0000103595FALSE00001035952022-10-062022-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 10, 2023

VILLAGE SUPER MARKET, INC.

(Exact Name of Registrant as specified in its charter)

| | | | | | | | |

New Jersey | 0-2633 | 22-1576170 |

| (State or Other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

733 Mountain Avenue

Springfield, New Jersey 07081

(Address of principal executive offices)

Registrant’s telephone number, including area code

(973) 467-2200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[☐] Written communication pursuant to Rule 425 under the Securities Act ( 17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act ( 17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Class A common stock, no par value | VLGEA | NASDAQ |

| (Title of Class) | (Trading Symbol) | (Name of exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 4, 2023, Village Super Market, Inc. issued a press release to announce its results for the fourth quarter of Fiscal 2023. A copy of the press release is attached as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

| | | | | |

| Exhibit No. | Description |

| | |

| 99.1 | |

Signature

Pursuant to the requirements of the Securities and Exchange Act of 1934. the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Village Super Market, Inc. |

| | |

Dated: October 10, 2023 | /s/ John L. Van Orden |

| | John L. Van Orden |

| | (Chief Financial Officer) |

VILLAGE SUPER MARKET, INC.

REPORTS RESULTS FOR THE FOURTH QUARTER ENDED

JULY 29, 2023

| | | | | |

| Contact: | John Van Orden, CFO |

| | (973) 467-2200 |

| | villageinvestorrelations@wakefern.com |

Springfield, New Jersey – October 4, 2023 - Village Super Market, Inc. (NSD-VLGEA) today reported its results of operations for the fourth quarter ended July 29, 2023.

Fourth Quarter Highlights

•Net income of $15.3 million, an increase of 21% compared to $12.6 million in the fourth quarter of the prior year

•Adjusted net income of $15.6 million, an increase of 27% compared to $12.3 million in the fourth quarter of the prior year

•Same store sales increased 3.2%

•Same store digital sales increased 12%

Fiscal 2023 Highlights

•Net income of $49.7 million, an increase of 85% compared to $26.8 million in fiscal 2022

•Adjusted net income of $49.2 million, an increase of 40% compared to $35.0 million in fiscal 2022

•Same store sales increased 3.5%

•Same store digital sales increased 5%

Fourth Quarter of Fiscal 2023 Results

Sales were $553.8 million in the 13 weeks ended July 29, 2023 compared to $527.5 million in the 13 weeks ended July 30, 2022. Sales increased due to an increase in same store sales of 3.2% and increased sales due to the remodel and conversion of the Pelham, NY Fairway to the ShopRite banner on August 15, 2022. Same store sales increased due primarily to retail price inflation. New stores, replacement stores and stores with banner changes are included in same store sales in the quarter after the store has been in operation for four full quarters. Store renovations and expansions are included in same store sales immediately.

Gross profit as a percentage of sales increased to 29.08% in the 13 weeks ended July 29, 2023 compared to 28.11% in the 13 weeks ended July 30, 2022 due primarily to increased departmental gross margin percentages (.51%), increased patronage dividends and rebates received from Wakefern (.37%), less promotional spending (.14%) and lower LIFO charges (.24%) partially offset by increased warehouse assessment charges from Wakefern (.24%) and an unfavorable change in product mix (.05%). Departmental gross margin percentages increased due primarily to improvements in commissary operations.

Operating and administrative expense as a percentage of sales increased to 23.92% in the 13 weeks ended July 29, 2023 compared to 23.14% in the 13 weeks ended July 30, 2022. Adjusted operating and administrative expenses increased to 23.84% in the 13 weeks ended July 29, 2023 compared to 23.23% in the 13 weeks ended July 30, 2022. The increase in

Adjusted operating and administrative expenses is due primarily to increases in self-insured claim costs (.22%), facility repair and maintenance costs (.17%), security (.05%), technology initiatives (.05%) and legal and consulting fees (.05%).

Depreciation and amortization expense increased in the 13 weeks ended July 29, 2023 compared the 13 weeks ended July 30, 2022 due primarily to capital expenditures.

Interest expense increased in the 13 weeks ended July 29, 2023 compared to the 13 weeks ended July 30, 2022 due primarily to higher average outstanding debt balances.

Interest income increased in the 13 weeks ended July 29, 2023 compared to the 13 weeks ended July 30, 2022 due primarily to higher interest rates and larger amounts invested in variable rate notes receivable from Wakefern and demand deposits invested at Wakefern.

The Company’s effective income tax rate was 32.7% in the 13 weeks ended July 29, 2023 compared to 30.8% in the 13 weeks ended July 30, 2022.

