UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ☒ Form 40-F: ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

Atento announces successful capital raise

• Kyma Capital, MCI and other key investors

have provided new financing to support Atento

• Atento engaged Houlihan Lokey as

financial advisor to assist with the fundraising

• Atento continues to work to add additional

investors to the new financing as part of the Company’s long-term goals

• This significant fundraising strengthens

Atento´s balance sheet and liquidity

NEW YORK, February 3, 2023 – Atento

S.A. (NYSE: ATTO, “Atento” or the “Company”), one of the largest providers worldwide and a leading company

in customer relationship services and business process outsourcing (CRM / BPO), confirms today that it has secured its previously announced

financing program. The additional capital raised will further strengthen Atento’s balance sheet and liquidity position as management

focuses on transforming the business.

Atento engaged Houlihan Lokey as financial

advisor to assist in this round of fundraising. As stated in the Q3 earnings call, Atento has evaluated different financial alternatives

from current investors and other institutions to enhance its liquidity position. Atento will continue to work to add additional investors

as part of the long-term financing goals.

Atento remains focused on driving shareholder

value with significant initiatives directed at both revenue growth and operational optimization. Atento continues working to solidify

its financial position while transforming and elevating Atento´s next generation customer experience. This fundraise fortifies its

commitment to their +400 blue chip clients and operations in 16 countries delivering best-in-class customer experience services.

The fourth quarter has continued the positive

trend by generating strong EBITDA margin growth, delivering the cash balance to close at US$ 84 million on December 31, 2022.

Atento continues to benefit from its unique

leadership position in the Latin American region with a renewed sales focus on near-shore Spanish support, while also remaining on track

to open its first offshore operation in the Philippines with marquee clients.

About Atento

Atento is the largest provider of customer

relationship management and business process outsourcing (“CRM BPO”) services in Latin America, and among the top providers

globally. Atento is also a leading provider of nearshoring CRM BPO services to companies that carry out their activities in the United

States. Since 1999, the company has developed its business model in 16 countries where it employs approximately 130,000 people. Atento

has over 400 clients to whom it offers a wide range of CRM BPO services through multiple channels. Atento’s clients are mostly leading

multinational corporations in industries such as telecommunications, banking and financial services, health, retail and public administrations,

among others. Atento’s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento was named one of

the World’s 25 Best Multinational Workplaces and one of the Best Multinationals to Work for in Latin America by Great Place to Work®.

Also, in 2021 Everest named Atento as a “star performer”. Gartner named the company as a leader for two years in a row, since

2021 in the Gartner Magic Quadrant. For more information visit www.atento.com

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking

statements can be identified by the use of words such as “may,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “intends,” “continue”

or similar terminology. In particular, these forward-looking statements include those about the effects on Atento and its growth of changes

to it´s executive officers and Board of Directors. These statements reflect only Atento’s current expectations and are not

guarantees of future performance or results. These statements are subject to risks and uncertainties that could cause actual results

to differ materially from those contained in the forward-looking statements. Risks and uncertainties include, but are not limited to,

competition in Atento’s highly competitive industries; increases in the cost of voice and data services or significant interruptions

in these services; Atento’s ability to keep pace with its clients’ needs for rapid technological change and systems availability;

the continued deployment and adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the

effects of global economic trends on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts

and the absence of revenue commitments; security and privacy breaches of the systems Atento uses to protect personal data; the cost of

pending and future litigation; the cost of defending Atento against intellectual property infringement claims; extensive regulation affecting

many of Atento’s businesses; Atento’s ability to protect its proprietary information or technology; service interruptions

to Atento’s data and operation centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified

employees; increases in labor costs and turnover rates; the political, economic and other conditions in the countries where Atento operates;

changes in foreign exchange rates; Atento’s ability to complete future acquisitions and integrate or achieve the objectives of

its recent and future acquisitions; future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and

Atento’s ability to recover consumer receivables on behalf of its clients. Atento is also subject to other risk factors described

in documents filed by the company with the United States Securities and Exchange Commission. These forward-looking statements speak only

as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

ATENTO S.A. |

| Date: February 3, 2023 |

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

| |

|

Exhibit 99.1

Atento announces successful capital raise

| · | Kyma Capital, MCI and other key investors have provided new financing to support Atento |

| · | Atento engaged Houlihan Lokey as financial advisor to assist with the fundraising |

| · | Atento continues to work to add additional investors to the new financing as part of the Company’s

long-term goals |

| · | This significant fundraising strengthens Atento´s balance sheet and liquidity |

NEW YORK, February 3, 2023 – Atento S.A.

