,995 |

18.8 |

1,258,968 |

1,039,634 |

21.1 |

| Gross profit |

|

225,308 |

220,428 |

2.2 |

549,033 |

509,796 |

7.7 |

| EBIT |

|

(1,671) |

34,670 |

(104.8) |

104,224 |

134,419 |

(22.5) |

| EBITDA |

|

32,471 |

61,576 |

(47.3) |

167,597 |

188,123 |

(10.9) |

| Net income |

|

(10,455) |

18,968 |

(155.1) |

54,089 |

83,352 |

(35.1) |

| Earnings per share (CLP) |

|

(28.3) |

51.3 |

(155.1) |

146.4 |

225.6 |

(35.1) |

1 For an explanation of the terms used in this report, please

refer to the Glossary in Additional Information and Exhibits. Figures in tables and exhibits have been rounded and may not add up exactly

to the total shown.

2 All growth or variation references in this Earnings Release

refer to 2Q22 compared to 2Q21, unless otherwise stated. For comparison purposes only, in certain sections we include volume variations

versus 2Q19, to consider the impacts of COVID-19 in 2020 (lockdowns) and 2021 (strong consumption recovery from extraordinary liquidity).

PRESS RELEASE |  |

| | |

We are facing a challenging and volatile macroeconomic scenario.

In this context, we need to focus on maintain business scale and recover our margins. On the positive side, in terms of business scale,

in spite of a decline in our consolidated volumes, considering a high comparison base versus 2Q21, we reported double-digit growth when

compared with pre-pandemic volumes (2Q19). Our business scale remains strong through a constant improvement in brand equity and excellence

in sales execution. On the negative side, regarding margins, these were negatively impacted by strong external effects coming from higher

prices in commodities, a sharp depreciation of our main local currencies against the USD, and higher inflation levels, impacting our costs

and expenses, partially offset by price increases in all our categories and geographies. In summary, during the second semester, we will

decidedly continue with our revenue management efforts, along with efficiencies to recover our profitability sustained on a solid business

scale.

In 2Q22, our revenues expanded 18.8%, boosted by 22.4% rise

in average prices in CLP while volumes contracted 2.9% (11.4% growth vs. 2Q19). The better average prices in CLP were mainly explained

by revenue management initiatives and price increases. EBITDA reached CLP 32,471 million, down 47.3% and EBITDA margin decreased from

13.1% to 5.8%. The weaker financial results were mainly associated with: (i) higher cost from raw and packaging materials, (ii) the depreciation

of our main local currencies against the USD, impacting negatively our USD denominated costs, partially compensated with export revenues,

and (iii) costs and expenses pressures associated with an accelerating inflation in our main geographies, and higher oil prices. The price

efforts mentioned above, were not enough to offset these external effects, hence the need to strengthen our revenue management initiatives

in the coming quarters. Regarding Net income, we totalized a loss of CLP 10,455 million, versus a gain of CLP 18,968 million last year, caused by the lower EBITDA mentioned above, and a higher loss in Non-operating

result, the latter mostly driven by higher Net financial costs, owing to a larger debt.

In the Chile Operating segment, our top line expanded 3.7%,

due to 7.3% growth in average prices while volumes declined 3.4% (17.3% growth vs. 2Q19). The higher average prices were explained by

revenue management initiatives, partially offset by a negative mix effect in the portfolio. Lower volumes were caused by a high comparison

base, and a less favorable consumption environment. Gross profit contracted 19.0%, and Gross margin dropped from 49.5% to 38.7%, mostly

as a consequence of cost pressures, and a 17.6%3 devaluation of the CLP against the

USD, affecting our USD denominated costs. MSD&A expenses grew 5.0%, and as percentage of Net sales increased 43 bps, where efficiencies

helped us to offset expenses pressures coming from higher inflation and oil prices. In all, EBITDA reached CLP 23,711 million, decreasing

59.1%, and EBITDA margin decreased from 18.3% to 7.2%.

In the International Business Operating segment, which includes

Argentina, Bolivia, Paraguay and Uruguay, Net sales recorded a 70.9% rise, as a result of an increase of 73.8% in average prices in CLP,

while volumes contracted 1.7% (1.7% decrease vs. 2Q19). The better average prices were mostly explained by revenue management initiatives

in all the geographies. Volumes in Argentina and Paraguay expanded versus pre-pandemic levels (2Q19), while Uruguay was practically flat

and Bolivia declined. Gross profit expanded 73.7%, and Gross margin grew from 44.3% to 45.1%. MSD&A expenses as a percentage of Net

sales improved by 235 bps due to efficiencies, compensating higher inflation and other cost pressures. Altogether, EBITDA reached CLP

1,072 million, versus a loss of CLP 2,223 million last year.

In the Wine Operating segment, revenues were up 16.7%, explained

by a 17.4% growth in average prices, while volumes decreased 0.5% (13.7% growth vs. 2Q19). The higher prices in CLP were mainly explained

by a positive impact on export revenues from the depreciation of the CLP versus the USD, and revenue and mix management initiatives in

the Chile and Argentina domestic markets which permitted us to partially compensate higher costs in packaging materials and inflationary

pressures. Consequently, Gross profit expanded 13.6% and Gross margin decreased 101 bps from 37.9% to 36.9%. MSD&A expenses grew 17.9%,

and as a percentage of Net sales increased 26 bps. In all, EBITDA reached CLP 11,788 million, a 9.1% rise, while EBITDA margin decreased

from 16.7% to 15.6%.

