Fanhua Inc. (Nasdaq: FANH) (the “Company” or “Fanhua”), a leading

independent financial services provider in China, today announced

its unaudited financial results for the first quarter ended March

31, 20231.

Financial Highlights for the First

Quarter of 2023:

|

(In thousands, except per ADS) |

2022Q1(RMB) |

2023Q1(RMB) |

2023Q1(US$) |

Change % |

|

Total net revenues |

686,387 |

|

827,737 |

120,528 |

20.6 |

|

Operating income |

20,589 |

|

60,355 |

8,789 |

193.1 |

|

Non-GAAP operating income2 |

20,589 |

|

63,474 |

9,243 |

208.3 |

|

Net income (loss) attributable to the Company’s

shareholders |

(37,838 |

) |

60,452 |

8,803 |

N/A |

|

Non-GAAP net income attributable to the Company’s

shareholders3 |

40,439 |

|

63,571 |

9,257 |

57.2 |

|

Diluted net income (loss) per ADS |

(0.70 |

) |

1.13 |

0.16 |

N/A |

|

Non-GAAP diluted net income per ADS4 |

0.75 |

|

1.18 |

0.17 |

57.3 |

|

Cash, cash equivalents, short- term investments and others (As of

March 31, 2022 and 2023) |

1,281,469 |

|

1,654,1865 |

240,868 |

29.1 |

Mr. Yinan Hu, chairman and chief executive

officer of Fanhua, commented on the financial results of first

quarter of 2023, “With the positive macro and industry environment

over the first quarter of 2023, we are pleased to report strong

results over the period with solid growth across various key

operating metrics:

- Total gross written premiums

(“GWP”) grew by 29.0% year-over-year to RMB4.4 billion,

significantly above the premium growth rate of 8.9% of the life

insurance industry

- First year premiums(“FYP”) grew by

51.4% year-over-year to RMB851.9 million, significantly above the

average growth rate of approximately 15% achieved by listed Chinese

life insurers

- Total net revenues grew by 20.6%

year-over-year to RMB827.7 million, and

- Operating income grew by 193.1% to

RMB60.4 million, significantly above our previous estimate of RMB30

million.

“The impressive figures were combined results of

significant increase in agent quality and productivity, material

contribution from acquisitions and open-platform strategy as well

as material operational gains from digitization, demonstrating that

we are executing on our well-defined strategy of driving

sustainable growth in our business through ‘Professionalization,

Specialization, Digitalization, and Open Platform’.

“Our good start in the first quarter of 2023

will help lay a solid foundation for us to accelerate the execution

of our strategies and achieve our 2023 operational targets of

generating 50% year-over-year growth in life insurance new business

sales and non-GAAP operating income. In the coming quarters, we

will focus on i) enhancing our unique competitive edge through

optimizing various value-added service offerings to our end

customers in addition to insurance products, ii) attracting top

talents from various industries through our Family Office

Consultant (“FOC”) training programs, iii) accelerating market

consolidation through both acquisitions and expansion of digital

tenants on our open platform, and iv) encouraging and supporting

Million-Dollar Round Table (“MDRT”) members in Fanhua to obtain

relevant financial qualifications and certificates to further

improve their professional expertise.

“2023 marks the 25th anniversary of our company.

It is a milestone that each and one of us at Fanhua are truly proud

for. Over the past 25 years, we are proud that we have navigated

through China’s economic and financial industry cycles. Relative to

other developed markets, the industry we operate in remains young

and continues to be filled with opportunities. Relative to our

global peers, our company remains young, and we see immense growth

opportunities ahead. We are confident that with the continued

execution of our well-defined strategy, Fanhua will continue to

deliver superior results to our shareholders.”

Financial Results for the First Quarter

of 2023

Total net revenues were

RMB827.7 million (US$120.5 million) for the first quarter of 2023,

representing an increase of 20.6% from RMB686.4 million for the

corresponding period in 2022.

-

Net revenues for agency business were RMB725.5

million (US$105.6 million) for the first quarter of 2023,

representing an increase of 23.4% from RMB588.0 million for the

corresponding period in 2022. Total GWP increased by 29.0%

year-over-year to RMB4,444.0 million, of which FYP grew by 51.4%

year-over-year to RMB851.9 million while renewal premiums increased

by 24.6% year-over-year to RMB3,592.1 million.

