false000108203800010820382024-05-132024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

May 13, 2024

Date of Report

(Date of earliest event reported)

DURECT CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

000-31615 |

|

94-3297098 |

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

10240 Bubb Road

Cupertino, CA 95014

(Address of principal executive offices) (Zip code)

(408) 777-1417

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock $0.0001 par value per share

|

DRRX |

The NASDAQ Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2024, DURECT Corporation, a Delaware corporation (“DURECT”), announced its first quarter 2024 financial results. This Current Report is filed to disclose nonpublic information required to be disclosed by Regulation FD. A copy of DURECT’s press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information concerning financial results in this Form 8-K and in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information concerning financial results in this Form 8-K and in Exhibit 99.1 shall not be incorporated into any registration statement or other document filed with the Securities and Exchange Commission by the company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DURECT Corporation |

|

|

|

|

|

Date: May 13, 2024 |

|

By: |

|

/s/ James E. Brown |

|

|

|

|

James E. Brown Chief Executive Officer |

|

|

|

|

|

Exhibit 99.1

DURECT Corporation Reports First Quarter 2024 Financial Results and Business Update

- FDA Feedback Supports Single Pivotal Trial for Approval of Larsucosterol in Alcohol-Associated Hepatitis

- Webcast of Earnings Call Today, May 13th at 4:30 p.m. ET

CUPERTINO, Calif., May 13, 2024 /PRNewswire / -- DURECT Corporation (Nasdaq: DRRX) today announced financial results for the three months ended March 31, 2024 and provided a business update.

“We are pleased that the feedback from the U.S. Food and Drug Administration (FDA) supports the advancement of larsucosterol into a single pivotal Phase 3 clinical trial which, if successful, may serve as the basis for a New Drug Application (NDA) in alcohol-associated hepatitis (AH),” stated James E. Brown, D.V.M., President and CEO of DURECT. “We are in the process of designing the registrational Phase 3 trial incorporating the FDA’s comments and insights gained from our Phase 2b AHFIRM trial. In addition, we are excited about the upcoming presentation at the European Association for the Study of the Liver (EASL) Congress 2024, which will be the first presentation of the AHFIRM data at a medical conference. We expect to provide additional details on our planned Phase 3 protocol and present new analyses from AHFIRM later in the year.”

Business Update:

•During a Type C meeting with the FDA, DURECT received feedback on the recommendations for a Phase 3 clinical trial for larsucosterol in AH that could support a potential NDA filing. DURECT is in the process of designing its planned Phase 3 clinical trial based on the FDA feedback and the results from its completed Phase 2b AHFIRM clinical trial.

•DURECT announced the acceptance of a late-breaking oral presentation at the European Association for the Study of the Liver (EASL) Congress 2024 to take place June 5-8, 2024 in Milan, Italy. The presentation will feature data from the Company’s Phase 2b AHFIRM trial, which evaluated the safety and efficacy of larsucosterol as a treatment for patients with severe AH.

Financial Highlights for Q1 2024:

•Total revenues were $1.8 million and net loss was $7.6 million for the three months ended March 31, 2024 compared to total revenues of $2.1 million and net loss of $12.0 million for the three months ended March 31, 2023.

•Cash, cash equivalents and investments were $21.6 million at March 31, 2024, compared to $29.8 million at December 31, 2023. Debt at March 31, 2024 was $14.6 million, compared to $16.7 million at December 31, 2023.

Earnings Conference Call

We will host a conference call and webcast today at 4:30 p.m. Eastern Time/1:30 p.m. Pacific Time to discuss the first quarter 2024 results and provide a corporate update:

Monday, May 13 @ 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time

Toll Free: 1-877-407-0790

International: 1-201-689-8560

Conference ID: 13746111

Webcast: https://callme.viavid.com/viavid/?callme=true&passcode=13740526&h=true&info=company-email&r=true&B=6

A live audio webcast of the presentation will be also available by accessing DURECT’s homepage at www.durect.com on the “Events” page, under the “Investors” section. If you are unable to participate during the live webcast, the call will be archived on DURECT’s website under the same section, following the completion of the call.