In terms of our main international joint ventures, in Colombia,

volumes remained growing double digit in the second quarter, driven by beer and malt. In terms of financial results, our increase in business

scale together with revenue management initiatives, allowed to improve last year profitability levels, in spite of cost pressures and

the recent devaluation of the Colombian peso against the USD. In Argentina, our JV with Aguas Danone de Argentina S.A, showed strong top

line growth, led by volumes and prices.

During 2Q22 we faced a challenging and volatile macroeconomic

scenario, which will probably remain in the short-term. In order to face this, we will focus on three key aspects to recover our profitability:

(i) maintain business scale, (ii) increase prices across our main categories and geographies, and (iii) expenses and costs efficiencies

through our CCU Transformation program. This is not the first time we have face such a challenging scenario but we are sure that with

the mentioned strategy we will be able to overcome it as we have successfully done it in the past.

3 The CLP currency variation against the USD considers 2022 average of period (aop)

compared to 2021 aop.

PRESS RELEASE |  |

| | |

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS – SECOND QUARTER (Exhibit 1 & 2) |

| · | Net sales were up 18.8%, explained by 22.4% higher

average prices in CLP while volumes declined 2.9%. In terms of Operating segments the higher average prices in CLP were explained by:

(i) a 7.3% growth in the Chile Operating segment, explained by revenue management initiatives, offset by a negative mix effect in the

portfolio, (ii) an expansion of 73.8% in the International Business Operating segment, explained by revenue management initiatives in

all the geographies, and (iii) a 17.4% increase in the Wine Operating segment, mainly explained by the positive impact on export revenues

from the depreciation of the CLP versus the USD, and both revenue and mix management initiatives in the Chile and Argentina domestic markets.

In terms of volume growth, the performance by Operating segment was as follows: (i) a 3.4% contraction in the Chile Operating segment

explained by a high comparison base, and a less favorable consumption environment, (ii) a 1.7% contraction in the International Business

Operating segment, although volumes in Argentina and Paraguay expanded versus pre-pandemic levels (2Q19), while Uruguay was practically

flat and Bolivia declined, and (iii) a 0.5% decrease in the Wine Operating segment. |

| · | Cost of sales was up 33.5%, explained by 37.6% increase

in Cost of sales per hectoliter. The Chile Operating segment reported a 30.4% growth in Cost of sales per hectoliter, driven by: (i) higher

costs in raw and packaging materials, mainly aluminum, PET, malt, and sugar, (ii) the 17.6%3 devaluation of the CLP against

the USD, impacting negatively our USD denominated costs, and (iii) inflationary pressures. In the International Business Operating segment,

the Cost of sales per hectoliter expanded 71.5% in CLP, mostly explained by a higher cost in raw and packaging materials, a higher inflation,

and the negative impact from the 30.6%4 devaluation of the ARS against the USD in our

USD-linked costs. In the Wine Operating segment, the Cost of sales per hectoliter grew 19.3%, due to higher costs in packaging materials,

and inflationary pressures. |

| · | Gross profit reached CLP 225,308 million, a 2.2% expansion

while Gross margin dropped 656 bps, from 46.9% to 40.3%. |

| · | MSD&A expenses were up 22.3%, and as percentage

of Net sales, increased 116 bps, from 39.6% to 40.7%. The latter was mostly caused by an accelerating inflation in our main geographies,

together with higher oil prices, partially compensated with efficiencies and expenses control initiatives from our CCU Transformation

program. In the Chile Operating segment, MSD&A expenses expanded 5.0%, and as a percentage of Net sales increased 43 bps. In the International

Business Operating segment MSD&A expenses in CLP were up 63.5%, and as a percentage of Net sales decreased 235 bps. In the Wine Operating

segment, MSD&A expenses grew 17.9%, and as a percentage of Net sales rose 26 bps. |

| · | EBIT reached a loss of CLP 1,671 million versus a gain

of CLP 34,670 million last year, mainly due to the contraction in volumes, and sharp negative external effects coming from: (i) higher

cost in raw and packaging materials, (ii) the depreciation of our main local currencies against the USD, impacting negatively our USD

denominated costs, partly compensated with export revenues, and (iii) costs and expenses pressures associated with an accelerating inflation

in our main geographies, and higher oil prices. These effects were partially compensated by a double-digit growth in revenues driven by

revenue management efforts. |

| · | EBITDA was down 47.3%, explained by a 59.1% drop in

the Chile Operating segment, while the Wine Operating segment rose 9.1%, and the International Business Operating segment improved from

a loss of CLP 2,223 million in 2021 to a gain of CLP 1,072 million. EBITDA margin contracted 729 bps, from 13.1% to 5.8%. |

| · | Non-operating

result totalized a loss of CLP 13,744 million, which compares with a negative result of CLP 4,140 million last year. The higher loss

was explained by: (i) a higher loss by CLP 10,052 million in Foreign currency exchange differences, (ii) a lower result by CLP 7,036

million in Net financial expenses, mainly due to a larger debt, (iii) a higher loss in Equity and income of JVs and associated by CLP

2,085 million, and (iv) a lower result in Results as per adjustment units by CLP 2,210 million, explained by a higher inflation. These

effects were partially compensated by a better result in Other gains/(losses) by CLP 11,778 million, mostly explained by a better result

in derivative contracts5. |

| · | Income taxes reached a gain of CLP 8,020 million, versus

a loss of CLP 7,973 million last year. The lower taxes were explained by both, a lower taxable income and a better result on Tax effect

of permanent differences, net6. |

| · | Net income reached a loss of CLP 10,455 million, versus

a gain of CLP 18,968 million recorded last year. |

4 The ARS currency variation against the USD considers 2022 end of period (eop) compared

to 2021 eop.

