Although Europe is presently on a roller-coaster ride, the

continent has lately come out of the crisis that hit several years

ago. The lull then had been pretty widespread, but the epicenter of

the turmoil was arguably in the Eurozone.

When the Eurozone returned to the growth path in Q2 by improving

0.3%, all eyes again shifted toward this vital market. Reduced debt

worries and improved growth in some key members like Germany helped

create this optimism.

To add to this, the recent cut in benchmark rate to a record low of

0.25% by the European Central Bank (ECB) to trigger growth and

inflation signals that the authority will leave no stone unturned

to boost activity in the region (see all the European ETFs

here).

Notably, the ECB follows a directive to maintain inflation rates

close to 2% which was far behind the 0.7% inflation rise in

October.

Though the region is far from attaining sustainable growth, just

the end of a long-run recession itself is great news. The big

component of the region – Germany – walked on the growth path to

start the year.

Although, in the third quarter, France dipped after peeping into

the growth corner, sustained improvement in the country seems close

at hand.

The Eurozone’s third largest economy – Italy – will likely log GDP

growth in the final quarter of the year putting an end to its nine

consecutive quarter long recessionary steak.

The Netherlands broke free from recession in Q3 scoring 0.1%

quarter over quarter. The growth rate was in stark contrast to a

sharp drop of 0.9% in the year-ago quarter.

Thus, given the region’s slow-but-improving fundamentals, a look at

the top ranked ETF in Europe or rather some countries in the

Eurozone could be a good idea, especially by using our Zacks ETF

Ranking system.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box or asset class (Read: Zacks ETF Rank Guide).

Our proprietary methodology also takes into account the risk

preferences of investors. ETFs are ranked on a scale of 1 (Strong

Buy) to 5 (Strong Sell) while they also receive one of three risk

ratings, namely Low, Medium or High.

The aim of our models is to select the best ETFs within each risk

category. We assign each ETF one of the five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other products with a similar level of risk.

For investors seeking to apply this methodology to their portfolio

in the European equities space, we have taken a closer look at the

top ranked EZU. This ETF has a Zacks ETF Rank of 1 or ‘Strong Buy’

(see the full list of top ranked ETFs) and is detailed below:

EWZ in Focus

Launched in July 2000,

iShares MSCI EMU ETF (EZU)

is a passively managed exchange traded fund (ETF) looking to

deliver the return of the MSCI EMU Index before fees and

expenses.

The fund is among the most popular in the Europe equities space

with more than $7.0 billion in assets. With a huge trading volume

of around 3,000,000 shares a day, the fund provides investors ample

liquidity.

The choice is also a cheaper one as it charges 49 basis points in

fees a year which is quite below the average expense ratio in the

Europe equities space. In fact, higher trading volume led to

relatively lower expenses.

With 244 stocks in its basket, this fund from iShares puts only

25.0% of its total assets in the top 10 holdings with no company

accounting for more 3.31% of the total, suggesting low

concentration risk. Top companies include Total SA, Sanofi and

Bayer AG, all of which account for around 9% of the assets.

In terms of sector exposure, the top allocation, financials,

comprise a little greater than one-fifth of the total assets

followed by industrial companies making up around 14%.

Beyond this, consumer discretionary (12.7%) and consumer staples

(10.6%) round out the top four. Information technology (5.18%) gets

the least weight (read: Forget Europe's Currency Risks with These

Hedged ETFs).

Style-wise, the fund has a value tilt with 56% exposure, keeping

the fund away from excessive volatility. As much as 88% focus on

large caps also calls for somewhat lower volatility.

Although it seeks to provide international diversification for U.S

investors, it is prudent to note that it has a strong correlation

with the S&P 500 Index as indicated by an R-squared of 78%

against the S&P 500.

The fund has returned around 19.4% in the year-to-date frame ending

November 22, 2013 which surpassed the biggest European fund by

assets

Vanguard FTSE Europe ETF’s (VGK) 16.6%

return.

EZU has returned an impressive 28.8% roughly in the last one-year

period ended September 30, 2013. The fund is currently hovering

near its 52-week high level. EZU pays out a yield of 2.20% per

annum.

Bottom Line

This ETF is appropriate for investors looking for a targeted bet on

European stocks with a focus on maximizing total income in the form

of dividends as well as capital appreciation.

Though we expect a rough road to recovery as evident from slowing

Euro-area growth of just 0.1% in Q3 as opposed to 0.3% in Q2, the

region has surely come out of the meltdown.

Thus, investors having a steady appetite for risk can consider

buying the product on the recent dip. Just remember, the fund is

unhedged, making it vulnerable to any weakness in the Euro.

We don’t expect this to create too much of a concern in the near

term though, given the current market scenario, suggesting that

this could be a solid pick for those seeking broad Europe exposure

at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMU IDX (EZU): ETF Research Reports

VANGD-FTSE EUR (VGK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

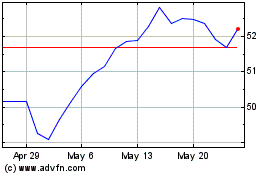

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

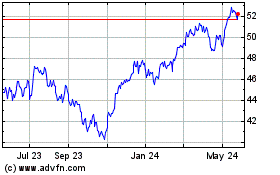

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024