New York Fed Enhances Disaster Recovery Requirements for Primary Dealers

March 24 2016 - 12:10PM

Dow Jones News

The Federal Reserve Bank of New York is requiring primary

dealers to ensure their backup trading systems are more spread out

in case of disruptive events.

The revised policy for primary dealers—institutions that are

authorized to trade directly with the government—includes "new

geographic dispersion standards and a few minor clarifications,"

the New York Fed said in a statement on its website Thursday.

The New York Fed oversees the mechanisms and systems the U.S.

central bank uses to communicate and trade with Wall Street firms,

and operates the trading desk the Fed uses to implement its

monetary-policy decisions.

That desk also oversees all auctions of government debt on

behalf of the Treasury Department. Following the Sept. 11, 2001,

terrorism attacks and superstorm Sandy in 2012, the New York Fed

has been beefing up its own backup market operations site in

Chicago.

The new standards outlined by the New York Fed "require primary

dealers to employ geographic dispersion between their primary and

secondary locations to allow participation in desk operations even

amid wide-scale disruptions," such as a large terrorism or natural

disaster event.

The list of 22 primary dealers comprises a range of bank-owned

and independent securities-trading firms, including Goldman Sachs

& Co. and J.P. Morgan Securities LLC as well as Jefferies LLC

and Cantor Fitzgerald & Co. In that role, they must meet

certain obligations, including participation in Fed trading

operations and providing the Fed with market information.

The statement said primary dealers would have a transition

period in which they would be allowed to gear up for the

changes.

The New York Fed added the following to its policy: "Primary

dealers' disaster recovery capabilities, as reflected in their

business continuity plans and routinely tested, should ensure that

robust end-to-end participation in New York Fed's trading desk

operations and Treasury auctions (including trading, clearing and

settling) will occur even amid a wide-scale disruption in the

firm's primary location by employing geographic dispersion between

primary and secondary locations."

Write to Katy Burne at katy.burne@wsj.com

(END) Dow Jones Newswires

March 24, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

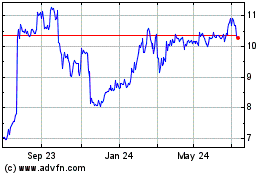

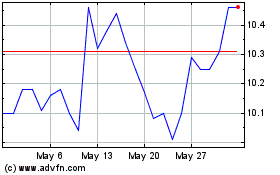

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024