Australian mining companies fell sharply Monday as investors

factored in lower earnings for the companies after the government

said Sunday that it plans to introduce a 40% tax on the industry's

profits.

Analysts cut target prices and earnings estimates for many of

the firms and said that the proposed Resource Super Profits Tax

could cause potential mergers and acquisition suitors to reassess

their valuation of target companies.

Credit Suisse analysts said that the proposals could force the

country's two largest miners, BHP Billiton Ltd. (BHP) and Rio Tinto

PLC (RTP), back to the negotiating table on their proposed A$116

billion joint venture to combine their iron ore assets in Western

Australia's Pilbara region.

"We are still committed to the joint venture. We are assessing

the impact but it is a bit early to say," a BHP spokeswoman said

adding there is "still a great deal that is unclear" about the

detail of the tax changes.

Rio Tinto wasn't immediately available for comment.

Mining companies were still digesting the implications of the

plans, which came as part of a review of Australia's entire

taxation system which will also see the country's headline

corporate tax rate reduced to 28% from 30%.

Royalty payments that mining companies currently pay to state

governments will also be rebated as part of the proposals, reducing

the net effect of the tax changes below the headline rate of

40%.

But, combined with company taxes and after allowing for

extraction costs and recouping capital investment, companies will

pay a statutory rate of around 58%, according to a Treasury

estimate.

The proposals still have to pass Australia's parliament, where

several recent major laws have failed to get through the Senate,

where the government lacks a majority.

Opposition leader Tony Abbott told Australian Broadcasting Corp.

radio on Monday that he was "deeply hostile" to the plans, but

refused to say whether he would oppose the laws in the Senate.

Miners nonetheless suffered a savage sell-off in morning trading

in Sydney.

At 0240 GMT, Rio Tinto was down 3.4% at A$69.65 and BHP was down

2.7% at A$39.65. Macarthur Coal Ltd. (MCC.AU) was down 7.4% at

A$14.32.

Macarthur, which has been the subject of a takeover bid by the

U.S. miner Peabody Energy Corp. (BTU), could see its suitor's plans

hit by the tax review's impact on its valuation, according to

Macquarie analysts. "The prospective fall in (Macarthur's) net

present value...is likely to see Peabody reassess its estimate of

'fair value'," Macquarie said.

Australian mining companies have been the subject of a string of

mergers and acquisitions bids over the past year, driven by the

rebounding value of commodities and expectations of future demand

from China.

Many of these deals were likely to be put on ice until the law

is finalised, according to one Australia-based M&A expert for a

major international investment bank, who asked not to be named.

The details of the tax will affect the profitability and

valuations of target companies on which takeover pricing decisions

are made, making it hard to reach final decisions until the

legislation is inked.

But while the profit cuts would hurt local companies' ability to

take over foreign rivals, it wouldn't necessarily damp overseas

companies' appetite for local assets to the same extent. "It will

make Australian companies less competitive internationally but for

international companies looking inwards it won't change as much,"

he said.

Initial sharp falls in share prices had recovered somewhat by

late morning. The slide had been "at the upper end of what we'd

been expecting," said Brendan Fitzpatrick, a mining analyst at

Deutsche Bank in Sydney.

Deutsche Bank estimated that the new rules would hit sector

valuations by 7%, a reduction which should already be at least

partially factored into share prices.

"After completing the detailed analysis it wasn't as detrimental

as it appears on the first review," he said, citing the fact that

the introduction of the changes will be pushed back to 2012; the

rebate of state royalties; the reduction in the main corporate tax

rate; and the fact that depreciation and amortisation will not be

included in the tax calculation.

Companies with large numbers of offshore projects and in an

early stage of development would be likely to fare best, he said,

as the taxes will only hit profits, rather than revenues, from

Australian mines. However, overseas companies with significant

Australian operations will be affected.

Mick Davis, Chief Executive of Anglo-Swiss mining giant Xstrata,

said that under the plan, Australia would have the highest taxes on

the minerals sector anywhere in the world.

"(It) will result in significant and disproportionate additional

taxation on the industry and could well curb the large scale,

long-term investments required to develop Australia's natural

resources for the benefit of all Australians," Xstrata said in a

statement.

For energy companies, the new tax is set to hurt those with

onshore assets.

Australian oil and gas producers are already subject to the

Petroleum Resource Rent Tax, which is at a rate of 40% of company's

taxable profits.

"It's almost like everybody else catching up to where we're at,"

said Woodside Petroleum Ltd. Chief Executive Don Voelte.

Santos Ltd. (STO.AU) has a large quantity of assets onshore in

Australia's Cooper Basin and along with Origin Energy Ltd. (ORG.AU)

it wants to convert vast onshore coal seam gas reserves in

Queensland state into liquefied natural gas for export.

Santos shares were down 3.9% at A$13.30 and Origin was down 1.3%

at A$16.16.

The Australian government said projects within the scope of the

PRRT can elect to transfer into the RSPT and that it anticipates

that many projects will make the transition over time.

-By David Fickling; Dow Jones Newswires;

david.fickling@dowjones.com

(Rebecca Thurlow, James Glynn, Ross Kelly in Sydney and Neil

Sands in Melbourne contributed to this article)

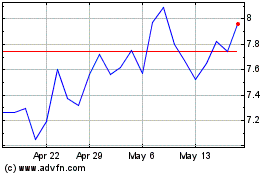

Iluka Resources (ASX:ILU)

Historical Stock Chart

From Apr 2024 to May 2024

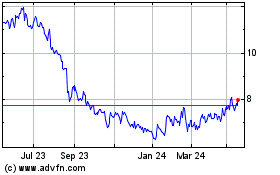

Iluka Resources (ASX:ILU)

Historical Stock Chart

From May 2023 to May 2024