Australian Industry Reaction To Carbon Tax Package Mixed

July 10 2011 - 5:28AM

Dow Jones News

Industry reaction to the Australian government's carbon tax

package was mixed Sunday, with miners saying it would chase away

investment, steelmakers welcoming assistance for their industry and

others still considering what impact it might have.

The Minerals Council of Australia, whose members include mining

giants BHP Billiton (BHP, BHP.AU), Rio Tinto (RIO.AU) and Xstrata

PLC (XTA.LN), said the tax would cost the industry A$25 billion to

2020 and 20,000 jobs.

The council's chief executive, Mitch Hooke, said the new tax

also meant Australia would become the only country in the world to

tax methane emissions from coal mines.

"The only way in which you will reduce methane emissions in coal

mines in Australia is to close them down," Hooke said. "A new tax

will go a long way to impeding investment and jobs and growth and

closing down coal mines in Australia."

Xstrata Coal, which has interests in coal mines in Queensland

and New South Wales states, said in a statement it was reviewing

the tax package to determine the impact on its business.

The company, the world's largest exporter of thermal coal,

according to its website, said it was disappointed by a lack of

consultation by the federal government in designing the

package.

"We have consistently advocated for a scheme that protects all

exposed export industries, invests in low emission technologies;

and provides a phased introduction with clear longer term emissions

reduction targets," company spokesman James Rickards said.

Australian steel company BlueScope Steel Ltd. (BSL.AU) said a

A$300 million assistance package to minimize the impact on steel

producers of the carbon tax would "materially" reduce the overall

cost of the tax on the company.

The federal government's Steel Transformation Plan, or STP,

would provide four years of transitional support for steelmakers

and provide support for innovation, investment and production.

"In the STP (the government) has produced a package that, if

implemented as explained to us, deals with the steel sector's

carbon tax issues in a significant way," BlueScope Chief Executive

Paul O'Malley said in a statement.

The company said the STP would be split roughly 60% for

BlueScope and 40% for fellow steelmaker OneSteel Ltd. (OST.AU).

Retailers, who are already suffering from a downturn in spending

by cautious consumers, were worried the tax could further dent

consumer confidence.

"Much of the uncertainty around the carbon price may now lessen,

but the negativity of the 'anti' campaign will continue and that

may be enough to convince Australians they need to keep saving

their pennies," said Australian National Retailers Association

Chief Executive Margy Osmond.

The Australian Food and Grocery Council, representing the

nation's food, drink and grocery manufacturers, said the carbon tax

would increase costs through the supply chain, predominantly

through increased power prices.

But the council welcomed the decision to exclude transport fuel

until 2014 and a A$150 million program over six years to help

industry become more energy efficient.

-By Gavin Lower, Dow Jones Newswires; gavin.lower@dowjones.com;

61 3 9292 2095

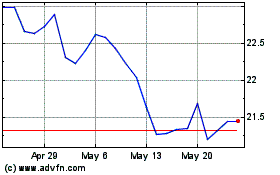

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Apr 2024 to May 2024

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From May 2023 to May 2024