UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: August

Commission File Number:

001-34985

Globus Maritime Limited

(Translation of registrant’s name into English)

128 Vouliagmenis Avenue, 3rd Floor, Glyfada,

Attica, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT INDEX

REFERENCE INTO THE COMPANY’S REGISTRATION

STATEMENTS: (A) ON FORM F-3 (FILE NO. 333-240042),

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 23, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020 (B) ON FORM F-3 (FILE

NO. 333-239250), FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 31, 2020 AND DECLARED EFFECTIVE AUGUST 6, 2020, AND

(C) ON FORM F-3 (FILE NO. 333-273249), FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 14, 2023 AND DECLARED

EFFECTIVE ON JULY 26, 2023.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GLOBUS MARITIME LIMITED |

| |

|

|

| |

By: |

/s/ Athanasios Feidakis |

| |

Name: |

Athanasios Feidakis |

| |

Title: |

President, Chief Executive Officer and Chief Financial Officer |

Date: August 22, 2023

Exhibit 99.1

Globus

Maritime Announces annual meeting of sHAREholders

Glyfada, Greece, August 22, 2023 - Globus

Maritime Limited (“Globus” or the “Company”) (NASDAQ: GLBS), a dry bulk shipping company, announced today that

the annual meeting of shareholders will be held at the offices of Globus Shipmanagement Corp. at 128 Vouliagmenis Avenue in Glyfada,

Attica Greece, on September 21, 2023, at 11:00 a.m. local time.

Shareholders of record at the close of business

on August 15, 2023, are entitled to receive notice of, and to vote at, the annual meeting, or any adjournments thereof.

Notice of the Annual Meeting of Shareholders

and Proxy Statement are available free of charge on the Company’s website: www.globusmaritime.gr.

Formal notice of the meeting and the Company’s

proxy statement will be sent to shareholders of the Company in due course.

About Globus Maritime Limited

Globus is an integrated dry bulk shipping company

that provides marine transportation services worldwide and presently owns, operates and manages a fleet of eight dry bulk vessels that

transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally. Globus’ subsidiaries

own and operate eight vessels with a total carrying capacity of 567,467 DWT and a weighted average age of 11.2 years as of June 30, 2023.

Safe Harbor Statement

This communication contains “forward-looking

statements” as defined under U.S. federal securities laws. Forward-looking statements provide the Company’s current expectations

or forecasts of future events. Forward-looking statements include statements about the Company’s expectations, beliefs, plans,

objectives, intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Words

or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements are subject

to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ

materially from those expected or implied by the forward-looking statements. The Company’s actual results could differ materially

from those anticipated in forward-looking statements for many reasons specifically as described in the Company’s filings with the

Securities and Exchange Commission. Accordingly, you should not unduly rely on these forward-looking statements, which speak only as

of the date of this communication. Globus undertakes no obligation to publicly revise any forward-looking statement to reflect circumstances

or events after the date of this communication or to reflect the occurrence of unanticipated events. You should, however, review the

factors and risks Globus describes in the reports it files from time to time with the Securities and Exchange Commission.

For further information please contact:

| |

|

| Globus Maritime Limited +30 210 960 8300 |

Capital Link – New York +1 212 661 7566 |

| Athanasios Feidakis, President, CEO & CFO |

Nicolas Bornozis globus@capitallink.com |

| a.g.feidakis@globusmaritime.gr |

|

Exhibit 99.2

GLOBUS MARITIME LIMITED

August 22, 2023

TO THE SHAREHOLDERS OF

GLOBUS MARITIME LIMITED

Enclosed is a Notice of

Annual Meeting of Shareholders (the “Meeting”) of Globus Maritime Limited (the “Company”), which

will be held at the offices of Globus Shipmanagement Corp. located at 128 Vouliagmenis Avenue, 3rd floor, Glyfada, 16674 Attica, Greece,

on September 21, 2023, at 11:00 a.m. local time, and related materials.

At the Meeting, the shareholders

of the Company will consider and vote upon the following proposals:

| 1. | To elect two Class I directors to

serve until the 2026 annual meeting of shareholders (“Proposal One”); |

| 2. | To approve the appointment of Ernst &

Young (Hellas) Certified Auditors Accountants S.A. as the Company’s independent auditors

for the fiscal year ending December 31, 2023 (“Proposal Two”); |

| 3. | To approve one or more amendments to the

Company’s Amended and Restated Articles of Incorporation to effect one or more reverse

stock splits of the Company’s issued and outstanding shares of common stock and Series B

preferred shares by an aggregate ratio of not more than one-for-20, with the exact ratio

to be set ata whole number to be determined by the Company’s Board of Directors or

a committee thereof in its discretion, at any time or times after approval of the amendments,

and to authorize the Company’s Board of Directors to implement one or more reverse

stock splits by filing one or more amendments with the Registrar of Corporations of the Republic

of the Marshall Islands (“Proposal Three”); and |

| 4. | To transact any other business as may properly

come before the Meeting or any adjournment or postponement thereof. |

Adoption of Proposal One

requires the affirmative vote of a plurality of the votes cast by shareholders present in person or by proxy and entitled to vote at

the Meeting, provided that a quorum is present. Adoption of Proposal Two requires the affirmative vote of a majority of the votes cast

by shareholders present in person or by proxy and entitled to vote at the Meeting, provided that a quorum is present. Adoption of Proposal

Three requires the affirmative vote of a majority of the votes eligible to be cast by shareholders entitled to vote thereon.

