UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023

COMMISSION FILE NUMBER 001-34041

Evotec

SE

(Translation of registrant’s name into English)

Essener Bogen 7

22419 Hamburg

Germany

Tel:

+49 40 560810

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F: Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On August 29, 2023, Evotec SE (the “Company”)

issued a press release announcing the Company’s financial results and business updates for the first half of 2023 attached hereto

as Exhibit 99.1.

Exhibit 99.2 and Exhibit 99.3 to this report on Form 6-K,

respectively the Amended Form of U.S. Restricted Share Unit Plan and Amended Form of U.S. Restricted Share Unit Plan Award

Agreement, are incorporated by reference into the registration statement on Form S-8 (File No. 333-265727), and shall be deemed

to be part thereof from the date on which this current report is furnished to the SEC, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of s the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Evotec

SE |

| |

|

|

| |

|

|

| |

By: |

/s/

Laetitia Rouxel |

| |

|

Name:

Laetitia Rouxel |

| |

|

Title:

Chief Financial Officer |

Date: August 29, 2023

EXHIBIT INDEX

Exhibit 99.1

| For further information, please

contact: Volker Braun, SVP Head of Global Investor Relations & ESG,

volker.braun@evotec.com, M. +49.(0)151.1940 5058, www.evotec.com | |

|

HALF-YEAR

REPORT 2023 |

|

| |

I.

MANAGEMENT REPORT

| 4 | NEW

AND EXTENDED ALLIANCES underline PIPELINE POTENTIAL |

| 4 | NEW

GUIDANCE For full-year 2023 confIRMED |

HIGHLIGHTS

Q2

CYBER-incident IMPACTING STRONG organic REVENUE GROWTH

| 4 | Group

revenues increased by 14% to € 383.8 m (H1 2022: € 336.9 m) driven by strong demand for base business

and successful partnering activities; like-for-like revenue growth (excluding fx-effects and M&A effects) 14%, thereof € 36.9 m

coming from the new Biologics partnership in Q2. |

| 4 | Costs

of € 39.3 m were incurred in Q2 as a direct result of the cyber-incident, including additional expenditures and underutilised

capacities. |

| 4 | Total

EVT Execute revenues (incl. intersegment revenues) up 2% to € 356.6 m (H1 2022: € 351.0 m), strongly affected

by cyber-incident; EVT Innovate revenues up 66% to € 129.7 m (H1 2022: € 78.0 m) |

| 4 | Adjusted

Group EBITDA totalled € 26.1 m (H1 2022: € 33.6 m); delivery of Sandoz work packages and Bristol-Myers

Squibb (“BMS”) collaboration yield excellent gross margin, partially compensating for underutilised capacities as a result

of the cyber-incident. |

new

and extended alliances reflect success of growth strategy “ACTION PLAN 2025”

| 4 | New

significant collaboration announced with Janssen |

| 4 | Extension

and expansion of strategic neurodegeneration partnership with BMS, and strong progress in strategic targeted protein degradation partnership

with BMS |

| 4 | Validation

of Just – Evotec Biologics’ strategy, new agreements with Sandoz and the U.S. Department of Defense (after period-end) |

| 4 | Milestone

payment received with first patient dosed in Phase I study of Bayer kidney disease program |

|

HALF-YEAR

REPORT 2023 |

|

| |

Business

Outlook for Full-Year 2023 reflecting CYBER-ATTACk;

mid-term

goals 2025 Confirmed

| 4 | Group

revenues expected to be in a range of € 750 – 790 m (€ 765 – 805 m at constant exchange rates) (2022: € 751 m)

in FY 2023 |

| 4 | Adjusted

Group EBITDA guidance range between € 60 – 80 m (€ 70 – 90 m at constant exchange rates) (2022: € 102 m) |

| 4 | Unpartnered

research and development expenses expected to be in a range of € 60 – 70 m (2022: € 70 m) |

| | |

Guidance 2023 | |

Guidance

2023

at constant fx1) | |

Actual

31 December 20222) |

| Group revenues | |

€ 750 – 790 m | |

€ 765 – 805 m | |

€ 751 m |

| Unpartnered R&D expenses | |

€ 60 – 70 m | |

- | |

€ 70 m |

| Adjusted Group EBITDA | |

€ 60 - 80 m | |

€ 70 - 90 m | |

€ 102 m |

1) Average exchange rate

euro vs. US Dollar for 2023: 1.0530

2) Including effects related

the M&A (Rigenerand, Central Glass)

| 4 | Mid-term

goals target revenue growth to > € 1,000 m, adjusted EBITDA of ≥ € 300 m and unpartnered

research and development expenses of > € 100 m |

Due to the criminal cyber-attack

discovered on 6 April 2023, productivity was affected throughout the entire second quarter. In response to the criminal cyber-attack,

Evotec took immediate action to contain and remediate the attack by taking its external-facing systems offline. This was deemed necessary

to protect all the Company’s partners and stakeholders and meant Evotec could ensure that integrity of scientific data remained

unaffected. The Company re-started operations at the end of April with productivity reaching approx. 50% in May and more than

80% in June.

|

HALF-YEAR

REPORT 2023 |

|

| |

Financial

Highlights

The following table provides an initial

overview of the financial performance in the first half-year 2023 compared to the same period in 2022. More detailed information can

be found from page 6 of this report.

Key figures of unaudited consolidated

income statement & segment information

Evotec SE & subsidiaries – First half-year 2023

| In k€ | |

Evotec

Group

H1 2023 | | |

Evotec

Group

H1 2022 | |

| Revenues1) | |

| 383,835 | | |

| 336,875 | |

| Intersegment revenues | |

| – | | |

| – | |

| Costs of revenue | |

| (284,275 | ) | |

| (273,685 | ) |

| Gross profit | |

| 99,560 | | |

| 63,190 | |

| Gross margin in % | |

| 25.9 | % | |

| 18.8 | % |

| | |

| | | |

| | |

| R&D expenses2) | |

| (30,863 | ) | |

| (36,838 | ) |

| SG&A expenses | |

| (88,192 | ) | |

| (67,379 | ) |

| Other operating income (expenses), net | |

| (4,278 | ) | |

| 37,738 | |

| Net operating income (loss) | |

| (23,773 | ) | |

| (3,307 | ) |

1) Adjusted for exchange

rate effects of € 0.8 m, Group revenues would have amounted to € 383.0 m

2) Includes unpartnered

R&D expenses of € 29.0 m € in H1 2023 (H1 2022: € 33.3 m)

The following table details Evotec’s

segment revenues and operating income (loss) for the six months ended 30 June 2023

| In T€ | |

EVT

Execute | | |

EVT

Innovate | | |

Intersegment

Eliminations | | |

Evotec Group

6M 2023 | |

| Revenues | |

| 254,150 | | |

| 129,685 | | |

| (102,445 | ) | |

| 383,835 | |

| Operating result | |

| (24,708 | ) | |

| 934 | | |

| – | | |

| (23,773 | ) |

|

HALF-YEAR

REPORT 2023 |

|

| |

Operational

Highlights

Signing of new and extended drug

discovery and development agreements

In the first half-year of 2023, Evotec

continued to further expand its operational activities based on its fully integrated End-to-End shared R&D and precision medicine

platforms. Despite the cyber-attack, the Company entered into several new partnerships and extended existing alliances across the various

stages of drug discovery and development e.g.:

| · | In

January, Evotec announced a new strategic collaboration and licence agreement with Janssen

focussing on the development of first-in-class targeted immune-based therapies for oncology.

Besides research funding, Evotec is entitled to an undisclosed upfront payment, success-based

research and commercial milestones exceeding US$ 350 m over a minimum of 3 years, as well

as tiered royalties on products resulting from the collaboration. |

| · | In

February, Evotec extended and expanded its integrated multi-target drug discovery agreement

with Related Sciences to continue to grow the joint portfolio of drug development

candidates through 2030, leveraging Evotec’s industry-leading capabilities across the

full R&D continuum. |

| · | In

March, Evotec announced key scientific progress in the targeted protein degradation alliance

with BMS, first signed in 2018. Performance-based and programme-based achievements

triggered payments of in total US$ 72.6 m to Evotec. |

| · | Also

in March, Evotec and BMS extended and expanded their neurodegeneration partnership,

originally signed in 2016 for an additional 8 years. Evotec received a US$ 50 m upfront payment,

undisclosed license, and performance milestone payments, as well as tiered royalties of up

to low double-digit percentages on product sales. Including the upfront and downstream performance

milestone payments, the overall transaction results in a deal value of US$ 4 bn with revenue

recognized over the lie of the contract. |

Just – Evotec Biologics:

Validation of paradigm shift in biologics manufacturing

Just – Evotec Biologics, while

still in start-up and investment phase, has demonstrated its strategic potential through newly signed agreements and ongoing discussions

from discovery through process development to clinical and commercial supply.

| · | In

May, Just – Evotec Biologics and Sandoz launched a multi-year, long-term tech

partnership for the immediate development and subsequent manufacturing of multiple biosimilars.

