Treasury Official Calls for Greater Foreign Bank Policies

March 07 2016 - 1:50PM

Dow Jones News

International regulators have made significant headway in

putting in place regulatory changes in the wake of the 2008

financial crisis, but the U.S. Treasury is continuing to push for

more policies to establish a level playing field between foreign

and U.S. banks, said Treasury Under Secretary for International

Affairs Nathan Sheets.

Mr. Sheets, who attended the Group of 20 meeting of finance

ministers and central bank governors in China late last month, said

the officials' agenda remains focused on bank capital and leverage,

the resolution of systemically important financial institutions,

stability in the shadow banking system and regulating

derivatives.

"My sense is that most of the heavy lifting on these reforms has

been completed," Mr. Sheets told the Institute of International

Bankers' annual conference in Washington. "However,

standard-setting bodies will continue to refine and calibrate the

capital and liquidity frameworks to promote coherence and

effectiveness." He added that the "Basel Committee has signaled

that it does not envision significantly increasing overall capital

standards from here."

Overall, Mr. Sheets said the regulatory changes adopted

following the financial crisis have made the financial system safer

despite recent market turbulence.

"Investors are more appropriately pricing the risk of debt

instruments and coming to terms with new expectations for banks'

return on equity," he said. "My assessment is that these important

steps greatly reduce the risk of systemic crises, while still

allowing banks to continue to play a critical role in

intermediating credit for the real economy."

Mr. Sheets seemed particularly concerned about how foreign

regulators are applying "uneven" changes that are "behind schedule"

to improve the trading and reporting of certain derivatives

contracts. He did, however, note a recent agreement between the

European Commission and the Commodity Futures Trading Commission to

allow U.S. central counterparties to continue providing clearing

services in the European market. He also expects some additional

guidance related to the central counterparties system before the

G-20 ministers and central bankers meet again in September.

"We continue to urge our fellow G-20 members to act on these

critical reforms to foster financial stability, reduce market

fragmentation, and support a level playing field for global firms,"

Mr. Sheets said. He also said the Financial Stability Board, the

international organization aimed at promoting financial stability,

is coordinating with member countries on central counterparties "so

that these crucial parts of the financial architecture are not

themselves too big to fail."

Further, he said, another priority is promoting financial

inclusion by lowering the costs and improving regulation of

international money transfers, or remittances.

Beyond that, he said, the Treasury is emphasizing financial

education and transparency along with greater disclosure

"particularly for those services designed to reach traditionally

excluded and underserved groups," and, to that end, is working with

international standards bodies.

Mr. Sheets also gave credit to regulators for developing

standards to avoid the "too big to fail" problem with financial

institutions. Known as total loss-absorbing capacity, or TLAC, the

standards require banks to increase their capital reserves and will

be phased in beginning in 2019.

"Analysis concludes that there will be sufficient demand for the

TLAC instruments that must be issued to satisfy the standard," he

said. "That said, the standard recognizes that emerging market

G-SIBs (global systemically important banks) may need additional

time to come into compliance due to their less developed domestic

bond markets."

Write to Rachel Witkowski at Rachel.Witkowski@wsj.com

(END) Dow Jones Newswires

March 07, 2016 13:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

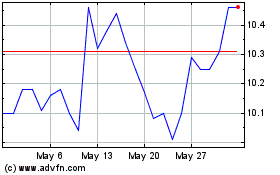

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

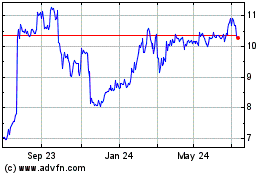

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024