You are cordially invited

to attend the Meeting in person. If you attend the Meeting, you may revoke your proxy and vote your shares in person. If your shares

are held in the name of your broker, bank or other nominee and you wish to attend the Meeting, you must bring a legal proxy from your

broker, bank or other nominee in order to vote.

WHETHER OR NOT YOU PLAN

TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE

IF MAILED IN THE UNITED STATES. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY PROMPTLY

WILL BE APPRECIATED.

ANY SIGNED PROXY RETURNED

AND NOT COMPLETED WILL BE VOTED IN FAVOR OF ALL PROPOSALS PRESENTED IN THE PROXY STATEMENT.

| |

Very truly yours, |

| |

|

| |

Athanasios Feidakis |

| |

President, Chief Executive Officer and Chief Financial Officer |

GLOBUS MARITIME LIMITED

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

September 21, 2023

NOTICE IS HEREBY given that the annual meeting

of shareholders (the “Meeting”) of Globus Maritime Limited (the “Company”) will be held at the

offices of Globus Shipmanagement Corp., located at 128 Vouliagmenis Avenue, 3rd floor, Glyfada, 16674 Attica, Greece on September 21,

2023 at 11:00 a.m. local time, for the following purposes, of which items 1, 2 and 3 are more completely set forth in the accompanying

Proxy Statement:

| 1. | To elect two Class I directors to

serve until the 2026 Annual Meeting of Shareholders (“Proposal One”); |

| 2. | To approve the appointment of Ernst &

Young (Hellas) Certified Auditors Accountants S.A. as the Company’s independent auditors

for the fiscal year ending December 31, 2023 (“Proposal Two”); |

| 3. | To approve one or more amendments to the

Company’s Amended and Restated Articles of Incorporation to effect one or more reverse

stock splits of the Company’s issued and outstanding shares of common stock and Series B

preferred shares by an aggregate ratio of not more than one-for-20, with the exact ratio

to be set at a whole number to be determined by the Company’s Board of Directors or

a committee thereof in its discretion, at any time or times after approval of the amendments,

and to authorize the Company’s Board of Directors to implement one or more reverse

stock splits by filing one or more amendments with the Registrar of Corporations of the Republic

of the Marshall Islands (“Proposal Three”); and |

| 4. | To transact any other business as may properly

come before the Meeting or any adjournment or postponement thereof. |

The board of directors of the Company has fixed

the close of business on August 15, 2023 as the record date for the determination of the shareholders entitled to receive notice

of and to vote at the Meeting or any adjournment or postponement thereof.

You are cordially invited to attend the Meeting

in person. If you attend the Meeting, you may revoke your proxy and vote your shares in person. If your shares are held in the name of

your broker, bank or other nominee and you wish to attend the Meeting, you must bring a legal proxy from your broker, bank or other nominee

in order to vote.

To constitute a quorum, there must be present

either in person or by proxy shareholders of record holding at least one third of the voting power of the shares entitled to vote at

the Meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING,

PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED

STATES. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY PROMPTLY WILL BE APPRECIATED.

ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED IN FAVOR OF ALL PROPOSALS PRESENTED IN THE PROXY STATEMENT.

If you attend the Meeting and do not hold your

shares through an account with a brokerage firm, bank or other nominee, you may revoke your proxy and vote in person. If you hold your

shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote

your shares or to revoke your vote, if necessary.

The

Company’s 2022 Annual Report on Form 20-F (the “2022 Annual Report”), which contains the Company’s

audited financial statements for the fiscal year ended December 31, 2022, is available on the Company’s website at www.globusmaritime.gr.

Any shareholder may receive a hard copy of the Company’s 2022 Annual Report, free of charge upon request.

This Notice of the Meeting, the Proxy Statement and related materials,

including the Company’s 2022 Annual Report, can also be found at:

http://globusmaritime.agmdocuments.com/agm2023.html

| |

By Order of the Board of Directors |

| |

|

| |

Olga Lambrianidou |

| |

Secretary |

August 22, 2023

GLOBUS MARITIME LIMITED

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

SEPTEMBER 21, 2023

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of

the board of directors of Globus Maritime Limited, a Marshall Islands corporation (the “Company”), for use at the

Annual Meeting of Shareholders to be held at the offices of Globus Shipmanagement Corp., located at 128 Vouliagmenis Avenue, 3rd floor,

Glyfada, 166 74 Attica, Greece on September 21, 2023 at 11:00 a.m. local time, or at any adjournment or postponement thereof

(the “Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders.

This Proxy Statement and the accompanying form of proxy are expected to be mailed to shareholders of the Company entitled to vote at

the Meeting on or about August 22, 2023.