Just – Evotec Biologics will receive a double-digit-million upfront and future payments

US$ 640 m dependent on successful development progress of as well as additional payments

dependent on progress into commercial manufacturing. |

| · | In

June, the successful installation of multiple cleanroom PODs significantly advanced the construction

of J.POD Toulouse, France (EU). The strategic investment in this platform expansion

will make Just – Evotec Biologics’ J.POD technology, with its cost-effective

and flexible clinical and commercial supply solutions for biomanufacturing available for

the first time in Europe. |

| · | On

5 July 2023 (after period-end), the U.S. Department of Defense (“DOD”)

awarded Just – Evotec Biologics a second contract under the accelerated antibodies

program valued up to US$ 74 m for the rapid development of monoclonal antibody (“mAb”)

-based drug product prototypes targeting orthopoxviruses. |

|

HALF-YEAR

REPORT 2023 |

|

| |

Co-owned pipeline projects progressing

well.

| · | In

June, Evotec received a € 2 m milestone payment from Bayer which was triggered

by the first patient dosed in the clinical Phase I study of a kidney disease programme stemming

from the Evotec-Bayer multi-target research collaboration in kidney diseases. The drug candidate,

a monoclonal antibody targeting the protein Semaphorin-3A (“Sema3A”) is being

developed as a potential first-to-market treatment for Alport syndrome, a rare genetic kidney

disease. |

New funding for long-term growth

| · | In

February, Evotec and the European Investment Bank (“EIB”) finalized an

agreement for an unsecured loan facility that includes a low fixed interest rate plus a reward-sharing

component for the EIB. The loan will be invested over a period of three years and each tranche

will mature seven years after drawing down. Evotec will use the loan, with a total volume

of up to € 150 m, to fund its internal R&D activities, equity investments,

as well as the new biologics manufacturing facility, J.POD Toulouse, France (EU). |

| · | In

June, Evotec received a US$ 1.7 m grant from Open Philanthropy. Under the grant, Evotec

leverages its RNA-targeting small molecules platform to identify promising RNA sequences

to target with small molecule ligands that can be developed into potentially first-in-class

therapeutics against Henipaviruses. |

Strong start to the year

Prior to the cyber-attack on 6 April,

the Company’s Q1 results remained materially unaffected and represented a strong start to the year. While all efforts were focused

on a fast return to full productivity and business recovery, Q2 saw delays in business operations, of which most are expected to be recovered

in the second half of 2023.

Report

on the Financial Situation and Results

1. Results of operations

Group revenues in the reporting

period increased by 14% or € 47.0 m to € 383.8 m (H1 2022: € 336.9 m). Evotec had a

strong start to the year with revenues of € 213.6 m (Q1 2022: € 164.7 m) and 30% revenue growth in the

first quarter of 2023, driven by robust underlying business dynamics in a challenging environment and payments from BMS after the extensions

and expansions of strategic alliances in targeted protein degradation and neurodegeneration. Due to the criminal cyber-attack on 6 April 2023,

productivity was affected throughout the entire second quarter. In response to the criminal cyber-attack, Evotec took immediate action

to contain and remediate the attack by taking its external-facing systems offline. This was deemed necessary to protect all the Company’s

partners and stakeholders and Evotec could ensure that integrity of scientific data remained unaffected. The Company re-started operations

at the end of April with productivity reaching approx. 50% in May and more than 80% in June leading to a contribution

of € 170.2 m (Q2 2022: € 172.2 m). The second quarter was positively influenced by the recognition

of the delivery of work packages as part of the new Technology-Partnership with Sandoz. Excluding the recognition of minor fx-effects,

Group revenues grew by 14% or € 47.0 m to € 383.8 m within the first 6 months. Growth of the base business

was 14% or € 49.4 m from € 330.1 m in H1 2022 to € 379.5 m in the first six months

of 2023, of which € 212.0 m were generated in Q1 2023 and € 167.5 m in the second quarter of 2023.

In connection with other collaborations, we generated milestone, upfront and license revenues of € 4.3 m (H1 2022:

€ 6.8 m); thereof € 1.6 m achieved between January and March, € 2.7 m from April until June 2023.

Just – Evotec Biologics more than doubled its revenue share year-over-year to € 59.0 m during the six months ended

30 June 2023 (H1 2022: € 21.4 m) which composes of € 11.1 m in Q1 2023 and € 47.9 m

in Q2 2023.

|

HALF-YEAR

REPORT 2023 |

|

| |

Geographically, 26% of Evotec’s

revenues were generated with partners in Germany, France, and UK, 72% with partners in the USA and 2% with partners in the rest of the

world. This compares to 29%, 53% and 17%, respectively, in the same period of the previous year.

The Costs of revenue during the

six months ended 30 June 2023 amounted to € 284.3 m (H1 2022: € 273.7 m) yielding a gross

margin of 25.9% (H1 2022: 18.8%). The significant increase of margin was attributable to recent signed beneficial cooperations and

partnerships with BMS, Sandoz and the milestone payment of € 2 m from Bayer. Excluding Just – Evotec Biologics, total

gross margin amounted to 25.3% vs. 27.3% during the same period last year. The cost of revenues of the group was divided into € 160.3 m

in Q1 2023 (Gross margin: 24.9 %) versus € 124.0 m in Q2 2023 (Gross margin: 27.2 %).

Total R&D expenses decreased

by € 6.0 m or 16% for the six months ended 30 June 2023 to € 30.9 m (H1 2022: € 36.8 m).

The decrease in unpartnered R&D expenses by 11% to € 29.0 m (H1 2022: € 33.3 m) and partnered

R&D expenses by 64% to € 1.9m (H1 2022: € 3.5 m) was primarily related to the impacted business

activity due to the cyber incident in the second quarter leading to a temporary reduction of R&D costs in Q2 2023. to €

12.2 m (Q2 2022: € 18.7 m) after € 18.7 m in Q1 2023 (Q1 2022: € 18.1 m).

In comparison to the same period of

2022, SG&A expenses increased by € 20.8 m or 31% to € 88.2 m (H1 2022: € 67.4 m),

mainly driven by increasing headcount at all sites to sustain the business expansion.and strengthen the end-to-end global processes and

systems.

Other operating income and expenses

amounted in total to € (4.3) m expense (H1 2022: Other operating income of € 37.7 m). The decrease is mainly

resulted from costs related to managing the impact of the cyber-attack in Q2. These costs – which are one-off costs in nature –

related to third party involvement like consultants and legal advisors as well as to work contributed by Evotec staff and totalled to

€ 39.3 m as of 30 June 2023. Internal costs reported under Other operating expenses related mainly to time spent

in IT and other departments on recovering after the cyber-attack. Further, the company recognized € 5.1 m of impairment

on intangible assets.

Less activity in R&D resulted in

a lower than anticipated other operating income from R&D tax credits of € 20.1 m (H1 2022: 19.3 m). Recharges

of Sanofi for ID Lyon amounted to € 16.9 m in H1 2023 (H1 2022: € 16.8 m).

The improvement in net income (loss)

before taxes of € (26.7) m (H1 2022: € (93.1) m) was mainly related to a gain on investment in

equity instruments re-evaluation in the amount of € 5.6 m (H1 2022 € (97.7) m for Evotec’s equity

position in Exscientia plc . In H1 2023, Exscientia's ordinary share price increased by 11% from US$ 5.33 at the end of 2022

to US$ 5.92 as of 30 June 2023.

Adjusted Group EBITDA of the

first six months 2023 totalled at € 26.1 m (H1 2022: € 33.6 m), caused by missed revenues after the

cyber-attack as well as higher costs to manage adverse effects of the incident. Business dynamics were fully intact until 6 April, leading

to a very strong start to the year yielding an EBITDA of € 34.3 m in Q1 2023. One-off burdens in Q2 2023 were partially

mitigated due to the signing of the Technology-Partnership with Sandoz. Still, adjusted EBITDA was negative at € (8.2) m

in Q2 2023.