About the AHFIRM Trial

AHFIRM was a Phase 2b randomized, double-blind, placebo-controlled, international, multi-center study conducted in subjects with severe alcohol-associated hepatitis (AH) to evaluate the saFety and effIcacy of laRsucosterol treatMent (AHFIRM). The study was comprised of three arms and enrolled 307 patients, with approximately 100 patients in each arm: (1) Placebo, which consists of standard of care, with or without methylprednisolone capsules at the investigators’ discretion; (2) larsucosterol (30 mg); and (3) larsucosterol (90 mg). Patients in the larsucosterol arms received the same supportive care without steroids. The primary outcome measure was the 90-Day incidence of mortality or liver transplantation for patients treated with larsucosterol compared to those treated with placebo, and the key secondary endpoint was 90-Day survival. The Company enrolled patients at clinical trial sites across the U.S., EU, U.K., and Australia. In November 2023, the Company announced topline data for the AHFIRM Trial. Reflecting the life-threatening nature of AH and the lack of therapeutic options, the U.S. Food and Drug Administration (FDA) has granted larsucosterol Fast Track Designation for the treatment of AH. For more information, refer to ClinicalTrials.gov Identifier: NCT04563026.

About Alcohol-associated Hepatitis (AH)

AH is an acute form of alcohol-associated liver disease (ALD) associated with long-term heavy alcohol intake, often following a recent period of increased consumption (i.e., a binge). AH is typically characterized by severe inflammation and liver cell damage, potentially leading to life-threatening complications including liver failure, acute kidney injury and multi-organ failure. There are no FDA approved therapies for AH, and a retrospective analysis of 77 studies published between 1971 and 2016, which included data from 8,184 patients, showed the overall mortality from AH was 26% at 28 days, 29% at 90 days and 44% at 180 days. A subsequent global study published in December 2021, which included 85 tertiary centers in 11 countries across 3 continents, prospectively enrolled 2,581 AH patients with a median Model of End-Stage Liver Disease (MELD) score of 23.5, reported mortality at 28 and 90 days of approximately 20% and 31%, respectively. Stopping alcohol consumption is necessary, but frequently not sufficient for recovery in many moderate (defined as MELD scores of 11-20) and severe (defined as MELD scores >20) patients, and therapies that reduce liver inflammation, such as corticosteroids, are limited by contraindications, have not been shown to improve survival at 90 days or one year, and have demonstrated an increased risk of infection. While liver transplantation is becoming more common for ALD patients, including AH patients, the total number of such transplants is still relatively small, and limited by organ availability. Average charges for a liver transplant exceed $875,000, and patients require lifelong immunosuppressive therapy to prevent organ rejection.

About Larsucosterol

Larsucosterol is an endogenous sulfated oxysterol and an epigenetic modulator. Epigenetic regulators are compounds that regulate patterns of gene expression without modifying the DNA sequence. DNA hypermethylation, an example of epigenetic dysregulation, results in transcriptomic reprogramming and cellular dysfunction, and has been reported in many acute (e.g., AH) and chronic diseases (e.g., MASH). As an inhibitor of DNA methyltransferases (DNMT1, DNMT3a and 3b), larsucosterol inhibits DNA methylation, which subsequently modulates expression of genes that are involved in cell signaling pathways associated with stress responses, cell death and survival, and lipid biosynthesis. This may ultimately lead to improved cell survival, reduced inflammation, and decreased lipotoxicity. As an epigenetic modulator, the proposed mechanism of action provides further scientific rationale for developing larsucosterol for the treatment of acute organ injury and certain chronic diseases.

