G-20 Likely to Reiterate Currency Commitments, Treasury Official Says

February 22 2016 - 3:40PM

Dow Jones News

WASHINGTON—Global financial leaders likely will reiterate

previous currency policy commitments, a senior U.S. Treasury

official signaled Monday, despite concerns that lackluster growth

around the world may tempt some countries to use devalued

currencies to juice exports.

A senior U.S. official, speaking ahead of a gathering of finance

ministers and central bankers from the Group of 20 largest

economies in Shanghai later this week, said exchange-rate

commitments in previous G-20 communiqué s have been "constructive

and helpful, and I think nicely articulate the rules of the

game."

Central banks around the world, including in Europe and Japan,

have expanded easy-money policies into uncharted territories,

policies that are cheapening their currencies. China, meanwhile, is

struggling to manage a slowdown and major economic overhaul,

leaving many investors worried that Beijing may revert to yuan

depreciation to goose exports. As central banks vie to gain

monetary policy traction and the strengthening U.S. dollar

threatens to damp American growth, speculation has grown the G-20

could orchestrate a coordinated exchange-rate adjustment.

Such a proposal is premature, say some G-20 watchers.

The senior U.S. Treasury official indicated the Shanghai meeting

would simply replicate past commitments: "We will emphasize the

importance for all G-20 members to honor their commitments to avoid

persistent exchange-rate misalignments and not target exchange

rates for competitive purposes."

The official did say U.S. Treasury Secretary Jacob Lew will

"emphasize the value of ongoing communication and consultation in

foreign-exchange management."

But that message was likely aimed at Beijing, where economic

struggles and policy missteps in recent months have fueled market

speculation authorities are preparing for a yuan depreciation

strategy to offset declining growth.

The U.S. official praised recent comments by China central bank

chief Zhou Xiaochuan saying the government isn't seeking a yuan

devaluation and is committed to policy clarity.

Write to Ian Talley at ian.talley@wsj.com

(END) Dow Jones Newswires

February 22, 2016 15:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

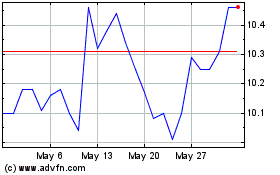

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

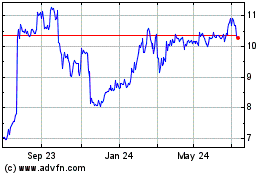

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024