0001644378false2023FYP3YP3Y00016443782022-10-012023-09-3000016443782023-03-31iso4217:USD0001644378us-gaap:CommonClassAMember2023-11-09xbrli:shares0001644378us-gaap:CommonClassBMember2023-11-090001644378rmr:CommonClassB2Member2023-11-0900016443782023-09-3000016443782022-09-300001644378us-gaap:RelatedPartyMember2023-09-300001644378us-gaap:RelatedPartyMember2022-09-300001644378us-gaap:CommonClassAMember2023-09-30iso4217:USDxbrli:shares0001644378us-gaap:CommonClassAMember2022-09-300001644378us-gaap:CommonClassBMember2022-09-300001644378us-gaap:CommonClassBMember2023-09-300001644378rmr:CommonClassB2Member2023-09-300001644378rmr:CommonClassB2Member2022-09-300001644378us-gaap:ManagementServiceMember2022-10-012023-09-300001644378us-gaap:ManagementServiceMember2021-10-012022-09-300001644378us-gaap:ManagementServiceMember2020-10-012021-09-300001644378rmr:ManagementServicesIncentiveAndTerminationMember2022-10-012023-09-300001644378rmr:ManagementServicesIncentiveAndTerminationMember2021-10-012022-09-300001644378rmr:ManagementServicesIncentiveAndTerminationMember2020-10-012021-09-300001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMember2022-10-012023-09-300001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMember2021-10-012022-09-300001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMember2020-10-012021-09-300001644378rmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:ReimbursementPayrollRelatedAndOtherCostsMember2022-10-012023-09-300001644378rmr:ReimbursementPayrollRelatedAndOtherCostsMember2021-10-012022-09-300001644378rmr:ReimbursementPayrollRelatedAndOtherCostsMember2020-10-012021-09-300001644378rmr:ReimbursementClientCompanyEquityBasedConpensationMember2022-10-012023-09-300001644378rmr:ReimbursementClientCompanyEquityBasedConpensationMember2021-10-012022-09-300001644378rmr:ReimbursementClientCompanyEquityBasedConpensationMember2020-10-012021-09-300001644378rmr:ReimbursementsOtherMember2022-10-012023-09-300001644378rmr:ReimbursementsOtherMember2021-10-012022-09-300001644378rmr:ReimbursementsOtherMember2020-10-012021-09-300001644378rmr:ReimbursementMember2022-10-012023-09-300001644378rmr:ReimbursementMember2021-10-012022-09-300001644378rmr:ReimbursementMember2020-10-012021-09-3000016443782021-10-012022-09-3000016443782020-10-012021-09-300001644378us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-09-300001644378us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-09-300001644378rmr:CommonClassB2Memberus-gaap:CommonStockMember2020-09-300001644378us-gaap:AdditionalPaidInCapitalMember2020-09-300001644378us-gaap:RetainedEarningsMember2020-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-09-300001644378us-gaap:ParentMember2020-09-300001644378us-gaap:NoncontrollingInterestMember2020-09-3000016443782020-09-300001644378us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300001644378us-gaap:ParentMember2020-10-012021-09-300001644378us-gaap:RetainedEarningsMember2020-10-012021-09-300001644378us-gaap:NoncontrollingInterestMember2020-10-012021-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-10-012021-09-300001644378us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-09-300001644378us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-09-300001644378rmr:CommonClassB2Memberus-gaap:CommonStockMember2021-09-300001644378us-gaap:AdditionalPaidInCapitalMember2021-09-300001644378us-gaap:RetainedEarningsMember2021-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-09-300001644378us-gaap:ParentMember2021-09-300001644378us-gaap:NoncontrollingInterestMember2021-09-3000016443782021-09-300001644378us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-10-012022-09-300001644378us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001644378us-gaap:ParentMember2021-10-012022-09-300001644378us-gaap:RetainedEarningsMember2021-10-012022-09-300001644378us-gaap:NoncontrollingInterestMember2021-10-012022-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-10-012022-09-300001644378us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-09-300001644378us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-09-300001644378rmr:CommonClassB2Memberus-gaap:CommonStockMember2022-09-300001644378us-gaap:AdditionalPaidInCapitalMember2022-09-300001644378us-gaap:RetainedEarningsMember2022-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-09-300001644378us-gaap:ParentMember2022-09-300001644378us-gaap:NoncontrollingInterestMember2022-09-300001644378us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001644378us-gaap:ParentMember2022-10-012023-09-300001644378us-gaap:RetainedEarningsMember2022-10-012023-09-300001644378us-gaap:NoncontrollingInterestMember2022-10-012023-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-10-012023-09-300001644378us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-09-300001644378us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-09-300001644378rmr:CommonClassB2Memberus-gaap:CommonStockMember2023-09-300001644378us-gaap:AdditionalPaidInCapitalMember2023-09-300001644378us-gaap:RetainedEarningsMember2023-09-300001644378us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-09-300001644378us-gaap:ParentMember2023-09-300001644378us-gaap:NoncontrollingInterestMember2023-09-300001644378us-gaap:CommonClassAMemberus-gaap:CapitalUnitClassAMember2023-09-300001644378rmr:RMRLLCMember2022-10-012023-09-30xbrli:pure0001644378us-gaap:CapitalUnitClassAMember2023-09-300001644378rmr:RMRLLCMemberrmr:CapitalUnitRedeemableClassMemberrmr:AbpTrustMember2022-10-012023-09-30rmr:real_estate_investment_trust0001644378rmr:MPCPartnershipHoldingsLLCMember2022-10-012023-09-300001644378rmr:MPCPartnershipHoldingsLLCMember2023-09-300001644378rmr:ManagedEquityREITMember2022-10-012023-09-300001644378rmr:ManagedEquityREITMember2023-09-300001644378rmr:ManagedEquityREITMember2021-10-012022-09-300001644378rmr:ManagedEquityREITMember2020-10-012021-09-300001644378rmr:ManagedOperatingCompaniesMember2022-10-012023-09-300001644378rmr:ManagedPublicRealEstateCapitalMember2022-10-012023-09-300001644378rmr:ManagedPublicRealEstateCapitalMember2021-10-012022-09-300001644378rmr:ManagedPublicRealEstateCapitalMember2020-10-012021-09-300001644378rmr:TerminationFeeMember2023-05-152023-05-150001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMemberrmr:TremontAdvisorsMember2022-10-012023-09-300001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMemberrmr:TremontAdvisorsMember2021-10-012022-09-300001644378us-gaap:InvestmentAdvisoryManagementAndAdministrativeServiceMemberrmr:TremontAdvisorsMember2020-10-012021-09-300001644378rmr:TremontAdvisorsMember2022-10-012023-09-300001644378us-gaap:ManagementServiceIncentiveMemberrmr:TremontAdvisorsMember2022-10-012023-09-300001644378us-gaap:ManagementServiceIncentiveMemberrmr:TremontAdvisorsMember2021-10-012022-09-300001644378us-gaap:ManagementServiceIncentiveMemberrmr:TremontAdvisorsMember2020-10-012021-09-300001644378srt:MinimumMemberrmr:TremontAdvisorsMember2022-10-012023-09-300001644378srt:MaximumMemberrmr:TremontAdvisorsMember2022-10-012023-09-300001644378rmr:TremontAdvisorsMemberus-gaap:ManagementServiceMember2022-10-012023-09-300001644378rmr:TremontAdvisorsMemberus-gaap:ManagementServiceMember2021-10-012022-09-300001644378rmr:TremontAdvisorsMemberus-gaap:ManagementServiceMember2020-10-012021-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:TremontRealityCapitalMember2023-09-300001644378us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberrmr:SevenHillsRealtyTrustMember2023-09-300001644378us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberrmr:SevenHillsRealtyTrustMember2022-09-300001644378rmr:SevenHillsRealtyTrustMember2022-10-012023-09-300001644378rmr:SevenHillsRealtyTrustMember2021-10-012022-09-300001644378rmr:SevenHillsRealtyTrustMember2021-09-300001644378rmr:TremontMortgageTrustMember2020-10-012021-09-300001644378rmr:TremontRealityCapitalMember2021-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:RMRLLCMember2023-03-310001644378rmr:TravelCentersOfAmericaLLCMemberrmr:BPProductsNorthAmericaIncMember2023-05-150001644378rmr:TravelCentersOfAmericaLLCMember2023-05-152023-05-150001644378rmr:TravelCentersOfAmericaLLCMember2022-10-012023-09-300001644378rmr:TravelCentersOfAmericaLLCMember2021-10-012022-09-300001644378rmr:TravelCentersOfAmericaLLCMember2020-10-012021-09-300001644378srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-09-300001644378srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-09-300001644378us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2023-09-300001644378srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2023-09-300001644378us-gaap:FurnitureAndFixturesMember2023-09-300001644378us-gaap:FurnitureAndFixturesMember2022-09-300001644378us-gaap:LeaseholdImprovementsMember2023-09-300001644378us-gaap:LeaseholdImprovementsMember2022-09-300001644378us-gaap:SoftwareDevelopmentMember2023-09-300001644378us-gaap:SoftwareDevelopmentMember2022-09-300001644378rmr:ManagedEquityREITMember2015-06-052015-06-050001644378rmr:ManagedEquityREITMember2015-06-050001644378rmr:UpCTransactionMemberrmr:ManagedEquityREITMember2022-10-012023-09-300001644378rmr:UpCTransactionMemberrmr:ManagedEquityREITMember2021-10-012022-09-300001644378rmr:UpCTransactionMemberrmr:ManagedEquityREITMember2020-10-012021-09-3000016443782020-10-012020-12-310001644378us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300001644378us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-09-300001644378rmr:TravelCentersOfAmericaLlcMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300001644378rmr:TravelCentersOfAmericaLlcMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-09-300001644378rmr:SEVNMember2023-09-300001644378rmr:DiversifiedHealthcareTrustMember2023-09-300001644378rmr:OfficePropertiesIncomeTrustMemberus-gaap:RelatedPartyMemberrmr:AdamDPortnoyMember2023-09-300001644378us-gaap:RelatedPartyMemberrmr:AdamDPortnoyMemberrmr:TravelCentersOfAmericaLLCMember2023-09-300001644378us-gaap:RelatedPartyMemberrmr:AdamDPortnoyMemberrmr:ServicePropertiesTrustMember2023-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberus-gaap:RelatedPartyMemberrmr:AdamDPortnoyMember2023-09-300001644378rmr:DiversifiedHealthcareTrustMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:DiversifiedHealthcareTrustMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:DiversifiedHealthcareTrustMember2022-10-012023-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMember2022-10-012023-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:OfficePropertiesIncomeTrustMember2022-10-012023-09-300001644378rmr:ReimbursementMemberrmr:OfficePropertiesIncomeTrustMember2022-10-012023-09-300001644378rmr:OfficePropertiesIncomeTrustMember2022-10-012023-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ServicePropertiesTrustMember2022-10-012023-09-300001644378rmr:ReimbursementMemberrmr:ServicePropertiesTrustMember2022-10-012023-09-300001644378rmr:ServicePropertiesTrustMember2022-10-012023-09-300001644378rmr:ManagedEquityREITMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:ManagedEquityREITMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:SevenHillsRealtyTrustMember2022-10-012023-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:TravelCentersOfAmericaLLCMember2022-10-012023-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:AlerisLifeIncMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:AlerisLifeIncMemberrmr:ReimbursementMember2022-10-012023-09-300001644378rmr:AlerisLifeIncMember2022-10-012023-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:SonestaInternationalHotelsCorporationMember2022-10-012023-09-300001644378rmr:ReimbursementMemberrmr:SonestaInternationalHotelsCorporationMember2022-10-012023-09-300001644378rmr:SonestaInternationalHotelsCorporationMember2022-10-012023-09-300001644378rmr:OtherPrivateEntitiesMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378rmr:ReimbursementMemberrmr:OtherPrivateEntitiesMember2022-10-012023-09-300001644378rmr:OtherPrivateEntitiesMember2022-10-012023-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ManagedPrivateRealEstateCapitalMember2022-10-012023-09-300001644378rmr:ReimbursementMemberrmr:ManagedPrivateRealEstateCapitalMember2022-10-012023-09-300001644378rmr:ManagedPrivateRealEstateCapitalMember2022-10-012023-09-300001644378us-gaap:RelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378us-gaap:RelatedPartyMemberrmr:ReimbursementMember2022-10-012023-09-300001644378us-gaap:RelatedPartyMember2022-10-012023-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2022-10-012023-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ReimbursementMember2022-10-012023-09-300001644378us-gaap:NonrelatedPartyMember2022-10-012023-09-300001644378rmr:DiversifiedHealthcareTrustMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:DiversifiedHealthcareTrustMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:DiversifiedHealthcareTrustMember2021-10-012022-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMember2021-10-012022-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:OfficePropertiesIncomeTrustMember2021-10-012022-09-300001644378rmr:ReimbursementMemberrmr:OfficePropertiesIncomeTrustMember2021-10-012022-09-300001644378rmr:OfficePropertiesIncomeTrustMember2021-10-012022-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ServicePropertiesTrustMember2021-10-012022-09-300001644378rmr:ReimbursementMemberrmr:ServicePropertiesTrustMember2021-10-012022-09-300001644378rmr:ServicePropertiesTrustMember2021-10-012022-09-300001644378rmr:ManagedEquityREITMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:ManagedEquityREITMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:SevenHillsRealtyTrustMember2021-10-012022-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:TravelCentersOfAmericaLLCMember2021-10-012022-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:AlerisLifeIncMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:AlerisLifeIncMemberrmr:ReimbursementMember2021-10-012022-09-300001644378rmr:AlerisLifeIncMember2021-10-012022-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:SonestaInternationalHotelsCorporationMember2021-10-012022-09-300001644378rmr:ReimbursementMemberrmr:SonestaInternationalHotelsCorporationMember2021-10-012022-09-300001644378rmr:SonestaInternationalHotelsCorporationMember2021-10-012022-09-300001644378rmr:OtherPrivateEntitiesMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378rmr:ReimbursementMemberrmr:OtherPrivateEntitiesMember2021-10-012022-09-300001644378rmr:OtherPrivateEntitiesMember2021-10-012022-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ManagedPrivateRealEstateCapitalMember2021-10-012022-09-300001644378rmr:ReimbursementMemberrmr:ManagedPrivateRealEstateCapitalMember2021-10-012022-09-300001644378rmr:ManagedPrivateRealEstateCapitalMember2021-10-012022-09-300001644378us-gaap:RelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378us-gaap:RelatedPartyMemberrmr:ReimbursementMember2021-10-012022-09-300001644378us-gaap:RelatedPartyMember2021-10-012022-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2021-10-012022-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ReimbursementMember2021-10-012022-09-300001644378us-gaap:NonrelatedPartyMember2021-10-012022-09-300001644378rmr:JointVentureWithInstitutionalInvestorMemberrmr:DiversifiedHealthcareTrustMember2021-12-232021-12-230001644378rmr:JointVentureWithInstitutionalInvestorMemberrmr:DiversifiedHealthcareTrustMember2021-12-230001644378rmr:JointVentureWithInstitutionalInvestorMemberrmr:DiversifiedHealthcareTrustMember2022-06-292022-06-290001644378rmr:JointVentureWithInstitutionalInvestorMemberrmr:DiversifiedHealthcareTrustMember2022-06-290001644378rmr:DiversifiedHealthcareTrustMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:DiversifiedHealthcareTrustMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:DiversifiedHealthcareTrustMember2020-10-012021-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMember2020-10-012021-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:OfficePropertiesIncomeTrustMember2020-10-012021-09-300001644378rmr:ReimbursementMemberrmr:OfficePropertiesIncomeTrustMember2020-10-012021-09-300001644378rmr:OfficePropertiesIncomeTrustMember2020-10-012021-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ServicePropertiesTrustMember2020-10-012021-09-300001644378rmr:ReimbursementMemberrmr:ServicePropertiesTrustMember2020-10-012021-09-300001644378rmr:ServicePropertiesTrustMember2020-10-012021-09-300001644378rmr:ManagedEquityREITMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:ManagedEquityREITMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:SevenHillsRealtyTrustMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:SevenHillsRealtyTrustMember2020-10-012021-09-300001644378rmr:TremontMortgageTrustMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:TremontMortgageTrustMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:TremontMortgageTrustMember2020-10-012021-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:TravelCentersOfAmericaLLCMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:TravelCentersOfAmericaLLCMember2020-10-012021-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:ManagedPublicRealEstateCapitalMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:AlerisLifeIncMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:AlerisLifeIncMemberrmr:ReimbursementMember2020-10-012021-09-300001644378rmr:AlerisLifeIncMember2020-10-012021-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:SonestaInternationalHotelsCorporationMember2020-10-012021-09-300001644378rmr:ReimbursementMemberrmr:SonestaInternationalHotelsCorporationMember2020-10-012021-09-300001644378rmr:SonestaInternationalHotelsCorporationMember2020-10-012021-09-300001644378rmr:OtherPrivateEntitiesMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378rmr:ReimbursementMemberrmr:OtherPrivateEntitiesMember2020-10-012021-09-300001644378rmr:OtherPrivateEntitiesMember2020-10-012021-09-300001644378rmr:ManagementAndAdvisoryServicesMemberrmr:ManagedPrivateRealEstateCapitalMember2020-10-012021-09-300001644378rmr:ReimbursementMemberrmr:ManagedPrivateRealEstateCapitalMember2020-10-012021-09-300001644378rmr:ManagedPrivateRealEstateCapitalMember2020-10-012021-09-300001644378us-gaap:RelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378us-gaap:RelatedPartyMemberrmr:ReimbursementMember2020-10-012021-09-300001644378us-gaap:RelatedPartyMember2020-10-012021-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ManagementAndAdvisoryServicesMember2020-10-012021-09-300001644378us-gaap:NonrelatedPartyMemberrmr:ReimbursementMember2020-10-012021-09-300001644378us-gaap:NonrelatedPartyMember2020-10-012021-09-300001644378rmr:DiversifiedHealthcareTrustMember2023-09-300001644378rmr:DiversifiedHealthcareTrustMember2022-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMember2023-09-300001644378rmr:IndustrialLogisticsPropertiesTrustMember2022-09-300001644378rmr:OfficePropertiesIncomeTrustMember2023-09-300001644378rmr:OfficePropertiesIncomeTrustMember2022-09-300001644378rmr:ServicePropertiesTrustMember2023-09-300001644378rmr:ServicePropertiesTrustMember2022-09-300001644378rmr:ManagedEquityREITMember2022-09-300001644378rmr:SevenHillsRealtyTrustMember2023-09-300001644378rmr:SevenHillsRealtyTrustMember2022-09-300001644378rmr:TravelCentersOfAmericaLLCMember2023-09-300001644378rmr:TravelCentersOfAmericaLLCMember2022-09-300001644378rmr:ManagedPublicRealEstateCapitalMember2023-09-300001644378rmr:ManagedPublicRealEstateCapitalMember2022-09-300001644378rmr:AlerisLifeIncMember2023-09-300001644378rmr:AlerisLifeIncMember2022-09-300001644378rmr:SonestaInternationalHotelsCorporationMember2023-09-300001644378rmr:SonestaInternationalHotelsCorporationMember2022-09-300001644378rmr:OtherPrivateEntitiesMember2023-09-300001644378rmr:OtherPrivateEntitiesMember2022-09-300001644378rmr:ManagedPrivateRealEstateCapitalMember2023-09-300001644378rmr:ManagedPrivateRealEstateCapitalMember2022-09-300001644378rmr:AbpTrustAndManagedReitMember2022-10-012023-09-300001644378rmr:AbpTrustAndManagedReitMember2021-10-012022-09-300001644378rmr:AbpTrustAndManagedReitMember2020-10-012021-09-300001644378rmr:UpCTransactionMemberrmr:AbpTrustMember2022-10-012023-09-300001644378rmr:UpCTransactionMemberrmr:AbpTrustMember2021-10-012022-09-300001644378rmr:UpCTransactionMemberrmr:AbpTrustMember2020-10-012021-09-300001644378rmr:UpCTransactionMemberrmr:AbpTrustMember2023-09-300001644378rmr:AbpTrustAndManagedReitMemberrmr:RMRLLCMember2022-10-012023-09-300001644378rmr:AbpTrustAndManagedReitMemberrmr:RMRLLCMember2021-10-012022-09-300001644378rmr:AbpTrustAndManagedReitMemberrmr:RMRLLCMember2020-10-012021-09-300001644378rmr:RMRLLCMember2022-10-012023-09-300001644378rmr:RMRLLCMember2021-10-012022-09-300001644378rmr:RMRLLCMember2020-10-012021-09-300001644378rmr:RMRLLCMemberrmr:AbpTrustMember2022-10-012023-09-300001644378rmr:RMRLLCMemberrmr:AbpTrustMember2021-10-012022-09-300001644378rmr:RMRLLCMemberrmr:AbpTrustMember2020-10-012021-09-300001644378us-gaap:RelatedPartyMemberrmr:SevenHillsRealtyTrustMemberrmr:TremontRealityCapitalMember2022-05-112022-05-110001644378us-gaap:RelatedPartyMemberrmr:TravelCentersOfAmericaLLCMemberrmr:BPProductsNorthAmericaIncMember2023-05-150001644378us-gaap:RelatedPartyMemberrmr:TravelCentersOfAmericaLLCMember2023-05-152023-05-150001644378us-gaap:RelatedPartyMemberrmr:TerminationFeeMember2023-05-152023-05-1500016443782015-06-012015-06-300001644378rmr:RetirementAgreementMemberrmr:JonathanMPertchikMember2023-03-272023-03-270001644378rmr:FormerNonexecutiveOfficerMemberus-gaap:RelatedPartyMember2022-10-012023-09-300001644378rmr:FormerNonexecutiveOfficerMemberus-gaap:RelatedPartyMember2021-10-012022-09-300001644378rmr:FormerNonexecutiveOfficerMemberus-gaap:RelatedPartyMember2020-10-012021-09-300001644378rmr:SevenHillsRealtyTrustMember2023-07-012023-07-310001644378rmr:SevenHillsRealtyTrustMemberrmr:ConstructionSupervisionFeesMember2023-07-012023-07-310001644378rmr:PercentageofExecutiveBusinessTimeDevotedtoServicestoManagedOperatorMember2022-10-012023-09-300001644378rmr:PercentageofExecutivesCashCompensationPaidbyManagedOperatorsMember2022-10-012023-09-300001644378us-gaap:CommonClassAMember2022-10-012023-09-30rmr:vote0001644378us-gaap:CommonClassBMember2022-10-012023-09-300001644378rmr:CommonClassB2Memberrmr:AbpTrustMember2023-09-300001644378us-gaap:CapitalUnitClassAMemberrmr:AbpTrustMember2023-09-300001644378rmr:CommonClassB2Member2022-10-012023-09-300001644378us-gaap:CommonClassAMember2021-10-012022-09-300001644378us-gaap:CommonClassAMember2020-10-012021-09-300001644378srt:DirectorMemberus-gaap:CommonClassAMember2022-10-012023-09-300001644378srt:DirectorMemberus-gaap:CommonClassAMember2020-10-012021-09-300001644378srt:DirectorMemberus-gaap:CommonClassAMember2021-10-012022-09-300001644378us-gaap:CommonClassAMemberrmr:A2016OmnibusEquityPlanMember2023-09-30rmr:vesting_installment0001644378us-gaap:CommonClassAMemberrmr:OfficersandEmployeesMemberrmr:A2016OmnibusEquityPlanMember2022-10-012023-09-300001644378us-gaap:CommonClassAMemberrmr:OfficersandEmployeesMemberrmr:A2016OmnibusEquityPlanMember2021-10-012022-09-300001644378us-gaap:CommonClassAMemberrmr:OfficersandEmployeesMemberrmr:A2016OmnibusEquityPlanMember2020-10-012021-09-300001644378us-gaap:CommonClassAMemberrmr:A2016OmnibusEquityPlanMember2022-10-012023-09-300001644378us-gaap:CommonClassAMemberrmr:A2016OmnibusEquityPlanMember2021-10-012022-09-300001644378us-gaap:CommonClassAMemberrmr:A2016OmnibusEquityPlanMember2020-10-012021-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2022-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2021-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2020-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2022-10-012023-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2021-10-012022-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2020-10-012021-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMember2023-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-10-012023-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-10-012023-09-300001644378us-gaap:RestrictedStockMemberrmr:A2016OmnibusEquityPlanMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-10-012023-09-300001644378us-gaap:RestrictedStockMemberrmr:SharebasedCompensationAwardTrancheFourMemberrmr:A2016OmnibusEquityPlanMember2022-10-012023-09-300001644378us-gaap:RestrictedStockMemberus-gaap:CommonClassAMemberrmr:A2016OmnibusEquityPlanMember2023-09-300001644378rmr:CommonClassAAndB1Member2022-11-172022-11-170001644378rmr:CommonClassAAndB1Member2023-02-162023-02-160001644378rmr:CommonClassAAndB1Member2023-05-182023-05-180001644378rmr:CommonClassAAndB1Member2023-08-172023-08-170001644378rmr:CommonClassAAndB1Member2022-10-012023-09-300001644378rmr:CommonClassAAndB1Member2021-11-182021-11-180001644378rmr:CommonClassAAndB1Member2022-02-172022-02-170001644378rmr:CommonClassAAndB1Member2022-05-192022-05-190001644378rmr:CommonClassAAndB1Member2022-08-182022-08-180001644378rmr:CommonClassAAndB1Member2021-10-012022-09-300001644378rmr:CommonClassAAndB1Member2020-11-192020-11-190001644378rmr:CommonClassAAndB1Member2021-02-182021-02-180001644378rmr:CommonClassAAndB1Member2021-05-202021-05-200001644378rmr:CommonClassAAndB1Member2021-08-192021-08-190001644378rmr:CommonClassAAndB1Member2021-09-162021-09-160001644378rmr:CommonClassAAndB1Member2020-10-012021-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2022-11-172022-11-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2022-11-172022-11-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2022-11-172022-11-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2023-02-162023-02-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2023-02-162023-02-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2023-02-162023-02-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2023-05-182023-05-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2023-05-182023-05-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2023-05-182023-05-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2023-08-172023-08-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2023-08-172023-08-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2023-08-172023-08-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2022-10-012023-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2022-10-012023-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2022-10-012023-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-11-182021-11-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-11-182021-11-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-11-182021-11-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2022-02-172022-02-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2022-02-172022-02-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2022-02-172022-02-170001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2022-05-192022-05-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2022-05-192022-05-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2022-05-192022-05-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2022-08-182022-08-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2022-08-182022-08-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2022-08-182022-08-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-10-012022-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-10-012022-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-10-012022-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2020-11-192020-11-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2020-11-192020-11-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2020-11-192020-11-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-02-182021-02-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-02-182021-02-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-02-182021-02-180001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-05-202021-05-200001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-05-202021-05-200001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-05-202021-05-200001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-08-192021-08-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-08-192021-08-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-08-192021-08-190001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2021-09-162021-09-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2021-09-162021-09-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2021-09-162021-09-160001644378rmr:RMRLLCMemberrmr:MembershipUnitsMember2020-10-012021-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2020-10-012021-09-300001644378rmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2020-10-012021-09-300001644378rmr:CommonClassAAndB1Memberus-gaap:SubsequentEventMember2023-10-122023-10-120001644378us-gaap:SubsequentEventMemberrmr:RMRLLCMemberrmr:MembershipUnitsMember2023-10-122023-10-120001644378us-gaap:SubsequentEventMemberrmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:RMRIncMember2023-10-122023-10-120001644378us-gaap:SubsequentEventMemberrmr:RMRLLCMemberrmr:MembershipUnitsMember2023-10-120001644378us-gaap:SubsequentEventMemberrmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2023-10-122023-10-120001644378us-gaap:SubsequentEventMemberrmr:RMRLLCMemberrmr:MembershipUnitsMemberrmr:AbpTrustMember2023-10-120001644378us-gaap:CapitalUnitClassAMember2022-10-012023-09-300001644378rmr:DefinedContributionPlanTranche1Member2022-10-012023-09-300001644378rmr:DefinedContributionPlanTranche2Member2022-10-012023-09-30rmr:operating_lease0001644378rmr:PrincipalExecutiveOfficesMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-37616