Just – Evotec Biologics started

ahead of plan mainly based on closing of the Tech-Partnership with Sandoz and a strong overall orderbook, contributing an EBITDA of € 8.5 m

for H1 2023 (Q1 2023: € (11.5) m; Q2 2023: € 20.0 m).

Group net income as of 30 June 2023

amounted to € (28.8) m (H1 2022: € (101.2) m), mainly because of the gain on revaluation of investments

in equity instruments of € 5.6 m versus € (97.7) m in H1 2022 for Evotec’s 14 m shares

in Exscientia plc.

|

HALF-YEAR

REPORT 2023 |

|

| |

2. Progressing convergence of

integrated services

The majority of missed external revenues

€ 70 m (net) were related to EVT Execute while EVT Innovate demonstrated a very strong H1, mainly driven by the progress

in its PanOmics-based partnerships with BMS. Despite material one-off effects, total EVT Execute revenues (incl. intersegment revenues)

increased by 2% to € 356.6 m (H1 2022: € 351.0 m), supported by an increase of revenues of Just –

Evotec Biologics. Intersegment revenues amounted to € 102.4 m (H1 2022: € 92.1 m), which is an indicator

for the convergence of our offering based on our fully integrated platform. Intersegment sales are reflective of the progress of projects

recognised within EVT Innovate where Evotec maintains rights to participate in the success of partnered projects in the future.

EVT Execute recorded costs

of revenue of € 291.4 m in the first six months of 2023 (H1 2022: € 289.8 m), resulting in a gross

margin of 25.7% (H1 2022: 17.4%). EVT Execute gross margin excluding Just – Evotec Biologics (US) would have reached

23.2% in H1 2023, a 210-basis point change compared to 25.3% in the same period 2022. The delta to the total gross margin of EVT

Execute shows the positive contribution of our Biologics business. R&D expenses were € 2.4 m (H1 2022: € 2.6 m),

SG&A expenses increased to € 67.3 m (H1 2022: € 54.1 m) as a mix of increase in headcount and

more consultancy. The impact of the cyber-attack is visible in line with Other operating expense (income), net, which amounted to € 20.2 m

and included internal as well as external costs.

Adjusted EBITDA of the EVT Execute

segment was € 22.6 m, 59% below the previous year level (H1 2022: € 54.7 m) due to loss of operations

as a consequence of the cyber-attack. While the miss of revenues and related costs are considered temporary, preparations for future

growth have been pursued by moderately increasing headcount even in a challenging situation.

The EVT Innovate segment generated

revenues of € 129.7 m (H1 2022: € 78.0 m). This increase of 66% was mainly driven by high base revenues

from the collaborations with BMS.

The EVT Innovate segment incurred costs

of revenue of € 89.5 m (H1 2022: € 68.3 m). Gross margin as a percent of revenue was 31.0%, a significant

increase of 18.6 percentage points compared with H1 2022 (12.4%). The EVT Innovate segment reported R&D expenses of

€ 34.3 m (H1 2022: € 42.0 m) which were below budget due to the cyber-attack in early April. Expanded

business development activities resulted in an increase of SG&A expenses to € 20.9 m (H1 2022: € 13.3 m).

Other operating expense (income), net, decreased from € 22.2 m to € 15.9 m, mainly as a result of the cyber-attack.

The EVT Innovate adjusted EBITDA reached € 3.5 m in H1 2023 (H1 2022: € (21.1) m).

3. Financing and financial position

Cash flow provided by operating activities

in the first six months of 2023 amounted to € (5.2) m (H1 2022: € 240.6 m). The comparable figure

last year was driven by a $ 200 m upfront payment from BMS. In H1 2023, this figure does not yet reflect payments in connection with

the BMS collaboration and the agreement with Sandoz, which were received after the due date on 30 June.

Cash flow from investing activities

for the first six months of 2023 amounted to € 28.8 m (Cash flow used in investing activities in H1 2022: € 206.9 m),

mainly driven by a positive net effect of € 141.6 m from purchase and proceeds of investments. The proceeds from investments were

mainly used to fund the capital expenditures. Capital expenditure amounted to € 104.0 m (H1 2022: € 81.4 m),

of which investments into the J.POD, Toulouse (EU) facility amounted to € 48.3 m. Apart from this growth projects, capital

expenditures include investments focused on Global Drug Discovery (GDD), Drug Discovery Services (DDS), the J.POD Redmond (U.S.) facility,

energy-efficiency improvements and the taken measures after the cyber-attack.

|

HALF-YEAR

REPORT 2023 |

|

| |

Cash flow from financing activities

were € 10.5 m for the first six month against € (45.8) m in H1 2022. Proceeds from new loans amounted

to € 20 m, partly offset by repayments of lease obligations.

Cash and cash equivalents were

€ 459.8 m as of 30 June 2023 (31 December 2022: € 415.2 m). In detail, the cash outflow

from investing activities decreased to € 28.8 m (H1 2022: € (206.9) m), which was more than off-set

by the received pre-payments from the recent extension of partnership with BMS in protein degradation. Consequently, total Liquidity

amounted to € 620.8 m (31 December 2022: € 718.5 m).

4. Assets, liabilities, and stockholders’

equity

Assets

Between 31 December 2022

and 3o June 2023, total assets increased slightly by € 44.0 m to € 2,301.2 m (31 December 2022:

€ 2,257.2 m).

Investments, and other current financial

assets including derivatives amounted to € 173.2 m (31 December 2022: € 314.8 m). This significant

decrease was a result of the sale of current investments as part of the financing of our capacity expansion.

Trade and other receivables increased

in the six months ended 30 June 2023 by € 30.7 m to € 202.5 m (31 December 2022: € 171.8

m), due to the recognition of the new contracts with BMS and Sandoz. As of 30 June, Days Sales Outstanding (DSO) of 96 were significantly

reduced to 62 again in July 2023 after reception of the payments from BMS and Sandoz.

Contract assets and Inventories remained

relatively stable with € 59.1 m versus € 60.3 m as of 31 December 2022.

Current tax assets increased

from € 54.4 m as per 31 December 2022 to € 62.4 m as per 30 June 2023, mainly related

to increased tax credits in Italy.

Prepaid expenses and other current

assets increased by € 12.4 m to € 69.6 m (31 December 2022: € 57.1 m) mainly

due to the increase of VAT receivables.

Property, plant, and equipment

rose by € 70.9 m to € 721.1 m (31 December 2022: € 650.2 m) caused by capital

expenditures for site expansion, exceeding depreciations.

Intangible assets and Goodwill declined

by € 6.0 m compared with 31 December 2022, to € 292.6 m (31 December 2022: € 298.6 m),

primarily due to straight-line amortisation of definite life intangibles and fx-effects.

Non-current tax receivables increased

to € 88.8 m (31 December 2022: € 70.3 m) mainly due to receivables relating to R&D tax credits

in France and Prepayments regarding Corporate Income Tax and Trade Tax in Germany.

Long-term financial investments and

other long-term assets and investments in associates and Joint ventures amounted to € 160.8 m (31 December 2022:

€ 154.1 m). This increase resulted mainly from the revaluation to Evotec’s stake in Exscientia plc.

|

HALF-YEAR

REPORT 2023 |

|

| |

Liabilities

Trade and other payables increased

by € 8.7 m in the six months ended 30 June 2023 to € 106.0 m (31 December 2022: € 97.3 m) in

accordance with the overall business growth.

Provisions decreased by € 6.1 m

to € 48.3 m (31 December 2022: € 54.4 m) due to annual bonus payments in April 2023.

Other current financial liabilities

increased to € 151.6 m (31 December 2022: € 23.5 m) mainly due to reclassification of long-term

financial liabilities.

Current and non-current contract

liabilities increased by € 29.5 m to € 358.6 m (31 December 2022: € 329.1 m)

due to the recognition of the upfront payments from BMS.

Net debt leverage ratio of (3,6)x

adjusted EBITDA, excl. IFRS 16 effect and (0,9)x incl. IFRS 16 improved versus Q4 2022 with reference to the overall positive

net cash position.

Stockholders’ equity

As of 30 June 2023, Evotec’s

overall capital structure remained stable at a strong equity balance compared with the end of 2022. Total stockholders’ equity

declined by one percent (€ 12.9 m) to € 1,174.3 m (31 December 2022: € 1,187.2 m).

Due to the exercise of stock options and Share Performance Awards, a total amount of 177,185,744 shares were issued and outstanding with

a nominal value of € 1.00 per share as of 30 June 2023. Evotec’s equity ratio as of 3o June 2023

amounted to 51.0% (31 December 2022: 52.6%).