5 See Note 32 Other Gain/(Losses) of our 2Q22 Financial Statements

6 See Note 25 Income taxes of our 2Q22 Financial Statements

PRESS RELEASE |  |

| | |

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS –

FIRST HALF (Exhibit 2 & 4) |

| · | Net sales were up 21.1%, explained by 17.8% higher

average prices in CLP and 2.8% increase in consolidated volumes. The higher average prices in CLP were explained by: (i) a 7.8% growth

in the Chile Operating segment, due to the implementation of revenue management initiatives, partially compensated by negative mix effects

in the portfolio, (ii) an expansion of 53.5% in the International Business Operating segment, explained by revenue management initiatives

in all the geographies, and (iii) a 15.6% increase in the Wine Operating segment, mainly explained by the positive impact on export revenues

from the depreciation of the CLP versus the USD, and both revenue and mix management initiatives in the Chile and Argentina domestic markets.

The expansion in volumes was driven by a 2.8% growth in the Chile Operating segment and a 4.1% increase in the International Business

Operating segment, while the Wine Operating segment declined 0.4%. |

| · | Cost of sales was up 34.0%, mainly explained by a 30.3%

increase in Cost of sales per hectoliter. The Chile Operating segment reported a 28.9% growth in Cost of sales per hectoliter, driven

by: (i) higher costs in raw and packaging materials, mainly aluminum, PET, malt, and sugar, (ii) the 14.6%3 devaluation of

the CLP against the USD, impacting negatively our USD denominated costs, and (iii) inflationary pressures. In the International Business

Operating segment, the Cost of sales per hectoliter expanded 47.3% in CLP, mostly explained by a higher cost in raw and packaging materials,

a higher inflation, and the negative impact from the 30.6%4 devaluation of the ARS against the USD in our USD-linked costs.

In the Wine Operating segment, the Cost of sales per hectoliter grew 17.6%, due to higher costs in packaging materials, inflationary pressures

and mix effects. |

| · | Gross profit reached CLP 549,033 million, a 7.7% expansion.

Gross margin dropped 543 bps, from 49.0% to 43.6%, as a consequence of the effects described above. |

| · | MSD&A expenses were up 17.3%, and as percentage

of Net sales, improved 115 bps, from 36.5% to 35.4%. The latter was mostly caused by an accelerating inflation in our main geographies,

together with higher oil prices, partially compensated with efficiencies and expenses control initiatives from our CCU Transformation

program. The performance by segment was as follows: In the Chile Operating segment, MSD&A expenses expanded 4.1%, and as a percentage

of Net sales decreased 204 bps. In the International Business Operating segment MSD&A expenses in CLP were up 50.2%, and as a percentage

of Net sales decreased 291 bps. In the Wine Operating segment, MSD&A expenses grew 13.9%, and as a percentage of Net sales improved

29 bps. |

| · | EBIT reached CLP 104,224 million, a contraction of

22.5%, mainly due to sharp negative external effects coming from: (i) higher cost in raw and packaging materials, (ii) the depreciation of our main local currencies against the USD, impacting negatively

our USD denominated costs, partly compensated with export revenues, and (iii) costs and expenses pressures associated with an accelerating

inflation in our main geographies, and higher oil prices. These effects were partially compensated by a double-digit growth in revenues

driven by revenue management efforts and volumes. |

| · | EBITDA reached CLP 167,597 million, a 10.9% decrease,

driven by a 27.6% decreased in the Chile Operating segment, while the International Business Operating segment expanded 136.6%, and the

Wine Operating segment grew 10.8%. In addition, EBITDA margin contracted 478 bps, from 18.1% to 13.3%. |

| · | Non-operating result totalized a loss of CLP 31,668

million versus a negative result of CLP 10,912 million last year. The higher loss was explained by: (i) a lower result by CLP 9,591 million

in Net financial expenses due to a larger debt, (ii) a higher loss by CLP 7,070 million in Foreign currency exchange differences, (iii)

a higher loss in Results as per adjustment units by CLP 5,870 million, explained by a higher inflation, and (iv) a higher loss in Equity

and income of JVs and associated by CLP 2,053 million. These effects were partially compensated by Other gains/(losses) by CLP 3,828 million,

mostly explained by a better result in derivative contracts5. |

| · | Income taxes reached CLP 9,544 million, a 69.7% decrease,

mostly explained by a lower taxable income. |

| · | Net income reached a gain of CLP 54,089 million, a

35.1% contraction, explained by the reasons described above. |

PRESS RELEASE |  |

| | |

|

HIGHLIGHTS OPERATING SEGMENTS SECOND QUARTER |

CHILE OPERATING SEGMENT

In the Chile Operating segment, our top line expanded 3.7%,

due to 7.3% growth in average prices while volumes declined 3.4% (17.3% growth vs. 2Q19). The higher average prices were explained by