VOTING RIGHTS AND OUTSTANDING SHARES

On August 15, 2023 (the

“Record Date”), the Company had outstanding 20,582,301 common shares, par value $0.004 per share (the

“Common Shares”), and 10,300 Series B preferred shares, par value $0.001 per share (the

“Series B Preferred Shares” and together with the Common Shares, the “Shares,” and any

holder of Shares, a “Shareholder”). Each Shareholder of record at the close of business on the Record Date is

entitled to one vote for each Common Share then held and 25,000 votes for each Series B Preferred Share then held provided

however, that pursuant to the Amended and Restated Statement of Designation of the Series B Preferred Shares, no holder of

Series B Preferred Shares may exercise voting rights pursuant to any Series B Preferred Share that would result in the

total number of votes such holder, together with each beneficial owner of such Series B Preferred Share and any of their

affiliates, is entitled to vote (including any voting power derived from Series B Preferred Shares or Common Shares) to exceed

49.99% of the total number of votes eligible to be cast.

To constitute a quorum, there must be present

either in person or by proxy one or more Shareholders of record holding at least one third of the voting power of the Shares entitled

to vote at the Meeting. The Shares represented by any proxy in the enclosed form will be voted in accordance with the instructions given

on the proxy if the proxy is properly executed and is received by the Company prior to the close of voting at the Meeting or any adjournment

or postponement thereof. Any proxies returned without instructions will be voted FOR the proposals set forth on the Notice of Annual

Meeting of Shareholders.

The Common Shares are listed on the NASDAQ Capital

Market under the symbol “GLBS.”

REVOCABILITY OF PROXIES

A Shareholder of record giving a proxy may revoke

it at any time before it is exercised. A proxy may be revoked by filing with the Secretary of the Company at the Company’s office

at c/o Globus Shipmanagement Corp., located at 128 Vouliagmenis Avenue, 3rd floor, Glyfada, 166 74 Attica, Greece a written notice of

revocation or a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. If you hold Shares in street

name, through a brokerage firm, bank or other nominee, please contact the brokerage firm, bank or other nominee to revoke your proxy.

SOLICITATION

The cost of preparing and soliciting proxies

will be borne by the Company. Solicitation, if any, is expected to be made primarily by mail, but Shareholders may be solicited by telephone,

e-mail or personal contact.

Important Notice Regarding the Availability

of Proxy Materials for the Shareholders Meeting to be Held on September 21, 2023

The Notice of the Annual Meeting of Shareholders

and Proxy Statement is available free of charge at www.globusmaritime.gr

PROPOSAL ONE

ELECTION OF CLASS I

DIRECTORS

The Company currently has four directors on its

board, which is divided into three classes. As provided in the Company’s Amended and Restated Articles of Incorporation, each director

is elected to serve for a three-year term and until such director’s successor is duly elected and qualified, except in the event

of removal, resignation or death prior to the annual meeting of shareholders in which such director’s term of office expires. The

term of the Company’s Class I directors expires at the Meeting. Accordingly, the board of directors of the Company has nominated

Athanasios Feidakis and Ioannis Kazantzidis, Class I directors, for re-election as directors whose term would expire at the 2026

annual meeting of shareholders.

Unless the proxy is marked to indicate that such

authorization is expressly withheld, the persons named in the enclosed proxy intend to vote the Shares authorized thereby FOR the election

of the following nominee. It is expected that the nominee will be able to serve, but if before the election it develops that such nominee

is unavailable, the persons named in the accompanying proxy will vote for the election of such substitute nominee as the current board

of directors of the Company may recommend.

Nominees for Election to the Company’s

Board of Directors

Information concerning the nominees for director of the Company is

set forth below:

| Name |

Age |

Position |

| |

|

|

| Athanasios Feidakis |

36 |

Class I Director |

| |

|

|

| Ioannis Kazantzidis |

72 |

Class I Director |

Athanasios

(“Thanos”) Feidakis, a Class I Director, has been a member of our board of directors since

July 2013. As of December 28, 2015, Mr. Athanasios Feidakis was also appointed our President, CEO and CFO. From

October 2011 through June 2013, Mr. Athanasios Feidakis worked for our operations and chartering department as an

operator. Prior to that and from September 2010 to May 2011, Mr. Athanasios Feidakis worked for ACM, a shipbroking

firm, as an S&P broker, and from October 2007 to April 2008, he worked for Clarksons, a shipbroking firm, as a

chartering trainee on the dry cargo commodities chartering and on the sale and purchase of vessels. From April 2011 to

April 2016, Mr. Athanasios Feidakis was a director of F.G. Europe S.A., a company controlled by his family, specializing

in the distribution of well-known brands in Greece, the Balkans, Turkey, Italy and the UK. From December 2008 to

December 2015, Mr. Athanasios Feidakis was the President of Cyberonica S.A., a family-owned company specializing in real

estate development. Mr. Athanasios Feidakis holds a B.Sc. in Business Studies and a M.Sc. in Shipping Trade and Finance from

the Bayes Business School (formerly known as Cass Business School) of City University in London and an MBA from London School of

Economics. In addition, Mr. Athanasios Feidakis has professional qualifications in dry cargo chartering and operations from the

Institute of Chartered Shipbrokers.