-

Net revenues for the life insurance business were

RMB683.4 million (US$99.5 million) for the first quarter of 2023,

representing an increase of 22.3% from RMB558.6 million for the

corresponding period in 2022. Total life insurance GWP increased by

29.1% year-over-year to RMB4,359.8 million, of which life insurance

FYP increased by 55.9% year-over-year to RMB767.8 million and

renewal premiums increased by 24.6% year-over-year to RMB3,592.1

million. The increase in net revenues for the life insurance

business was mainly due to an increase in new policy sales and

acquisitions completed in the first quarter of 2023 which generated

total revenues of RMB163.6 million, offset by the decrease in

renewal commission income as a result of the decreased weighted

average renewal commission rate of renewal premium collected, and

to a lesser extent, due to changes in product mix. For long-term

life insurance policies that we sell, renewal commissions are paid

throughout the policy payment period but the renewal commission

rates tend to recede few years after the sales of the insurance

policies.Net revenues generated from our life insurance business

accounted for 82.6% of our total net revenues in the first quarter

of 2023, as compared to 81.4% in the same period of 2022.

-

Net revenues for the P&C insurance business

were RMB42.1 million (US$6.1 million) for the first quarter of

2023, representing an increase of 43.2% from RMB29.4 million for

the corresponding period in 2022. The increase was mainly due to

the contribution from a brokerage firm which was acquired in the

second half of 2022. Net revenues generated from the P&C

insurance business accounted for 5.1% of our total net revenues in

the first quarter of 2023, as compared to 4.3% in the same period

of 2022.

-

Net revenues for the claims adjusting business

were RMB102.2 million (US$14.9 million) for the first quarter of

2023, representing an increase of 3.9% from RMB98.4 million for the

corresponding period in 2022. Net revenues generated from the

claims adjusting business accounted for 12.3% of our total net

revenues in the first quarter of 2023, as compared to 14.3% in the

same period of 2022.

Total operating costs and

expenses were RMB767.4 million (US$111.7million) for the

first quarter of 2023, representing an increase of 15.3% from

RMB665.8 million for the corresponding period in 2022.

-

Commission costs were RMB553.1 million

(US$80.5million) for the first quarter of 2023, representing an

increase of 22.7% from RMB450.7 million for the corresponding

period in 2022.

-

Commission costs for agency business were RMB487.4

million (US$71.0 million) for the first quarter of 2023,

representing an increase of 27.1% from RMB383.4 million for the

corresponding period in 2022.

-

Costs of the life insurance business were RMB456.6

million (US$66.5 million) for the first quarter of 2023,

representing an increase of 25.6% from RMB363.5 million for the

corresponding period in 2022. The increase was mainly attributable

to the commission cost associated with and incurred by new

acquisitions which were completed in the first quarter of 2023. Our

cost increased faster than revenues, primarily due to the managing

general agency platform model adopted by one of the newly acquired

entity, under which it earns a relatively lower gross profit than

our self-operated business. Costs incurred by the life insurance

business accounted for 82.5% of our total commission costs in the

first quarter of 2023, as compared to 80.7% in the same period of

2022.

-

Costs of the P&C insurance business were

RMB30.8 million (US$4.5 million) for the first quarter of 2023,

representing an increase of 54.8% from RMB19.9 million for the

corresponding period in 2022. The costs of the P&C insurance

business mainly represent commission costs we incurred for

operating Baowang (www.baoxian.com) and brokerage business. Costs

incurred by the P&C insurance business accounted for 5.6% of

our total commission costs in the first quarter of 2023, as

compared to 4.4% in the same period of 2022.

- Costs

of claims adjusting business were RMB65.8 million (US$9.6

million) for the first quarter of 2023, representing a decrease of

2.1% from RMB67.2 million for the corresponding period in 2022.

Costs incurred by the claims adjusting business accounted for 11.9%

of our total costs in the first quarter of 2023, as compared to

14.9% in the same period of 2022.

-

Selling expenses were RMB66.5 million (US$9.7

million) for the first quarter of 2023, representing a decrease of

11.2% from RMB74.9 million for the corresponding period in 2022.