About DURECT Corporation

DURECT is a late-stage biopharmaceutical company pioneering the development of epigenetic therapies that target dysregulated DNA methylation to transform the treatment of serious and life-threatening conditions, including acute organ injury and cancer. Larsucosterol, DURECT’s lead drug candidate, binds to and inhibits the activity of DNA methyltransferases (DNMTs), epigenetic enzymes that are elevated and associated with hypermethylation found in alcohol-associated hepatitis (AH) patients. Larsucosterol is in clinical development for the potential treatment of AH, for which FDA has granted a Fast Track Designation; metabolic dysfunction-associated steatohepatitis (MASH) is also being explored. In addition, POSIMIR® (bupivacaine solution) for infiltration use, a non-opioid analgesic utilizing the innovative SABER® platform technology, is FDA-approved and is exclusively licensed to Innocoll Pharmaceuticals for sale and distribution in the United States. For more information about DURECT, please visit www.durect.com and follow us on X (formerly Twitter) at https://x.com/DURECTCorp.

DURECT Forward-Looking Statements

This press release contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, relating to: the potential for a single Phase 3 trial of larsucosterol, if successful, to support an NDA filing, and the potential uses and benefits of laruscosterol in patients with AH and potentially other indications. Actual results may differ materially from those contained in the forward-looking statements contained in this press release, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from those projected include, among other things, the risk that future clinical trials of larsucosterol are delayed or do not confirm the results from subset analyses of the AHFIRM trial, including geographic or other segmentation, or of earlier clinical or pre-clinical trials, or do not demonstrate the safety or efficacy of larsucosterol in a statistically significant manner; the risk that the FDA or other government agencies may require additional clinical trials for larsucosterol before approving larsucosterol for the treatment of AH, and that larsucosterol may never be approved; risks that Innocoll may not commercialize POSIMIR successfully; and risks related to the sufficiency of our cash resources, our anticipated capital requirements, our need or desire for additional financing, our ability to continue to meet the minimum bid price for continued listing on Nasdaq, our ability to obtain capital to fund our operations and expenses, and our ability to continue to operate as a going concern. Further information regarding these and other risks is included in DURECT’s most recent Securities and Exchange Commission (SEC) filings, including its annual report on Form 10-K for the year ended December 31, 2023 and quarterly report on Form 10-Q for the quarter ended March 31, 2024, when filed, under the heading “Risk Factors.” These reports are available on our website www.durect.com under the “Investors” tab and on the SEC’s website at www.sec.gov. All information provided in this press release and in the attachments is based on information available to DURECT as of the date hereof, and DURECT assumes no obligation to update this information as a result of future events or developments, except as required by law.

NOTE: POSIMIR® is a trademark of Innocoll Pharmaceuticals, Ltd. in the U.S. and a trademark of DURECT Corporation outside of the U.S. SABER® is a trademark of DURECT Corporation. Other referenced trademarks belong to their respective owners. Larsucosterol is an investigational drug candidate under development and has not been approved for commercialization by the U.S. Food and Drug Administration or other health authorities for any indication.

DURECT CORPORATION

CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three months ended

March 31 |

|

|

|

2024 |

|

|

2023 |

|

Collaborative research and development and other revenue |

|

$ |

496 |

|

|

$ |

643 |

|

Product revenue, net |

|

|

1,331 |

|

|

|

1,411 |

|

Total revenues |

|

|

1,827 |

|

|

|

2,054 |

|

Operating expenses: |

|

|

|

|

|

|

Cost of product revenues |

|

|

289 |

|

|

|

388 |

|

Research and development |

|

|

4,119 |

|

|

|

8,593 |

|

Selling, general and administrative |

|

|

3,136 |

|

|

|

4,095 |

|

Total operating expenses |

|

|

7,544 |

|

|

|

13,076 |

|

Loss from operations |

|

|

(5,717 |

) |

|

|

(11,022 |

) |

Other income (expense): |

|

|

|

|

|

|

Interest and other income |

|

|

321 |

|

|

|

517 |

|

Interest and other expenses |

|

|

(529 |

) |

|

|

(726 |

) |

Change in fair value of warrant liabilities |

|

|

(1,718 |

) |

|

|

2,477 |

|

Issuance cost for warrants |

|

|

— |

|

|

|

(1,200 |

) |

Loss on issuance of warrants |

|

|

— |

|

|

|

(2,033 |

) |

Other income (expense), net |

|

|

(1,926 |

) |

|

|

(965 |

) |

Net loss |

|

|

(7,643 |

) |

|

|

(11,987 |

) |

Net change in unrealized gain on available-for-sale securities, net of reclassification adjustments and taxes |