5. Human Resources

Employees

Headquartered

in Hamburg, Germany, the Evotec Group employed 5,067 people globally as of 30 June 2023 (31 December 2022: 4,952

employees), which corresponds to a total increase of 2.3% compared to the prior year’s end. Overall, the number of employees grew

by 115 in the first six months of 2023 (H1 2022: 323 employees).

Stock-based compensation

During

the first half of 2023, 227,555 Share Performance and Restricted Awards from the total granted 806,500 Share Performance and 603,161

Restricted Awards were given to the members of the Management Board. The remaining number of awards were given to other key employees.

During the first half-year 2023 233,083

shares were issued through the exercise of Share Performance Awards. As of 30 June 2023, the total number of Share Performance and

Restricted Awards available for future exercise amounted to 2,802,180 (approximately 1.0% of shares in issue).

Share Performance and Restricted Awards

have been accounted for under IFRS 2 using the fair value at the grant date.

With the exception of Dr Mario Polywka,

the Supervisory Board of Evotec SE does not hold any Share Performance Awards.

|

HALF-YEAR

REPORT 2023 |

|

| |

Shareholdings of the Boards of

Evotec SE as of 30 June 2023

| | |

Shares | | |

Stock options | | |

Outstanding Shares

from vested SPA’s | | |

Granted

unvested SPA’s

and RSA´s

(total) | |

| Management Board | |

| | | |

| | | |

| | | |

| | |

| Dr Werner Lanthaler | |

| 1,540,906 | | |

| – | | |

| – | | |

| 241,824 | |

| Dr Cord Dohrmann | |

| 195,079 | | |

| – | | |

| – | | |

| 115,201 | |

| Dr Matthias Evers | |

| – | | |

| – | | |

| – | | |

| 39,353 | |

| Dr Craig Johnstone | |

| 20,161 | | |

| – | | |

| – | | |

| 108,197 | |

| Laetitia Rouxel | |

| 51,655 | | |

| – | | |

| – | | |

| 42,488 | |

| | |

| | | |

| | | |

| | | |

| | |

| Supervisory Board | |

| | | |

| | | |

| | | |

| | |

| Prof. Dr Iris Löw-Friedrich | |

| – | | |

| – | | |

| – | | |

| – | |

| Roland Sackers | |

| – | | |

| – | | |

| – | | |

| – | |

| Camilla Macapili Languille | |

| – | | |

| – | | |

| – | | |

| – | |

| Dr Mario Polywka | |

| 11,938 | | |

| – | | |

| – | | |

| – | |

| Dr Constanze Ulmer-Eilfort | |

| – | | |

| – | | |

| – | | |

| – | |

| Dr Elaine Sullivan | |

| – | | |

| – | | |

| – | | |

| – | |

Pursuant to Article 19 of the European

Market Abuse Regulation (EU-Marktmissbrauchsverordnung), the above tables and information list the number of Company shares held and

rights for such shares granted to each board member as of 30 June 2023 separately for each member of Evotec’s Management Board.

RISKS

AND OPPORTUNITIES MANAGEMENT

The risks and opportunities described

in Evotec’s Annual Report 2022 on pages 66 to 80 remain mainly unchanged. At present, no risks have been identified that either

individually or in combination could endanger the continued existence of Evotec SE.

General

Market and Healthcare environment

Trends in the pharmaceutical and

biotechnology sector

There were no material changes to the

overall trends in the pharmaceutical and biotechnology sector described in Evotec’s Annual Report 2022 on page 43 and 44.

Please see Evotec’s Annual Report 2022 for further information.

|

HALF-YEAR

REPORT 2023 |

|

| |

FORWARD-LOOKING STATEMENTS

This half-year

interim report contains forward-looking statements concerning future events. Words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “should,” “target,” “would” and variations of such words and similar expressions

are intended to identify forward-looking statements. Such statements include comments regarding Evotec’s expectations for revenues,

Adjusted Group EBITDA and unpartnered R&D expenses, as well as the anticipated impact from the Russian invasion of Ukraine. These

forward-looking statements are based on the information available to, and the expectations and assumptions deemed reasonable by Evotec

at the time these statements were made. No assurance can be given that such expectations will prove to have been correct. These statements

involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant

uncertainties and contingencies, many of which are beyond the control of Evotec. Factors that could cause actual results to differ are

discussed under the heading "Risk Factors" in our Annual Report for the year ended December 31, 2021. Evotec expressly

disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in Evotec’s expectations with respect thereto or any change in events, conditions or circumstances on which

any statement is based.

NON-IFRS METRICS

This interim report

includes certain financial measures and metrics not based on IFRS, including Adjusted Group EBITDA. We define Adjusted EBITDA as net

income (loss) adjusted for interest, taxes, depreciation and amortization of intangibles, impairments on goodwill and other intangible

and tangible assets, total non-operating results and change in contingent consideration (earn-out).

Adjusted EBITDA

should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with IFRS. Adjusted

EBITDA is a non-IFRS measures presented as a supplemental measure of our performance. Adjusted EBITDA should not be considered as an

alternative to net income as a measure of financial performance. Adjusted EBITDA is presented because it is a key metric used by our

Management Board to assess our financial performance. Management believes Adjusted EBITDA is an appropriate measure of operating performance

because it eliminates the impact of expenses that do not relate directly to the performance of the underlying business. Our definition

of this non-IFRS financial measure may not be comparable to similarly titled measures of other companies, thereby, reducing the usefulness

of our Adjusted EBITDA as a tool for comparison.

|

HALF-YEAR

REPORT 2023 |

|

| |

The following table shows the reconciliation

of net income to Adjusted EBITDA

| In T€ | |

Evotec Group

6M 2023 | | |

Evotec Group

6M 2022 | |

| Net income | |

| (28,828 | ) | |

| (101.179 | ) |

| Interest expense (net) | |

| 640 | | |

| (5,796 | ) |

| Tax expense | |

| 2,175 | | |

| 8,110 | |

| Depreciation of tangible assets | |

| 40,851 | | |

| 32.833 | |

| Amortization of intangible assets | |

| 3,902 | | |

| 4.885 | |

| EBITDA | |

| 17.460 | | |

| (49.555 | ) |

| Impairment of intangible assets | |

| 5,119 | | |

| - | |

| Impairment of goodwill | |

| - | | |

| - | |

| Measurement gains from investments | |

| (5,567 | ) | |

| 97,718 | |

| Share of loss of associates accounted for using the equity method | |

| 7,149 | | |

| 7,628 | |

| Impairment of financial assets | |

| - | | |

| - | |

| Other income from financial assets, net | |

| - | | |

| - | |

| Foreign currency exchange (loss) gain, net | |

| 2,477 | | |

| (21,456 | ) |

| Other non-operating income, net | |

| (540 | ) | |

| 76 | |

| Change in contingent consideration (earn-out) | |

| - | | |

| (775 | ) |

| Adjusted EBITDA | |

| 26.099 | | |

| 33,636 | |

|

HALF-YEAR

REPORT 2023 |

|

| |

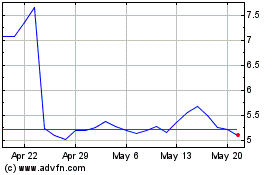

The

Evotec share

Performance of the Evotec share

in the first six months of 2023

The performance of the Evotec share

in the first six months of 2023 was accompanied by numerous company announcements. At the end of January, Evotec already announced that

it had entered into an agreement with Janssen for the development of immune-based therapies. The extension of the strategic partnership

with BMS at the end of March, too, led to an upward movement. The announcement of a criminal cyber-attack on 6 April ended this

trend.