Fiscal 2023 Results

Sales were $2.17 billion in fiscal 2023 compared to $2.06 billion in fiscal 2022. Sales increased due primarily to an increase in same store sales of 3.5%, the opening of a Gourmet Garage in the West Village in Manhattan, NY on April 29, 2022 and increased sales due to the remodel and conversion of the Pelham, NY Fairway to the ShopRite banner on August 15, 2022. Same store sales increased due primarily to retail price inflation.

Gross profit as a percentage of sales increased to 28.45% in fiscal 2023 compared to 28.12% in fiscal 2022 due primarily to increased departmental gross margin percentages (.23%), increased patronage dividends and rebates received from Wakefern (.08%), lower LIFO charges (.04%), a favorable change in product mix (.02%) and lower promotional spending (.03%) partially offset by increased warehouse assessment charges from Wakefern (.07%). Department gross margins increased due primarily to pricing initiatives and improvements in commissary operations partially offset by higher inventory shrink.

Operating and administrative expense as a percentage of sales decreased to 23.86% in fiscal 2023 compared to 24.63% in fiscal 2022. Adjusted operating and administrative expense as a percentage of sales decreased to 23.89% in fiscal 2023 compared to 24.05% in fiscal 2022 due primarily to lower labor costs (.19%) and decreased supply spending (.12%) partially offset by increased self insured claim costs (.09%) and higher facility repair and maintenance costs (.05%). Labor costs and fringe benefits decreased due primarily to sales leverage and ongoing productivity initiatives partially offset by minimum wage and market-driven pay rate increases.

Depreciation and amortization expense increased in fiscal 2023 compared to fiscal 2022 due primarily to capital expenditures.

Interest expense increased in fiscal 2023 compared to fiscal 2022 due primarily to higher average outstanding debt balances.

Interest income increased in fiscal 2023 compared to fiscal 2022 due primarily to higher interest rates and larger amounts invested in variable rate notes receivable from Wakefern and demand deposits invested at Wakefern.

The Company’s effective income tax rate was 31.6% in fiscal 2023 compared to 31.3% in fiscal 2022.

Village Super Market operates a chain of 34 supermarkets in New Jersey, New York, Maryland and Pennsylvania under the ShopRite and Fairway banners and four Gourmet Garage specialty markets in New York City.

Forward Looking Statements and Non-GAAP Measures

All statements, other than statements of historical fact, included in this Press Release are or may be considered forward-looking statements within the meaning of federal securities law. The Company cautions the reader that there is no assurance that actual results or business conditions will not differ materially from future results, whether expressed, suggested or implied by such forward-looking statements. The Company undertakes no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof. The following are among the principal factors that could cause actual results to differ from the forward-looking statements: general economic conditions; competitive pressures from the Company’s operating environment; the ability of the Company to maintain and improve its sales and margins; the ability to attract and retain qualified associates; the availability of new store locations; the availability of capital; the liquidity of the Company; the success of operating initiatives; consumer spending patterns; the impact of changing energy prices; increased cost of goods sold, including increased costs from the Company’s principal supplier, Wakefern; disruptions or changes in Wakefern's operations; the results of litigation; the results of tax examinations; the results of union contract negotiations; competitive store openings and closings; the rate of return on pension assets; and other factors detailed herein and in the Company’s filings with the SEC.

We provide non-GAAP measures, including Adjusted net income and Adjusted operating and administrative expenses as management believes these supplemental measures are useful to investors and analysts. These non-GAAP financial measures should not be reviewed in isolation or considered as a substitute for our financial results as reported in accordance with GAAP,

nor as an alternative to net income, operating and administrative expense or any other GAAP measure of performance. Adjusted net income and Adjusted operating and administrative expense are useful to investors because they provide supplemental measures that exclude the financial impact of certain items that affect period-to-period comparability. Management and the Board of Directors use these measures as they provide greater transparency in assessing ongoing operating performance on a period-to-period basis. Other companies may have different definitions of Non-GAAP Measures and provide for different adjustments, and comparability to the Company's results of operations may be impacted by such differences. The Company's presentation of Non-GAAP Measures should not be construed as an implication that its future results will be unaffected by unusual or non-recurring items.

VILLAGE SUPER MARKET, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | 13 Weeks Ended | | 13 Weeks Ended | | 52 Weeks Ended | | 52 Weeks Ended |

| | July 29,

2023 | | July 30,

2022 | | July 29,

2023 | | July 30,

2022 |

| | | | | | | |

| Sales | $ | 553,806 | | | $ | 527,503 | | | $ | 2,166,654 | | | $ | 2,061,084 | |

| | | | | | | |

| Cost of sales | 392,743 | | | 379,218 | | | 1,550,204 | | | 1,481,417 | |

| | | | | | | |

| Gross profit | 161,063 | | | 148,285 | | | 616,450 | | | 579,667 | |

| | | | | | | |

| Operating and administrative expense | 132,450 | | | 122,076 | | | 516,902 | | | 507,597 | |

