MARKET COMMENT: S&P/ASX 200 Flat in Mixed Trading

June 27 2013 - 9:16PM

Dow Jones News

0045 GMT [Dow Jones] Australia's S&P/ASX 200 is flat at

4809.3 after an early rise to 4829.2. Gains in banks are offsetting

falls in miners after offshore equity markets rose. Spot gold

continued to tumble and copper prices remained shaky after recent

weakness. ANZ (ANZ.AU) leads banks with a 0.6% rise, while BHP

(BHP.AU) falls 1.0% and Newcrest sinks 1.5%. Woodside (WPL.AU) is

up 1.8% after oil prices rose and the energy producer bought stakes

in oil and gas blocks offshore Ireland. Caltex (CTX.AU) dives 11%

after a profit warning late yesterday. AMP (AMP.AU) falls 2.7%

after a profit warning earlier this week. "It seems the three-day

bounce in equities is likely a result of investors taking advantage

of a short-term overreaction by the market to the Federal Reserve's

statement last week," says Rivkin global analyst Tim Radford.

"While sentiment has improved in the past three sessions,

overarching concerns over stimulus reduction will continue weighing

on broader market sentiment." (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

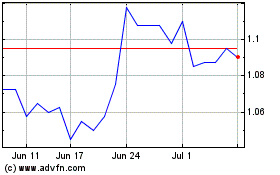

AMP (ASX:AMP)

Historical Stock Chart

From Apr 2024 to May 2024

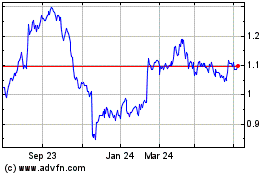

AMP (ASX:AMP)

Historical Stock Chart

From May 2023 to May 2024