Due to the attack, Evotec was unable

to report its results for the fiscal year 2022 in due time. The delay, which in the end amounted to 12 days, prompted Qontigo GmbH, a

part of Deutsche Börse Group, to remove Evotec from all relevant indices on 5 May and to implement its decision accordingly

four days later. The announcement by Evotec and Sandoz to launch a technology partnership for the development and commercial manufacturing

of biosimilars triggered a strong recovery immediately thereafter. Following the ad-hoc release on the new partnership on 9 May 2023,

the Evotec share gained 14 percentage points. With the publication of the annual report on 12 May, Evotec satisfied the conditions to

re-join the MDAX and the TecDAX, which further strengthened the positive share price performance even before the announcement that it

would resume its dual listing as of 19 June. As a result, based on the closing price of 30 June 2023, the Evotec share traded 35%

higher than at the end of 2022. The share price significantly outperformed both benchmark indices, TecDAX and the MDAX, by more than

20%.

|

HALF-YEAR

REPORT 2023 |

|

| |

II. UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

Evotec SE and

Subsidiaries

Consolidated interim statement of financial position as of 30 June 2023

| in k€ except share data | |

Note reference | | |

as of

30 June 2023 | | |

as of

31 December 2022 | |

| ASSETS | |

| | |

| | | |

| | |

| Current assets: | |

| | |

| | | |

| | |

| — Cash and cash equivalents | |

| | |

| 459,752 | | |

| 415,155 | |

| — Investments | |

| | |

| 161,094 | | |

| 303,334 | |

| — Trade and other receivables | |

| | |

| 202,496 | | |

| 171,799 | |

| — Contract assets | |

| | |

| 26,459 | | |

| 30,516 | |

| — Inventories | |

| | |

| 32,612 | | |

| 29,825 | |

| — Current tax assets | |

| | |

| 62.346 | | |

| 54,422 | |

| — Other current financial assets including derivatives | |

| | |

| 12,127 | | |

| 11,494 | |

| — Prepaid expenses and other current assets | |

| | |

| 69,563 | | |

| 57,126 | |

| Total current assets | |

| | |

| 1,026,449 | | |

| 1,073,671 | |

| | |

| | |

| | | |

| | |

| Non-current assets: | |

| | |

| | | |

| | |

| — Long-term financial investments and other long-term assets | |

| | |

| 149,738 | | |

| 138,074 | |

| — Investments in associates and Joint Ventures | |

| | |

| 11,104 | | |

| 16,043 | |

| — Property, plant and equipment | |

| | |

| 721,136 | | |

| 650,201 | |

| — Intangible assets and Goodwill | |

6 | | |

| 292,612 | | |

| 298,638 | |

| — Deferred tax assets | |

| | |

| 11,382 | | |

| 10,327 | |

| — Non-current tax assets | |

| | |

| 88,800 | | |

| 70,293 | |

| Total non-current assets | |

| | |

| 1,274,772 | | |

| 1,183,576 | |

| Total assets | |

| | |

| 2,301,221 | | |

| 2,257,247 | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

| | | |

| | |

| Current liabilities: | |

| | |

| | | |

| | |

| — Current financial liabilities | |

| | |

| 151,638 | | |

| 23,468 | |

| — Trade and other payables | |

| | |

| 106,038 | | |

| 97,277 | |

| — Contract liabilities | |

| | |

| 138,893 | | |

| 122,922 | |

| — Deferred income | |

| | |

| 11,539 | | |

| 13,748 | |

| — Provisions | |

| | |

| 48,257 | | |

| 54,410 | |

| — Current income tax liabilities | |

| | |

| 10,480 | | |

| 8,987 | |

| — Other current liabilities | |

| | |

| 21,263 | | |

| 16,894 | |

| Total current liabilities | |

| | |

| 488,107 | | |

| 337,706 | |

| | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | |

| | | |

| | |

| — Long-term financial liabilities | |

| | |

| 382,509 | | |

| 490,293 | |

| — Deferred tax liabilities | |

| | |

| 19,130 | | |

| 18,524 | |

| — Provisions | |

| | |

| 16,641 | | |

| 16,427 | |

| — Contract liabilities | |

| | |

| 219,654 | | |

| 206,136 | |

| — Other non-current liabilities | |

| | |

| 893 | | |

| 977 | |

| Total non-current liabilities | |

| | |

| 638,827 | | |

| 732,357 | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | |

| | | |

| | |

| —Share capital1) | |

| | |

| 177,186 | | |

| 176,953 | |

| — Additional paid-in capital | |

| | |

| 1,445,357 | | |

| 1,440,010 | |

| — Retained Earnings | |

| | |

| (448,256 | ) | |

| (429,779 | ) |

| Equity attributable to shareholders of Evotec SE | |

| | |

| 1,174,287 | | |

| 1,187,184 | |

| — Non-controlling interest | |

| | |

| - | | |

| - | |

| Total stockholders’ equity | |

| | |

| 1,174,287 | | |

| 1,187,184 | |

| Total liabilities and stockholders’ equity | |

| | |

| 2,301,221 | | |

| 2,257,247 | |

1) 177,185,744 and 176,952,653

shares issued and outstanding in 2023 and 2022, respectively

|

HALF-YEAR

REPORT 2023 |

|

| |

Evotec SE and Subsidiaries

Consolidated interim income statement for the six months ended 30 June 2023 and 30 June 2022

| in k€ except share and per share data | |

Note reference | | |

Six months

ended

30 June 2023 | | |

Six months

ended

30 June 2022 | | |

Three months

ended

30 June 2023 | | |

Three months

ended

30 June 2022 | |

| Revenue | |

| 5 | | |

| 383,835 | | |

| 336,875 | | |

| 170,279 | | |

| 172,203 | |

| Cost of Revenue | |

| | | |

| (284,275 | ) | |

| (273,686 | ) | |

| (123,956 | ) | |

| (141,308 | ) |

| Gross profit | |

| | | |

| 99,560 | | |

| 63,189 | | |

| 46,324 | | |

| 30,895 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| — Research and development | |

| | | |

| (30,863 | ) | |

| (36,838 | ) | |

| (12,377 | ) | |

| (18,725 | ) |

| — Selling, General and Administrative | |

| | | |

| (88,192 | ) | |

| (67,396 | ) | |

| (45,609 | ) | |

| (35,830 | ) |

| — Other operating income (expense) | |

| | | |

| (4,278 | ) | |

| 37,738 | | |

| (24,626 | ) | |

| 19,890 | |

| Operating income (loss) | |

| | | |

| (23,773 | ) | |

| (3,307 | ) | |

| (36,288 | ) | |

| (3,770 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| — Gain (loss) on investment in equity instruments revaluation | |

| | | |

| 5,567 | | |

| (97,718 | ) | |

| 8,065 | | |

| (34,914 | ) |

| — Share of profit (loss) of associates and Joint ventures | |

| | | |

| (7,149 | ) | |

| (7,628 | ) | |

| (3,090 | ) | |

| (3,528 | ) |

| — Financial income | |

| | | |

| 5,678 | | |

| 2,021 | | |

| 2,826 | | |

| 1,232 | |

| — Financial expense | |

| | | |

| (5,038 | ) | |

| (7,817 | ) | |

| (2,540 | ) | |

| (3,667 | ) |

| — Other non-operating income (expense) | |

| | | |

| (1,937 | ) | |

| 21,380 | | |

| 10,590 | | |

| 20,311 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) before taxes | |

| | | |

| (26,652 | ) | |

| (93,069 | ) | |

| (20,437 | ) | |

| (24,336 | ) |

| — Income taxes | |

| | | |

| (2,175 | ) | |

| (8,110 | ) | |

| 5,508 | | |

| (3,601 | ) |

| Net income (loss) | |

| | | |

| (28,828 | ) | |

| (101,179 | ) | |

| (14,929 | ) | |

| (27,937 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding | |

| | | |

| 176,935,744 | | |

| 176,702,653 | | |

| 176,935,744 | | |

| 176,702,653 | |

| Net income per share (basic) | |

| | | |

| (0.16 | ) | |

| (0.57 | ) | |

| (0.08 | ) | |

| (0.16 | ) |

| Net income per share (diluted) | |

| | | |

| (0.16 | ) | |

| (0.57 | ) | |

| (0.08 | ) | |

| (0.16 | ) |

|

HALF-YEAR

REPORT 2023 |

|

| |

Evotec SE and Subsidiaries

Consolidated interim statement of comprehensive income (loss) for the six months ended 30 June 2023 and 30 June 2022

| in k€ | |

Six months

ended

30 June 2023 | | |

Six months

ended

30 June 2022 | | |

Three months

ended

30 June 2023 | | |

Three months

ended

30 June 2022 | |

| Net income (loss) | |

| (28,828 | ) | |

| (101,179 | ) | |

| (14,929 | ) | |

| (27,937 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Accumulated other comprehensive income | |

| | | |

| | | |

| | | |

| | |

| Items which are not re-classified to the income statement | |

| | | |

| | | |

| | | |

| | |

| — Remeasurement of defined benefit obligation | |

| - | | |

| - | | |

| | | |

| | |

| — Revaluation of investments | |

| 1,861 | | |

| (4,112 | ) | |

| 865 | | |

| (4,112 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Items which may have to be re-classified to the income statement at a later date | |

