Treasury Department Reviewing Retaliatory Tax Law Against EU

March 04 2016 - 3:30PM

Dow Jones News

WASHINGTON—The U.S. Treasury Department said it is "closely"

reviewing a never-used 82-year-old law that would impose

retaliatory double taxes on European Union companies and

individuals.

The law is being investigated following objections from the

Treasury and a bipartisan group of senators to the European

Commission's "state aid" investigations, which the U.S. officials

contend disproportionately target U.S. firms in an effort to claw

back European tax breaks.

The retaliatory double tax represents the most concrete—and

confrontational—way the U.S. could respond to the EU

investigations.

The Treasury said it is studying Section 891 of the Internal

Revenue Code, which allows the president to double U.S. taxes on

individuals and corporations from countries that are deemed to have

subjected U.S. citizens and companies to "discriminatory or

extraterritorial taxes."

"We are reviewing this provision and its history closely, and we

are continuing to consider all modes of engagement to convey our

strong view" that European officials should reconsider their

approach to the issue, wrote Anne Wall, the assistant Treasury

secretary for legislative affairs, in a letter dated March 2.

In the letter, which was a response to a January request from

Senate Finance Committee Chairman Orrin Hatch (R., Utah), Ron Wyden

(D., Ore.), Rob Portman (R., Ohio) and Charles Schumer (D., N.Y.),

the Treasury also noted that no president has ever invoked this

portion of the code.

EU officials have said they are applying long-standing legal

principles and they aren't disproportionately targeting U.S.

companies. The probes include investigations of Apple Inc. and

Amazon.com Inc., as well as non-U.S. companies, such as BP PLC and

BASF SE.

European regulators have been investigating whether tax breaks

in individual countries, such as Belgium, Ireland and Luxembourg,

violate rules against excessive government aid to companies. If

deemed illegal, European officials could then press the countries

to recover corporate funds related to the tax breaks.

When U.S. companies pay taxes abroad, they receive tax credits

against their eventual U.S. tax liability. They pay the residual

U.S. tax when they repatriate they money—but U.S. lawmakers are

considering a mandatory one-time tax on foreign profits as part of

a major revamp of the tax system

"While Treasury has clearly signaled a sense of disappointment

and concern regarding the European Union's state aid investigation,

it's imperative the administration stays the course," Mr. Hatch

said on Friday in response to the Treasury's letter.

"Treasury should remain vigilant in oversight and be prepared to

take action to ensure American businesses do not fall

victim—retroactively—to a novel legal theory that undermines the

U.S.-EU tax treaty network and disproportionately targets U.S.

companies," he said.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

March 04, 2016 15:15 ET (20:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

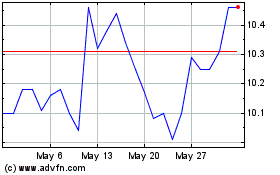

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

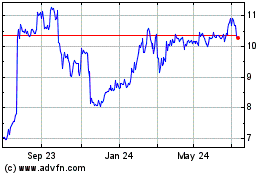

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024