2nd UPDATE: Alumina Posts A$26 Million FY09 Loss; Outlook Positive

February 08 2010 - 10:52PM

Dow Jones News

Alumina Ltd. (AWC.AU) posted a full year loss on Tuesday but

said the outlook for aluminum markets in 2010 was improving and

underlined its more buoyant view by reinstating dividend

payments.

The company posted a net loss for the year ended Dec. 31 of A$26

million, down from a profit of A$168 million in the prior year.

The aluminum industry has been hit particularly hard by the

global downturn as demand and prices have sagged and Alumina and

its joint venture partner Alcoa Inc. (AA) have been forced to make

deep cuts to higher-cost production in an attempt to preserve

margins.

Chief Executive John Bevan said the 2009 results showed the

severity of the impact of the downturn but that the market had

since improved and aluminum prices were now 55% higher than they

were at the beginning of 2009.

"The outlook for improved returns for shareholders has

strengthened," he said.

Alumina posted an underlying loss of A$2 million, down from

underlying earnings of A$202 million in 2008.

At first glance, this appears well below market consensus for

underlying earnings of about A$36 million but Macquarie analysts

said once you strip out non-cash items, underlying earnings are

much closer to consensus at around A$30 million.

The underlying loss included a A$33 million charge for

accounting adjustments arising from the recognition of differences

between the U.S. GAAP and IFRS accounting standards in their

treatment of acquisitions, inventory movements, and asset

retirement obligations.

The Melbourne-based miner, which owns stakes in bauxite mines,

alumina refineries and aluminum smelters through its 40% stake in

the Alcoa World Alumina & Chemicals joint venture with Alcoa,

posted a final dividend of two Australian cents after posting no

final dividend in the prior year.

Alumina had suspended its dividend payments due to adverse

market conditions. JPMorgan analyst David George said few market

watchers had been forecasting a final dividend so the reinstatement

of a payment was a positive signal of the company's confidence in

the market outlook.

Bevan said AWAC's bauxite and alumina operations had remained

profitable throughout the downturn and, while its aluminum smelters

had run at a loss like the rest of the industry, they had returned

to profitability in the fourth quarter of 2009.

He said aluminum demand was now recovering and Alumina Ltd.

expected it to be about 10% higher in 2010 than it was in 2009.

"Most of this growth will be in China, where record production

was achieved in the fourth quarter (of 2009), up 50% on the low of

the first quarter," he told analysts.

"Outside of China, the growth rate is more muted but it will be

positive relative to 2009."

Bevan said supply and demand of alumina is expected to be in

balance in 2010, with new supply going to satisfy Chinese smelter

growth.

About 20% of AWAC's longer-term alumina sales contracts roll

over each year, and Bevan said new contracts were now being struck

at prices that more closely reflect spot prices.

Bevan said the AWAC joint venture is forecast to increase

production by about two million metric tons to 15.8 million tons of

alumina in 2010 to meet stronger customer demand and that costs are

targeted to remain at improved 2009 levels. The company gave

guidance for its sensitivity to market movements, saying that every

one cent movement in the LME aluminum price will move its profit by

US$14 million before tax and that every one cent change in the

Australian to U.S. dollar exchange rate would have a US$9 million

impact.

AWAC has completed the major spend on its Brazilian projects and

is forecasting US$200 million in growth capex in 2010 and a further

US$200 million in sustaining capex.

Bevan said the ramp up of the expansion of the Alumar alumina

refinery in Brazil is going well and the plant should reach

capacity in the first quarter of 2010.

Alumina had net debt of A$342 million at year end, giving it

gearing of 9%.

Alumina and Alcoa are currently negotiating wage deals with

workers at their alumina refineries in Western Australia state.

Bevan said he expects agreements to be reached amicably but that

there could be some limited industrial action.

-By Alex Wilson, Dow Jones Newswires; 61-3-9292-2094;

alex.wilson@dowjones.com

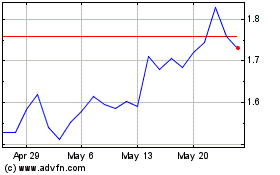

Alumina (ASX:AWC)

Historical Stock Chart

From May 2024 to Jun 2024

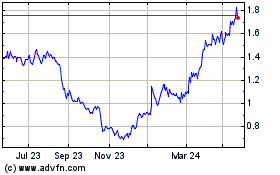

Alumina (ASX:AWC)

Historical Stock Chart

From Jun 2023 to Jun 2024