The decrease was due to cost savings from personnel optimization

and decreased rental costs of our sales outlets, partially offset

by the increase in sales events and the recognition of RMB2.7

million (US$0.4 million) share-based compensation expenses related

to shares options granted to MDRT members from sales teams under

the Company’s MDRT Share Incentive Plan in the first quarter of

2023.

-

General and administrative expenses were RMB147.7

million (US$21.5 million) for the first quarter of 2023,

representing an increase of 5.3% from RMB140.2 million for the

corresponding period in 2022. The increase was mainly contributed

by the acquisitions completed in the first quarter of 2023

amounting to approximately RMB17.6 million offset by savings from

personnel optimization and decrease in the number of branches since

2022.

As a result of the foregoing factors, we

recorded operating income of RMB60.4 million

(US$8.8 million) for the first quarter of 2023, representing an

increase of 193.1% from RMB20.6 million for the corresponding

period in 2022.

Non-GAAP operating income was

RMB63.5 million (US$9.2 million) for the first quarter of 2023,

representing an increase of 208.3% from RMB20.6 million for the

corresponding period in 2022.

Operating margin was 7.3% for

the first quarter of 2023, compared to 3.0% for the corresponding

period in 2022.

Investment income was RMB12.6

million (US$1.8 million) for the first quarter of 2023,

representing an increase of 207.3% from RMB4.1 million for the

corresponding period in 2022. The investment income in the first

quarter of 2023 consisted of yields from short-term investments in

financial products, and is recognized when the investment matures

or is disposed of.

Income tax expense was RMB18.1

million (US$2.6 million) for the first quarter of 2023,

representing an increase of 187.3% from RMB6.3 million for the

corresponding period in 2022. The effective tax rate for the first

quarter of 2023 was 22.9% compared with 18.0% for the corresponding

period in 2022.

Net income was RMB60.5 million

(US$8.8 million) for the first quarter of 2023, as compared to net

loss of RMB41.7 million for the corresponding period in 2022.

Net income attributable to the Company’s

shareholders was RMB60.5 million (US$8.8 million) for the

first quarter of 2023, as compared to net loss attributable to the

Company’s shareholders of RMB37.8 million for the corresponding

period in 2022.

Non-GAAP net income attributable to the

Company’s shareholders2 was RMB63.6

million (US$9.3 million) for the first quarter of 2023,

representing an increase of 57.2% as compared to RMB40.4 million

for the corresponding period in 2022.

Net margin was 7.3% for the

first quarter of 2023, as compared to negative 5.5% for the

corresponding period in 2022.

Non-GAAP net margin6 was 7.7%

for the first quarter of 2023, as compared to 5.9% for the

corresponding period in 2022.

Basic and diluted net income per

ADS were RMB1.13 (US$0.16) and RMB1.13 (US$0.16) for the

first quarter of 2023, respectively, as compared to basic and

diluted net loss per ADS RMB0.70 and RMB0.70 for the corresponding

period in 2022, respectively.

Non-GAAP

basic7 and diluted net income per

ADS4 were RMB1.18 (US$0.17) and RMB1.18

(US$0.17) for the first quarter of 2023, respectively, as compared

to RMB0.75 and RMB0.75 for the corresponding period in 2022,

respectively.

As of March 31, 2023, the Company had RMB1,654.2

million (US$240.9 million) in cash, cash

equivalents, short-term investments and others.

The amount included short term loans to third parties of RMB183.2

million as recorded in other receivables and an advance payment of

RMB200.0 million for the purchase of short-term investment products

as recorded in other current assets.

Fanhua’s Insurance Sales and Service

Distribution Network:

- The

number of performing agents for selling life insurance products was

6,941 in the first quarter of 2023, compared to 9,371 in the same

period of 2022. Insurance premiums facilitated per performing

agents for selling life insurance products were RMB82,448 in the

first quarter of 2023, representing a growth of 95.1%

year-over-year from RMB42,261 in the same period of 2022.

- The

decrease in the number of performing agents was primarily due to

the Company’s shifted focus to serving high-end customers and

high-performing agents and maintaining an elite-based agent pool.

The decrease was mainly due to the decrease in the number of

low-performing agents while the number of elite agents increased in

the same period, which led to the sharp increase in premiums

facilitated per performing agents.

- As of

March 31, 2023, Fanhua had 2,063 in-house claims adjustors as

compared with 2,174 in-house claims adjustors as of March 31, 2022.