Ioannis

Kazantzidis, a Class I Director, has been a member of our board of directors since November 2016. Mr. Kazantzidis

has been the principal of Porto Trans Shipping LLC, a shipping and logistics company based in the United Arab Emirates, since 2007. Between

1987 to 2007, Mr. Kazantzidis was with HSBC Group, where he served in managerial positions participating in the development and

implementation of financial systems in multiple locations. Mr. Kazantzidis has since 2009 been a Director of Saeed Mohammed Heavy

Equipment Trading LLC, a general trading company, and a senior partner in Porto Trans Auto Services Company, both based in Jebel Ali,

UAE. Mr. Kazantzidis has served as the Chairman of Nazaki Corporation, a private investment company based in the British Virgin

Islands, since 1988. Mr. Kazantzidis has served, from 2015 to 2018, as the Chairman of W.M.Mendis Hotel Pvt Ltd in the Republic

of Sri Lanka. From 1989 to 2015, he was the Chairman of Fishermans Wharf Pvt Ltd, and a director of Dow Corning Lanka Pvt Ltd from 2000

to 2013 and Propasax Pvt Ltd from 2010 to 2015. Mr. Kazantzidis became a director of Longdom Place Developer LLC as of December 31,

2020 and remains in such position.

Audit

Committee. The Company’s Board has established an Audit Committee, composed of two independent members of its board

of directors, who are responsible for ensuring that our financial performance is properly reported on and monitored, for reviewing internal

control systems and the auditors’ reports relating to our accounts and for reviewing all related party transactions. The Audit

Committee is comprised of Ioannis Kazantzidis and Jeffrey O. Parry. The Company believes that Mr. Kazantzidis qualifies as an “audit

committee financial expert,” as such term is defined under Securities and Exchange Commission rules.

Remuneration

Committee. The Remuneration Committee is comprised of Jeffrey O. Parry and Ioannis Kazantzidis. It is responsible for determining,

subject to approval from our board of directors, the remuneration guidelines to apply to our executive officer, secretary and other members

of the executive management as our board of directors designates the Remuneration Committee to consider. It is also responsible for suggesting

the total individual remuneration packages of each director including, where appropriate, bonuses, incentive payments and share options.

Nomination

Committee. The Nomination Committee is comprised of George Feidakis, Ioannis Kazantzidis and Jeffrey O. Parry. It is

responsible for reviewing the structure, size and composition of our board of directors and identifying and nominating candidates to

fill board positions as necessary.

Corporate

Governance Practices. As the Company is a foreign private issuer, it is exempt from the Nasdaq corporate governance rules,

other than the requirements regarding the disclosure of a going concern audit opinion, submission of a listing agreement, notification

to Nasdaq of non-compliance with Nasdaq corporate governance practices, and the establishment of an audit committee satisfying Nasdaq

Listing Rule 5605(c)(3) and ensuring that such audit committee’s members meet the independence requirement of Listing

Rule 5605(c)(2)(A)(ii).

As a foreign private issuer listed on the Nasdaq

Capital Market, we are required to disclose certain self- identified diversity characteristics about our directors pursuant to Nasdaq

board diversity and disclosure rules approved by the Securities and Exchange Commission in 2021. In accordance with Nasdaq Listing

Rules, the Company posted its board diversity matrix on its website, which matrix may be found here: http://www.globusmaritime.gr/board_diversity_matrix.pdf.

Required

Vote. Adoption of Proposal One requires the affirmative vote of a plurality of the votes cast by Shareholders present in person

or by proxy and entitled to vote at the Meeting, provided that a quorum is present. Abstentions and broker non-votes will have no effect

on the outcome of Proposal One.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE IN FAVOR OF THE PROPOSED DIRECTORS. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF

SUCH PROPOSED DIRECTORS UNLESS A CONTRARY VOTE IS SPECIFIED.

PROPOSAL TWO

APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITORS

The board of directors of the Company is submitting

for approval at the Meeting the selection of Ernst & Young (Hellas) Certified Auditors Accountants S.A. as the Company’s

independent auditors for the fiscal year ending December 31, 2023. Ernst & Young (Hellas) Certified Auditors Accountants

S.A. has advised the Company that it does not have any direct or indirect financial interest in the Company, nor has it had any such

interest in connection with the Company during the past three fiscal years other than in its capacity as the Company’s independent

auditors.

All services rendered by the independent auditors

are subject to review by the Company’s Audit Committee.

Required

Vote. Adoption of Proposal Two requires the affirmative vote of a majority of the votes cast by Shareholders present in person

or by proxy and entitled to vote at the Meeting, provided that a quorum is present. Abstentions and broker non-votes will have no effect

on the outcome of Proposal Two.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE FOR APPROVAL OF THE APPOINTMENT OF ERNST & YOUNG (HELLAS) CERTIFIED AUDITORS ACCOUNTANTS S.A. AS INDEPENDENT AUDITORS

OF THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE

VOTED IN FAVOR OF SUCH APPROVAL UNLESS A CONTRARY VOTE IS SPECIFIED.

