2nd UPDATE: E.ON, MPX Partner To Build Power Plants In S America

January 11 2012 - 12:05PM

Dow Jones News

German utility E.ON AG (EOAN.XE) said Wednesday it has agreed to

acquire a minority stake in Brazilian power company MPX Energia SA

(MPX3.BR), in a deal that will see both companies jointly invest

billions of dollars in new power plants in South America.

The deal marks E.ON's first investment in Brazil and comes as

giant European utilities seek to increase their leverage to booming

emerging economies as growth in Europe stagnates. Peer companies

like Spain's Iberdrola SA (IBDRY) and France's GDF Suez (GSZ.FR)

have also announced recent transactions, in Brazil and China,

respectively.

Under the deal, E.ON will acquire a 10% stake in MPX for around

EUR350 million, the companies said. The shares will be purchased in

a capital increase at MPX, through which the Brazilian company

expects to raise a total of EUR423 million, they added.

The transaction is expected to close in the second quarter of

2012, they said.

For E.ON, the partnership opens the door to fast-growing South

America and provides it with a partner that has knowledge and

experience of these markets.

MPX gets access to E.ON's long track-record of building and

operating coal and gas-fired power plants as well as renewable

energies. The venture also provides the Brazilian company with a

partner to shoulder a costly capital program, an effort that will

also be supported by Brazilian development bank BNDES. One company

official said the massive construction campaign could cost $34

billion.

"The partnership between MPX and E.ON aims to develop a total

[power production] capacity of 20 gigawatt in Brazil and Chile,

thus becoming the largest private energy company in Brazil," both

companies said in a joint statement.

The 20 GW program nearly doubles MPX' 11 GW power plant

expansion program that had been envisioned prior to the E.On

venture. Initially, the companies intend to develop MPX's existing

pipeline of coal and gas-fired power generation projects with a

total capacity of 11 GW, they said.

Eike Batista--founder of MPX parent company EBX Group and

Brazil's wealthiest man--said that building the entire 20 GW

program could require $34 billion, up from the previous estimate of

$22 billion for 11 GW program.

Eduardo Karrer, Chief Executive of MPX, said MPX might also

accelerate, or "recalibrate," the pace its capital program. Karrer

said the venture's investment would target both government auctions

to expand capacity and private companies, such as mining firms,

that have sought more power generation.

The costs of building the new power generation capacity will be

split equally, the companies said. However, with some 75% of

financing expected to come from banks--the bulk of which is

expected to come from Brazil's development bank BNDES--E.ON and MPX

each only have to provide 12.5% in equity capital to the projects,

Batista said.

Wednesday's deal is a major step by Germany's most valuable

utility into emerging markets, a goal which it had announced last

year as it seeks to move into regions that have stronger growth

rates than its present core markets of Europe and the U.S.

E.ON had previously identified Brazil as one of three markets in

which it would consider an investment.

The other two countries are Turkey and India. Chief Executive

Johannes Teyssen Wednesday said that he wouldn't rule out pushes

into these markets at a later point in time, despite the agreed

Brazilian expansion.

MPX also said it will spin-off its compliance coal mining assets

in Colombia to form a new company named CCX, adding that this

business won't be part of the partnership with E.ON.

-By Jan Hromadko and Paulo Winterstein, Dow Jones Newswires; +49

69 29 725 503; jan.hromadko@dowjones.com;

paulo.winterstein@dowjones.com

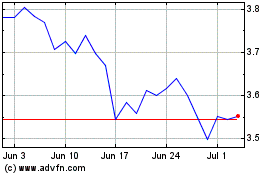

EDP Energias DE Portugal (EU:EDP)

Historical Stock Chart

From May 2024 to Jun 2024

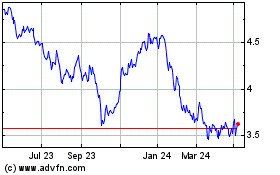

EDP Energias DE Portugal (EU:EDP)

Historical Stock Chart

From Jun 2023 to Jun 2024