| | | |

| | | |

| | | |

| | |

| — Foreign currency translation | |

| 4,264 | | |

| 10,364 | | |

| 5,475 | | |

| 7,244 | |

| — Revaluation and disposal of investments | |

| 4,225 | | |

| (12,973 | ) | |

| (4,216 | ) | |

| (12,579 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| 10,350 | | |

| (6,721 | ) | |

| 2,124 | | |

| (9,447 | ) |

| Total comprehensive income (loss) | |

| (18,478 | ) | |

| (107,900 | ) | |

| (12,805 | ) | |

| (37,384 | ) |

| Total comprehensive income (loss) attributable to: | |

| | | |

| | | |

| | | |

| | |

| — Shareholders of Evotec SE | |

| (18,478 | ) | |

| (107,900 | ) | |

| (12,805 | ) | |

| (37,384 | ) |

|

HALF-YEAR

REPORT 2023 |

|

| |

Evotec SE and Subsidiaries

Condensed consolidated interim statement of cash flows for the six months ended 30 June 2023 and 30 June 2022

| in k€ | |

Note reference | | |

Six months

ended

30 June 2023 | | |

Six months

ended

30 June 2022 | |

| Cash flow from operating activities: | |

| | | |

| | | |

| | |

| — Net income (loss) | |

| | | |

| (28,828 | ) | |

| (101,179 | ) |

| — Adjustments to reconcile net income to net cash provided by operating activities | |

| | | |

| 59,695 | | |

| 163,178 | |

| — Change in assets and liabilities | |

| | | |

| (36,442 | ) | |

| 178,608 | |

| Net cash provided by operating activities | |

| | | |

| (5,575 | ) | |

| 240,607 | |

| | |

| | | |

| | | |

| | |

| Cash flow from investing activities: | |

| | | |

| | | |

| | |

| — Purchase of current investments | |

| | | |

| (19,203 | ) | |

| (161,289 | ) |

| — Purchase of investments in associated companies and other long-term investments | |

| | | |

| (4,631 | ) | |

| (59,413 | ) |

| — Purchase of property, plant and equipment | |

| | | |

| (104,034 | ) | |

| (81,371 | ) |

| — Purchase of convertible loans | |

| | | |

| (4,579 | ) | |

| (2,053 | ) |

| — Proceeds from sale of current investments | |

| | | |

| 160,818 | | |

| 97,270 | |

| — Dividends received | |

| | | |

| 424 | | |

| - | |

| Net cash used in investing activities | |

| | | |

| 28,793 | | |

| (206,857 | ) |

| | |

| | | |

| | | |

| | |

| Cash flow from financing activities: | |

| | | |

| | | |

| | |

| — Proceeds from capital increase | |

| | | |

| - | | |

| 355 | |

| — Proceeds from option exercise | |

| | | |

| 233 | | |

| 345 | |

| — Proceeds from loans | |

| | | |

| 20,807 | | |

| - | |

| — Repayment lease obligation | |

| | | |

| (8,281 | ) | |

| (10,967 | ) |

| — Repayment of loans | |

| | | |

| (2,280 | ) | |

| (35,538 | ) |

| Net cash provided by (used in) financing activities | |

| | | |

| 10,480 | | |

| (45,805 | ) |

| | |

| | | |

| | | |

| | |

| Net increase in cash and cash equivalents | |

| | | |

| 34,122 | | |

| (12,055 | ) |

| — Exchange rate difference | |

| | | |

| 10,899 | | |

| 9,721 | |

| — Cash and cash equivalents at beginning of year | |

| | | |

| 415,155 | | |

| 699,326 | |

| Cash and cash equivalents at end of the period | |

| | | |

| 459,752 | | |

| 696,992 | |

|

HALF-YEAR

REPORT 2023 |

|

| |

Evotec SE and Subsidiaries

Interim consolidated

statement of changes in stockholders’ equity of the six months ended 30 June 2023 and 30 June 2022

| | |

Share

capital | | |

| | |

Income

and expense

recognised in other

comprehensive income | | |

| | |

| | |

| |

| in k€

except share data | |

Shares | | |

Amount | | |

Additional

paid-in

capital | | |

Foreign

currency

translation | | |

Re-

valuation

reserve | | |

Accumulated

deficit | | |

Stockholders’

equity

attributable to

the

Shareholders

of Evotec SE | | |

Total

stockholders’

equity | |

| Balance at 1 January 2022 | |

176,608,195 | | |

176,608 | | |

1,430,136 | | |

(15,691 | ) | |

3,053 | | |

(216,421 | ) | |

1,377,685 | | |

1,377,685 | |

| — Capital Increase | |

- | | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| — Exercised stock options | |

344,458 | | |

345 | | |

| | |

- | | |

- | | |

- | | |

345 | | |

345 | |

| — Stock option plan | |

- | | |

| | |

4,810 | | |

- | | |

- | | |

- | | |

4,810 | | |

4,810 | |

| — Transaction costs | |

- | | |

- | | |

355 | | |

- | | |

- | | |

- | | |

355 | | |

355 | |

— Deferred and current tax on future deductible

expenses | |

- | | |

- | | |

- | | |

- | | |

- | | |

244 | | |

244 | | |

244 | |

| Other comprehensive income | |

- | | |

- | | |

- | | |

10,364 | | |

(17,085 | ) | |

- | | |

(6,721 | ) | |

(6,721 | ) |

Net

income (loss) for the period | |

- | | |

- | | |

- | | |

- | | |

- | | |

(101,179 | ) | |

(101,179 | ) | |

(101,179 | ) |

| Total comprehensive income

(loss) | |

- | | |

- | | |

- | | |

10,364 | | |

(17,085 | ) | |

(101,179 | ) | |

(107,900 | ) | |

(107,900 | ) |

| Balance at 30 June 2022 | |

176,952,653 | | |

176,953 | | |

1,435,301 | | |

(5,327 | ) | |

(14,032 | ) | |

(317,356 | ) | |

1,275,539 | | |

1,275,539 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at 1 January 2023 | |

176,952,653 | | |

176,953 | | |

1,440,010 | | |

(16,289 | ) | |

(21,113 | ) | |

(392,377 | ) | |

1,187,184 | | |

1,187,184 | |

| — Capital Increase | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | |

| — Exercised stock options | |

233,091 | | |

233 | | |

(77 | ) | |

- | | |

- | | |

- | | |

156 | | |

156 | |

| — Stock option plan | |

- | | |

- | | |

5,425 | | |

- | | |

- | | |

- | | |

5,425 | | |

5,425 | |

| — Transaction costs | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | |

| — Deferred and current

tax on future deductible expenses | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | | |

- | |

| Other comprehensive income | |

- | | |

- | | |

- | | |

4,264 | | |

6,086 | | |

- | | |

10,350 | | |

10,350 | |

| Net income (loss) for the

period | |

- | | |

- | | |

- | | |

- | | |

- | | |

(28,828 | ) | |

(28,828 | ) | |

(28,828 | ) |

| Total comprehensive income

(loss) | |

- | | |

- | | |

- | | |

4,264 | | |

6,086 | | |

(28,828 | ) | |

(18,478 | ) | |

(18,478 | ) |

| Balance at 30 June 2023 | |

177,185,744 | | |

177,186 | | |

1,445,358 | | |

(12,025 | ) | |

(15,027 | ) | |

(421,205 | ) | |

1,174,287 | | |

1,174,287 | |

|

HALF-YEAR

REPORT 2023 |

|

| |

Notes to the unaudited

Interim condensed consolidated financial statements

1. Corporate information

| 4 | Effective

April 2023, Laetitia Rouxel joins Management Board as Chief Financial Officer |

| 4 | Remediation

of cyber-attack discovered on 06 April 2023 proceeding to plan |

| 4 | Unsecured

loan facility of m€ 150 granted by European Investment Bank to support R&D activities, equity investments and the construction

of the new J.POD Toulouse, France (EU) production facility |

| 4 | Relocation

of Cyprotex US, LLC from Watertown, MA to a new facility in Framingham, MA completed |

| 4 | Annual

General Meeting 2023: Approval of all proposed agenda items |

2. Basis of presentation

The interim condensed consolidated financial statements for the six

months ended June 30, 2023, have been prepared in accordance with IAS 34 Interim Financial Reporting as endorsed in the European

Union. The Group has prepared the interim condensed financial statements on the basis that it will continue to operate as a going concern.

The Group considers that there are no material uncertainties that may cast significant doubt over this assumption. The interim condensed

consolidated financial statements do not include all the information and disclosures required in the annual financial statements and should

be read in conjunction with the Group’s consolidated financial statements and accompanying notes for the year ended 31 December 2022.