PROPOSAL THREE

APPROVAL OF AMENDMENT TO THE COMPANY’S

AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT ONE OR MORE REVERSE STOCK SPLITS

General.

The Company’s Board of Directors has determined that the Company may need to effect one or more reverse stock splits

of its issued and outstanding Common Shares and Series B Preferred Shares by an aggregate reverse stock split ratio of not more

than one-for-20, whereby, except as explained below with respect to fractional shares, on the effective date, Common Shares and Series B

Preferred Shares issued and outstanding immediately prior thereto will be, automatically and without any action on the part of the Shareholders,

combined, converted and changed into new Common Shares and Series B Preferred Shares, as applicable, in accordance with the reverse

split ratio, which shall be determined by the Board of Directors or a committee thereof in its discretion. If the Shareholders approve

this Proposal Three, the Board of Directors of the Company or a committee thereof will have the authority, but not the obligation, in

its sole discretion, and without further action on the part of the Shareholders, on one or more occasions, to select an approved reverse

stock split ratio and effect the approved reverse stock split and the date and time to effect the reverse stock split. The Company is

seeking approval from the Shareholders to effect one or more reverse stock splits and to approve one or more amendments, substantially

in the form attached hereto as Appendix I, to the Company’s Amended and Restated Articles of Incorporation to effect the reverse

stock split(s). The following description is qualified in its entirety by reference to Appendix I.

Purpose.

A reverse stock split is intended to increase the per share trading value of our Common Shares. The Board of Directors intends

to effect a proposed reverse stock split only if the implementation of such a reverse stock split is determined by our Board of Directors

(or a committee thereof) to be in the best interests of the Company and its shareholders.

The Company believes that by effecting a reverse

stock split, the Company will be better able to maintain compliance with the Nasdaq Capital Market’s minimum bid price requirement.

The Nasdaq Capital Market has several listing criteria that companies must satisfy in order to maintain their listing. One of these criteria

is that our Common Shares have a minimum closing bid price that is greater than or equal to $1.00 per share. The Company received a notice

from Nasdaq Stock Market LLC indicating that it was no longer in compliance with this requirement because the closing bid price of our

Common Shares over a period of 30 consecutive business days was less than $1.00 per share. As of August 15, 2023, the Company continues

to not be in compliance with this requirement. The Company believes that by effecting a reverse stock split, it will be better able to

maintain compliance with this listing requirement in the future.

In addition, the Company believes that a number

of institutional investors and investment funds are reluctant to invest, and in some cases may be prohibited from investing, in lower-priced

stocks and that brokerage firms are reluctant to recommend lower-priced stocks to their clients. Other investors may also be dissuaded

from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for

lower-priced stocks. A higher stock price after a reverse stock split could alleviate these concerns. By effecting a reverse stock split,

we believe we may be able to raise the price of our Common Shares to a level where the Common Shares could be viewed more favorably by

potential investors.

The combination of maintaining our listing

on the Nasdaq Capital Market and the lower transaction costs and increased interest from institutional investors and investment

funds could have the effect of improving the trading liquidity and price of our Common Shares. In addition, because the number of

authorized Common Shares, which is currently 500,000,000 under our Amended and Restated Articles of Incorporation, would not

decrease in accordance with the selected exchange ratio of the reverse stock split, if implemented, the reverse stock split would

decrease the number of issued and outstanding shares of Common Shares and thus provide us with additional Common Shares, which would

be available for issuance from time to time for corporate purposes such as acquisitions of companies or assets, sales of stock or

securities convertible into Common Shares and raisingadditional capital.

You should consider that, although our Board

of Directors believes that a reverse stock split should increase the price of our Common Shares or maintain the overall value, in many

cases, because of variables outside of a company’s control (such as market volatility, investor response to the news of a proposed

reverse stock split and the general economic environment), the market price of a company’s shares of common stock could decline

in value after a reverse stock split. You should also keep in mind that the implementation of a reverse stock split does not have a direct

effect on the actual or intrinsic value of our business or a shareholder’s proportional ownership in our company (subject to changes

based on the fractional shares discussion below). However, should the overall value of our Common Shares decline after the proposed reverse

stock split, then the actual or intrinsic value of the Common Shares held by you will also proportionately decrease as a result of the

overall decline in value.

The Board of Directors may effect one or more

reverse stock splits in connection with this Proposal Three. The Board of Directors believes that shareholder approval of an aggregate

exchange ratio range (rather than an exact exchange ratio) provides the Board of Directors with maximum flexibility to achieve the purposes

of one or more reverse stock splits. In addition, the Board of Directors reserves its right to elect not to proceed, and abandon, any

reverse stock split if it determines, in its sole discretion, that implementing this Proposal Three, or a particular reverse stock split,

is not in the best interests of the Company and its shareholders.