THE RMR GROUP INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Maryland | 47-4122583 |

| (State of Organization) | (IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite 300, Newton, MA 02458-1634

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code 617-796-8230

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title Of Each Class | | Trading Symbol | | Name Of Each Exchange On Which Registered |

| Class A common stock, $0.001 par value per share | | RMR | | The Nasdaq Stock Market LLC |

| | | | | (Nasdaq Capital Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | | | | Accelerated filer | ☒ | | |

| Non-accelerated filer | ☐ | | | | | Smaller reporting company | ☐ | | |

| Emerging growth company | ☐ | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

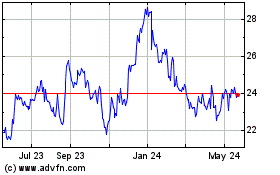

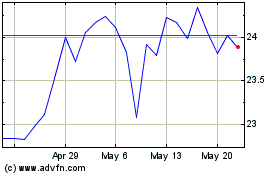

The aggregate market value of the voting shares of Class A common stock, $0.001 par value, of the registrant held by non-affiliates was approximately $399.6 million based on the $26.24 closing price per common share on The Nasdaq Stock Market LLC, on March 31, 2023. For purposes of this calculation, an aggregate of 391,754 shares of Class A common stock, held directly by, or by affiliates of, the directors and executive officers of the registrant have been included in the number of common shares held by affiliates.