Fanhua’s distribution network consisted of 631 sales outlets in 24

provinces and 92 services outlets in 31 provinces as of March 31,

2023, compared with 717 sales outlets in 23 provinces and 109

service outlets in 31 provinces as of March 31, 2022.

Recent Developments

- As of

March 31, 2023, eHuzhu, our online mutual aid platform which serves

to provide alternative risk-protection programs to lower-income

group at more affordable costs, have approximately 1.8 million

paying members8 and assisted 11,862 families in raising

approximately RMB1.3 billion to cover their medical costs and help

them get through tough times.

Business Outlook

Fanhua expects its non-GAAP operating income

adjusted for share-based compensation expenses to be no less than

RMB46 million for the second quarter of 2023. Fanhua reaffirms its

full year life insurance first year premiums target of no less than

RMB3.7 billion for 2023, representing a year-over-year growth of

50% and non-GAAP operating income target of no less than RMB253

million for 2023, representing a year-over-year growth of 50%. This

forecast is based on the current market conditions and reflects

Fanhua’s preliminary estimate, which is subject to change caused by

various factors.

Conference Call

The Company will host a conference call to

discuss its first quarter 2023 financial results as per the

following details.

Time: 9:00 p.m. Eastern Daylight Time on June 5, 2023

or 9:00 a.m. Beijing/Hong Kong Time on June

6, 2023

Please pre-register online in advance to join

the conference call by navigating to the link provided below and

dial in 10 minutes before the call is scheduled to begin.

Conference call details will be provided upon registration.

Conference Call Preregistration:

https://register.vevent.com/register/BI858e6e49b05c4b44a667fed864942a88

Additionally, a live and archived webcast of the conference call

will be available at Fanhua’s investor relations website:

https://edge.media-server.com/mmc/p/ecbdzyh4

About Fanhua Inc.

Driven by its digital technologies and

professional expertise in the insurance industry, Fanhua Inc. is

the leading independent financial service provider in China,

focusing on providing insurance-oriented family asset allocation

services that covers customers’ full lifecycle and a one-stop

service platform for individual sales agents and independent

insurance intermediaries.

With strategic focus on long-term life insurance

products, we offer a broad range of insurance products, claims

adjusting services and various value-added services to meet

customers’ diverse needs, through an extensive network of digitally

empowered sales agents and professional claims adjustors. We also

operate Baowang (www.baoxian.com), an online insurance platform

that provides customers with a one-stop insurance shopping

experience.

As of March 31, 2023, our distribution and

service network consisted of 631 sales outlets covering 24

provinces, autonomous regions and centrally-administered

municipalities and 92 service outlets covering 31 provinces.

For more information about Fanhua Inc., please visit

http://ir.fanhuaholdings.com/.

Forward-looking Statements

This press release contains statements of a

forward-looking nature. These statements, including the statements

relating to the Company’s future financial and operating results,

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management’s quotations and

the Business Outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about Fanhua and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to its ability to attract and retain

productive agents, especially entrepreneurial agents, its ability

to maintain existing and develop new business relationships with

insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the

Chinese insurance industry, its ability to compete effectively

against its competitors, quarterly variations in its operating

results caused by factors beyond its control and macroeconomic

conditions in China, future development of COVID-19 outbreak and

their potential impact on the sales of insurance products. Except

as otherwise indicated, all information provided in this press

release speaks as of the date hereof, and Fanhua undertakes no

obligation to update any forward-looking statements to reflect

subsequent occurring events or circumstances, or changes in its

expectations, except as may be required by law. Although Fanhua

believes that the expectations expressed in these forward-looking

statements are reasonable, it cannot assure you that its

expectations will turn out to be correct, and investors are

cautioned that actual results may differ materially from the

anticipated results. Further information regarding risks and

uncertainties faced by Fanhua is included in Fanhua’s filings with

the U.S. Securities and Exchange Commission, including its annual

report on Form 20-F.