Fractional

Shares. No fractional Common Shares or Series B Preferred Shares will be created or issued in connection with any reverse

stock split. Shareholders of record who otherwise would be entitled to receive fractional Common Shares as a consequence of a reverse

stock split will be entitled, upon surrender to the exchange agent of certificates representing such Common Shares or, in the case of

non-certificated Common Shares, such proof of ownership as required by the exchange agent, to a cash payment in lieu thereof at a price

equal to the fraction to which the shareholder would otherwise be entitled multiplied by the closing price per Common Share on the NASDAQ

Capital Market on the last trading day prior to the effective date of the reverse stock split, as adjusted for the reverse stock split

as appropriate or, if such price is not available, or in the case of Series B Preferred Shares, a price to be determined by our

Board of Directors. The ownership of a fractional interest will not give the holder of any voting, dividend or other rights except to

receive payment therefor as described herein.

Authorized

Common Shares and Par Value. The reverse stock split will not result in a change in the number of authorized Common Shares

or par value of the Common Shares. Because the Company’s authorized number of Common Shares, which is currently 500,000,000 Common

Shares under the Company’s Amended and Restated Articles of Incorporation, will not decrease in accordance with the reverse stock

split, effecting a reverse stock split would provide the Company with additional Common Shares, which would be available for issuance

from time to time for corporate purposes such as acquisitions of companies or assets, sales of stock or securities convertible into Common

Shares and raising additional capital.

Material

U.S. Federal Income Tax Consequences. The following is a summary of the material U.S. federal income tax consequences of the

reverse stock split to U.S. Holders (as defined below) of our Common Shares. This summary is based on the Internal Revenue Code of 1986,

as amended (the “Code”), the Treasury regulations promulgated thereunder, and administrative rulings and court decisions

in effect as of the date of this proxy statement, all of which may be subject to change, possibly with retroactive effect. This summary

only addresses holders who hold their shares as capital assets within the meaning of the Code and does not address all aspects of U.S.

federal income taxation that may be relevant to U.S. Holders subject to special tax treatment, such as financial institutions, dealers

or traders in securities or currencies, partnerships, S corporations, insurance companies, real estate investment trusts, regulated investment

companies, persons that own shares as part of a hedge, straddle, or conversion transaction, persons whose functional currency is not

the U.S. dollar, expatriates, tax-exempt entities and investors that own, directly, indirectly or by attribution, 10% or more of our

stock by vote or value. In addition, this summary does not consider the effects of U.S. federal alternative minimum tax or estate or

gift tax consequences, or any applicable state, local, foreign or other tax laws, and does not address the U.S. federal income consequences

of the reverse stock split to persons who are not U.S. Holders.

As used herein, the term “U.S. Holder”

means a beneficial owner of Common Shares that is a U.S. citizen or resident, a corporation or other entity taxable as a corporation

created or organized in or under the laws of the United States, any state thereof or the District of Columbia, an estate the income of

which is subject to U.S. federal income taxation regardless of its source, or a trust if a court within the United States is able to

exercise primary jurisdiction over the administration of the trust and one or more U.S. persons have the authority to control all substantial

decisions of the trust.

If a partnership holds our Common Shares, the

tax treatment of a partner will generally depend upon the status of the partner and upon the activities of the partnership. If you are

a partner in a partnership holding our Common Shares, you are encouraged to consult your tax advisor.

We have not sought and will not seek any ruling

from the Internal Revenue Service (the “IRS”), or an opinion from counsel with respect to the U.S. federal income

tax consequences discussed below. There can be no assurance that the tax consequences discussed below would be accepted by the IRS or

a court. The authorities on which this summary is based are subject to various interpretations, and it is therefore possible that the

U.S. federal income tax treatment may differ from the treatment described below.

We urge holders to consult with their own tax

advisors as to any U.S. federal, state, or local or foreign tax consequences applicable to them that could result from the reverse stock

split.

The reverse stock split is intended to constitute

a “reorganization” within the meaning of Section 368 of the Code and is not intended to be part of a plan to increase

periodically a shareholder’s proportionate interest in our earnings and profits. Assuming the reverse stock split so qualifies,

for U.S. federal income tax purposes,

| • | A

U.S. Holder should not recognize any gain or loss on the reverse stock split (except for

cash, if any, received in lieu of a fractional Common Share); |

| • | The

U.S. Holder’s aggregate tax basis of the Common Shares received pursuant to the reverse

stock split, including any fractional Common Share not actually received, should be equal

to the aggregate tax basis of such holder’s Common Shares

surrendered in the exchange; |

| • | The

U.S. Holder’s holding period for the Common Shares received pursuant to the reverse

stock split should include such holder’s holding period for the Common Shares surrendered

in the exchange; and |

| • | Cash

payments received by the U.S. Holder for a fractional Common Share generally should be treated

as if such fractional share had been issued pursuant to the reverse stock split and then

redeemed by us, and such U.S. Holder generally should recognize capital gain or loss with

respect to such payment, measured by the difference between the amount of cash received and

such U.S. Holder’s tax basis in such fractional share. However, in certain circumstances,

it is possible that the cash received in lieu of a fractional share could be characterized

as a dividend for such purposes. U.S. Holders are encouraged to consult their tax adviser

on the treatment of the receipt of cash in lieu of fractional shares in their specific situation. |

U.S. Holders will be required to provide their

social security or other taxpayer identification numbers (or, in some instances, additional information) to the exchange agent in connection

with the reverse stock split to avoid backup withholding requirements that might otherwise apply. This information is generally provided

on IRS Form W-9 or a substitute form. Failure to provide such information may result in backup withholding at a rate of 24%.