All majority-owned subsidiaries of the Company are included in the

interim condensed consolidated financial statements and intercompany transactions have been eliminated in consolidation. The interim condensed

financial statements are presented in Euros, due to rounding, amounts may not add up to totals provided.

3. New standards, interpretations and amendments adopted by the

Group

The accounting policies adopted in the preparation

of the interim condensed consolidated financial statements are consistent with those followed in the preparation of the Group’s

annual consolidated financial statement for the year ended 31 December 2022, except for the adoption of new standards effective as

of 1 January 2023. The Group has not early adopted any standard, interpretation or amendment that has been issued but is not yet

effective.

Several amendments apply for the first time in

2023, but do not have a significant impact on the interim condensed consolidated financial statements of the Group:

| 4 | IFRS 17 Insurance Contracts (including

Amendments to IFRS 17 issued in June 2020 and Amendment to IFRS 17 - Initial Application of IFRS 17 and IFRS 9 —

Comparative Information issued in December 2021) |

| 4 | Amendments

to IAS 12 – Deferred Tax related to Assets and Liabilities arising from a Single Transaction |

| 4 | Amendments

to IAS 1 and IFRS Practice Statement 2 – Disclosure of Accounting Policies |

| 4 | Amendments to IAS 8 – Definition of

Accounting Estimates |

4. Segment information

EVT Execute and EVT Innovate have been identified by the

Management Board as operating segments. The segments’ key performance indicators are used monthly by the Management Board to evaluate

the resource allocation as well as Evotec’s performance. Intersegment revenues are valued with a price comparable to other third-party

revenues. The evaluation of each operating segment by the management is performed based on revenues and adjusted EBITDA. For the EVT Innovate

segment, R&D expenses are another key performance indicator.

|

HALF-YEAR

REPORT 2023 |

|

| |

The segment information for the first six months of 2023 is

as follows:

| In k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Intersegment

eliminations | | |

Evotec Group | |

| Revenue | |

| 254,150 | | |

| 129,685 | | |

| – | | |

| 383,835 | |

| Intersegment revenues | |

| 102,445 | | |

| – | | |

| (102,445 | ) | |

| – | |

| Cost of Revenue | |

| (291,383 | ) | |

| (89,538 | ) | |

| 96,646 | | |

| (284,275 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 65,213 | | |

| 40,147 | | |

| (5,800 | ) | |

| 99,560 | |

| — Research and development | |

| (2,356 | ) | |

| (34,306 | ) | |

| 5,800 | | |

| (30,863 | ) |

| — Selling, general and administrative | |

| (67,338 | ) | |

| (20,855 | ) | |

| – | | |

| (88,192 | ) |

| — Other operating income (expense) | |

| (20,227 | ) | |

| 15,949 | | |

| – | | |

| (4,278 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| (24,708 | ) | |

| 934 | | |

| – | | |

| (23,773 | ) |

| — Gain (loss) on investment in equity instruments re-evaluation | |

| – | | |

| – | | |

| – | | |

| 5,567 | |

| — Share of profit (loss) of associates and Joint ventures | |

| – | | |

| – | | |

| – | | |

| (7,149 | ) |

| — Financial income | |

| – | | |

| – | | |

| – | | |

| 5,678 | |

| — Financial expense | |

| – | | |

| – | | |

| – | | |

| (5,038 | ) |

| — Other non-operating income (expense) | |

| – | | |

| – | | |

| – | | |

| (1,937 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) before taxes | |

| – | | |

| – | | |

| – | | |

| (26,652 | ) |

| — Income taxes | |

| – | | |

| – | | |

| – | | |

| (2,175 | ) |

| Net income (loss) | |

| – | | |

| – | | |

| – | | |

| (28,828 | ) |

The EBITDA adjusted for the first six months of 2023 is derived from

Net operating income (loss) as follows:

| in k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Evotec Group | |

| Net operating income (loss) | |

| (24,708 | ) | |

| 934 | | |

| (23,773 | ) |

| plus, depreciation of tangible assets | |

| 38,293 | | |

| 2,558 | | |

| 40,851 | |

| plus, amortisation of intangible assets | |

| 3,868 | | |

| 34 | | |

| 3,902 | |

| plus, impairment of intangible assets | |

| 5,119 | | |

| – | | |

| 5,119 | |

| less, change in contingent consideration (earn-out) | |

| – | | |

| – | | |

| – | |

| EBITDA Adjusted | |

| 22,572 | | |

| 3,526 | | |

| 26,099 | |

|

HALF-YEAR

REPORT 2023 |

|

| |

The segment information for the first six months of 2022 is

as follows:

| In k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Intersegment

eliminations | | |

Evotec Group | |

| Revenue | |

| 258,847 | | |

| 78,028 | | |

| – | | |

| 336,875 | |

| Intersegment revenues | |

| 92,142 | | |

| 0 | | |

| (92,142 | ) | |

| 0 | |

| Cost of Revenue | |

| (289,752 | ) | |

| (68,324 | ) | |

| 84,391 | | |

| (273,685 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 61,237 | | |

| 9,704 | | |

| (7,751 | ) | |

| 63,190 | |

| — Research and development | |

| (2,561 | ) | |

| (42,028 | ) | |

| 7,751 | | |

| (36,838 | ) |

| — Selling, general and administrative | |

| (54,139 | ) | |

| (13,258 | ) | |

| – | | |

| (67,397 | ) |

| — Other operating income (expense) | |

| 15,573 | | |

| 22,165 | | |

| – | | |

| 37,738 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income (loss) | |

| 20,110 | | |

| (23,417 | ) | |

| – | | |

| (3,307 | ) |

| — Gain (loss) on investment in equity instruments re-evaluation | |

| – | | |

| – | | |

| – | | |

| (97,718 | ) |

| — Share of profit (loss) of associates and Joint ventures | |

| – | | |

| – | | |

| – | | |

| (7,628 | ) |

| — Financial income | |

| – | | |

| – | | |

| – | | |

| 2,021 | |

| — Financial expense | |

| – | | |

| – | | |

| – | | |

| (7,817 | ) |

| — Other non-operating income (expense) | |

| – | | |

| – | | |

| – | | |

| 21,380 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) before taxes | |

| – | | |

| – | | |

| – | | |

| (93,069 | ) |

| — Income taxes | |

| – | | |

| – | | |

| – | | |

| (8,110 | ) |

| Net income (loss) | |

| – | | |

| – | | |

| – | | |

| (101,179 | ) |

The EBITDA adjusted for the first six months 2022 is derived from Net

operating income (loss) as follows:

| in k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Evotec Group | |

| Net operating income (loss) | |

| 20,110 | | |

| (23,417 | ) | |

| (3,307 | ) |

| plus, depreciation of tangible assets | |

| 30,554 | | |

| 2,279 | | |

| 32,833 | |

| plus, amortisation of intangible assets | |

| 4,800 | | |

| 85 | | |

| 4,885 | |

| plus, impairment of intangible assets | |

| – | | |

| 683 | | |

| 683 | |

| less change in contingent consideration (earn-out) | |

| 775 | | |

| – | | |

| 775 | |

| EBITDA Adjusted | |

| 54,689 | | |

| (21,053 | ) | |

| 33,626 | |

|

HALF-YEAR

REPORT 2023 |

|

| |

5. Revenues

The following schedule shows a breakdown of the revenue Evotec recognised

for the first six months of 2023:

| | |

6 months | |

| in k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Total | |

| Revenues | |

| | |

| | |

| |

| Service fees and FTE-based research payments | |

| 207,641 | | |

| 115,430 | | |

| 359,971 | |

| Material Recharges | |

| 14,957 | | |

| 2,774 | | |

| 17,731 | |

| Compound access fees | |

| 1,209 | | |

| 665 | | |

| 1,875 | |

| Milestone fees | |

| 38,222 | | |

| 2,832 | | |

| 4,154 | |

| Licences | |

| 0 | | |

| 105 | | |

| 105 | |

| Total | |

| 262,030 | | |

| 121,805 | | |

| 383,835 | |

| | |

| | | |

| | | |

| | |

| Timing of revenue recognition | |

| | | |

| | | |

| | |

| At a certain time | |

| 53,179 | | |

| 5,605 | | |

| 21,884 | |

| Over a period of time | |

| 208,851 | | |

| 116,200 | | |

| 361,951 | |

| Total | |

| 262,030 | | |

| 121,805 | | |

| 383,835 | |

| | |

| | | |

| | | |

| | |

| Revenues by region | |

| | | |

| | | |

| | |

| USA | |

| 123,320 | | |

| 96,055 | | |

| 219,375 | |

| Germany | |

| 6,718 | | |

| 11,463 | | |

| 18,181 | |

| France | |

| 13,147 | | |

| 2,902 | | |

| 16,049 | |

| United Kingdom | |

| 37,096 | | |

| 3,036 | | |

| 40,132 | |

| Rest of the World | |

| 81,749 | | |

| 8,349 | | |

| 90,098 | |

| Total | |

| 262,030 | | |

| 121,805 | | |

| 383,835 | |

Included in the revenues are revenues from contribution in the amount

of k€ 4,539 (H1 2022: k€ 5,269).