About Non-GAAP Financial Measures

In addition to the Company’s consolidated

financial results under generally accepted accounting principles in

the United States (“GAAP”), the Company also provides non-GAAP

operating income,non-GAAP net income attributable to the Company’s

shareholders, non-GAAP net margin and non-GAAP basic and diluted

net income per ADS, all of which are non-GAAP financial measures,

as supplemental measures to review and assess operating

performance. Non-GAAP operating income is defined as income of

operation before share-based compensation expenses. Non-GAAP net

income attributable to the Company’s shareholders is defined as net

income attributable to the Company’s shareholders before impairment

on investment in an affiliate and share-based compensation

expenses. Non-GAAP net margin is defined as non-GAAP net income

attributable to the Company's shareholders as a percentage of net

revenues. Non-GAAP basic net income per ADS is defined as non-GAAP

net income attributable to the Company’s shareholders divided by

total weighted average number of ADSs of the Company outstanding

during the period. Non-GAAP diluted net income per ADS is defined

as non-GAAP net income attributable to the Company’s shareholders

divided by total weighted average number of diluted ADSs of the

Company outstanding during the period. The Company believes that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing the Company’s performance

and when planning and forecasting future periods. The Company’s

non-GAAP financial measures do not reflect all items of income and

expenses that affect the Company’s operations. Specifically, the

Company’s non-GAAP measures exclude impairment on investment in an

affiliate and share-based compensation expenses. Further, these

non-GAAP financial measures may not be comparable to similarly

titled measures presented by other companies, including peer

companies. The presentation of these non-GAAP financial measures

has limitations as analytical tools, and investors should not

consider them in isolation from, or as a substitute for analysis

of, the financial information prepared and presented in accordance

with GAAP. We encourage investors and other interested persons to

review our financial information in its entirety and not rely on a

single financial measure.

For more information on these non-GAAP financial

measures, please see the tables captioned “Reconciliations of GAAP

Financial Measures to Non-GAAP Financial Measures” set forth at the

end of this press release.