THE

FOREGOING IS A SUMMARY OF THE MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO U.S. HOLDERS OF COMMON SHARES

UNDER CURRENT LAW AND IS FOR GENERAL INFORMATION ONLY. THE FOREGOING DOES NOT PURPORT TO ADDRESS ALL U.S. FEDERAL INCOME TAX CONSEQUENCES

OR TAX CONSEQUENCES THAT MAY ARISE UNDER THE TAX LAWS OF OTHER JURISDICTIONS OR THAT MAY APPLY TO PARTICULAR CATEGORIES OF

SHAREHOLDERS. YOU ARE ENCOURAGED TO CONSULT YOUR OWN TAX ADVISOR AS TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO

YOU, INCLUDING THE APPLICATION OF U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX LAWS, AND THE EFFECT OF POSSIBLE CHANGES IN TAX LAWS

THAT MAY AFFECT THE TAX CONSEQUENCES DESCRIBED ABOVE.

Procedures

for Effecting Reverse Stock Split. As soon as practicable after the effective date of the reverse stock split, the Company’s

shareholders will be notified that the reverse stock split has been effected. The Company expects that its transfer agent, Computershare,

will act as exchange agent for purposes of implementing the exchange of share certificates for Common Shares. The Company will act as

exchange agent for purposes of implementing the exchange for Series B Preferred Shares. Holders of pre-split certificated Common

Shares will be asked to surrender to the exchange agent certificates representing pre-split Common Shares in exchange for post-split

Common Shares in accordance with the procedures to be set forth in a letter of transmittal the Company will send to its registered shareholders.

No new share certificates will be issued to shareholders, and any shareholder submitting a stock certificate will receive uncertificated

shares in return. Any pre-split Common Shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise,

will automatically be exchanged for post-split Common Shares.

SHAREHOLDERS SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND

SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Shareholders holding shares in book-entry form

with the transfer agent need not take any action to receive post-split shares or cash payment in lieu of any fractional share interest,

if applicable. If a Shareholder is entitled to post-split shares, a transaction statement will automatically be sent to the Shareholder’s

address of record indicating the number of Shares held following the reverse stock split.

Banks, brokers or other nominees will be instructed

to effect the reverse stock split for their beneficial holders holding shares in “street name.” However, these banks, brokers

or other nominees may have different procedures from those that apply to registered shareholders for processing the reverse stock split

and making payment for fractional shares. If a shareholder holds shares with a bank, broker or other nominee and has any questions in

this regard, shareholders are encouraged to contact their bank, broker or other nominee.

Required

Vote. Approval of Proposal Three requires the affirmative vote of a majority of the votes eligible to be cast by Shareholders

entitled to vote thereon. Abstentions and broker non-votes will have the effect of votes “against” Proposal Three.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE FOR PROPOSAL THREE, THE APPROVAL OF ONE OR MORE AMENDMENTS TO THE AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT ONE

OR MORE REVERSE STOCK SPLITS. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF SUCH APPROVAL

UNLESS A CONTRARY VOTE IS SPECIFIED.

OTHER MATTERS

No other matters are expected to be presented

for action at the Meeting. Should any additional matter come before the Meeting, it is intended that proxies in the accompanying form

will be voted in accordance with the judgment of the person or persons named in the proxy.

By Order of the Board of Directors

Olga Lambrianidou

Secretary

August 22, 2023

APPENDIX I

ARTICLES OF AMENDMENT TO

THE AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

GLOBUS MARITIME LIMITED

PURSUANT TO SECTION 90 OF THE MARSHALL ISLANDS

BUSINESS CORPORATIONS ACT

I, [ ], as the [ ] of Globus

Maritime Limited, a Marshall Islands corporation (the “Corporation”), for the purpose of amending the Amended and

Restated Articles of Incorporation of said Corporation pursuant to Section 90 of the Business Corporations Act, as amended, hereby

certify:

| |

1. |

The name

of the Corporation is: Globus Maritime Limited |

| |

2. |

The Company was formed under the laws of Jersey on July 26, 2006 in Jersey and domesticated as a Corporation into Marshall Islands and filed its Articles of Incorporation with the Registrar of Corporations as of November 24, 2010. Amended and Restated Articles of Incorporation were filed with the Registrar of Corporations as of October 22, 2020. |

| |

3. |

Article III of the Amended and Restated Articles of Incorporation is hereby amended by adding the following paragraph at the end thereof: |

“Reverse Stock Split. As of the

commencement of business on [ ] (the “Reverse Stock Split Effective Date”), each [ ] Common Shares and Series B

preferred shares, par value $0.001 per share (“Series B Preferred Shares”), issued and outstanding immediately

prior to the Reverse Stock Split Effective Date either issued and outstanding or held by the Corporation as treasury stock shall be combined

into one (1) validly issued, fully paid and non-assessable Common Share and Series B Preferred Share, respectively, without

any further action by the Corporation or the holder thereof (the “Reverse Stock Split”); provided that no fractional

shares shall be issued to any holder and that in lieu of issuing any such fractional shares, fractional shares resulting from the Reverse