|

HALF-YEAR

REPORT 2023 |

|

| |

The following schedule shows a breakdown of the revenue Evotec recognised

for the first six months of 2022:

| | |

6 months | |

| in k€ | |

EVT

Execute | | |

EVT

Innovate | | |

Total | |

| Revenues | |

| | |

| | |

| |

| Service fees and FTE-based research payments | |

| 236,717 | | |

| 74,799 | | |

| 311,516 | |

| Material Recharges | |

| 18,136 | | |

| 2,491 | | |

| 20,627 | |

| Compound access fees | |

| 230 | | |

| 444 | | |

| 674 | |

| Milestone fees | |

| 3,764 | | |

| – | | |

| 3,764 | |

| Licence | |

| – | | |

| 294 | | |

| 294 | |

| Total | |

| 258,847 | | |

| 78,028 | | |

| 336,875 | |

| | |

| | | |

| | | |

| | |

| Timing of revenue recognition | |

| | | |

| | | |

| | |

| At a certain time | |

| 21,900 | | |

| 2,491 | | |

| 24,391 | |

| Over a period of time | |

| 236,947 | | |

| 75,537 | | |

| 312,484 | |

| Total | |

| 258,847 | | |

| 78,028 | | |

| 336,875 | |

| | |

| | | |

| | | |

| | |

| Revenues by region | |

| | | |

| | | |

| | |

| USA | |

| 130,561 | | |

| 51,490 | | |

| 182,051 | |

| Germany | |

| 16,946 | | |

| 12,372 | | |

| 29,318 | |

| France | |

| 6,802 | | |

| 6,024 | | |

| 12,826 | |

| United Kingdom | |

| 57,420 | | |

| 4,278 | | |

| 61,698 | |

| Rest of the World | |

| 47,118 | | |

| 3,864 | | |

| 50,982 | |

| Total | |

| 258,847 | | |

| 78,028 | | |

| 336,875 | |

6. Goodwill and other Intangible asset

Goodwill:

Goodwill amounted to k€ 277,490 as of June 30, 2023, versus

k€ 274,819 as of December 31, 2022. The movement during the period was due to the impact of changes in exchange rates.

The Group performs its annual impairment test over goodwill in the

fourth quarter of the fiscal year and when circumstances indicate that the carrying value may be impaired. The Group’s impairment

test for goodwill is based on value-in-use calculations.

The key assumptions used to determine the recoverable amount for the

different cash generating units were disclosed in the Group’s consolidated financial statements for the year ended 31 December 2022.

Based on the analysis of the business performance as of and for the

six months ended 30 June 2023, the Group has not identified any impairment trigger

|

HALF-YEAR

REPORT 2023 |

|

| |

Long lived intangible assets:

The Group has also reviewed its finite lived intangible assets for

impairment whenever triggering events or changes in circumstances indicate that carrying amount value may not be recoverable. This review

led to the recognition of an impairment loss of k€ 5,119 linked to research and development projects.

7. Equity investments

In the six months ended 30 June 2023, Evotec participated

in a capital contribution of a company accounted for using the equity method. The add-on investment amounts to k€ 935.

| in k€ | |

2023 | | |

2022 | |

| Balance at 1 Jan | |

| 16,043 | | |

| 13,068 | |

| Additions | |

| 935 | | |

| 7,185 | |

| Pro rata net result | |

| (5,451 | ) | |

| (7,750 | ) |

| Dividends received | |

| (423 | ) | |

| – | |

| Balance at 30 June | |

| 11,104 | | |

| 12,503 | |

8. Borrowings

External borrowings increased to k€ 534,147 (2022 k€ 513,761)

mainly to support networking increase and capex investments.

9. Changes in shareholder’s equity and potentially dilutive

instruments

In the six months ended 30 June 2023 227,555 of the 806,500 total

granted Share Performance Awards were given to the members of the Management Board. During the first half of 2023, 233,083 shares were

issued through the exercise of Share Performance Awards which increased stockholder’s equity.

On February 14, 2023, Evotec’s Management Board approved

the U.S. Restricted Share Unit Plan (“U.S. RSU Plan”). The U.S. RSU Plan became effective May 31, 2023. The U.S. RSU

Plan provides for the grant of restricted share units, which payment may be granted in the form of shares, American depositary shares,

each representing one-half of one Evotec SE ordinary share (ADSs), or cash amounts as the Management Board determines to be consistent

with best interests of the Company, Evotec and its shareholders and in accordance with the purpose of the U.S. RSU Plan. The number of

restricted share units granted in the six months ended 30 June 2023 totalled 603,161.

10. Financial risk management

The Group’s activities expose it to a variety of financial risks

such as currency risks, interest rate risks, credit risks and liquidity risks. The interim condensed consolidated financial statements

do not include all financial risk management information and disclosures required. Additional disclosures can be found in the “Risks

and uncertainties” section of the management report as of and for the six months ended 30 June 2023. They should be read in

conjunction with the Group’s annual management report as of and for the year ended 31 December 2022. The fair values of

financial assets and liabilities, together with the carrying amounts shown in the balance sheet as of 30 June 2023 and 31 December 2022

are as follows:

There have not been significant changes to the risk management approach

or to risk management policies since 31 December 2022.

|

HALF-YEAR

REPORT 2023 |

|

| |

Fair value of financial assets and liabilities:

The Group classifies its fair value measurements using a fair value

hierarchy that reflects the significance of the inputs used in making the measurements, The fair value hierarchy has the following levels:

▪ Level 1 – Quoted (unadjusted) prices in active markets

for identical assets or liabilities

▪ Level 2 – Observable inputs other than quoted prices

included within Level 1 that are observable for the assets or liabilities, either directly (i.e., such as prices) or indirectly (i.e..,

derived from prices)

▪ Level 3 – Inputs for the assets or liabilities that

are not based on observable market data

The carrying amounts and fair values of the financial assets and liabilities

as of 30 June 2023 are as follows:

| In k€ | |

Carrying amount | | |

Fair value | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Financial assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity instruments | |

| 130,437 | | |

| 130,437 | | |

| 76,466 | | |

| - | | |

| 53,971 | |

| Financial assets carried at FVTPL | |

| 130,437 | | |

| 130,437 | | |

| 76,466 | | |

| - | | |

| 53,971 | |

| Equity instruments | |

| 10,426 | | |

| 10,426 | | |

| 10,426 | | |

| | | |

| | |

| Current financial assets | |

| 161,094 | | |

| 161,094 | | |

| 161,094 | | |

| | | |

| | |

| Financial assets carried at FVOCI | |

| 171,519 | | |

| 171,519 | | |

| 171,519 | | |

| | | |

| | |

| Derivative financial instruments | |

| 9,086 | | |

| 9,086 | | |

| | | |

| 9,086 | | |

| | |

| Financial assets carried at fair value | |

| 9,086 | | |

| 9,086 | | |

| | | |

| 9,086 | | |

| | |

| Cash and cash equivalents | |

| 459,752 | | |

| 459,752 | | |

| | | |

| | | |

| | |

| Receivables and Contract Assets | |

| 226,710 | | |

| 226,710 | | |

| | | |

| | | |

| | |

| Other financial assets | |

| 10,556 | | |

| 10,556 | | |

| | | |

| | | |

| | |

| Carried at (amortized) costs | |

| 697,017 | | |

| 697,017 | | |

| | | |

| | | |

| | |

| Total financial assets | |

| 1,008,060 | | |

| 1,008,060 | | |

| 247,986 | | |

| 9,086 | | |

| 53,971 | |

| In k€ | |

Carrying amount | | |

Fair value | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Financial liabilities | |

| | | |

| | | |

| | | |

| | | |

| | |

| Derivative financial instruments | |

| (2,028 | ) | |

| (2,028 | ) | |

| | | |

| (2,028 | ) | |

| | |

| Financial liabilities carried at fair value | |

| (2,028 | ) | |

| (2,028 | ) | |

| | | |

| (2,028 | ) | |

| | |

| Payables and Contract Liabilities | |