revenue management initiatives, partially offset by a negative mix effect in the portfolio. Lower volumes were caused by a high comparison

base, and a less favorable consumption environment. Gross profit contracted 19.0%, and Gross margin dropped from 49.5% to 38.7%, mostly

as a consequence of cost pressures, and a 17.6% devaluation of the CLP against the USD, affecting our USD denominated costs. MSD&A

expenses grew 5.0%, and as percentage of Net sales increased 43 bps, where efficiencies helped us to offset expenses pressures coming

from higher inflation and oil prices. In all, EBITDA reached CLP 23,711 million, decreasing 59.1%, and EBITDA margin decreased from 18.3%

to 7.2%.

In terms of innovation, in beer we presented Patagonia Black

Lager, the fourth variety of the successful Patagonia portfolio. Also, our brand Stones launched two new varieties of flavored lager beer,

“Tropical” and “Sensation”, inspired by our consumers and their preferences towards flavored and easy-to-drink

beers. In spirits, we launched Campanario Selección Crème, the first premium variety for Campanario (a mainstream pisco

brand), which mixed pisco with cream, with notes of vanilla and chocolate. In the non-alcoholic category, the brand Watt’s presented

Watt’s Selección Frutas y Verduras, a 100% natural juice which combines fruits and vegetables with no sugar added. We also

incorporated Gatorade Zero, a no sugar sport drink. Finally, Pepsico awarded CCU as the best Latam bottler, sustained on the good performance

of the Pepsico portfolio, world class production processes, and successful marketing campaigns, among other aspects.

Regarding sustainability initiatives, for third consecutive

year CCU was part of the 2022 Santiago Marathon, committing with recycling 100% of the recyclable cups in every hydration station, with

the purpose of creating sport gear with recyclable materials. In addition, JP Morgan positioned CCU at the top ESG companies in Latam,

and at the same time, we obtained the 1st place in the beverages sector, in the Merco Responsibility ESG Chile 2021 ranking, which evaluated

progress on issues related to the environment.

INTERNATIONAL BUSINESS

OPERATING SEGMENT

In the International Business Operating segment, which includes

Argentina, Bolivia, Paraguay and Uruguay, Net sales recorded a 70.9% rise, as a result of an increase of 73.8% in average prices in CLP,

while volumes contracted 1.7% (1.7% decrease vs. 2Q19). The better average prices were mostly explained by revenue management initiatives

in all the geographies. Volumes in Argentina and Paraguay expanded versus pre-pandemic levels (2Q19), while Uruguay was practically flat

and Bolivia declined. Gross profit expanded 73.7%, and Gross margin grew from 44.3% to 45.1%. MSD&A expenses as a percentage of Net

sales improved by 235 bps due to efficiencies, compensating higher inflation and other cost pressures. Altogether, EBITDA reached CLP

1,072 million, versus a loss of CLP 2,223 million last year.

In Argentina, we did the kick-off of investments to continue

increasing our beer production capacity, reaffirming our long-term commitment with this country. In Paraguay, we incorporated the premium

beer Blue Moon, and in Bolivia we launched a new Tangerine flavor for our CSD brand Mendocina.

WINE OPERATING SEGMENT

In the Wine Operating segment, revenues were up 16.7%, explained

by a 17.4% growth in average prices, while volumes decreased 0.5% (13.7% growth vs. 2Q19). The higher prices in CLP were mainly explained

by a positive impact on export revenues from the depreciation of the CLP versus the USD, and revenue and mix management initiatives in

the Chile and Argentina domestic markets which permitted us to partially compensate higher costs in packaging materials and inflationary

pressures. Consequently, Gross profit expanded 13.6% and Gross margin decreased 101 bps from 37.9% to 36.9%. MSD&A expenses grew 17.9%,

and as a percentage of Net sales increased 26 bps. In all, EBITDA reached CLP 11,788 million, a 9.1% rise, while EBITDA margin decreased

from 16.7% to 15.6%.

In terms of innovation, VSPT Wine group continues to expand

its low alcohol portfolio with the launch of the new Alpaca Delight in Japan. With only 5.5 alcoholic degrees and less than 50 calories

per glass, Alpaca Delight joins the company's portfolio of dealcoholized and partially dealcoholized products in its two versions White

Blend and Red Blend. Also, in the permanent search for innovations in products and formats, we launched a new 269 cc can format for the

Vibra line of wine cocktails, in orange and sweet flavor, for Paraguay.

In terms of sustainability, VSPT launched a responsible consumption

webpage to educate consumers, and it will implement recycling instructions in all its products by 2030, the latter within the framework

of the company's new Circular Economy and eco-design policy.