As of November 9, 2023, there were 15,711,047 shares of Class A common stock, par value $0.001 per share, 1,000,000 shares of Class B-1 common stock, par value $0.001 per share, and 15,000,000 shares of Class B-2 common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its 2024 annual meeting of shareholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

WARNING CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These statements include, among others, statements about: our business strategy; the CARROLL Acquisition, as defined below; economic and industry conditions; the impact and opportunities for our and our clients’ businesses from business cycles in the U.S. real estate industry as well as economic and industry conditions; our belief that it is possible to grow real estate based businesses in selected property types or geographic areas despite general national trends; our cash and cash equivalents, including their sufficiency to pursue a range of capital allocation strategies and fund our operations and enhance our technology infrastructure and risk exposure; and our sustainability practices.

Forward-looking statements reflect our current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to the following:

•The dependence of our revenues on a limited number of clients;

•The variability of our revenues;

•Risks related to supply chain constraints, commodity pricing and inflation, including inflation impacting wages and employee benefits;

•Changing market conditions, practices and trends, which may adversely impact our clients and the fees we receive from them;

•Potential terminations of the management agreements with our clients;

•Increases in or sustained high market interest rates, which may significantly reduce our revenues or impede our growth;

•Our dependence on the growth and performance of our clients;

•Our ability to obtain or create new clients for our business and other circumstances beyond our control;

•The ability of our clients to operate their businesses profitably, optimize their capital structures and to grow and increase their market capitalizations and total shareholder returns;

•Our ability to successfully provide management services to our clients;

•Our ability to maintain or increase the distributions we pay to our shareholders;

•Our ability to successfully pursue and execute capital allocation strategies;

•Our ability to prudently invest in our business to enhance our operations, services and competitive positioning;

•Our ability to complete the acquisition of MPC Partnership Holdings LLC, a Georgia limited liability company which does business as CARROLL, or the CARROLL Acquisition, and if completed, our ability to successfully integrate the CARROLL business and realize our expected returns on our investment;

•Changes to our operating leverage or client diversity;

•Litigation risks;

•Risks related to acquisitions, dispositions and other activities by or among our clients;

•Allegations, even if untrue, of any conflicts of interest arising from our management activities;

•Our ability to retain the services of our managing directors and other key personnel;

•Our and our clients’ risks associated with our and our clients’ costs of compliance with laws and regulations, including securities regulations, exchange listing standards and other laws and regulations affecting public companies; and

•other risks described under “Risk Factors” beginning on page 12. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in this Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission, or SEC. Our filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue reliance upon our forward-looking statements.

Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

THE RMR GROUP INC.

2023 FORM 10-K ANNUAL REPORT

Table of Contents

PART I

Item 1. Business

Our Company

The RMR Group Inc., or RMR Inc., is a holding company incorporated as a Maryland corporation and substantially all of its business is conducted by its majority owned subsidiary, The RMR Group LLC, or RMR LLC. RMR LLC is a Maryland limited liability company. RMR Inc. serves as the sole managing member of RMR LLC and, in that capacity, operates and controls the business and affairs of RMR LLC. In this Annual Report on Form 10-K, unless otherwise indicated, “we”, “us” and “our” refers to RMR Inc. and its direct and indirect subsidiaries, including RMR LLC.

As of September 30, 2023, RMR Inc. owned 15,712,007 class A membership units of RMR LLC, or Class A Units, and 1,000,000 class B membership units of RMR LLC, or Class B Units. The aggregate RMR LLC membership units RMR Inc. owns represent approximately 52.7% of the economic interest of RMR LLC. A subsidiary of ABP Trust owns 15,000,000 redeemable Class A Units, representing approximately 47.3% of the economic interest of RMR LLC.

Adam D. Portnoy, the Chair of our Board, one of our Managing Directors and our President and Chief Executive Officer, is the sole trustee, an officer and the controlling shareholder of our controlling shareholder, ABP Trust, and owns all of ABP Trust’s voting securities and a majority of the economic interest of ABP Trust. As of September 30, 2023, Adam D. Portnoy beneficially owned (including through ABP Trust), in aggregate, (i) 200,502 shares of Class A common stock of RMR Inc., or Class A Common Shares; (ii) all the outstanding shares of Class B-1 common stock of RMR Inc., or Class B-1 Common Shares; and (iii) all the outstanding shares of Class B-2 common stock of RMR Inc., or Class B-2 Common Shares.

Since its founding in 1986, RMR LLC has substantially grown assets under management and the number of real estate businesses it manages. As of September 30, 2023, we had $35.9 billion of assets under management.

We provide management services to four publicly traded equity real estate investment trusts, or REITs, whose securities are listed on The Nasdaq Stock Market LLC, or Nasdaq: Diversified Healthcare Trust, a Maryland REIT, including its subsidiaries, or DHC; Industrial Logistics Properties Trust, a Maryland REIT, including its subsidiaries, or ILPT; Office Properties Income Trust, a Maryland REIT, including its subsidiaries, or OPI; and Service Properties Trust, a Maryland REIT, including its subsidiaries, or SVC. DHC, ILPT, OPI and SVC are collectively referred to as the Managed Equity REITs.

As manager of the Managed Equity REITs, we are responsible for implementing investment strategies and managing day to day operations, subject to supervision and oversight by each Managed Equity REIT’s board of trustees. The Managed Equity REITs have no employees, and we provide the personnel and services necessary for each Managed Equity REIT to conduct its business. The Managed Equity REITs invest in diverse income producing properties across multiple real estate asset classes as follows:

•DHC (Nasdaq: DHC) owns medical office and life science properties, senior living communities and other healthcare related properties. As of September 30, 2023, DHC owned 376 properties located in 36 states and the District of Columbia.

•ILPT (Nasdaq: ILPT) owns and leases industrial and logistics properties. As of September 30, 2023, ILPT owned 413 properties, including 226 buildings, leasable land parcels and easements in Oahu, Hawaii and 187 properties located in 38 other states.

•OPI (Nasdaq: OPI) owns office properties primarily leased to single tenants and those with high credit quality characteristics. As of September 30, 2023, OPI owned 154 properties located in 30 states and the District of Columbia.

•SVC (Nasdaq: SVC) owns a diverse portfolio of hotels and service-focused retail net lease properties. As of September 30, 2023, SVC owned 982 properties (221 hotels and 761 net lease properties) located in 46 states, the District of Columbia, Canada and Puerto Rico.

RMR LLC’s wholly owned subsidiary, Tremont Realty Capital LLC, or Tremont, an investment adviser registered with the SEC, provides advisory services for Seven Hills Realty Trust, or SEVN. SEVN is a publicly traded mortgage REIT that focuses on originating and investing in first mortgage loans secured by middle market and transitional commercial real

estate. Tremont also provided advisory services to Tremont Mortgage Trust, or TRMT, until it merged with and into SEVN on September 30, 2021, or the Tremont Merger, with SEVN continuing as the surviving company.

RMR LLC also provided management services to TravelCenters of America Inc., or TA, until it was acquired by BP Products North America Inc., or BP, on May 15, 2023. TA is a real estate operating company that operates and franchises travel centers primarily along the U.S. interstate highway system, many of which are owned by SVC, and standalone truck service facilities.

The Managed Equity REITs, SEVN, TRMT until September 30, 2021, and TA until May 15, 2023, are collectively referred to as the Perpetual Capital clients.