|

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Balance Sheets (In

thousands) |

|

|

|

|

|

|

As of December 31, |

|

As of March 31, |

|

As of March 31, |

|

|

|

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

ASSETS: |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

567,525 |

|

574,565 |

|

83,663 |

|

|

Restricted cash |

59,957 |

|

63,469 |

|

9,242 |

|

|

Short term investments |

347,754 |

|

696,401 |

|

101,404 |

|

|

Accounts receivable, net |

667,554 |

|

776,349 |

|

113,045 |

|

|

Other receivables |

231,049 |

|

286,523 |

|

41,721 |

|

|

Other current assets |

419,735 |

|

232,743 |

|

33,890 |

|

|

Total current assets |

2,293,574 |

|

2,630,050 |

|

382,965 |

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

Restricted bank deposit – non-current |

20,729 |

|

22,747 |

|

3,312 |

|

|

Contract assets, net - non-current |

385,834 |

|

484,345 |

|

70,526 |

|

|

Property, plant, and equipment, net |

98,459 |

|

96,654 |

|

14,074 |

|

|

Goodwill and intangible assets, net |

109,997 |

|

481,300 |

|

70,083 |

|

|

Deferred tax assets |

20,402 |

|

31,958 |

|

4,653 |

|

|

Investment in affiliates |

4,035 |

|

3,704 |

|

539 |

|

|

Other non-current assets |

11,400 |

|

20,042 |

|

2,918 |

|

|

Right of use assets |

145,086 |

|

132,867 |

|

19,347 |

|

|

Total non-current assets |

795,942 |

|

1,273,617 |

|

185,452 |

|

|

Total assets |

3,089,516 |

|

3,903,667 |

|

568,417 |

|

|

Current liabilities: |

|

|

|

|

Short-term loan |

35,679 |

|

208,895 |

|

30,417 |

|

|

Accounts payable |

436,784 |

|

593,920 |

|

86,481 |

|

|

Insurance premium payables |

16,580 |

|

17,488 |

|

2,546 |

|

|

Other payables and accrued expenses |

174,326 |

|

227,286 |

|

33,095 |

|

|

Accrued payroll |

96,279 |

|

94,942 |

|

13,825 |

|

|

Income tax payable |

130,024 |

|

125,235 |

|

18,236 |

|

|

Current operating lease liability |

62,304 |

|

58,409 |

|

8,505 |

|

|

Total current liabilities |

951,976 |

|

1,326,175 |

|

193,105 |

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

Accounts payable – non-current |

192,917 |

|

173,505 |

|

25,264 |

|

|

Other tax liabilities |

36,647 |

|

35,650 |

|

5,191 |

|

|

Deferred tax liabilities |

102,455 |

|

131,365 |

|

19,128 |

|

|

Non-current operating lease liability |

74,190 |

|

67,835 |

|

9,878 |

|

|

Total non-current liabilities |

406,209 |

|

408,355 |

|

59,461 |

|

|

Total liabilities |

1,358,185 |

|

1,734,530 |

|

252,566 |

|

|

|

|

|

|

|

Ordinary shares |

8,091 |

|

8,675 |

|

1,263 |

|

|

Treasury stock |

(10 |

) |

(10 |

) |

(1 |

) |

|

Additional Paid-in capital |

461 |

|

213,980 |

|

31,158 |

|

|

Statutory reserves |

559,520 |

|

559,520 |

|

81,472 |

|

|

Retained earnings |

1,087,984 |

|

1,148,436 |

|

167,225 |

|

|

Accumulated other comprehensive loss |

(32,643 |

) |

(33,350 |

) |

(4,856 |

) |

|

Total shareholders’ equity |

1,623,403 |

|

1,897,251 |

|

276,261 |

|

|

Non-controlling interests |

107,928 |

|

271,886 |

|

39,590 |

|

|

Total equity |

1,731,331 |

|

2,169,137 |

|

315,851 |

|

|

Total liabilities and equity |

3,089,516 |

|

3,903,667 |

|

568,417 |

|

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Income and Comprehensive Income

(In thousands, except for shares and per

share data) |

|

|

|

|

For the Three Months Ended |

|

|

March 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

USD |

|

|

Net revenues: |

|

|

|

|

Agency |

587,988 |

|

725,552 |

|

105,649 |

|

|

Life insurance business |

558,574 |

|

683,402 |

|

99,511 |

|

|

P&C insurance business |

29,414 |

|

42,150 |

|

6,138 |

|

|

Claims adjusting |

98,399 |

|

102,185 |

|

14,879 |

|

|

Total net revenues |

686,387 |

|

827,737 |

|

120,528 |

|

|

Operating costs and expenses: |

|

|

|

|

Agency |

(383,443 |

) |

(487,367 |

) |

(70,966 |

) |

|

Life insurance Business |

(363,527 |

) |

(456,616 |

) |

(66,488 |

) |

|

P&C insurance Business |

(19,916 |

) |

(30,751 |

) |

(4,478 |

) |

|

Claims adjusting |

(67,249 |

) |

(65,753 |

) |

(9,574 |

) |

|

Total operating costs |

(450,692 |

) |

(553,120 |

) |

(80,540 |

) |

|

Selling expenses |

(74,868 |

) |

(66,521 |

) |

(9,686 |

) |

|

General and administrative expenses |

(140,238 |

) |

(147,741 |

) |

(21,513 |

) |

|

Total operating costs and expenses |

(665,798 |

) |

(767,382 |

) |

(111,739 |

) |

|

Income from operations |

20,589 |

|

60,355 |

|

8,789 |

|

| Other income, net: |

|

|

|

|

Investment income |

4,054 |

|

12,632 |

|

1,839 |

|

|

Interest income |

679 |

|

5,327 |

|

776 |

|

|

Financial cost |

— |

|

(1,959 |

) |

(285 |

) |

|

Others, net |

9,973 |

|

2,542 |

|

370 |

|

|

Income from operations before income taxes and share income

of affiliates |

35,295 |

|

78,897 |

|

11,489 |

|

|

Income tax expense |

(6,348 |

) |

(18,087 |

) |

(2,634 |

) |

|

Share of income (loss) of affiliates, net of impairment |

(70,634 |

) |

(331 |

) |

(48 |

) |

|

Net (loss) income |

(41,687 |

) |

60,479 |

|

8,807 |

|

|

Less: net (loss) income attributable to non-controlling

interests |

(3,849 |

) |

27 |

|

4 |

|

| Net (loss) income

attributable to the Company’s shareholders |

(37,838 |

) |

60,452 |

|

8,803 |

|

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Income and Comprehensive

Income-(Continued) (In thousands,

except for shares and per share

data) |

|

|

| |

For The Three Months Ended |

| |

December 31, |

| |

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

Net (loss) income per share: |

|

|

|

|

Basic |

(0.04 |

) |

0.06 |

|

0.01 |

|

|

Diluted |

(0.04 |

) |

0.06 |

|

0.01 |

|

|

Net (loss) income per ADS: |

|

|

|

|

Basic |

(0.70 |

) |

1.13 |

|

0.16 |

|

|

Diluted |

(0.70 |

) |

1.13 |

|

0.16 |

|

|

Shares used in calculating net income per

share: |

|

|

|

|

Basic |

1,073,994,006 |

|

1,073,981,523 |

|

1,073,981,523 |

|

|

Diluted |

1,073,994,006 |

|

1,074,400,371 |

|

1,074,400,371 |

|

| Net (loss)