PRESS RELEASE |  |

| | |

|

ADDITIONAL INFORMATION AND EXHIBITS |

ABOUT CCU

CCU is a multi-category beverage

company with operations in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. CCU is one of the largest players in each one of

the beverage categories in which it participates in Chile, including beer, soft drinks, mineral and bottled water, nectar, wine and pisco,

among others. CCU is the second-largest brewer in Argentina and also participates in the cider, spirits and wine industries. In Uruguay

and Paraguay, the Company is present in the beer, mineral and bottled water, soft drinks, wine and nectar categories. In Bolivia, CCU

participates in the beer, water, soft drinks and malt beverage categories. In Colombia, the Company participates in the beer and in the

malt industry. The Company’s principal licensing, distribution and / or joint venture agreements include Heineken Brouwerijen B.V.,

PepsiCo Inc., Seven-up International, Schweppes Holdings Limited, Société des Produits Nestlé S.A., Pernod Ricard

Chile S.A., Promarca S.A. (Watt’s), Red Bull Panamá S.A., Stokely Van Camp Inc., and Coors Brewing Company.

CORPORATE HEADQUARTERS

Vitacura 2670, 26th floor

Santiago

Chile

STOCK TICKER

Bolsa de Comercio de Santiago:

CCU

NYSE: CCU

CAUTIONARY STATEMENT

Statements made in this press

release that relate to CCU’s future performance or financial results are forward-looking statements, which involve known and unknown

risks and uncertainties that could cause actual performance or results to materially differ. We undertake no obligation to update any

of these statements. Persons reading this press release are cautioned not to place undue reliance on these forward-looking statements.

These statements should be taken in conjunction with the additional information about risk and uncertainties set forth in CCU’s

annual report on Form 20-F filed with the US Securities and Exchange Commission and in the annual report submitted to the CMF (Chilean

Market Regulator) and available on our web page.

GLOSSARY

Operating segments

The Operating segments are defined with respect to its revenues

in the geographic areas of commercial activity:

| · | Chile: This segment commercializes Beer, Non Alcoholic

Beverages, Spirits and Cider in the Chilean market, and also includes the results of Transportes CCU Limitada, Comercial CCU S.A., Creccu

S.A. and Fábrica de Envases Plásticos S.A. |

| · | International Business: This segment commercializes

Beer, Cider, Wine, Non-Alcoholic Beverages and Spirits in Argentina, Uruguay, Paraguay and Bolivia. |

| · | Wine: This segment commercializes Wine and Sparkling

Wine, mainly in the export market reaching over 80 countries, as well as the Chilean and Argentine domestic market. |

| · | Other/Eliminations: Considers the non-allocated corporate

overhead expenses and eliminations of transactions and volumes between segments. |

PRESS RELEASE |  |

| | |

ARS

Argentine peso.

CLP

Chilean peso.

Cost of sales

Formerly referred to as Cost of Goods Sold (COGS), includes direct

costs and manufacturing costs.

Earnings per Share (EPS)

Net profit divided by the weighted average number of shares during

the year.

EBIT

Earnings Before Interest and Taxes. For management purposes, EBIT

is defined as Net income before other gains (losses), net financial expenses, equity and income of joint ventures, foreign currency exchange

differences, results as per adjustment units and income taxes. EBIT is equivalent to Adjusted Operating Result used in the 20-F Form.

EBITDA

EBITDA represents EBIT plus depreciation and amortization. EBITDA

is not an accounting measure under IFRS. When analyzing the operating performance, investors should use EBITDA in addition to, not as

an alternative for Net income, as this item is defined by IFRS. Investors should also note that CCU’s presentation of EBITDA may

not be comparable to similarly titled indicators used by other companies. EBITDA is equivalent to ORBDA (Adjusted Operating Result Before

Depreciation and Amortization), used in the 20-F Form.

Exceptional Items (EI)

Formerly referred to as Non-recurring items (NRI), Exceptional

Items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately

because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature.

Gross profit

Gross profit represents the difference between Net sales

and Cost of sales.

Gross margin

Gross profit as a percentage of Net sales.

Liquidity ratio

Total current assets / Total current liabilities

Marketing, Sales, Distribution and Administrative expenses

(MSD&A)

MSD&A includes marketing, sales, distribution and administrative

expenses.

Net Financial Debt

Total Financial Debt minus Cash & Cash Equivalents.

Net Financial Debt / EBITDA

The ratio is based on a twelve month rolling calculation

for EBITDA.

Net income

Net income attributable to the equity holders of the parent.

UF

The UF is a monetary unit indexed to the Consumer Price Index

variation in Chile.

USD

United States Dollar.

