Global Stocks Down as Commodities Prices Slip

February 24 2016 - 4:50AM

Dow Jones News

Global stocks fell Wednesday, weighed by fresh declines in

commodities prices and China's currency.

The Stoxx Europe 600 was down 1% in early trade following a weak

finish on Wall Street and in Asia.

Losses were led by the mining and energy sectors as oil and base

metals prices continued their retreat.

Crude oil lost further ground after Saudi Arabia's oil minister

dismissed the possibility of a production cut amid a global supply

glut. Brent crude was down 1.6% at $32.75 a barrel, adding to pain

for the energy sector and its creditors.

Some investors have used the oil price as a gauge of the health

of the global economy, responding to downward moves by selling

risky assets, such as stocks, across the board.

Also keeping investors cautious, Chinese authorities guided the

yuan weaker for a second day in a row. Depreciation of the currency

sent shock waves through financial markets last August and at the

start of this year.

Investors fear a substantially weaker Chinese currency could

spur capital outflows from the country and adversely impact China's

trading partners.

"China remains one of our biggest concerns in global financial

markets," said Barclays economist Shengzu Wang.

The Shanghai Composite Index closed up 0.9%, but shares

elsewhere in Asia fell, catching up with losses in the U.S. and

Europe.

Japan's Nikkei Stock Average was down 0.9% as a stronger yen

weighed on shares of exporters. Bank of Japan Governor Haruhiko

Kuroda said Wednesday that the central bank wouldn't hesitate to

act if market volatility threatens its efforts to defeat deflation,

helping to push long-term Japanese government bond yields to record

lows. Yields fall as prices rise.

Australia's S&P ASX 200 fell 2.1%, weighed down by energy

and financial shares, while Hong Kong's Hang Seng Index lost

1.2%.

Stocks around the world had climbed last week, recouping some of

the steep losses in global financial markets earlier this year. A

slump in bank shares and declining commodity prices halted the

rally Tuesday as Wall Street ended lower.

Mixed U.S. data did little to reassure investors about the

strength of the U.S. economy after consumer confidence figures

disappointed.

The yield on the 10-year Treasury note fell around 0.02 of a

percentage point Wednesday to 1.717%, and is down over half a

percentage point this year.

"The 10-year Treasury is literally telling you the bond market

sees clouds on the horizon," said Bob Andres, chief investment

officer of Andres Capital Management.

Mr. Andres expects stocks to fall further amid a global

slowdown, low commodities prices, and after years of quantitative

easing in the U.S., which he said artificially boosted stock

prices.

In currencies, the dollar was up 0.1% against the yen at ¥

112.0680, while the euro was down 0.2% against the dollar at

$1.0998.

Recent weak manufacturing and business expectations figures in

Europe have further fueled expectations for the European Central

Bank to expand its stimulus measures at its March meeting.

In metals, gold was up 0.3% at $1,226 an ounce.

Copper was down 1.5% at $4,585 a ton, adding to pain in Europe's

basic resources sector. With Wednesday's losses, the mining sector

fell back into negative territory for the year.

Summer Said and Hiroyuki Kachi contributed to this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

February 24, 2016 04:35 ET (09:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

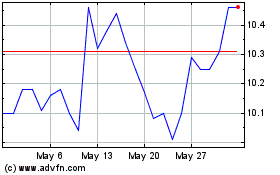

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

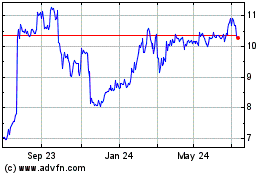

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024