|

|

4 |

|

|

|

6 |

|

Total comprehensive loss |

|

$ |

(7,639 |

) |

|

$ |

(11,981 |

) |

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.50 |

) |

Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.52 |

) |

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share |

|

|

|

|

|

|

Basic |

|

|

30,637 |

|

|

|

23,767 |

|

Diluted |

|

|

30,637 |

|

|

|

23,940 |

|

DURECT CORPORATION

CONDENSED BALANCE SHEETS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

|

31-Mar-24 |

|

|

December 31, 2023 (1) |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

19,252 |

|

|

$ |

28,400 |

|

Short-term Investments |

|

|

2,187 |

|

|

|

1,280 |

|

Accounts receivable, net |

|

|

1,020 |

|

|

|

1,261 |

|

Inventories, net |

|

|

2,398 |

|

|

|

2,219 |

|

Prepaid expenses and other current assets |

|

|

1,228 |

|

|

|

1,511 |

|

Total current assets |

|

|

26,085 |

|

|

|

34,671 |

|

Property and equipment, net |

|

|

58 |

|

|

|

91 |

|

Operating lease right-of-use assets |

|

|

3,631 |

|

|

|

3,980 |

|

Goodwill |

|

|

6,169 |

|

|

|

6,169 |

|

Long-term restricted investments |

|

|

150 |

|

|

|

150 |

|

Other long-term assets |

|

|

128 |

|

|

|

128 |

|

Total assets |

|

$ |

36,221 |

|

|

$ |

45,189 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

782 |

|

|

$ |

1,777 |

|

Accrued liabilities |

|

|

5,105 |

|

|

|

5,966 |

|

Term loan, current portion, net |

|

|

14,612 |

|

|

|

16,663 |

|

Operatinglease liabilities, current portion |

|

|

1,298 |

|

|

|

1,381 |

|

Warrant liabilities |

|

|

2,942 |

|

|

|

1,224 |

|

Total current liabilities |

|

|

24,739 |

|

|

|

27,011 |

|

Operating lease liabilities, non-current portion |

|

|

2,466 |

|

|

|

2,702 |

|

Other long-term liabilities |

|

|

716 |

|

|

|

693 |

|

Stockholders’ equity |

|

|

8,300 |

|

|

|

14,783 |

|

Total liabilities and stockholders’ equity |

|

$ |

36,221 |

|

|

$ |

45,189 |

|

(1) Derived from audited financial statements.

|

|

|

SOURCE: DURECT Corporation |

|

|

|

|

|

Investor Relations |

|

Media Contact (DURECT) |

Ashley R. Robinson |

|

Mollie Godbout |

LifeSci Advisors |

|

LifeSci Communications |

arr@lifesciadvisors.com |

|

mgodbout@lifescicomms.com |

|

|

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

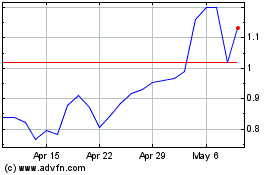

Durect (NASDAQ:DRRX)

Historical Stock Chart

From Apr 2024 to May 2024

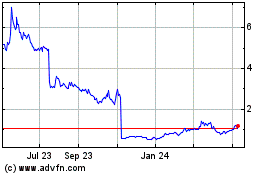

Durect (NASDAQ:DRRX)

Historical Stock Chart

From May 2023 to May 2024