PRESS RELEASE |  |

| | |

| Exhibit 1: Consolidated Income Statement (Second Quarter 2022) |

| Second Quarter |

2022 |

2021 |

Total

Change % |

| |

(CLP million) |

| Net sales |

558,503 |

469,995 |

18.8 |

| Cost of sales |

(333,194) |

(249,567) |

33.5 |

| % of Net sales |

59.7 |

53.1 |

656 bps |

| Gross profit |

225,308 |

220,428 |

2.2 |

| % of Net sales |

40.3 |

46.9 |

(656) bps |

| MSD&A |

(227,471) |

(185,974) |

22.3 |

| % of Net sales |

40.7 |

39.6 |

116 bps |

| Other operating income/(expenses) |

491 |

216 |

127.3 |

| EBIT |

(1,671) |

34,670 |

(104.8) |

| EBIT margin % |

(0.3) |

7.4 |

(768) bps |

| Net financial expenses |

(10,513) |

(3,477) |

202.4 |

| Equity and income of JVs and associated |

(3,837) |

(1,752) |

119.0 |

| Foreign currency exchange differences |

(11,430) |

(1,379) |

>500 |

| Results as per adjustment units |

(1,481) |

730 |

(303.0) |

| Other gains/(losses) |

13,517 |

1,739 |

>500 |

| Non-operating result |

(13,744) |

(4,140) |

232.0 |

| Income/(loss) before taxes |

(15,415) |

30,530 |

(150.5) |

| Income taxes |

8,020 |

(7,973) |

200.6 |

| Net income for the period |

(7,395) |

22,556 |

(132.8) |

| |

|

|

|

| Net income attributable to: |

|

|

|

| The equity holders of the parent |

(10,455) |

18,968 |

(155.1) |

| Non-controlling interest |

(3,060) |

(3,589) |

(14.7) |

| |

|

|

|

| EBITDA |

32,471 |

61,576 |

(47.3) |

| EBITDA margin % |

5.8 |

13.1 |

(729) bps |

| |

|

|

|

| OTHER INFORMATION |

|

|

|

| Number of shares |

369,502,872 |

369,502,872 |

|

| Shares per ADR |

2 |

2 |

|

| |

|

|

|

| Earnings per share (CLP) |

(28.3) |

51.3 |

(155.1) |

| Earnings per ADR (CLP) |

(56.6) |

102.7 |

(155.1) |

| |

|

|

|

| Depreciation |

34,142 |

26,906 |

26.9 |

| Capital Expenditures |

51,317 |

40,750 |

25.9 |

PRESS RELEASE |  |

| | |

| Exhibit 2: Consolidated Income Statement (Six months ended on June 30, 2022) |

| YTD as of June |

2022 |

2021 |

Total

Change % |

| |

(CLP million) |

| Net sales |

1,258,968 |

1,039,634 |

21.1 |

| Cost of sales |

(709,935) |

(529,838) |

34.0 |

| % of Net sales |

56.4 |

51.0 |

543 bps |

| Gross profit |

549,033 |

509,796 |

7.7 |

| % of Net sales |

43.6 |

49.0 |

(543) bps |

| MSD&A |

(445,648) |

(379,938) |

17.3 |

| % of Net sales |

35.4 |

36.5 |

(115) bps |

| Other operating income/(expenses) |

839 |

4,560 |

(81.6) |

| EBIT |

104,224 |

134,419 |

(22.5) |

| EBIT margin % |

8.3 |

12.9 |

(465) bps |

| Net financial expenses |

(16,883) |

(7,292) |

131.5 |

| Equity and income of JVs and associated |

(4,402) |

(2,349) |

87.4 |

| Foreign currency exchange differences |

(9,836) |

(2,766) |

(255.6) |

| Results as per adjustment units |

(5,072) |

798 |

<500 |

| Other gains/(losses) |

4,525 |

698 |

>500 |

| Non-operating result |

(31,668) |

(10,912) |

190.2 |

| Income/(loss) before taxes |

72,555 |

123,507 |

(41.3) |

| Income taxes |

(9,544) |

(31,505) |

(69.7) |

| Net income for the period |

63,011 |

92,002 |

(31.5) |

| |

|

|

|

| Net income attributable to: |

|

|

|

| The equity holders of the parent |

54,089 |

83,352 |

(35.1) |

| Non-controlling interest |

(8,922) |

(8,650) |

3.1 |

| |

|

|

|

| EBITDA |

167,597 |

188,123 |

(10.9) |

| EBITDA margin % |

13.3 |

18.1 |

(478) bps |

| |

|

|

|

| OTHER INFORMATION |

|

|

|

| Number of shares |

369,502,872 |

369,502,872 |

|

| Shares per ADR |

2 |

2 |

|

| |

|

|

|

| Earnings per share (CLP) |

146.4 |

225.6 |

35.1 |

| Earnings per ADR (CLP) |

292.8 |

451.2 |

35.1 |

| |

|

|

|

| Depreciation |

63,373 |

53,704 |

18.0 |

| Capital Expenditures |

78,803 |

70,851 |

11.2 |

PRESS RELEASE |  |

| | |

| Exhibit 3: Segment Information (Second Quarter 2022) |

| |

1. Chile Operating segment |

|

2. International Business Operating segment |

|

3. Wine Operating segment |

| Second Quarter |

|

|

| (In ThHL or CLP million unless stated otherwise) |

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

| |

|

|

