Form 424B3 - Prospectus [Rule 424(b)(3)]

May 20 2024 - 7:54AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259982

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 22,

2022)

Arqit Quantum Inc.

117,925,000 Ordinary Shares

6,266,667 Warrants to Purchase Ordinary Shares

14,891,640 Ordinary Shares Underlying Warrants

This

prospectus supplement updates and amends certain information contained in the prospectus dated November 22, 2022 (the

“Prospectus”) covering the offer and sale from time to time by the selling securityholders named in the Prospectus of up to

117,925,000 of our ordinary shares, par value $0.0001 per share (“Ordinary Shares”), and warrants to purchase up to 6,266,667

Ordinary Shares. The Prospectus also relates to the issuance by us of up to 14,891,640 Ordinary Shares, that are issuable by us upon the

exercise of the Public Warrants (as defined in the Prospectus), which were previously registered, and the Private Warrants (as defined

in the Prospectus). You should read this prospectus supplement in conjunction with the Prospectus. This prospectus supplement is not complete

without, and may not be utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 9 of the Prospectus, and under similar headings in any amendment or supplements to the Prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is May 20, 2024

EXPLANATORY NOTE

This

prospectus supplement updates and supplements the Prospectus to update the table of the Selling Securityholders (as defined in the Prospectus)

to reflect certain sales and distributions that have been made as permitted under the section entitled “Plan of Distribution”

included in the Prospectus.

Updated Table of Selling Securityholders

Where the name and information of a Selling Securityholder

identified in the table below also appears in the table and the related footnotes in the Prospectus on pages 29, 30 and 31, the

information set forth in the table below and the related footnotes regarding that Selling Securityholder supersedes and replaces the

information regarding such Selling Securityholder in the Prospectus. The percentages in the following table are based on 217,212,514

ordinary shares outstanding, including (i) 168,405,748 ordinary shares issued and outstanding as of May 16, 2024,

(ii) 42,549,709 ordinary shares underlying our outstanding warrants, all of which are currently exercisable, and

(iii) 6,257,057 shares underlying outstanding equity incentives that are exercisable or that will become exercisable within 60

days following the date of this prospectus supplement.

