3rd UPDATE: Alumina 1st Half Net Profit US$44.2 Million; Price Move To Take 5 Years

August 10 2010 - 12:50AM

Dow Jones News

Alumina Ltd. (AWC.AU) said Tuesday that first half net profit

for the period ended June 30 jumped to US$44.2 million from US$4.2

million a year earlier.

Chief Executive John Bevan forecast that global alumina demand

would grow 12% this year and predicted that any move toward index

pricing for the material would happen within five years.

"Overall, the results have been very pleasing (and) a very

strong improvement over 2009," he said.

The company attributed the earnings improvement to higher sales

volumes and prices and good cost control, offset by the impact of a

stronger Australian dollar and costs and charges associated with

ramping up its Brazilian operations.

Alumina, whose sole significant asset is a 40% stake in the

Alcoa World Alumina & Chemicals joint venture with Alcoa Inc.

(AA), will pay a dividend of 2 U.S. cents per share. It didn't pay

a dividend in the previous corresponding period.

Revenue for AWAC rose 55% to US$2.65 billion, compared to

US$1.71 billion during the first half of 2009.

AWAC is the world's largest producer of alumina. The joint

venture expects to produce 15.3 million tons-15.6 million tons this

year.

Bevan said the company expects markets to move to index-based

pricing of alumina within five years, in line with changes that

have begun over the past year in the pricing of iron ore and coking

coal.

But the success of the shift will depend on the performance of

tools to track an index price, he said.

Market data supplier Platts is due to release the first major

daily spot alumina price index on Monday.

"The index has only just been established now, and the success

of that over the next couple of months will determine whether the

conversion (to full index pricing) in fact occurs," Bevan said.

Alumina is an intermediate commodity in the production of

aluminum from bauxite ore. It has traditionally been priced at

around 12%-17% of the market aluminum price, but

producers--including BHP Billiton Ltd. (BHP.AU), Vale SA (VALE) and

Alcoa--have been pushing for a move toward index-based pricing.

The Australian Bureau of Agricultural & Resource Statistics

forecasts spot alumina prices averaging US$314/ton during 2010,

while aluminum is expected to average $2,035/ton.

Alumina Ltd. said the growth of third parties such as traders to

make up 40% of the global alumina market is creating pressure for

prices to be delinked from aluminum.

AWAC is the world's largest supplier of alumina to third

parties, Alumina said, accounting for 60% of its sales of the

commodity.

However, "a pretty low percentage" of its alumina had been sold

on an index basis during the year to date, he said.

AWAC's production of alumina during the first six months rose

16% on the year and hit a record, Alumina said, while the company

reduced its cash costs for the commodity by US$4/ton on the year.

The company didn't disclose a cash cost figure.

Two power outages and equipment commissioning issues at Brazil's

Alumar refinery--jointly owned by AWAC, BHP Billiton and Rio Tinto

Ltd. (RIO.AU)--resulted in US$27 million of one-off costs.

But US$3.5 billion of capital spending on AWAC's Brazilian

operations is almost complete and Alumar will hit full capacity of

3.6 million tons per year by the end of the year.

On an underlying basis, Alumina recorded a US$22.2 million

profit compared with a US$10.4 million loss in the first half of

2009.

A consensus of three analysts had forecast the figure at US$36

million, but UBS resources analyst Glyn Lawcock said the shortfall

wasn't a significant disappointment, since it was largely a result

of unexpected factors.

"It wasn't too bad a result. The potential for this stock is the

global recovery and change in the pricing paradigm" for alumina, he

said.

Aluminum prices on the London Metal Exchange have risen more

than 50% over the past year as the world has recovered from the

global financial crisis. Prices have continued to edge up in recent

months on expectations that moves to restrict energy-intensive

industries in China--the world's biggest aluminum consumer--will

lead to idling of the country's aluminum smelters, constricting

supply of the metal into the market.

However, demand for alumina won't suffer greatly: "There's no

doubt there's been some curtailed (smelter) capacity but we see

that improving," Bevan said, although adding that pricing will

continue to be volatile.

The vast majority of Alumina's profits come from sales of

alumina. The company uses all its mined bauxite internally and the

Portland and Point Henry smelters in Victoria are its only aluminum

production facilities.

Although the most profitable part of the aluminum industry will

increasingly be in bauxite and alumina rather than aluminum metal,

Bevan said the company has no plans to sell the smelters.

"Would we reinvest in them? Probably we wouldn't re-establish

them, but they're very valuable and we'd like to see them within

the portfolio for a long time," he said.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

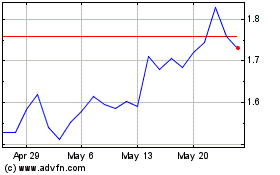

Alumina (ASX:AWC)

Historical Stock Chart

From May 2024 to Jun 2024

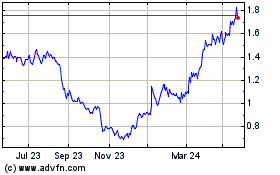

Alumina (ASX:AWC)

Historical Stock Chart

From Jun 2023 to Jun 2024