EDF 9-Month Revenue Up On Higher Nuclear Output; Targets Kept

November 10 2011 - 12:32PM

Dow Jones News

French state-controlled power giant Electricite de France SA

(EDF.FR) Thursday said revenue in the first nine months of the year

grew 2.7%, boosted by higher nuclear output and that its full-year

guidance was unchanged.

The group expects 2011 earnings before interest, tax,

depreciation and amortization, or Ebitda, to grow 4%- 6% on an

organic basis and sees a dividend at least equivalent to that of

2010. EDF also forecasts the 2011 ratio of net financial

debt/Ebitda between 2.1 and 2.3.

EDF's revenue in the first nine months of the year amounted to

EUR47.15 billion, from EUR45.9 billion a year earlier, adjusted to

exclude the group's French grid unit RTE, as well as divestitures

such as Germany's ENBW, networks and the Eggborough plant in the

U.K. The group also restated its 2010 figure at EUR47.2 billion, to

take into account the impact of the application of the IFRS 5

accounting rule and the change in presentation of SPE's

optimization activities.

EDF's French nuclear output in the period grew 5.7% to 315

terawatt-hours, while its U.K. nuclear output grew 25.7% to 44

TWh.

Such a performance allows the group to adjust and increase its

production target from 411-418 TWh to 415-420 TWh and the

corresponding availability factor, knwon as "Kd" between 79% and

80% from a previous estimate of 78.5%, EDF said.

EDF earlier decided to delay the construction of four planned

nuclear reactors in the U.K., instead taking time to evaluate the

consequences of delays at a reactor under construction in

Flamanville, northern France and the consequences of the Fukushima

Daiichi nuclear disaster in Japan. EDF will release a new calendar

for the project during in the autumn.

EDF had been due to start building the first of the planned

U.K.-based nuclear rectors in 2013.

EDF also reiterated that along with Italian utility A2A SpA

(A2A.MI) and investment vehicle Delmi, it agreed to extend a

shareholder pact for Edison until Nov. 30. It said talks over EDF

taking control of Edison are continuing, pending an opinion on

EDF's tender offer for the remaining stake from Italy's stock

market regulator Consob.

EDF currently holds about 50% of Edison directly and indirectly,

but has been pushing for more direct control following a series of

costly natural gas contracts that have marred Edison's financial

performance. Edison is 61.3%-held by Transalpina di Energia, itself

50%-held by EDF and 50% by Italian shareholder Delmi, which in turn

is led by A2A.

The French state owns around 83% in EDF.

Since the start of the year, shares in EDF have shed around 33%,

after the Fukushima accident triggered worries about additional

safety costs for nuclear plants and doubts over EDF's prospects as

an international nuclear builder and operator. Shares closed

Wednesday at EUR20.69.

-By Geraldine Amiel, Dow Jones Newswires; +33 1 40171767;

geraldine.amiel@dowjones.com

Order free Annual Report for A2A SpA

Visit http://djnweurope.ar.wilink.com/?ticker=IT0001233417 or

call +44 (0)208 391 6028

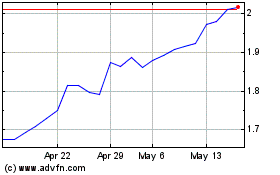

A2A (BIT:A2A)

Historical Stock Chart

From May 2024 to Jun 2024

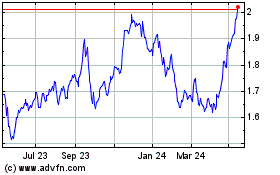

A2A (BIT:A2A)

Historical Stock Chart

From Jun 2023 to Jun 2024