Mosman Oil and Gas Raises GBP1.5 Million via Discounted Placing -- Update

September 22 2015 - 7:08AM

Dow Jones News

(Rewrites first paragraph, adds detail and share price

information.)

By Ian Walker

LONDON--Shares of Mosman Oil & Gas Ltd. (MSMN.LN) fell as

much as 23% in early trade Tuesday after the company said it has

raised 1.5 million pounds ($2.3 million) in a heavily discounted

share placing.

The New Zealand and Australia-focused oil exploration and

development company has issued 33.33 million ordinary shares via a

placing and subscription at 4.5 pence each, a 27% discount to its

closing share price of 6.13 pence on Monday.

The company said it will use the money to progress the

acquisition of a proposed 70% interest in the South Taranaki energy

project assets in New Zealand, announced earlier this month.

Shares at 10050 GMT are trading 1.25 pence, or 20% lower, at

4.88 pence, having dropped as low as 4.75 pence earlier in the

session. They are currently down 77% over the past 12 months.

Mosman announced on Sept. 3 that it was buying a share in the

assets for 7 million New Zealand dollars ($4.44 million) payable in

two parts, from Origin Energy Ltd. (ORG.AU). The first tranche of

NZ$4.9 million is payable on completion with the second tranche due

six months later.

WRDLS Pty Ltd., a private company with personnel experienced in

the resource and energy sector, is buying the other 30% of the

project.

Completion is dependent upon a number of conditions, including

Mosman and WRDLS providing reasonable financial assurance to Origin

Energy by Sept. 30.

The project assets being bought include fully operational and

established oil and gas processing facilities, equipment, permits,

infrastructure, and the assignment of both key employee contracts

and relevant commercial contracts, including oil and gas sales

agrements.

Since October 2014 the project has been producing an average 603

barrels of oil equivalent a day, which would generate annual

revenue of NZ$8 million based on current production rates, oil

price and exchange rates, the company said.

Mosman said at the time of the acquisition that it has already

completed detailed due diligence on the project and identified

areas that have the potential to significantly increase production

levels within a reasonable time period.

Mosman added that it has verified and prioritized a list of 12

opportunities that are expected to increase production, following

completion of the acquisition, quickly and at modest cost, some of

which are as simple as changing level sensors to avoid false

alarms.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 22, 2015 06:53 ET (10:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

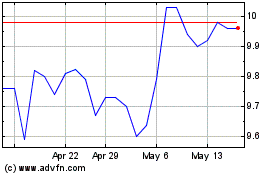

Origin Energy (ASX:ORG)

Historical Stock Chart

From May 2024 to Jun 2024

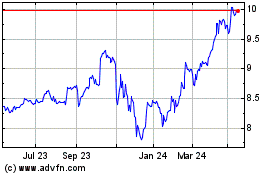

Origin Energy (ASX:ORG)

Historical Stock Chart

From Jun 2023 to Jun 2024