In addition, RMR LLC provides management services to private capital vehicles, including ABP Trust and its subsidiaries, or collectively ABP Trust, AlerisLife Inc., or AlerisLife, Sonesta International Hotels Corporation, or Sonesta, and other private entities that own commercial real estate, of which certain of our Managed Equity REITs own minority equity interests. AlerisLife is an operator of senior living communities, many of which are owned by DHC, and was a publicly traded company until March 20, 2023 when it was acquired by a subsidiary of ABP Trust. Sonesta is a privately owned franchisor and operator of hotels, resorts and cruise ships in the United States, Latin America, the Caribbean and the Middle East, and many of the U.S. hotels that Sonesta operates are owned by SVC. These clients are collectively referred to as the Private Capital clients.

Our Business Strategy

Our business strategy is to provide an expanded range of management services to our existing clients, as well as to diversify the number of clients to which we provide services and the sources of capital upon which those clients may rely for growth.

We believe we have several strengths that distinguish our business from other alternative asset managers:

•Revenue Base. Our revenues are primarily earned from long term agreements with credit quality companies, many of which are permanent capital vehicles. Our agreements with the Managed Equity REITs are 20 year term evergreen contracts with significant termination fees payable in certain circumstances. For the fiscal year ended September 30, 2023, revenues earned from the Managed Equity REITs represented 73.2% of our total management and advisory services revenue, excluding termination fee revenue.

•Strong Operating Margins and Resulting Cash Flows. For the fiscal year ended September 30, 2023, we continued to generate strong operating margins resulting in net cash from operating activities of $109.2 million and net income of $127.8 million. We have no debt outstanding. Our regular dividend of $0.40 per share per quarter ($1.60 per share per year) has been well covered by our cash flows.

•Diverse Portfolio of Managed Real Estate. We provide management services to a wide range of real estate assets and businesses that include healthcare facilities, senior living and other apartments, hotels, office buildings, industrial buildings, leased lands, net-lease service-focused retail, including travel centers, and various specialized properties such as properties leased to government tenants and properties specially designed for medical and biotech research. The properties and businesses we managed as of September 30, 2023, are located throughout the United States in 46 states and Washington D.C., and in Puerto Rico and Canada. The diversity of our managed portfolio helps provide balance throughout economic cycles, as the impacts to each respective real estate sector can vary.

•Growth. Since the founding of RMR LLC in 1986, we have substantially grown our assets under management and the number and variety of real estate businesses we manage. As of September 30, 2023, we had $35.9 billion of assets under management, including over 2,000 properties. The synergies among our clients may also facilitate their and our growth. We assist our clients in realizing investment opportunities by working together to make acquisitions, obtain financing, identifying possible joint venture partners, completing redevelopment activities, facilitating capital recycling from strategic property dispositions and assisting in portfolio repositioning and other business arrangements and strategic restructurings.

In addition, we expect to use cash on hand, future operating cash flows and may issue equity or incur debt to fund our growth and diversify our operations through possible acquisition opportunities or seeding new clients. In recent years, we sought to expand the sources of capital underlying our assets under management, with our Private Capital clients representing $7.7 billion of our assets under management as of September 30, 2023, an increase of $6.0

billion from September 30, 2021. If the CARROLL Acquisition is completed, our Private Capital assets under management are expected to increase by approximately $7 billion. For more information about the CARROLL Acquisition, see Note 1, Organization, to our consolidated financial statements included in Part IV, Item 15 of this Annual Report on Form 10-K.

•Quality and Depth of Management. Our highly qualified and experienced management team provides a broad base of deep expertise to our clients. Our senior management has worked together through several business cycles in which they acquired, financed, managed and disposed of real estate assets and started real estate businesses. We are a vertically integrated manager and as of September 30, 2023, we employed over 600 real estate professionals in more than 30 offices throughout the United States. We have also assisted our clients to grow by successfully accessing the capital markets; since our founding in 1986, our clients have successfully completed over $42.0 billion of financing in approximately 185 capital raising transactions.

•Alignment of Interests. We believe our structure fosters strong alignment of interests between our principal executive officer and our shareholders because our principal executive officer, Adam D. Portnoy, has a 51.1% economic interest in RMR LLC. Alignment of interests also exists between us and our Managed Equity REITs due to the manner upon which we earn base management fees and incentive management fees under our management agreements with the Managed Equity REITs, as described in more detail below.

We can provide no assurance that we will be able to implement our business strategy or achieve our desired growth. Our business and the businesses of our clients are subject to a number of risks and uncertainties. See “Risk Factors” beginning on page 12. Our Management Agreements with the Managed Equity REITs

RMR LLC is party to a business management agreement and a property management agreement with each Managed Equity REIT. The following is a summary of the terms of our business and property management agreements with the Managed Equity REITs. The summary does not purport to be complete and is subject to, and qualified in its entirety by, reference to the actual agreements, copies of which are filed or incorporated as exhibits to this Annual Report on Form 10-K.

Business Management Agreements

Each business management agreement requires RMR LLC to use its reasonable best efforts to present the Managed Equity REIT with a continuing and suitable real estate investment program consistent with the REIT’s real estate investment policies and objectives.

Subject to the overall management, direction and oversight of the Board of Trustees of each Managed Equity REIT, RMR LLC has the responsibility to:

•provide research and economic and statistical data in connection with the Managed Equity REIT’s real estate investments and recommend changes in the Managed Equity REIT’s real estate investment policies when appropriate;

•investigate, evaluate and negotiate contracts for the investment in, or the acquisition or disposition of, real estate and related interests, financing and refinancing opportunities and make recommendations concerning specific real estate investments to the Board of Trustees of the Managed Equity REIT;

•investigate, evaluate, prosecute and negotiate any of the Managed Equity REIT’s claims in connection with its real estate investments or otherwise in connection with the conduct of the Managed Equity REIT’s business;

•administer bookkeeping and accounting functions as required for the Managed Equity REIT’s business and operation, contract for audits and prepare or cause to be prepared reports and filings required by a governmental authority in connection with the conduct of the Managed Equity REIT’s business, and otherwise advise and assist the Managed Equity REIT with its compliance with applicable legal and regulatory requirements;

•advise and assist in the preparation of all equity and debt offering documents and all registration statements, prospectuses or other documents filed by the Managed Equity REIT with the SEC or any state;

•retain counsel, consultants and other third party professionals on behalf of the Managed Equity REIT;

•provide internal audit services;

•advise and assist with the Managed Equity REIT’s risk management and business oversight function;

•advise and assist the Managed Equity REIT with respect to the Managed Equity REIT’s public relations, preparation of marketing materials, internet website and investor relations services;

•provide communication facilities for the Managed Equity REIT and its officers and trustees and provide meeting space as required;

•provide office space, equipment and experienced and qualified personnel necessary for the performance of the foregoing services; and

•to the extent not covered above, advise and assist the Managed Equity REIT in the review and negotiation of the Managed Equity REIT’s contracts and agreements, coordination and supervision of all third party legal services and oversight for processing of claims by or against the Managed Equity REIT.

Property Management Agreements

Under each property management agreement, subject to the overall management and supervision of the Board of Trustees of each Managed Equity REIT, RMR LLC is required to act as managing agent for each Managed Equity REIT’s properties and devote such time, attention and effort as may be appropriate to operate and manage the Managed Equity REIT’s properties in a diligent, orderly and efficient manner.

Term and Termination

The business and property management agreements with each Managed Equity REIT automatically extend on December 31st of each year and have terms thereafter that end on the 20th anniversary of the date of each extension. A Managed Equity REIT has the right to terminate its management agreements with RMR LLC: (1) at any time upon 60 days’ written notice for convenience, (2) immediately upon written notice for cause, as defined in the agreements, (3) upon written notice given within 60 days after the end of an applicable calendar year for a performance reason, as defined in the agreements, and (4) by written notice during the 12 months following a manager change of control, as defined in the agreements. RMR LLC has the right to terminate the management agreements for good reason, as defined in the agreements.