| Volumes |

4,593 |

4,752 |

(3.4) |

|

1,602 |

1,629 |

(1.7) |

|

411 |

413 |

(0.5) |

| Net sales |

328,283 |

316,436 |

3.7 |

|

163,889 |

95,900 |

70.9 |

|

75,618 |

64,782 |

16.7 |

| Net sales (CLP/HL) |

71,474 |

66,586 |

7.3 |

|

102,313 |

58,866 |

73.8 |

|

183,950 |

156,739 |

17.4 |

| Cost of sales |

(201,239) |

(159,663) |

26.0 |

|

(90,037) |

(53,395) |

68.6 |

|

(47,738) |

(40,240) |

18.6 |

| % of Net sales |

61.3 |

50.5 |

1,084 bps |

|

54.9 |

55.7 |

(74) bps |

|

63.1 |

62.1 |

101 bps |

| Gross profit |

127,044 |

156,773 |

(19.0) |

|

73,852 |

42,505 |

73.7 |

|

27,880 |

24,542 |

13.6 |

| % of Net sales |

38.7 |

49.5 |

(1,084) bps |

|

45.1 |

44.3 |

74 bps |

|

36.9 |

37.9 |

(101) bps |

| MSD&A |

(120,878) |

(115,166) |

5.0 |

|

(85,284) |

(52,162) |

63.5 |

|

(19,522) |

(16,556) |

17.9 |

| % of Net sales |

36.8 |

36.4 |

43 bps |

|

52.0 |

54.4 |

(235) bps |

|

25.8 |

25.6 |

26 bps |

| Other operating income/(expenses) |

130 |

85 |

53.3 |

|

201 |

59 |

241.5 |

|

106 |

38 |

177.0 |

| EBIT |

6,297 |

41,692 |

(84.9) |

|

(11,230) |

(9,598) |

17.0 |

|

8,464 |

8,024 |

5.5 |

| EBIT margin |

1.9 |

13.2 |

(1,126) bps |

|

(6.9) |

(10.0) |

316 bps |

|

11.2 |

12.4 |

(119) bps |

| EBITDA |

23,711 |

57,935 |

(59.1) |

|

1,072 |

(2,223) |

148.2 |

|

11,788 |

10,809 |

9.1 |

| EBITDA margin |

7.2 |

18.3 |

(1,109) bps |

|

0.7 |

(2.3) |

297 bps |

|

15.6 |

16.7 |

(110) bps |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

4. Other/eliminations |

|

Total |

|

|

|

|

| Second Quarter |

|

|

|

|

|

| (In ThHL or CLP million unless stated otherwise) |

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

|

|

|

|

| |

|

|

|

|

|

| Volumes |

(47) |

(36) |

29.0 |

|

6,559 |

6,759 |

(2.9) |

|

|

|

|

| Net sales |

(9,287) |

(7,123) |

30.4 |

|

558,503 |

469,995 |

18.8 |

|

|

|

|

| Net sales (CLP/HL) |

|

|

|

|

85,145 |

69,540 |

22.4 |

|

|

|

|

| Cost of sales |

5,819 |

3,730 |

56.0 |

|

(333,194) |

(249,567) |

33.5 |

|

|

|

|

| % of Net sales |

|

|

|

|

59.7 |

53.1 |

656 bps |

|

|

|

|

| Gross profit |

(3,468) |

(3,392) |

2.2 |

|

225,308 |

220,428 |

2.2 |

|

|

|

|

| % of Net sales |

|

|

|

|

40.3 |

46.9 |

(656) bps |

|

|

|

|

| MSD&A |

(1,787) |

(2,091) |

(14.5) |

|

(227,471) |

(185,974) |

22.3 |

|

|

|

|

| % of Net sales |

|

|

|

|

40.7 |

39.6 |

116 bps |

|

|

|

|

| Other operating income/(expenses) |

53 |

34 |

57.6 |

|

491 |

216 |

127.3 |

|

|

|

|

| EBIT |

(5,202) |

(5,449) |

(4.5) |

|

(1,671) |

34,670 |

104.8 |

|

|

|

|

| EBIT margin |

|

|

|

|

(0.3) |

7.4 |

(768) bps |

|

|

|

|

| EBITDA |

(4,101) |

(4,945) |

(17.1) |

|

32,471 |

61,576 |

(47.3) |

|

|

|

|

| EBITDA margin |

|

|

|

|

5.8 |

13.1 |

(729) bps |

|

|

|

|

PRESS RELEASE |  |

| | |

| Exhibit 4: Segment Information (Six months ended on June 30, 2022) |

| |

1. Chile Operating segment |

|

2. International Business Operating segment |

|

3. Wine Operating segment |

| YTD as of June |

|

|

| (In ThHL or CLP million unless stated otherwise) |

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

| |

|

|

| Volumes |

11,315 |

11,001 |

2.8 |

|

4,258 |

4,091 |

4.1 |

|

763 |

766 |

(0.4) |

| Net sales |

786,767 |

709,656 |

10.9 |

|

352,437 |

220,562 |

59.8 |

|

139,623 |

121,185 |

15.2 |

| Net sales (CLP/HL) |

69,536 |

64,506 |

7.8 |

|

82,778 |

53,915 |

53.5 |

|

182,930 |

158,204 |

15.6 |

| Cost of sales |

(458,159) |

(345,734) |

32.5 |

|

(178,758) |

(116,618) |

53.3 |

|

(86,745) |

(74,022) |

17.2 |

| % of Net sales |

58.2 |

48.7 |

951 bps |

|

50.7 |

52.9 |

(215) bps |

|

62.1 |

61.1 |

105 bps |

| Gross profit |

328,609 |

363,922 |

(9.7) |

|

173,679 |

103,943 |

67.1 |

|

52,878 |

47,163 |

12.1 |

| % of Net sales |

41.8 |

51.3 |

(951) bps |

|

49.3 |

47.1 |

215 bps |

|

37.9 |

38.9 |

(105) bps |

| MSD&A |

(245,228) |

(235,654) |

4.1 |

|