income |

(41,687 |

) |

60,479 |

|

8,807 |

|

|

Other comprehensive income, net of tax: Foreign currency

translation adjustments |

90 |

|

(887 |

) |

(129 |

) |

|

Share of other comprehensive loss of affiliates |

(413 |

) |

— |

|

— |

|

|

Unrealized net (loss) gains on available-for-sale investments |

(5,112 |

) |

180 |

|

26 |

|

| Comprehensive (loss)

income |

(47,122 |

) |

59,772 |

|

8,704 |

|

|

Less: Comprehensive (loss) income attributable to the

non-controlling interests |

(3,849 |

) |

27 |

|

4 |

|

|

Comprehensive (loss) income attributable to the Company’s

shareholders |

(43,273 |

) |

59,745 |

|

8,700 |

|

|

|

|

FANHUA INC.Unaudited Condensed

Consolidated Statements of Cash Flow

(In thousands, except for shares and per

share data) |

|

|

|

|

For the Three Months Ended |

|

|

March 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

OPERATING ACTIVITIES |

|

|

|

|

Net (loss) income |

(41,687 |

) |

60,479 |

|

8,807 |

|

| Adjustments to

reconcile net income to net cash generated from operating

activities: |

|

|

|

|

Investment income |

(1,649 |

) |

(3,529 |

) |

(514 |

) |

|

Share of income of affiliates |

70,634 |

|

331 |

|

48 |

|

| Other

non-cash adjustments |

35,655 |

|

30,294 |

|

4,411 |

|

|

Changes in operating assets and liabilities |

(150,027 |

) |

(106,311 |

) |

(15,480 |

) |

| Net cash used in

operating activities |

(87,074 |

) |

(18,736 |

) |

(2,728 |

) |

|

Cash flows from investing activities: |

|

|

|

|

Purchase of short-term investments |

(855,000 |

) |

(615,030 |

) |

(89,555 |

) |

|

Proceeds from disposal of short-term investments |

1,068,447 |

|

461,333 |

|

67,175 |

|

| Cash

acquired from business acquisitions |

— |

|

21,208 |

|

3,088 |

|

|

Others |

(61,764 |

) |

(1,950 |

) |

(284 |

) |

|

Net cash generated from (used in) investing

activities |

151,683 |

|

(134,439 |

) |

(19,576 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Proceeds from bank and other borrowings |