If a Managed Equity REIT terminates a management agreement for convenience, or if RMR LLC terminates a management agreement with a Managed Equity REIT for good reason, the Managed Equity REIT is obligated to pay RMR LLC a termination fee equal to the sum of the present values of the monthly future fees, as defined in the agreement, payable for the remaining term of the agreement, assuming it had not been terminated. If a Managed Equity REIT terminates a management agreement for a performance reason, as defined in the agreement, the Managed Equity REIT is obligated to pay RMR LLC the termination fee calculated as described above, but assuming a remaining term of ten years.

The management agreements provide for certain adjustments to the termination fees if a Managed Equity REIT merges with another REIT to which RMR LLC is providing management services or if the Managed Equity REIT spins off a subsidiary to which it contributed properties and to which RMR LLC is providing management services both at the time of the spin off and on the date of the expiration or termination of either of the management agreements.

A Managed Equity REIT is not required to pay any termination fee if it terminates its business or property management agreements for cause, or as a result of a manager change of control, in each case as defined in such agreements.

Business Management Agreement Fees and Expense Reimbursement

Each business management agreement between RMR LLC and a Managed Equity REIT provides for (i) an annual base management fee, payable monthly in arrears, and (ii) an annual incentive business management fee.

The annual base management fee generally is calculated as the lesser of:

•the sum of (a) 0.5% of the historical cost of transferred real estate assets, if any, as defined in the applicable business management agreement, plus (b) 0.7% of the average invested capital (exclusive of the transferred real estate assets), as defined in the applicable business management agreement, up to $250.0 million, plus (c) 0.5% of the average invested capital exceeding $250.0 million; and

•the sum of (a) 0.7% of the average market capitalization, as defined in the applicable business management agreement, up to $250.0 million, plus (b) 0.5% of the average market capitalization exceeding $250.0 million.

The annual incentive business management fee payable by each Managed Equity REIT, if any, is calculated as follows:

•The incentive business management fee is calculated as an amount equal to 12.0% of the product of (a) the equity market capitalization of the Managed Equity REIT, as defined in the applicable business management agreement, on the last trading day of the year immediately prior to the measurement period, and (b) the amount, expressed as a percentage, by which the Managed Equity REIT’s total return per share realized by its common shareholders (i.e. share price appreciation plus dividends) or the “total return per share,” exceeds the total shareholder return of a specified REIT index, the “benchmark return per share,” for the relevant measurement period, with each of (a) and (b) subject to adjustments for net common shares issued by the Managed Equity REIT during the measurement period.

•The measurement period for an annual incentive business management fee is defined as the three year period ending on December 31 of the year for which such fee is being calculated.

•The specified REIT index utilized to calculate the benchmark return per share for each of our Managed Equity REITs when calculating the incentive business management fees is as follows:

| | | | | | | | | | | | | | | |

| | | | |

| | | | | | | |

| DHC | | | | | | MSCI U.S. REIT/Health Care Index |

| ILPT | | | | | | MSCI U.S. REIT/Industrial REIT Index |

| OPI | | | | | | MSCI U.S. REIT/Office REIT Index |

| SVC | | | | | | MSCI U.S. REIT/Hotel & Resort REIT Index |

•No incentive business management fee is payable by the Managed Equity REIT unless its total return per share during the measurement period is positive.

•If the Managed Equity REIT’s total return per share exceeds 12% per year in the measurement period, the benchmark return per share is adjusted to be the lesser of the total shareholder return of the specified REIT index for such measurement period and 12% per year, or the “adjusted benchmark return per share.” In instances where the adjusted benchmark return per share applies, the incentive fee will be reduced if the Managed Equity REIT’s total return per share is between 200 basis points and 500 basis points below the specified REIT index in any year, by a low return factor, as defined in the applicable business management agreement, and there will be no incentive business management fee paid if, in these instances, the Managed Equity REIT’s total return per share is more than 500 basis points below the specified REIT index in any year, determined on a cumulative basis (i.e., between 200 basis points and 500 basis points per year multiplied by the number of years in the measurement period and below the applicable market index).

•The incentive business management fee payable by the Managed Equity REIT is subject to a cap equal to the value of the number of its common shares which would, after issuance, represent (a) 1.5% of the number of its common shares outstanding on December 31 of the year for which such fee is being calculated multiplied by (b) the average closing price of its common shares during the 10 consecutive trading days having the highest average closing prices during the final 30 trading days of the relevant measurement period.

•Incentive fees paid by the Managed Equity REIT for any measurement period may be subject to certain “clawback” if the financial statements of the Managed Equity REIT for that measurement period are restated due to material non-compliance with any financial reporting requirements under the securities laws as a result of the bad faith, fraud, willful misconduct or gross negligence of RMR LLC and the amount of the incentive fee paid by the Managed Equity REIT was greater than the amount it would have paid based on the restated financial statements.

If the business management agreement is terminated, the base business management fee and incentive business management fee due in respect of any partial period prior to the date of termination will be prorated as provided in the agreement.

Under each business management agreement: the Managed Equity REIT pays or reimburses RMR LLC for all of the expenses relating to the Managed Equity REIT’s activities, including the costs and expenses of investigating, acquiring, owning and disposing of its real estate (third party property diligence costs, appraisal, reporting, audit and legal fees), its costs of borrowing money, its costs of securities listing, transfer, registration and compliance with reporting requirements

and its costs of third party professional services, including legal and accounting fees, and as otherwise agreed; and RMR LLC bears its general and administrative expenses relating to its performance of its obligations under the agreement, including expenses of its personnel, rent and other office expenses. Also, the allocable cost of internal audit services is reimbursed by each Managed Equity REIT to RMR LLC.

Property Management Agreement Fees and Expense Reimbursement

Each property management agreement between RMR LLC and a Managed Equity REIT provides for the following:

(i) a management fee equal to 3.0% of the gross rents collected from tenants, which is not applicable to any hotels, senior living communities or travel centers which are leased to, or managed by, AlerisLife, Sonesta or another operating business such as a hotel management company or a senior living or healthcare services provider; and

(ii) a construction supervision fee equal to 5.0% of the cost of any construction, renovation or repair activities at the Managed Equity REIT’s properties, other than ordinary maintenance and repairs, and 3% of the cost of any major capital project or repositionings at DHC’s senior living communities and SVC’s hotels.

Also, under each property management agreement, the Managed Equity REIT pays certain allocable expenses of RMR LLC in the performance of its duties, including wages for onsite property management personnel and allocated costs of centralized property management services.

Other Provisions

Under both the business and property management agreements, each Managed Equity REIT has agreed to indemnify RMR LLC, its members, officers, employees and affiliates against liabilities relating to acts or omissions of RMR LLC with respect to the provision of services by RMR LLC, except to the extent such provision of services was in bad faith or fraudulent, constituted willful misconduct or was grossly negligent. In addition, each management agreement provides that any disputes, as defined in those agreements, arising out of or relating to the agreement or the provision of services pursuant thereto, upon the demand of a party to the dispute, will be subject to mandatory arbitration in accordance with procedures provided in the agreement.