(160,904) |

(107,105) |

50.2 |

|

(36,400) |

(31,948) |

13.9 |

| % of Net sales |

31.2 |

33.2 |

(204) bps |

|

45.7 |

48.6 |

(291) bps |

|

26.1 |

26.4 |

(29) bps |

| Other operating income/(expenses) |

(93) |

527 |

(117.6) |

|

593 |

3,784 |

(84.3) |

|

252 |

200 |

26.3 |

| EBIT |

83,288 |

128,795 |

(35.3) |

|

13,367 |

623 |

> 500 |

|

16,731 |

15,415 |

8.5 |

| EBIT margin |

10.6 |

18.1 |

(756) bps |

|

3.8 |

0.3 |

351 bps |

|

12.0 |

12.7 |

(74) bps |

| EBITDA |

117,156 |

161,881 |

(27.6) |

|

34,268 |

14,483 |

136.6 |

|

23,258 |

20,989 |

10.8 |

| EBITDA margin |

14.9 |

22.8 |

(792) bps |

|

9.7 |

6.6 |

316 bps |

|

16.7 |

17.3 |

(66) bps |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

4. Other/eliminations |

|

Total |

|

|

|

|

| YTD as of June |

|

|

|

|

|

| (In ThHL or CLP million unless stated otherwise) |

2022 |

2021 |

YoY % |

|

2022 |

2021 |

YoY % |

|

|

|

|

| |

|

|

|

|

|

| Volumes |

(91) |

(58) |

58.5 |

|

16,244 |

15,801 |

2.8 |

|

|

|

|

| Net sales |

(19,860) |

(11,769) |

68.8 |

|

1,258,968 |

1,039,634 |

21.1 |

|

|

|

|

| Net sales (CLP/HL) |

|

|

|

|

77,503 |

65,797 |

17.8 |

|

|

|

|

| Cost of sales |

13,727 |

6,536 |

110.0 |

|

(709,935) |

(529,838) |

34.0 |

|

|

|

|

| % of Net sales |

|

|

|

|

56.4 |

51.0 |

543 bps |

|

|

|

|

| Gross profit |

(6,133) |

(5,232) |

17.2 |

|

549,033 |

509,796 |

7.7 |

|

|

|

|

| % of Net sales |

|

|

|

|

43.6 |

49.0 |

(543) bps |

|

|

|

|

| MSD&A |

(3,116) |

(5,231) |

(40.4) |

|

(445,648) |

(379,938) |

17.3 |

|

|

|

|

| % of Net sales |

|

|

|

|

35.4 |

36.5 |

(115) bps |

|

|

|

|

| Other operating income/(expenses) |

86 |

49 |

77.0 |

|

839 |

4,560 |

(81.6) |

|

|

|

|

| EBIT |

(9,162) |

(10,414) |

(12.0) |

|

104,224 |

134,419 |

(22.5) |

|

|

|

|

| EBIT margin |

|

|

|

|

8.3 |

12.9 |

(465) bps |

|

|

|

|

| EBITDA |

(7,085) |

(9,229) |

(23.2) |

|

167,597 |

188,123 |

(10.9) |

|

|

|

|

| EBITDA margin |

|

|

|

|

13.3 |

18.1 |

(478) bps |

|

|

|

|

PRESS RELEASE |  |

| | |

| Exhibit 5: Balance Sheet |

|

|

| |

June 30 |

December 31 |

| |

2022 |

2021 |

| |

(CLP million) |

| ASSETS |

|

|

| Cash and cash equivalents |

643,999 |

265,568 |

| Other current assets |

933,581 |

825,804 |

| Total current assets |

1,577,580 |

1,091,372 |

| |

|

|

| PP&E (net) |

1,307,387 |

1,222,261 |

| Other non current assets |

597,120 |

533,117 |

| Total non current assets |

1,904,508 |

1,755,378 |

| Total assets |

3,482,088 |

2,846,751 |

| |

|

|

| LIABILITIES |

|

|

| Short term financial debt |

186,860 |

107,579 |

| Other liabilities |

551,396 |

673,537 |

| Total current liabilities |

738,255 |

781,115 |

| |

|

|

| Long term financial debt |

1,080,265 |

487,279 |

| Other liabilities |

168,259 |

152,841 |

| Total non current liabilities |

1,248,525 |

640,120 |

| Total Liabilities |

1,986,780 |

1,421,235 |

| |

|

|

| EQUITY |

|

|

| Paid-in capital |

562,693 |

562,693 |

| Other reserves |

(805) |

(87,256) |

| Retained earnings |

811,006 |

832,181 |

| Total equity attributable to equity holders of the parent |

1,372,894 |

1,307,618 |

| Non - controlling interest |

122,414 |

117,897 |

| Total equity |

1,495,308 |

1,425,515 |

| Total equity and liabilities |

3,482,088 |

2,846,751 |

| |

|

|

| OTHER FINANCIAL INFORMATION |

|

|

| |

|

|

| Total Financial Debt |

1,267,125 |

594,858 |

| |

|

|

| Net Financial Debt |

623,126 |

329,289 |

| |

|

|

| Liquidity ratio |

2.14 |

1.40 |

| Total Financial Debt / Capitalization |

0.46 |

0.29 |

| Net Financial Debt / EBITDA |

1.47 |

0.74 |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

| |

/s/ Felipe Dubernet |

| |

Chief Financial Officer |

|

|

Date: August 3, 2022

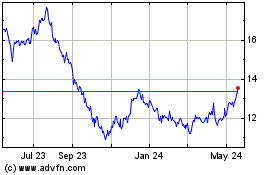

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Apr 2024 to May 2024

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From May 2023 to May 2024