2nd UPDATE: BlueScope Steel Loss Deepens As Materials Costs Rise

February 21 2011 - 12:35AM

Dow Jones News

Australia's resources boom is killing off other sectors of the

country's economy, the chief executive the country's largest

steelmaker by revenue warned Monday, as BlueScope Steel Ltd.

(BSL.AU) reported a deepening of losses during its fiscal first

half to Dec. 31.

Booming prices for steelmaking raw materials are cutting profit

margins for steelmakers worldwide despite delivering record profits

for miners, while the commodity-driven strength of the Australian

dollar is putting pressure on the domestic manufacturing sector and

cutting demand for steel products, Paul O'Malley said.

"It's a tough time to be a manufacturer in Australia, in fact a

very tough time," he said. "This economy needs to be more than just

a one-trick pony."

Diversified miners including Australia's BHP Billiton Ltd.

(BHP), Rio Tinto Ltd. (RIO), and Fortescue Metals Group Ltd.

(FMG.AU) have announced surging profits over the past two weeks on

the back of near-record prices for steelmaking materials,

particularly iron ore and coking coal. European counterparts Anglo

American PLC (AAL.LN) and Xstrata PLC (XTA.LN), which have

significant operations in the country, have declared similarly

impressive results.

But business leaders and economic policymakers, including

Reserve Bank of Australia Governor Glenn Stevens and RBA board

member Roger Corbett, have warned in recent months that Australia's

mining boom is hollowing out other parts of the economy.

BlueScope said net losses in its fiscal first half ended Dec. 31

nearly doubled to A$55 million from A$28 million the previous year,

despite revenues rising 13% to A$4.62 billion from A$4.11

billion.

The outcome also illustrates the stark divide between miners and

producers in the steel industry, as iron ore and coking coal costs

rise against a more restrained backdrop for steel prices. Steel is

a crucial commodity for the world's manufacturing and construction

sectors and a vital indicator of global economic health.

Each ton of steel requires around 1.5 tons of iron ore and 0.6

ton of coking coal. O'Malley said that the cost of raw materials,

which BlueScope largely buys from its former parent company BHP,

had risen to A$2.5 billion this year from A$400 million when it was

spun out of BHP in 2002.

East Asian hot-rolled coil, a benchmark sheet metal product, has

risen 18% to US$730 a metric ton from US$620 since the new year

amid rising expectations of global growth, according to

Commonwealth Bank of Australia. But record wet weather in mining

regions of Australia has driven up prices of iron ore and coking

coal still further.

BlueScope said the A$285 million deterioration in its underlying

earnings from the second half of the 2010 financial year was

largely caused by a A$356 million increase in materials costs,

which was offset by only a A$106 million improvement in steel sale

prices.

BlueScope's results were also hit by a stronger Australian

dollar cutting into export margins and offshore profits, by lower

steel demand in Australia, and A$16 million of negative accounting

and tax changes, the company said.

O'Malley also said profits would improve by A$200 million if the

local currency fell back to the US$0.8000 level it hovered below

for most of the past two decades. It last traded at US$1.0115.

The strong dollar is trimming the value of BlueScope's offshore

profits in local currency terms, O'Malley said, while upward

pressure on the cost of Australian exports was cutting steel demand

from the country's beleaguered manufacturing sector.

"Demand in Australia is 20% off where it was six months ago," he

said.

Australia's construction and manufacturing sectors have been hit

hard in recent months by a stronger currency and rising interest

rates caused by the resurgent mining sector. Output in the two

sectors has been in decline since August and May, respectively,

according to the Australian Industry Group, a trade body.

On an underlying basis excluding one-off items, the company's

net loss narrowed 11% to A$47 million from A$53 million. Management

predicted that the company would break even in the second half of

the year and proposed an interim dividend of 2 cents per share,

including franking tax credits, compared to a halted payout the

year before.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

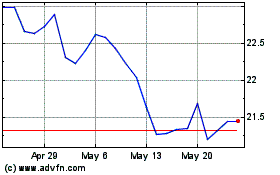

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Apr 2024 to May 2024

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From May 2023 to May 2024