| | |

Ordinary

Shares | | |

Warrants | |

| | |

| | |

| | |

Number | | |

| | |

| | |

| | |

| | |

Number | | |

| | |

| |

| | |

Beneficially Owned | | |

Registered | | |

Beneficially

Owned | | |

Beneficially

Owned | | |

Registered | | |

Beneficially

Owned | |

| | |

Prior

to Offering | | |

for

Sale | | |

After

Offering | | |

Prior

to Offering | | |

for

Sale | | |

After

Offering | |

| Name | |

Number | | |

Percent | | |

Hereby | | |

Number | | |

Percent | | |

Number | | |

Percent | | |

Hereby | | |

Number | | |

Percent | |

| Adam

Hall(1)(19) | |

| 74,910 | | |

| * | | |

| 74,910 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Adam

M. Aron(2) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Carlo

Calabria(3) | |

| 3,015,643 | | |

| 1.4 | % | |

| 2,433,837 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Centricus

Partners LP(4) | |

| 2,751,688 | | |

| 1.3 | % | |

| 2,751,688 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| D2BW

Limited(5) | |

| 31,564,030 | | |

| 14.5 | % | |

| 14,104,808 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| David

Bestwick(6)(19) | |

| 38,655,179 | | |

| 17.8 | % | |

| 6,582,934 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| David

Williams(6)(19) | |

| 44,721,472 | | |

| 20.6 | % | |

| 12,334,997 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Garth

Ritchie(7) | |

| 201,648 | | |

| * | | |

| 148,105 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Geoffrey

Taylor(8) | |

| 450,690 | | |

| * | | |

| 450,690 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Giulia

Nobili(9) | |

| 149,990 | | |

| * | | |

| 149,990 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Heritage

Assets SCSP(10) | |

| 29,458,178 | | |

| 13.6 | % | |

| 11,653,049 | | |

| — | | |

| — | | |

| 6,266,667 | | |

| 48.1 | % | |

| 6,266,667 | | |

| — | | |

| — | |

| Jack

Blockley(11) | |

| 494,711 | | |

| * | | |

| 494,711 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Lee

Boland(12)(19) | |

| 753,578 | | |

| * | | |

| 753,578 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Nicholas

Taylor(13) | |

| 18,770 | | |

| * | | |

| 16,440 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Patricia

Taylor(8) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Ropemaker

Nominees Limited(14) | |

| 20,011,538 | | |

| 9.2 | % | |

| 16,192,494 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Seraphim

Space Investment Trust plc(15) | |

| 2,234,752 | | |

| 1.0 | % | |

| 2,234,752 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| The

Evolution Technology Fund II SCSp(16) | |

| 9,931,461 | | |

| 4.6 | % | |

| 9,931,461 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Trevor

Barker(17) | |

| 3,790,279 | | |

| 1.7 | % | |

| 3,790,279 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| UK

FF Nominees Limited(18) | |

| 4,151,665 | | |

| 1.9 | % | |

| 4,151,665 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Williams

and Bestwick Foundation(5) | |

| 1,000,000 | | |

| * | | |

| 1,000,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| * |

Less than 1.0%. |

| |

|

| (1) |

The business address of Adam Hall is Nova North, Floor

7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (2) |

The business address of Adam M. Aron is c/o AMC Entertainment,

11500 Ash Street, Leawood, KS 66211, USA. |

| |

|

| (3) |

The business address of Carlo Calabria is Nova North,

Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. Includes 256,411

September 2023 Investor Warrants that are currently exercisable. |

| |

|

| (4) |

The business address for Centricus Partners LP is IFC

5, St Helier, Jersey JE1 1ST. |

| |

|

| (5) |

The address for each of D2BW Limited and the Williams

and Bestwick Foundation is Nova North, Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. David Williams and David Bestwick

are the beneficial owners of D2BW Limited and the Williams and Bestwick Foundation, and have shared investment and voting power over

the shares held by D2BW Limited and the Williams and Bestwick Foundation. |

| |

|

| (6) |

The business address for each of David Bestwick and

David Williams is Nova North, Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. Includes (i) 31,564,030 shares

held by D2BW Limited and (ii) 1,000,000 shares held by the Williams and Bestwick Foundation, of which David Williams and David

Bestwick are the beneficial owners and have shared investment and voting power over the shares held by D2BW Limited and the Williams

and Bestwick Foundation. |

| |

|

| (7) |

The address of Garth Ritchie is Nova North, Floor 7,

11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (8) |

The business address for each of Geoffrey Taylor and

Patricia Taylor is Nova North, Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (9) |

The address of Giulia Nobili is L’Estoril, 31

Avenue Princesse Grace, 98000, Monaco. |

| |

|

| (10) |

The business address for Heritage Assets SCSP is c/o

Heritage Services SAM Attn: Cristina Levis, 7 Rue Du Gabian, 98000, Monaco. Includes 17,422,280 shares, 6,266,667 Business Combination

Warrants and 5,769,231 September 2023 Investor Warrants that are currently exercisable and held by Heritage Assets SCSP. |

| |

|

| (11) |

The business address of Jack Blockley is Nova North,

Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (12) |

The business address of Lee Boland is Nova North, Floor

7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (13) |

The business address of Nicholas Taylor is 5 Anley Street,

St Helier, Jersey, Channel Islands, JE2 3QE. |

| |

|

| (14) |

The business address for Ropemaker

Nominees Limited is 1st Floor, Royal Chambers, St Julian’s Avenue, St Peter Port, Guernsey GY1 2HH. Notion Capital Managers

LLP has sole investment and voting power over Ropemaker Nominees Limited’s shares. The investment decisions of Notion Capital

Managers LLP are made by the majority vote of an investment committee comprised of five members, including Stephen Chandler. Under

the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s securities are made

by three or more individuals, and a voting or dispositive decision requires the approval of at least a majority of those individuals,

then none of the individuals is deemed a beneficial owner of the entity’s securities. Based upon the foregoing analysis, no

individual member of the investment committee of Notion Capital Managers LLP exercises voting or dispositive control over any of

the securities over which it holds sole investment and voting power. Accordingly, Mr. Chandler is not deemed to have or share

beneficial ownership of such shares. Includes 1,909,522 September 2023 Investor Warrants that are currently exercisable. |

| |

|

| (15) |

The address of Seraphim Space Investment Trust plc is

5th Floor, 20 Fenchurch Street, London, EC3M 3BY, United Kingdom. Seraphim Space Manager LLP is the fund manager of Seraphim Space

Investment Trust plc and its investment decisions are made by a unanimous vote of a committee comprised of four members. Therefore,

no individual has sole or shared investment and voting power over the shares held by Seraphim Space Investment Trust plc. |

| |

|

| (16) |

The address of The Evolution Technology Fund II, SCSp

is 15, Boulevard Friedrich Wilhelm Raiffeisen, L 2411. Luxembourg. Evolution Equity Partners II Sarl is the general partner of The

Evolution Technology Fund II, SCSp. and has sole investment and voting power over the shares held by The Evolution Technology Fund

II, SCSp. |

| |

|

| (17) |

The business address of Trevor Barker is Nova North,

Floor 7, 11 Bressenden Place, London SW1E 5BY, United Kingdom. |

| |

|

| (18) |

The address of UK FF Nominees Limited is 5 Churchill

Place, 10th Floor, London, E14 5HU, United Kingdom. The Secretary of State for Business and Trade (formerly the Secretary of State

for Business, Energy and Industrial Strategy) has sole investment and voting power over the shares held by UK FF Nominees Limited. |

| |

|

| (19) |

Selling Securityholder is a current or former employee

or consultant of the Company’s primary operating subsidiary, Arqit Limited. |

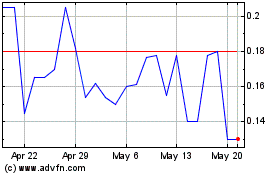

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From May 2024 to Jun 2024

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From Jun 2023 to Jun 2024