Stock Split will be rounded down to the nearest whole share and provided, further, that shareholders holding Common Shares who would

otherwise be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the ratio of the Reverse

Stock Split will receive a cash payment (without interest and subject to applicable withholding taxes) in an amount per share equal to

the closing price per Common Share on NASDAQ on the trading day immediately preceding the Reverse Stock Split Effective Date, as adjusted

for the reverse stock split as appropriate, and that shareholders holding Series B Preferred Shares who would otherwise be entitled

to receive fractional shares because they hold a number of shares not evenly divisible by the ratio of the Reverse Stock Split will receive

a cash payment (without interest and subject to applicable withholding taxes) in an amount per share equal to an amount determined by

the Board of Directors of the Corporation. Each certificate, if any, that immediately prior to the Reverse Stock Split Effective Date

represented Common Shares (“Old Certificates”), shall thereafter represent that number of Common Shares into which

the Common Shares represented by the Old Certificate shall have been combined, subject to the elimination of fractional shares as described

above. The reverse stock split described in this paragraph shall not change the number of Common Shares or Series B Preferred Shares

authorized to be issued or the par value of the Common Shares or the Series B Preferred Shares. The stated capital of the Corporation

shall be reduced from $[ ] to $[ ], which may be further adjusted for the cancellation of fractional shares, and the reduction of $[

], which may be further adjusted for the cancellation of fractional shares, shall be allocated to surplus. No change was made to the

number of registered shares of Class B Shares or Preferred Shares the Corporation is authorized to issue or to the par value of

Class B Shares or Preferred Shares.”

| |

4. |

All of the other provisions of the Amended and Restated Articles of Incorporation shall remain unchanged. |

| |

5. |

This amendment to the Amended and Restated Articles of Incorporation was authorized by vote of the holders of a majority of the voting power of the issued and outstanding shares of the Corporation. |

[Signature Page Follows]

IN

WITNESS WHEREOF, I have executed these Articles of Amendment to the Amended and Restated Articles of Incorporation on

this ________ day of _____________________, 20___.

Exhibit 99.3

01 - Athanasios Feidakis * 02 - Ioannis Kazantzidis * *To serve as Class I directors until the 2026 Annual Meeting of Shareholders. F o r W ithhold 2 2 D V F o r W ithhold Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. 0 3V4SB + + Proposals — The Board of Directors recommends a vote FOR all nominees and FOR Proposals 2 and 3. A 2. To approve the appointment of Ernst & Young (Hellas) Certified Auditors Accountants S.A. as the Company’s independent auditors for the fiscal year ending December 31, 2023 1. Election of Directors: For Against Abstain Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below B q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Annual Meeting Proxy Card 3. To approve one or more amendments to the Company’s Amended and Restated Articles of Incorporation to effect one or more reverse stock splits of the Company’s issued and outstanding shares of common stock and Series B preferred shares by an aggregate ratio of not more than one - for - 20, with the exact ratio to be set at a whole number to be determined by the Company’s Board of Directors or a committee thereof in its discretion, at any time or times after approval of the amendments, and to authorize the Company’s Board of Directors to implement one or more reverse stock splits by filing one or more amendments with the Registrar of Corporations of the Republic of the Marshall Islands. For Against Abstain MMMMMMMM M 5 8 3 2 8 0 MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND C 1234567890 J N T MMMMMMMMMMMM MMMMMMMMMMMMMM MMMMMM 000001 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 ENDORSEMENT_LINE______________ SACKPACK_____________ C123456789 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

Annual Meeting of Shareholders – September 21, 2023 Proxy Solicited On Behalf of the Board of Directors The undersigned shareholder hereby appoints Athanasios Feidakis and Olga Lambrianidou and each of them individually, proxies for the undersigned, with full power of substitution and re - substitution, to represent the undersigned and to vote all shares of common stock of GLOBUS MARITIME LIMITED (the “Company”) that the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held on Thursday, September 21 , 2023 at 11 : 00 a . m . local time at the offices of Globus Shipmanagement Corp . located at 128 Vouliagmenis Avenue, 16674 Glyfada, Attica Greece and at any and all adjournments or postponements thereof as indicated herein . THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED HEREIN . IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSAL ONE, PROPOSAL TWO AND PROPOSAL THREE, AND SHALL BE DEEMED TO AUTHORIZE THE PROXYHOLDERS TO VOTE IN THEIR DISCRETION AS TO ALL OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING TO THE EXTENT PERMITTED BY APPLICABLE LAW . PLEASE SIGN ON REVERSE Proxy — Globus Maritime Limited q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Non - Voting Items C + + Change of Address — Please print new address below. Comments — Please print your comments below. Meeting Attendance Mark box to the right if you plan to attend the Annual Meeting.

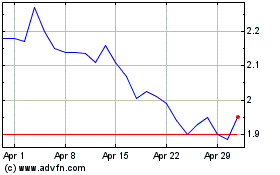

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2024 to May 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From May 2023 to May 2024