— |

|

170,268 |

|

24,793 |

|

|

Interests paid |

— |

|

(1,703 |

) |

(248 |

) |

|

Acquisition of additional equity interests in non-wholly owned

subsidiaries |

— |

|

(110 |

) |

(16 |

) |

|

Others |

3 |

|

— |

|

— |

|

|

Net cash generated from financing activities |

3 |

|

168,455 |

|

24,529 |

|

|

Net increase in cash, cash equivalents and restricted

cash |

64,612 |

|

15,280 |

|

2,225 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

656,522 |

|

648,211 |

|

94,387 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

254 |

|

(2,710 |

) |

(395 |

) |

|

Cash, cash equivalents and restricted cash at end of

period |

721,388 |

|

660,781 |

|

96,217 |

|

|

|

|

FANHUA INC.Reconciliations of GAAP

Financial Measures to Non-GAAP Financial Measures

(In RMB in thousands, except shares and per share

data) |

|

|

| |

For the Three Months Ended March 31, |

| |

2022 |

|

2023 |

|

|

|

|

GAAP |

|

Impairment on investment in affiliates |

|

Share-based Compensation expenses |

|

Non-GAAP |

|

GAAP |

|

Impairment on investment in affiliates |

Share-based Compensation expenses |

|

Non-GAAP |

|

Change% |

|

|

Net revenues |

686,387 |

|

— |

|

— |

|

686,387 |

|

827,737 |

|

— |

— |

|

827,737 |

|

20.6 |

|

|

Selling expenses |

(74,868 |

) |

— |

|

— |

|

(74,868 |

) |

(66,521 |

) |

— |

(2,685 |

) |

(63,836 |

) |

(14.7 |

) |

|

General and administrative expenses |

(140,238 |

) |

— |

|

— |

|

(140,238 |

) |

(147,741 |

) |

— |

(434 |

) |

(147,307 |

) |

5.0 |

|

|

Income from operations |

20,589 |

|

— |

|

— |

|

20,589 |

|

60,355 |

|

— |

(3,119 |

) |

63,474 |

|

208.3 |

|

|

Operating margin |

3.0% |

|

|

|

|

3.0% |

|

7.3% |

|

|

|

7.7% |

|

155.6 |

|

| Share

of income and impairment of affiliates, net |

(70,634 |

) |

(78,277 |

) |

— |

|

7,643 |

|

(331 |

) |

— |

— |

|

(331 |

) |

(104.3 |

) |

| Net

income attributable to the Company’s shareholders |

(37,838 |

) |

(78,277 |

) |

— |

|

40,439 |

|

60,452 |

|

— |

(3,119 |

) |

63,571 |

|

57.2 |

|

| Net

margin |

(5.5% |

) |

|

|

|

5.9% |

|

7.3% |

|

|

|

7.7% |

|

30.4 |

|

| Net

income per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

(0.04 |

) |

— |

|

— |

|

0.04 |

|

0.06 |

|

|

|

0.06 |

|

50.0 |

|

|

Diluted |

(0.04 |

) |

— |

|

— |

|

0.04 |

|

0.06 |

|

|

|

0.06 |

|

50.0 |

|

| Net

income per ADS: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

(0.70 |

) |

— |

|

— |

|

0.75 |

|

1.13 |

|

|

|

1.18 |

|

57.3 |

|

|

Diluted |

(0.70 |

) |

— |

|

— |

|

0.75 |

|

1.13 |

|

|

|

1.18 |

|

57.3 |

|

|

Shares used in calculating net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

1,073,994,006 |

|

|

— |

|

1,073,994,006 |

|

1,073,981,523 |

|

|

|

1,073,981,523 |

|

|

|

Diluted |

1,073,994,006 |

|

|

— |

|

1,073,994,006 |

|

1,074,400,371 |

|

|

|

1,074,400,371 |

|

|

|

1 |

This announcement contains currency conversions of certain Renminbi

(“RMB”) amounts into U.S. dollars (US$) at specified rate solely

for the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB6.8676 to US$1.00, the effective noon buying rate as of March

31, 2023 in The City of New York for cable transfers of RMB as set

forth in the H.10 weekly statistical release of the Federal Reserve

Board. |

|

2 |

Non-GAAP operating income is defined as income of operation before

share-based compensation expenses. |

|

3 |

Non-GAAP net income attributable to the Company’s shareholders is

defined as net income attributable to the Company’s shareholders

before share-based compensation expenses and impairment on

investment in an affiliate. |

|

4 |

Non-GAAP diluted net income per ADS is defined as non-GAAP net

income attributable to the Company’s shareholders divided by total

weighted average number of diluted ADSs of the Company outstanding

during the period. |

|

5 |

This amount includes short term loans to third parties of RMB183.2

million as recorded in other receivables and an advance payment of

RMB200.0 million. |

|

6 |

Non-GAAP net margin is defined as non-GAAP net income attributable

to the Company's shareholders as a percentage of net revenues |

|

7 |

Non-GAAP basic net income per ADS is defined as non-GAAP net income

attributable to the Company’s shareholders divided by total

weighted average number of ADSs of the Company outstanding during

the period. |

|

8 |

Including approximately 1.0 million paying members for cancel

coverage plan and approximately 0.8 million paying members for

accidental death coverage plan. |

For more information, please contact:

Investor Relations

Tel: +86 (20) 8388-3191

Email: qiusr@fanhuaholdings.com

Source: Fanhua Inc.

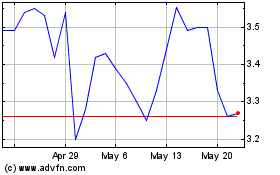

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Apr 2024 to May 2024

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From May 2023 to May 2024