| | | | | | | |

| Depreciation and amortization | 8,405 | | | 8,197 | | | 34,002 | | | 33,122 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 20,208 | | | 18,012 | | | 65,546 | | | 38,948 | |

| | | | | | | |

| Interest expense | (1,083) | | | (984) | | | (4,220) | | | (3,907) | |

| | | | | | | |

| Interest income | 3,601 | | | 1,192 | | | 11,399 | | | 4,023 | |

| | | | | | | |

| Income before income taxes | 22,726 | | | 18,220 | | | 72,725 | | | 39,064 | |

| | | | | | | |

| Income taxes | 7,430 | | | 5,617 | | | 23,009 | | | 12,234 | |

| | | | | | | |

| Net income | $ | 15,296 | | | $ | 12,603 | | | $ | 49,716 | | | $ | 26,830 | |

| | | | | | | |

| Net income per share: | | | | | | |

| Class A common stock: | | | | | | | |

| Basic | $ | 1.15 | | | $ | 0.97 | | | $ | 3.78 | | | $ | 2.06 | |

| Diluted | $ | 1.03 | | | $ | 0.87 | | | $ | 3.38 | | | $ | 1.84 | |

| | | | | | | |

| Class B common stock: | | | | | | | |

| Basic | $ | 0.74 | | | $ | 0.63 | | | $ | 2.45 | | | $ | 1.34 | |

| Diluted | $ | 0.74 | | | $ | 0.63 | | | $ | 2.45 | | | $ | 1.34 | |

| | | | | | | |

| Gross profit as a % of sales | 29.08 | % | | 28.11 | % | | 28.45 | % | | 28.12 | % |

| Operating and administrative expense as a % of sales | 23.92 | % | | 23.14 | % | | 23.86 | % | | 24.63 | % |

VILLAGE SUPER MARKET, INC.

RECONCILIATION OF NON-GAAP MEASURE

(In thousands) (Unaudited)

The following tables reconciles Net income to Adjusted net income and Operating and administrative expenses to Adjusted operating and administrative expenses:

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | 52 Weeks Ended |

| July 29,

2023 | | July 30,

2022 | | July 29,

2023 | | July 30,

2022 |

| Net Income | $ | 15,296 | | | $ | 12,603 | | | $ | 49,716 | | | $ | 26,830 | |

| | | | | | | |

| Adjustments to Operating Expenses: | | | | | | | |

| Litigation settlement gain (1) | $ | — | | | $ | — | | | $ | (1,200) | | | $ | — | |

| Loss (gain) on non-operating investments (2) | 400 | | | (494) | | | 400 | | | (494) | |

| Pension termination and settlement charges (3) | — | | | 45 | | | — | | | 12,341 | |

| Adjustments to Income Taxes: | | | | | | | |

| Tax impact of adjustments to operating expenses | (124) | | | 137 | | | 248 | | | (3,633) | |

| Adjusted net income | $ | 15,572 | | | $ | 12,291 | | | $ | 49,164 | | | $ | 35,044 | |

| | | | | | | |

| | | | | | | |

| Operating and administrative expenses | $ | 132,450 | | | $ | 122,076 | | | $ | 516,902 | | | $ | 507,597 | |

| Adjustments to operating and administrative expenses | (400) | | | 449 | | | 800 | | | (11,847) | |

| Adjusted operating and administrative expenses | 132,050 | | | 122,525 | | | 517,702 | | | 495,750 | |

| Adjusted operating and administrative expenses as a % of sales | 23.84 | % | | 23.23 | % | | 23.89 | % | | 24.05 | % |

(1) Fiscal 2023 litigation settlement gains are related to claims associated with the Fairway acquisition and liabilities associated thereto.

(2) Fiscal 2023 and 2022 include a $400 loss and a $494 gain, respectively, related to non-operating equity investments.

(3) Fiscal 2022 pension settlement charges related primarily to the termination of the Village Super Market, Inc. Employees’ Retirement Plan. The Company contributed cash of $1,440 to fully fund the plan and the remaining $10,901 represents non-cash charges for unrecognized losses within accumulated other comprehensive loss as of the termination date.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

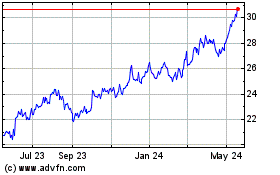

Village Super Market (NASDAQ:VLGEA)

Historical Stock Chart

From Apr 2024 to May 2024

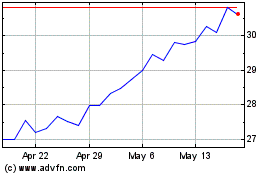

Village Super Market (NASDAQ:VLGEA)

Historical Stock Chart

From May 2023 to May 2024