Claymore Exchange-Traded Funds Declare Monthly Distributions

September 25 2008 - 10:02AM

Business Wire

Claymore Advisors, LLC, is pleased to announce that today the

following Claymore Exchange-Traded Funds (�ETFs�) have declared

monthly distributions. The table below summarizes the distribution

schedule for each Fund declaring a distribution. Ticker � Fund Name

� Ex-Date � Record Date � Pay-Date � Total Rate Per Share UBD �

Claymore U.S. Capital Markets Bond ETF � 09/24/08 � 9/26/2008 �

9/30/2008 � 0.087 ULQ � Claymore U.S. Capital Markets Micro-Term

Fixed Income ETF � 09/24/08 � 9/26/2008 � 9/30/2008 � 0.081 UEM �

Claymore U.S.-1-The Capital Markets Index ETF � 09/24/08 �

9/26/2008 � 9/30/2008 � 0.187 LVL � Claymore /BBD High Income Index

ETF � 09/24/08 � 9/26/2008 � 9/30/2008 � 0.135 CVY � Claymore/Zacks

Yield Hog ETF1 � 09/24/08 � 9/26/2008 � 9/30/2008 � 0.353 HGI �

Claymore/Zacks International Yield Hog Index ETF2 � 09/24/08 �

9/26/2008 � 9/30/2008 � 0.240 IRO � Claymore/Zacks Dividend

Rotation ETF � 09/24/08 � 9/26/2008 � 9/30/2008 � 0.124 ENY �

Claymore/SWM Canadian Energy Income Index ETF � 09/24/08 �

9/26/2008 � 9/30/2008 � 0.298 SEA � Claymore/Delta Global Shipping

Index ETF � 09/24/08 � 9/26/2008 � 9/30/2008 � 0.147 Past

performance is not indicative of future performance. To the extent

any portion of the distribution is estimated to be sourced from

something other than income, such as return of capital, the source

would be disclosed on a Section 19(a)-1 letter located on the

Fund�s website under the �Literature� tab. A distribution rate that

is largely comprised of sources other than income may not be

reflective of the Fund�s performance. Claymore Advisors, LLC is an

affiliate of Claymore Securities, Inc. Claymore Securities, Inc. is

a privately-held financial services company offering unique

investment solutions for financial advisors and their valued

clients. Claymore entities have provided supervision, management,

servicing and/or distribution on approximately $18.4 billion in

assets, as of June 30, 2008. Claymore currently offers closed-end

funds, unit investment trusts and exchange-traded funds. Additional

information on Claymore�s exchange-traded funds is available by

calling 888.WHY.ETFS (888.949.3837) or visiting

www.claymore.com/ETFs. Registered investment products are sold by

prospectus only and investors should read the prospectus carefully

before investing. There can be no assurance that the Funds will

achieve their investment objectives. An investment in the various

Claymore ETFs is subject to certain risks and other considerations.

Some general risks and considerations associated with investing in

an ETF may include: Investment Risk, Equity Risk, Foreign

Investment Risk, Income Risk, Non-Correlation Risk, Small Company

Risk, Emerging Markets Risk, Industry/Sector Risk, Replication

Management Risk, Issuer-Specific Changes, Non-Diversified Fund

Risk. Please refer to the individual ETF prospectus for a more

detailed discussion of the Fund-specific risks and considerations.

1Effective November 3, 2008, the name of the Claymore/Zacks Yield

Hog ETF will change to Claymore/Zacks Multi-Asset Income Index ETF.

At that time, the name of the Fund�s underlying index will change

to the Zacks Multi-Asset Income Index. 2�Effective November 3,

2008, the name of the Claymore/Zacks International Yield Hog Index

ETF will change to Claymore/Zacks International Multi-Asset Income

Index ETF. At that time, the name of the Fund�s underlying index

will change to the Zacks International Multi-Asset Income Index.

Investors should consider the investment objectives and policies,

risk considerations, charges and ongoing expenses of the ETFs

carefully before they invest. The prospectus contains this and

other information relevant to an investment in the ETFs. Please

read the prospectus carefully before you invest or send money. For

this and more information, please contact a securities

representative or Claymore Securities, Inc., 2455 Corporate Drive

West, Lisle, IL 60532, 800-345-7999. Member FINRA/SIPC (09/2008)

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY LOSE VALUE

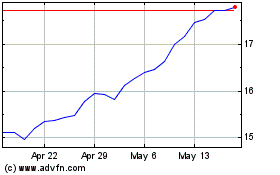

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Apr 2024 to May 2024

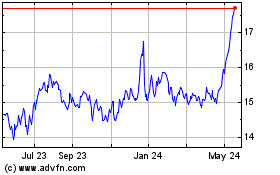

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From May 2023 to May 2024