(NYSE: ATTO, “Atento” or the “Company”), one of the largest providers worldwide and a leading company in customer

relationship services and business process outsourcing (CRM / BPO), confirms today that it has secured its previously announced financing

program. The additional capital raised will further strengthen Atento’s balance sheet and liquidity position as management focuses

on transforming the business.

Atento engaged Houlihan Lokey as financial advisor to assist

in this round of fundraising. As stated in the Q3 earnings call, Atento has evaluated different financial alternatives from current investors

and other institutions to enhance its liquidity position. Atento will continue to work to add additional investors as part of the long-term

financing goals.

Atento remains focused on driving shareholder value with significant

initiatives directed at both revenue growth and operational optimization. Atento continues working to solidify its financial position

while transforming and elevating Atento´s next generation customer experience. This fundraise fortifies its commitment to their

+400 blue chip clients and operations in 16 countries delivering best-in-class customer experience services.

The fourth quarter has continued the positive trend by generating

strong EBITDA margin growth, delivering the cash balance to close at US$ 84 million on December 31, 2022.

Atento continues to benefit from its unique leadership position

in the Latin American region with a renewed sales focus on near-shore Spanish support, while also remaining on track to open its first

offshore operation in the Philippines with marquee clients.

About Atento

Atento is the largest

provider of customer relationship management and business process outsourcing (“CRM BPO”) services in Latin America, and among

the top providers globally. Atento is also a leading provider of nearshoring CRM BPO services to companies that carry out their activities

in the United States. Since 1999, the company has developed its business model in 16 countries where it employs approximately 130,000

people. Atento has over 400 clients to whom it offers a wide range of CRM BPO services through multiple channels. Atento’s clients

are mostly leading multinational corporations in industries such as telecommunications, banking and financial services, health, retail

and public administrations, among others. Atento’s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento

was named one of the World’s 25 Best Multinational Workplaces and one of the Best Multinationals to Work for in Latin America by

Great Place to Work®. Also, in 2021 Everest named Atento as a “star performer”. Gartner named the company as a leader

for two years in a row, since 2021 in the Gartner Magic Quadrant. For more information visit www.atento.com

Media Relations

press@atento.com

// pablo.sanchez@atento.com

Forward-Looking Statements

This

press release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,”

“should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “intends,” “continue” or similar terminology. In particular, these forward-looking statements

include those about the effects on Atento and its growth of changes to it´s executive officers and Board of Directors. These statements

reflect only Atento’s current expectations and are not guarantees of future performance or results. These statements are subject

to risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements.

Risks and uncertainties include, but are not limited to, competition in Atento’s highly competitive industries; increases in the

cost of voice and data services or significant interruptions in these services; Atento’s ability to keep pace with its clients’

needs for rapid technological change and systems availability; the continued deployment and adoption of emerging technologies; the loss,

financial difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento’s clients;

the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments; security and privacy breaches of the

systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against intellectual

property infringement claims; extensive regulation affecting many of Atento’s businesses; Atento’s ability to protect its

proprietary information or technology; service interruptions to Atento’s data and operation centers; Atento’s ability to retain

key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political, economic

and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento’s ability to complete future

acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial goodwill,

intangible assets, or other long-lived assets; and Atento’s ability to recover consumer receivables on behalf of its clients. Atento

is also subject to other risk factors described in documents filed by the company with the United States Securities and Exchange Commission.

These forward-looking statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update

or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

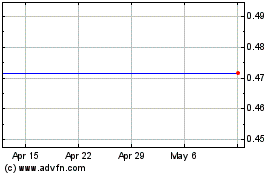

Atento (NYSE:ATTO)

Historical Stock Chart

From Apr 2024 to May 2024

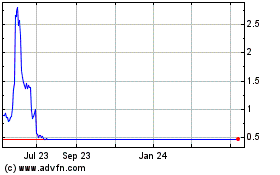

Atento (NYSE:ATTO)

Historical Stock Chart

From May 2023 to May 2024