Other Management Agreements

RMR LLC provides services and earns fees pursuant to management agreements with ABP Trust regarding AlerisLife; with Sonesta; and until May 15, 2023, with TA. Under these agreements, RMR LLC provides services to these clients relating to, or assists them with, among other things, their compliance with various laws and rules applicable to them, capital markets and financing activities, maintenance of their properties, selection of new business sites and evaluation of other business opportunities, accounting and financial reporting, internal audit, investor relations and general oversight of the company’s daily business activities, including legal and tax matters, human resources, insurance programs and management information systems.

Each of these clients pay RMR LLC a fee under its management agreement in an amount equal to 0.6% of: (i) in the case of AlerisLife, AlerisLife’s revenues from all sources reportable under U.S. Generally Accepted Accounting Principles, or GAAP, less any revenues reportable by AlerisLife with respect to properties for which it provides management services, plus the gross revenues at those properties determined in accordance with GAAP; (ii) in the case of Sonesta, Sonesta’s revenues from all sources reportable under GAAP, less any revenues reportable by Sonesta with respect to hotels for which it provides management services, plus the gross revenues at those hotels determined in accordance with GAAP; and (iii) in the case of TA, the sum of TA’s gross fuel margin, determined as TA’s fuel sales revenues less its cost of fuel sales, plus TA’s total nonfuel revenues. In addition, the management agreement with each of these clients provides that the compensation of their senior executives, who are also employees or officers of RMR LLC, is the responsibility of the party to or on behalf of which the individual renders services. In the past, because at least 80.0% of each of these executives’ business time was devoted to services to these clients, 80.0% of these executives’ total cash compensation was paid by these clients and the remainder was paid by RMR LLC.

The terms of the management agreements with ABP Trust regarding AlerisLife and with Sonesta end on December 31st of each year, and automatically extend for successive one year terms, unless RMR LLC, or ABP Trust or Sonesta, as applicable, gives notice of non-renewal before the expiration of the applicable term. Any party may terminate the applicable management agreement at any time on 30 days notice. In connection with BP’s acquisition of TA on May 15, 2023, TA terminated its management agreement with us and paid us a termination fee of $45,282.

ABP Trust and Sonesta have each agreed to indemnify RMR LLC, its members, officers, employees and affiliates against liabilities relating to acts or omissions of RMR LLC with respect to the provision of services by RMR LLC, except to the extent such provision of services was in bad faith or was grossly negligent. In addition, each of ABP Trust’s and Sonesta’s agreement provides that any disputes, as defined in those agreements, arising out of or relating to the agreement or the provision of services pursuant thereto, upon the demand of a party to the dispute, shall be subject to mandatory arbitration in accordance with procedures provided in the agreement.

RMR LLC provides management services to other Private Capital clients for which we receive, depending upon the services provided, a management fee based on a percentage of average invested capital, as defined in the applicable management agreements, a property management fee in an amount equal to 3.0% of rents collected from managed properties and a construction supervision fee in an amount up to 5.0% of the cost of any construction, renovation or repair activities at the managed properties, other than ordinary maintenance and repairs.

Our Management Agreements with Advisory Clients

Tremont is party to a management agreement with SEVN. Pursuant to this agreement, Tremont provides SEVN with a continuous investment program, makes day to day investment decisions and generally manages the business affairs of SEVN in accordance with SEVN’s investment objectives and policies.

Tremont is compensated pursuant to its management agreement with SEVN at an annual rate of 1.5% of equity, as defined in the agreement. Tremont may also earn an incentive fee under this management agreement equal to the difference between: (a) the product of (i) 20% and (ii) the difference between (A) core earnings, as defined in the agreement, for the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (B) the product of (1) equity in the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (2) 7% per year and (b) the sum of any incentive fees paid to Tremont with respect to the first three calendar quarters of the most recent 12 month period (or such lesser number of completed calendar quarters preceding the applicable period, if applicable). No incentive fee shall be payable with respect to any calendar quarter unless core earnings for the 12 most recently completed calendar quarters in the aggregate is greater than zero. The incentive fee may not be less than zero.

The initial term of the management agreement with SEVN ends on December 31, 2023, and the agreement will automatically renew for successive one year terms beginning January 1, 2024 and each January 1 thereafter, unless it is sooner terminated upon written notice delivered no later than 180 days prior to a renewal date by the affirmative vote of at least two-thirds (2/3) of the independent trustees of SEVN based upon a determination that (a) Tremont’s performance is unsatisfactory and materially detrimental to SEVN or (b) the base management fee and incentive fee, taken as a whole, payable to Tremont under the management agreement is not fair to SEVN (provided that in the instance of (b), Tremont will be afforded the opportunity to renegotiate the base management fee and incentive fee prior to termination). The management agreement may be terminated by Tremont before each annual renewal upon written notice delivered to the board of trustees of SEVN no later than 180 days prior to an annual renewal date.

In the event the management agreement is terminated by SEVN without a cause event or by Tremont for a material breach, SEVN will be required to pay Tremont a termination fee equal to (a) three times the sum of (i) the average annual base management fee and (ii) the average annual incentive fee, in each case paid or payable to Tremont during the 24 month period immediately preceding the most recently completed calendar quarter prior to the date of termination, plus (b) $1.6 million. In addition, the initial organizational costs related to TRMT’s formation and the costs of its initial public offering and the concurrent private placement that Tremont had paid pursuant to its management agreement with TRMT will be included in the “Termination Fee” under and as defined in SEVN’s management agreement with Tremont. No termination fee will be payable if the management agreement is terminated by SEVN for a cause event or by Tremont without SEVN’s material breach.

Our Organizational Structure

Regulation

We and our clients are subject to supervision and regulation by state, federal and non-U.S. governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions upon the ways in which we and our clients do business including various requirements for public disclosure of our and their activities.

The Managed Equity REITs and SEVN, or the Managed REITs, have qualified and expect to continue to qualify to be taxed as REITs under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code. In addition, the Managed REITs generally distribute 100.0% of their taxable income to avoid paying corporate federal income taxes; and as REITs, such companies must currently distribute, at a minimum, an amount equal to 90.0% of their taxable income. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status, including share ownership tests and assets and gross income composition tests. If a Managed REIT fails to continue to qualify as a REIT under Sections 856 through 860 of the Code in any taxable year, it will be subject to federal income tax (including any applicable alternative minimum tax) on its taxable income at regular corporate tax rates. Even if a Managed REIT qualifies for taxation as a REIT, it may be subject to state and local income taxes and to federal income tax and excise tax on its undistributed income.

Certain of our clients own or operate healthcare and senior living properties. These companies are subject to numerous federal, state and local laws and regulations that are subject to frequent and material changes (sometimes applied retroactively) resulting from legislation, adoption of rules and regulations and administrative and judicial interpretations of existing laws. Some of the revenues received by these companies are paid by governmental programs which are also subject to periodic and material changes.

Certain of our clients own and operate hotels and some provide dining, food and beverage services, including the sale of alcoholic beverages. The operation of such properties is subject to numerous regulations by various governmental entities.

Tremont is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940, as amended, or the Investment Advisers Act. Tremont provides investment advisory and administrative services to SEVN, and may, in the future, provide such services to private funds that invest in commercial real estate debt. Employees of Tremont may also act as transaction originators for its non-investment advisory clients, which we refer to as the Tremont business. These activities result in certain aspects of our asset management business being supervised by the SEC and requires our compliance with numerous obligations, including record keeping requirements, operational procedures and disclosure obligations. SEVN intends to conduct its business in a manner that does not require its registration under the Investment Company Act of 1940, or the 1940 Act, and to do so, may rely on any available exemption from registration, or exclusion from the definition of “investment company,” under the 1940 Act. To maintain this exemption from registration, SEVN will be required to ensure the composition of its portfolio complies with certain tests.